JHB

JHB's JournalThe president offers his sympathy (2007 edition)

On Wednesday, December 5, 2007, nineteen-year-old Robert Hawkins killed eight people and himself at the Westroads Mall in Omaha, Nebraska.

“I was in Omaha just before the shooting took place, and I know what a difficult day it is for that fine community,” said Bush, who had traveled to the area to attend a Republican fundraiser and was on his way back to Washington when the shootings took place.

“The victims and their loved ones are in the prayers of Americans,” Bush said. “The federal government stands ready to help in any way we can, and the whole nation grieves for the people of Omaha.”

Number of liberal pundits or Democratic presidential hopefuls who took umbrage, suggesting Bush would have been less sympathetic if his itinerary had been different: zero

A lot of times, people just add in a little personal note when expressing sympathy. That's all.

Anybody have any "most likely to be believed" April Fools' stories?

I don't but the thought occurred to me so I'm asking:

Every now and then someone winds up looking dumb because they quote a prank April Fools story. And it happens all year 'round with stories from The Onion.

Any such stories from today that look ripe for leaving someone's ass hanging in the wind?

TPL Podcast Ep 120: The JOBS Bill? 10 Conservative Lies about Jobs

The Professional Left podcast, with Driftglass and Blue Gal(contributors to Crooks and Liars)

Ep 120 The JOBS Bill? 10 Conservative Lies about Jobs (67:16)

Also, some discussion on why the manufacturing sector is important so we can't just send it all to China.

Carol Marin on Toni Preckwinkle and loyalty.

Driftglass and the Original, 2010 Etch-a-Sketch post NASDAQ on the Republican (HAND) JOBS Act.

Sara Robinson and the 40 hour work week.

Wonkette on Ron Paul's Libertarian Nepotism. Nepotarianism?

summary from http://driftglass.blogspot.com/2012/03/professional-left-podcast-120.html

TYT: Larry Pratt says Shooter Should Get Off on a Technicality

On The Young Turks show on Current TV:

http://current.com/shows/the-young-turks/videos/gun-advocate-to-cenk-martin-should-have-run-away-part-2

http://videocafe.crooksandliars.com/heather/cenk-uygur-blasts-gun-owners-americas-larr

Cenk is a little over the top here for my taste, which lets Pratt almost look like the reasonable one (almost. He's so far gone that nothing can help).

The real zingers that Cenk never hones in on here is pointing out that Pratt is arguing for the very thing his entire movement has used to condemn liberals as "soft on crime": letting the accused go free "on a technicality", and that Pratt's argument also goes against everything ever said about not "second guessing" police in brutality/excessive force cases.

Pratt argues (based on one account. Others differ, but for the sake of argument we'll just go with Pratt's version for now) that once the encounter became physical (a fight), Treyvon should have run once he gained an advantage over Zimmerman instead of punching him. with Zimmerman now on the defensive, he was justified in pulling his gun and shooting Martin. Pratt underscores this point with his "count on it, I'm gonna shoot you" line in Cenk's hypothietical recreation of the incident between him and Pratt.

Now, the entire "liberals are soft on crime" meme comes from efforts to force police to actually follow the rules about due process, collection of evidence, etc. so that people didn't go to jail for crimes they didn't commit. This occasionally resulted in cases being thrown out because improperly-collected evidence could not be admitted, improper interrogations, etc., which outraged a lot of people for "violent criminals getting off on a technicality". It's what gave birth to the entire vigilante-movie genre of the 70's -- Dirty Harry, Death Wish, etc. -- and the RW in general and gun-promotion lobby in particular relies heavily on it.

Further, we're supposed to be very lenient about excessive force cases because we are "not there, making the call in the heat of the moment" where there just isn't time to rationally evaluate things and make sure all boxes on the proper procedure checklist are followed completely. This is for peace officers trained in the use of force in potentially violent confrontations.

