Demeter

Demeter's JournalThe Church of Self-Help By Helaine Olen

http://www.slate.com/articles/business/the_bills/2015/06/new_york_times_op_ed_on_why_the_poor_won_t_rise_up_give_credit_to_our_culture.htmlThere’s a reason the poor don’t rise up over inequality. Because our culture shames them... The question of why we aren’t angrier about our increasing income inequality is back, courtesy of Thomas Edsall at the New York Times. In a Wednesday op-ed he asks, “Why are today’s working poor so quiescent?” While Edsall believes living conditions are better for the poor than they were in the past (affordable televisions and air conditioners go a long way!), he flags something else to blame for the lack of public rage: the United States’ individualistic culture, one that has left all of us ever-more skeptical of appeals to group action. “There is very little social support for class-based protest, “ he notes. We take the increased economic risk that’s been shifted onto the individual for granted. Instead of anger, there is acceptance and resignation.

The “great risk shift” described by Jacob Hacker in his book of the same name is so thorough and complete, most of us no longer realize—never mind believe—that our world could be any different. We’ve internalized the language of the corporate state. And this, in turn, leaves us powerless to change our electoral dynamic, one in which both political parties have little to gain by addressing the issues of those most pummeled by the economics of our great income divide. But this analysis, while compelling, misses a vital piece of the puzzle.

We like to say that we don’t have a national religion in the United States, but that’s only true if you think of religion in the conventional way, with an organized structure and a place of worship. But we do have one national belief system. Think of it as the First National Church of Self-Help, where the tenets preach that we are responsible for all that happens to us, for good or ill. In the Church of Self-Help, there is no problem for which there is not an individual solution. As Nicole Aschoff writes about Oprah Winfrey in the recently published The New Prophets of Capital, “In her story, success comes from righteousness and hard work, not luck—so anyone can achieve it.” The unspoken but equally compelling piece: The converse is also true. Failure is a result not of ill luck but insufficient effort and a poor attitude. It’s not for nothing that Oprah promoted The Secret, the book that claimed we could positive-think our way into success.

This stuff is legion in the subject I cover, the world of personal finance. Millionaires are regularly held up as having better, more orderly, and more disciplined traits than others, and we’re told they rarely fall prey to negative thoughts. (Who is paying the not-unsubstantial therapist bills in cities like New York, Los Angeles, and Atlanta is never addressed.) When I Google the phrase “habits of wealthy people,” I discovered Inc. had published “7 Habits of Exceptionally Rich People” this past January, a post that must have proved popular, because it was followed by “7 Habits of the World’s Richest People” a few weeks later. Not to be outdone, Fortune then posted “5 Surprising Habits of the Wealthy” the next month.

In the Church of Self-Help, there is no problem for which there is not an individual solution. It follows by extension that if the wealthy are wealthy because of their more virtuous habits, the poor must need improvement...

MORE--CAPITALISM MEETS CALVINISM....

Helaine Olen is the author of Pound Foolish: Exposing the Dark Side of the Personal Finance Industry and co-author of the upcoming The Index Card: Why Personal Finance Doesn't Have to Be Complicated.

Weekend Economists: Wedding Bells are Breaking Up that Old Gang June 26-28, 2015

With certain pronoun adjustments, this is the day!

Now civil rights are extended to any two adult people who wish to merge their families into a new one. No ifs, ands, or buts.

It's been a long time coming, but media commentary is astonished by how fast the change has happened...I won't go into all the reasons why that could be (certainly the internet is a big contributing factor), but it is a good sign for a nation in desperate need of course correction that at least one thing happened in a (somewhat) expeditious fashion. It's been decades, of course.

As a woman, and mother of daughters, I could wish that women's civil rights in pay, reproductive choice and the like had advanced equally precipitously...that may be our next social cataclysm for those politicians still riding the rails or dragging their heels. Or maybe not. We've only been at it since 1973....

But next, the TPP and all that, and JOBS! Break up the banksters and throw them out of their jobs, if not into jail. Ditch the DINOS and send them back to the pre-Stone Age, where they belong.