So here is Pratt, who has spent his career humping the leg of the "got off on a technicality" meme, arguing for exactly the thing he's supposed to be against. And to do it, his justification is that an untrained teenager going about his normal business and suddenly finding himself in a physical confrontation should dot every "i" and cross every "t" about when he should break off, in an even more extreme version of what gets called "micromanagment" and "Monday morning quarterbacking" when applied to holding trained police officers accountable.

A Century of Tax Bracket Thresholds

In many of the recent debates (and outright propagandizing) about taxes, one of the biggest obstacles to rational discussions on the topic -- other than pure anti-tax ideology – is simple ignorance of how taxation used to work in this country, especially progressive taxation. For instance, the whole debate as to whether a couple with a $250K income was “rich” was just nuts: why act like there was one simple dividing line?

The big reason for that is the “simplification” of the income tax system since the 1980s that has reduced the number of tax brackets drastically: from as few as two (1987-1990) to the current six (2002-present). Through most of the 20th Century, including all but the last few years of the Cold War, many more brackets were in place, making more gradations between income levels and making finer distinctions between who was trying to get ahead and who already was.

It’s fairly easy to find charts showing the history of the top marginal tax rate. It’s harder to find ones that illustrate the rest of the story clearly: what the taxes were for people well away from the top margin, what the people at the top actually paid once they’d made use of the vaunted loopholes, etc. The information is available, but hard to boil down to a bumper sticker.

These two charts are part of my effort to fill in some of those gaps in the bigger picture. They don’t deal with rates at all, just the breakpoints between different rates. Using the CPI inflation adjusted numbers from the Federal Individual Income Tax Rates History of The Tax Foundation (http://www.taxfoundation.org/taxdata/show/151.html). I’ve graphed the thresholds between one tax bracket and the next in 2011 dollars. The first is for the entire history of the income tax (1913-2011), and the second is the past 60 years (1951-2011). To keep it simple, these are for single-filers, but it is representative over the broader theme.

Remember, we’re just talking about bracket thresholds, so “series” just represents the number of brackets in a given year, not that they are the same rate or otherwise related. In 1932 and 1933 there were over 50 brackets, and only 4 of them dealt with incomes below the equivalent of $200K.

Gee, look at those brackets reaching way, way up into the 0.01%: incomes over the equivalent of $10 million, $30 million, even $80 million. Still want to quibble whether $250 thousand is “rich” (or rather, $200K since we’re talking single-filers in this chart)? Without even addressing levels that many more will agree fit that description?

The 1951-2011 chart is clearer, both because the period lacks those tens-of-millions brackets and because this is the period most familiar to most people. Changes in the tax code in the 60s, 80s, 90s and 2000s can be seen clearly.

Note how many brackets affected incomes above $200K before the Reagan era. Also note how there were more at lower levels below that level too.

Also note how it collapsed after Reagan: both at the high end (though inflation took its toll earlier) and by hollowing out gradations at the low end. From 1988-1990 there were only two rates: 15% up to ~$34,000, and 28% on everything above that. Very nearly a flat tax, and the one for which George H. W. Bush paid when it proved unsustainable and he had to go back on his “read my lips, no new taxes” line to add a higher bracket. Even when higher brackets were implemented under Clinton, you can still see the fruits of the conservative’s assault on the very idea of progressive taxation.

****

On edit (26 March 2012): Welcome to those following the link from Avedon Carol's blog The Sideshow.

Following one of the comments, I've added versions on a log scale. However, in ordinary, everyday terms it is only used in this context when referring to an "x-figure income". The median household income is in the ballpark of $50,000, and the vast majority of working Americans are somewhere in that 5-figure range. While useful for some forms of analysis, I think the way a log scale flattens the distribution visually was not appropriate to the point I was making. With a linear scale, a reader can pick out there their own income lies, see the way it was treated differently in the past, and most importantly can easily pick out how incomes that were double, 5 times, 30 times, etc. their own were treated in the past.