But let the blessings of love and family descend upon us all. I wish X could have seen this day. He would have been thrilled.

But, in the meanwhile, with this big social issue out of the way, perhaps the nation's political attention and will can be turned to matters of an economic nature, effecting all people of all ages and classes.

Trapped in a Bubble By Golem XIV REPOST

http://www.golemxiv.co.uk/2015/06/trapped-bubble/I think our ruling and wealthy elite are worried that they are stuck in their own ponzi scheme or bubble and are suffering from the general problem of all ponzis and bubbles – how to get out...You see, bubbles and Ponzi’s are fine as long as they keep going. As long as there are ever more suckers to recruit and as long as enough of those already in, remain confident and choose to stay in, there is no real reason a ponzi cannot go on and on. A perfect example is Madoff’s scheme. The weakness of all bubbles, ponzi or otherwise, is that all it takes is a rumour that it might be time to get out, that it might soon get difficult to get out, or that someone ‘in the know’ wants out, and a ponzi scheme pops like a soap bubble. They are notoriously unstable.

So if you are in one how do you get out?

I think this question is worrying our wealthy Over Class because stock markets around the world are over-valued and its their wealth which is most tied up in the markets. I think some of them are now rather worried that they have built themselves a luxury tower of paper wealth from which, when it catches fire, they will not all escape. I think they are right.

So, first, are the markets a bubble or ponzi?

Well if we look at the real economies of the West and then at the stock markets, the later have the look of a ponzi. I’m certainly not alone in thinking this. In Europe, the U.S. and Japan, over the last 6 years, in what we might call the ‘real economy’ of people making things, earning money and spending it to buy things other people have made, we have had either anaemic growth, no growth or outright contraction. And yet all the time the stock markets have roared ever higher....

And yet, its share price is $86 not far off its record highs, up from a low of $23 to which it fell in March 2009. $86 or thereabouts ever since 2010 despite 28 months of declining sales.

Is this supply and demand? I think not. Part of an explanation for this levitating share price is, as the ZeroHedge article points out, that the corporation has been buying back its own shares.

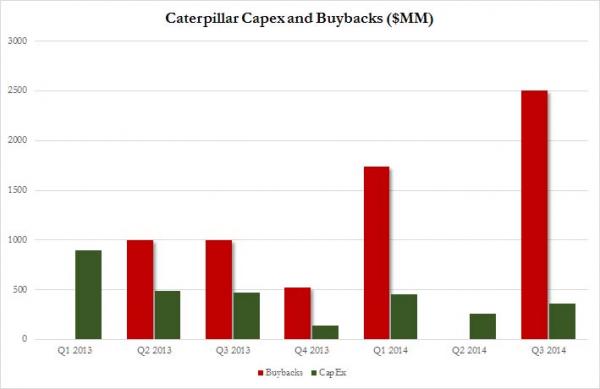

CAT had been using more and more of its cash (the red bar) to buy back its own shares inflating the apparent demand for them and therefore their price. It’s not illegal, but what does it do for the idea that share price indicates what a company is worth? And where was CAT getting the money with which to buy those shares? I doubt it was from profits given the long cumulative decline in sales. More likely it was from selling bonds i.e. using borrowed money. And indeed that seems to be the case. In May of 2014 CAT sold $2 billion of debt some of it dated as long as 50 years....So let’s take a look at what we have. In May of 2014, despite having already suffered a year of declining sales, CAT shares were the second best performing shares on the Dow Jones. Who was so keen to buy all their shares? Who knows. But CAT itself had just spent 175 million in buying their own shares in the first quarter (when it was the second best performing share on the DOW) and in the last quarter of the year went on to buy another 250 million dollars worth. In fact, and perhaps most critically, in January the CAT board had authorized $12 billion for buy-back. So the market know that a lot of shares were going to be bought up…by CAT. And not at bargain basement price either. Take a look at the record of their share price above and you’ll see that the board had authorized using borrowed money to buy their shares at around the highest price they had ever been. Hmm. Did buying all those shares encourage others to do likewise, especially knowing that CAT had a war chest of $12 billion earmarked for buying shares? Any ‘investor’ would know there was a buyer in the market who would be ready and willing to buy them back from him. The upshot would be a guaranteed buoyant market in CAT shares at a time when without such a buoyant demand a year of declining sales might just possibly have led to a steep decline in share price. Of course the official rationale for taking on debt to buy back shares is that debt costs are now low so its a good time to do it. The problem is that while in the short term it improves the look of the company’s share price and things like return on equity, it locks CAT, and any company that does the same, in to paying out interest on debt over the long term.

The systemic problem

If CAT were alone in being the only company whose share price looks to be over-valued based on actual profitability it wouldn’t matter and we’d be fine. But it isn’t. Here is what a recent note from Goldman Sachs chief equity strategist, David Kostin says – as reported at Zerohedge.

In other words almost everything looks over valued. Mr Kostin goes on to suggest one reason for the inflated prices is that

The key for me is he puts share buy back and returning money to investors together. Companies buy back their shares. This keeps their share price inflated in a market that has forgotten to worry about underlying profit and is fixated instead on short term ‘what someone will pay me for this bit of paper’. So the share price remain high and the experts tell us all is good. Wonderful in fact. But the money, some of it alt least, is being sucked out and given to those ‘investors’ who sold and cashed out. Now who are those people? Well we know that the wealthiest 10% own about 75% of all measured wealth and that the bulk of that wealth is not physical stuff but held in the form of financial products So it looks to me that as share prices are being kept high some are cashing out. Those who stay in are feeling happy because their shares keep going up in ‘value’. But of course its not that simple because someone has to keep buying in the market. So I suspect much of the cashed out money is still flowing back in to other shares to keep the market buoyant. Plus people will look at even a rigged market and say to themselves – “hey I’m missing out if I duck out of this bull market too early.” So they stay in even knowing the risks of a rigged market. Telling themselves there will be a better time later to cash out. And therein lies their danger. As Mr Kostin notes,

Seems like this was a strategy they tried before. And it is not just CAT and a few others it is market wide. Mr Kostin one more time

I think that is a systemic problem. $600 billion keeping stock prices buoyant and above any profit based valuation. And I’m not alone. Nobel laureate economist Robert Shiller of Yale University in a recent interview said, referring to the persistent bubble-like pricing in not just property but in stocks and various commodities,

The fact that Schiller thinks this bubble is driven by anxiety is, to me, very significant. I think he is right of course. I do think there is a palpable anxiety driving this bubble rather than the exuberant ‘animal spirits’ that Greenspan so famously identified as the cause of bubbles. Schiller goes on to say,

I agree with all those sources of anxiety. But I think he is missing out on possibly the major source which, as I’ve argued, is the anxiety of keeping your money in the market so as to maintain the inflated share prices, while at the same time trying to figure out how to get out, again, without popping the bubble. So – maintain and get out at the same time – no wonder they’re anxious. Round and round. Up and up. If you can’t get out and you are afraid there are not enough new buyers to keep your ponzi/bubble going what do you do? I think the answer is you and your friends do the buying yourself. If you and your friends are big enough players with enough to lose that defecting is really dangerous, then you actually have a workable incentive to keep playing. You buy the shares I sell and I buy yours (It doesn’t just have to be just buy-backs as per the CAT example). And I think this is what has been happening. Of course it only works of you are able, as a group, to have a really serious effect on the over all market. But if you think of the top 10% they certainly have that. I buy your shares and pay you your asking price. You do the same for me. Tomorrow we do it again and each time we ramp the price a little. The limiting factor, of course, is that we will not have enough money to buy all the shares as their price goes up and up. But that little problem can be easily solved if we have a friendly banker who will accept our shares as collateral for a loan. If our banker will extend us a loan and increase that loan periodically in line with the increase in value of the shares then all is good. Because the bank can just magic new money in to existence.