Note: on this graph the "series" legend on the right stops at 23 due to space. Also present but not displayed in the legend are more brackets for years which had more, up to 55 in the early 1930s.

"Why China’s Political Model Is Superior" sez Shanghai "venture capitalist"

This from the NY Times

http://www.nytimes.com/2012/02/16/opinion/why-chinas-political-model-is-superior.html

A related version is at Huffington Post:

http://www.huffingtonpost.com/eric-x-li/globalization-20-democrac_b_1278784.html

The West’s current competition with China is therefore not a face-off between democracy and authoritarianism, but rather the clash of two fundamentally different political outlooks. The modern West sees democracy and human rights as the pinnacle of human development. It is a belief premised on an absolute faith. China is on a different path. Its leaders are prepared to allow greater popular participation in political decisions if and when it is conducive to economic development and favorable to the country’s national interests, as they have done in the past 10 years.

However, China’s leaders would not hesitate to curtail those freedoms if the conditions and the needs of the nation changed. The 1980s were a time of expanding popular participation in the country’s politics that helped loosen the ideological shackles of the destructive Cultural Revolution. But it went too far and led to a vast rebellion at Tiananmen Square. That uprising was decisively put down on June 4, 1989. The Chinese nation paid a heavy price for that violent event, but the alternatives would have been far worse. The resulting stability ushered in a generation of growth and prosperity that propelled China’s economy to its position as the second largest in the world.

The fundamental difference between Washington’s view and Beijing’s is whether political rights are considered God-given and therefore absolute or whether they should be seen as privileges to be negotiated based on the needs and conditions of the nation.

The West seems incapable of becoming less democratic even when its survival may depend on such a shift. In this sense, America today is similar to the old Soviet Union, which also viewed its political system as the ultimate end. History does not bode well for the American way. Indeed, faith-based ideological hubris may soon drive democracy over the cliff.

A couple of thoughts:

1) you are a "crony capitalist" pal. If you didn't have friends in high places in the Party, you couldn't do jack. Out of curiosity, what sort of kickback arrangements do you have?

2) The only thing heartening about such blind arrogance is the way it will walk right into its doom. The problem is they are going to cause a lot of misery and take a lot of people with them before they find out they were wrong.

3) Before you get too comfortable, just remember how many of Mao's little books are out there. Wasn't it required reading? China's been riding the post-Tiannanmen "stability" for a while now. All it takes is a bump or a downturn, and you can wind up with an unpleasant reminder that the "vast rebellion at Tiananmen Square" was just a mass protest, not a rebellion. Rebels shoot back. Just ask Mao. If you're a "venture capitalist", maybe it's in your interest to NOT make that route look like a good thing.

I'd like to thank Mitt Romney for providing focus...

...or rather, being a focus, on revisiting exactly what "go go economics" meant for millions of ordinary people trying to make a decent living.

A focus for highlighting the bait-and-switch rationalizations for giving financial wheeler-dealers an ever-freer hand, and how all the glorious benefits never really pan out for people just trying to get ahead.

A focus for underscoring just how long this happy-face predation has been going on. Just take a look:

LA Times, Tuesday 1/3/2011:

Either way, Bain investors typically profited.

That was true in the case of GS Industries, the 10th-biggest Bain investment in the Romney years. Bain formed GSI in the early 1990s by spending $24 million to acquire and merge steel companies with plants in Missouri, South Carolina and other states. Company managers cut jobs and benefits almost immediately. Meanwhile, Bain and other investors received management fees from GSI and a $65-million dividend in the first years after the acquisition, according to interviews with company employees.

In 1999, as economic challenges mounted, GSI sought a federal loan guarantee intended to help steel companies compete internationally. The loan deal was approved, but in 2001, before it could be used, the company went bankrupt, two years after Romney left Bain. More than 700 workers were fired, losing not only their jobs but health insurance, severance and a chunk of their pension benefits. GSI retirees also lost their health insurance and other benefits. Bain partners received about $50 million on their initial investment, a 100% gain.