And if anyone get a creeping feeling that the banks are getting stretched a little thin or their margins – the interest they charge us for our loans above what they pay for borrowing – are too small for their comfort, then we all just tell the central bank that some new very low interest money is needed to juice the whole system. And since most of them are former us (bankers and financiers) they will understand. Plus they don’t want a systemic crash. It’s bad for their reputation and their personal wealth. So with help from bankers and central bankers our cash supply will keep pace with the bubble inflation. Let’s be clear the markets tell central bankers what is needed not the other way around. It is a myth that central bankers call the tune. They don’t. Certainly central bankers sit in their central banks board rooms and ‘make’ their decisions but it is what the private banks do, how much they loan, how much they inflate the credit supply, that has the whip hand in dictating what the central banks are obliged to do in order to keep the music playing.

Of course if everyone knows the whole thing is a bubble it might seem insane. But if your alternative is to see the bubble burst then its still a rational decision to keep playing. It will pop one day and all that paper will turn to ash. But if, in the mean time you have been siphoning off some wealth to buy up actual stuff then when the ash settles you will still own stuff. So keep playing. I wonder if this is why there is such a political push in the US and Europe to privatize anything and everything still in public hands? And this argument doesn’t even take in to account that the vast preponderance of the wealth of the top 10% is tied up in even more remote-from-reality paper. Certainly the wealthiest 10%, 5%, 1% 0.1% and 0.01% own mines and factories and land. But even those things are dwarfed by how much of the wealth is tied up in the paper wealth of derivatives, securities, loans, bonds piled on top of the inflated asset and share prices. You just have to think, for example, of the size of the OTC derivatives markets whose gross market value is somewhere around $21 trillion. A figure that is itself based upon the larger value of outstanding contracts which is about $630 Trillion. All of this would be dust, in a collapse that was not bailed out.

Is this actually happening?

Well price inflation certainly is. According to an article from AP a few days ago,

How bad is it?

At the same time leverage is again creeping up to unwise levels. Not in the banks this time (not officially at least) but in Hedge funds where it is up to 2004 levels. It is a truism that risk never goes away it just migrates to where the regulators can’t see it or have no power to do anything about it. Even the slowest guys in the room, the regulators, are beginning to be worried...The point, however, is that there is an air of conspiracy about it. The companies (which includes financial ones) are playing around on the border between creative accountancy and fraudulent misrepresentation and the analysts and auditors are not correcting them. Much as we saw in the figures for all the banks in the run up to the crash. All of the big 4 accountancy firms were signing off on the robust financial health of banks sometimes mere weeks before said bank then collapsed. All of the big 4 auditors subsequently found themselves in court. So to suggest that companies, analysts and auditors might be not just allowing and enabling dangerous misrepresentations but even endorsing them is not really conspiracy theory, more painful experience...

A BIT MORE

A Pink Slip for the Progress Fairy OCTOBER--RETURN TO THE FUTURE

http://thearchdruidreport.blogspot.com/2014/10/a-pink-slip-for-progress-fairy.htmlIf you’ve ever wondered just how powerfully 'collective thinking' grips most members of our species—including, by and large, those who most forcefully insist on the originality of their thinking—I have an experiment to recommend: go out in public and advocate an idea about the future that isn’t part of the conventional wisdom, and see what kind of reaction you field. If your experience is anything like mine, you’ll get some anger, some argument, and some blank stares, but the most telling reaction will come from people who try to force what you’re saying into the Procrustean bed of the conventional wisdom, no matter how thoroughly they have to stretch and chop what you’ve said to make it fit.

Now of course the project of this blog is guaranteed to field such reactions, since the ideas explored here don’t just ignore the conventional wisdom, they fling it to the floor and dance on the crumpled remains. When I mention that I expect the decline and fall of industrial civilization to take centuries, accordingly, people take this to mean that I expect a smooth, untroubled descent. When I mention that I expect crisis before this decade is finished, in turn, people take this to mean that I expect industrial civilization to crash into ruin in the next few years. Some people, for that matter, slam back and forth from one of these presuppositions to another, as though they can’t fit the concepts of prolonged decline and imminent crisis into their heads at the same moment. That sort of response has become more common than usual in recent months, and part of the reason may be that it’s been a while since I’ve sketched out the overall shape of the future as I see it. Some of my readers may have lost track of the broader picture, and more recent readers of this blog may not have encountered that picture at all. For that reason among others, I’m going to spend this week’s post summarizing the the decline and fall of industrial civilization.