From the 1992 book America: What Went Wrong by journalists Donald Barlett and James Steele:

As it turned out, Interco failed to be a textbook model for the wonders of corporate debt. Instead of encouraging efficiency, it compelled management to make short-term decisions that harmed the long-run interests of the corporation and its employees. Within two weeks of taking on the debt, Interco closed two Florsheim shoe plants-and sold the real estate. Interco announced that the shutdowns would save more than $2 million. That was just enough to pay the interest on the company's new mountain of debt for five days.

***

It was a model of stability for the town and one of the manufacturing jewels of the International Shoe Company, later Interco, its owner. Because of the factory's efficient work force, whenever Florsheim wanted to experiment with new technology or develop a new shoe, it did so at Hermann. The plant had a long history of good labor relations. And it operated at a profit. So why, then, did Interco choose to close the factory? Listen to Perry D. Lovett, who was city administrator of Hermann when the plant shut down and who discussed the closing with Interco officials: "We talked to the senior vice president who was selling the property and he told me this was a profitable plant and they were pleased with it. The only thing was, this plant and the one in Kentucky they actually owned. The other plants they had, they had leased. The only place they could generate cash was from the plant in Hermann and the one in Kentucky.

"He said it was just a matter that this was one piece of property in which they could generate revenue to pay off the debt. And that was it. That brought it down." In short, a profitable and efficient plant was closed because Interco actually owned-rather than leased-the building and real estate. And the company needed the cash from the sale of the property to help pay down the debt incurred in the restructuring that was supposed to make the company more efficient.

Remember, that book is from before Clinton, and the pattern was already underway. Excerpts from the book can be read at:

http://americawhatwentwrong.org/stories/excerpt-america-what-went-wrong/

and

http://www.politicalindex.com/wrong1.htm

Authors' site at:

http://americawhatwentwrong.org/

And more fun facts from the past:

While 23% is still a little over twice what the stock market returned over the period, Blackstone used a lot of borrowed money. If you’d borrowed half the money you had invested in the stock market, a legal and reasonably prudent thing to do, then your returns would be close to what Blackstone’s outside investors got. The real juice in this game is for the partners. Oh, and they’re going to take almost $4 billion of the IPO’s proceeds for themselves. They’ll also hold considerable blocks of the new Blackstone stock, but considering all they’ve taken out of the firm already, they’ll be sitting a lot prettier than the new public shareholders.

After going public, Blackstone will keep some cut of the profits—a presumably large cut, but there’s no number in the prospectus. Stockholders “will have only limited voting rights and will have no right to elect our general partner or its directors, which will be elected by our founders.”

Blackstone confesses to a long and scary set of risks: the financial markets could turn ugly; going public could drive away the talent responsible for all those years of splendid returns; lifting the veil of secrecy that comes with going public could ruin the magic; Congress or the regulators could come crashing down (e.g., they pay taxes on fee income at the favorable capital gains rate, which makes little sense to anyone not earning the fees); outside investors could demand their money back, which could leave Blackstone high and dry; losses could wipe the firm out completely and then some; shareholders have no recourse if the management team screws up; the inner circle has interests different from the shareholders, and reserves the right to think only of itself; an unspecified share of the proceeds of the stock offering will go into the pockets of the founders, and won’t be available for the business; shareholders could have to pay taxes on Blackstone’s income even though it didn’t distribute any of it as cash to shareholders.

Doug Henwood, Left Business Observer #115, May 2007

http://www.leftbusinessobserver.com/PrivateWads.html

and from today:

http://crooksandliars.com/mike-lux/so-much-quiet-monday-afternoon

In story after story, the same formula is repeated over and over again: after wondrous boasts of forthcoming prosperity, the wheeler-dealers at the top make out royally, investors do well (when they're not left holding the bag, that is), and everyone outside that top tier, who are just trying to have a normal life, get squeezed, screwed, and sent scrambling. All so that the already wealthy want to get more wealthy. It's a hell of a lot easier and safer (investment-wise) than actually innovating.

Or to put it in terms "pro-business" people understand: there's a mismatch of incentives between financial players and benefits for the real economy.

So thanks, Mitt. Now go away.

So when do the teabaggers start complaining about stolen elections...

...by the national Republican party?

...with absolutely no sense of irony.

I'm thinking in 5, 4, 3, 2....

Ron Paul said he didn't pay any attention to what was in his newsletter, so...

...how much money did he take from subscribers led to believe they were getting his views on events of the day?

And now that he claims that was not true, and he spent decades providing no oversite to things done in his name, will he give them their money back?

An antidote to RW e-mails and relatives (especially ones trying to un-blame Bush)

Crooks and Liars has an article up responding to Jeb Bush's recent 'Right to Rise' op-ed in the WSJ, but it is also a good source for current info to counter RW e-mails making the rounds (such as this http://www.democraticunderground.com/100251953 ) or relatives at holiday gatherings for whom the foam is not just their excitement over the family feast.

December 21, 2011 02:00 PM

Jeb Bush's 'Right to Rise' Falls Flat

37 comments

By Jon Perr

http://crooksandliars.com/jon-perr/jeb-bushs-right-to-rise-falls-flat

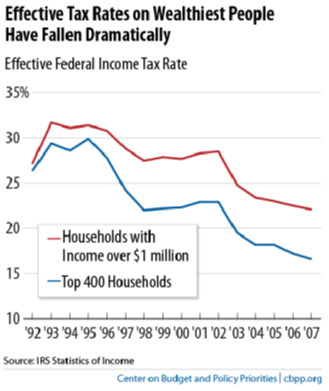

Once again, reality's well-known liberal bias belies Bush's, well, lies. As it turns out, the total federal tax burden as a percentage of the American economy is at its lowest level in 60 years. Income inequality has reached record levels not seen in 80 years. And thanks to brother George's lowering of the top income tax rate to 35 percent and the capital gains tax rate to just 15 percent, the top one percent has never had it better.

It's no wonder that between 2001 and 2007- a period during which poverty was rising and average household income had fallen - the 400 richest taxpayers saw their incomes double to an average of $345 million even as their effective tax rate was virtually halved. As the Washington Post noted, "The 400 richest taxpayers in 2008 counted 60 percent of their income in the form of capital gains and 8 percent from salary and wages. The rest of the country reported 5 percent in capital gains and 72 percent in salary."

***

To be sure, George W. Bush provided the perfect bookend to era of modern Republican economic management ushered by Herbert Hoover. The verdict on President Bush's reign of ruin was pronounced even before Barack Obama took the oath of office. Just days after the Washington Post documented that George W. Bush presided over the worst eight-year economic performance in the modern American presidency, the New York Times on January 24, 2009 featured an analysis ("Economic Setbacks That Define the Bush Years"![]() comparing presidential performance going back to Eisenhower. As the Times showed, George W. Bush, the first MBA president, was a historic failure when it came to expanding GDP, producing jobs and fueling stock market growth.

comparing presidential performance going back to Eisenhower. As the Times showed, George W. Bush, the first MBA president, was a historic failure when it came to expanding GDP, producing jobs and fueling stock market growth.

On January 9, 2009, the Republican-friendly Wall Street Journal summed it up with an article titled simply, "Bush on Jobs: the Worst Track Record on Record." (The Journal's interactive table quantifies his staggering failure relative to every post-World War II president.) The meager one million jobs created under President Bush didn't merely pale in comparison to the 23 million produced during Bill Clinton's tenure. In September 2009, the Congressional Joint Economic Committee charted Bush's job creation disaster, the worst since Hoover:

Profile Information

Gender: Do not displayCurrent location: Somewhere in the NYC metropolitan statistical area

Member since: 2001

Number of posts: 37,158