Yes, I’m aware that many people believe that such a thing can’t happen: that science, technology, or some other factor has made progress irreversible. I’m also aware that many people insist that progress may not be irreversible yet but will be if we all just do that little bit more. These are—well, let’s be charitable and call them faith-based claims. Generalizing from a sample size of one when the experiment hasn’t yet run its course is poor scientific procedure; insisting that just this once, the law of diminishing returns will be suspended for our benefit is the antithesis of science. It amounts to treating progress as some sort of beneficent fairy who can be counted on to tap us with her magic wand and give us a wonderful future, just because we happen to want one.

The overfamiliar cry of “but it’s different this time!” is popular, it’s comforting, but it’s also irrelevant. Of course it’s different this time; it was different every other time, too. Neolithic civilizations limited to one river valley and continental empires with complex technologies have all declined and fallen in much the same way and for much the same reasons. It may appeal to our sense of entitlement to see ourselves as destiny’s darlings, to insist that the Progress Fairy has promised us a glorious future out there among the stars, or even to claim that it’s humanity’s mission to populate the galaxy, but these are another set of faith-based claims; it’s a little startling, in fact, to watch so many people who claim to have outgrown theology clinging to such overtly religious concepts as humanity’s mission and destiny.

In the real world, when civilizations exhaust their resource bases and wreck the ecological cycles that support them, they fall. It takes between one and three centuries on average for the fall to happen—and no, big complex civilizations don’t fall noticeably faster or slower than smaller and simpler ones. Nor is it a linear decline—the end of a civilization is a fractal process composed of crises on many different scales of space and time, with equally uneven consequences. An effective response can win a breathing space; in the wake of a less effective one, part of what used to be normal goes away for good. Sooner or later, one crisis too many overwhelms the last defenses, and the civilization falls, leaving scattered remnants of itself that struggle and gleam for a while until the long night closes in. The historian Arnold Toynbee, whose study of the rise and fall of civilizations is the most detailed and cogent for our purpose, has traced a recurring rhythm in this process. Falling civilizations oscillate between periods of intense crisis and periods of relative calm, each such period lasting anywhere from a few decades to a century or more—the pace is set by the speed of the underlying decline, which varies somewhat from case to case. Most civilizations, he found, go through three and a half cycles of crisis and stabilization—the half being, of course, the final crisis from which there is no recovery.

That’s basically the model that I’m applying to our future. One wrinkle many people miss is that we’re not waiting for the first of the three and a half rounds of crisis and recovery to hit; we’re waiting for the second. The first began in 1914 and ended around 1954, driven by the downfall of the British Empire and the collapse of European domination of the globe. During the forty years between Sarajevo and Dien Bien Phu, the industrial world was hammered by the First World War, the Spanish Flu pandemic, the Great Depression, millions of political murders by the Nazi and Soviet governments, the Second World War, and the overthrow of European colonial empires around the planet. That was the first era of crisis in the decline and fall of industrial civilization. The period from 1945 to the present was the first interval of stability and recovery, made more prosperous and expansive than most examples of the species by the breakneck exploitation of petroleum and other fossil fuels, and a corresponding boom in technology. At this point, as fossil fuel reserves deplete, the planet’s capacity to absorb carbon dioxide and other pollutants runs up against hard limits, and a galaxy of other measures of impending crisis move toward the red line, it’s likely that the next round of crisis is not far off. What will actually trigger that next round, though, is anyone’s guess. In the years leading up to 1914, plenty of people sensed that an explosion was coming, some guessed that a general European war would set it off, but nobody knew that the trigger would be the assassination of an Austrian archduke on the streets of Sarajevo. The Russian Revolution, the March on Rome, the crash of ‘29, Stalin, Hitler, Pearl Harbor, Auschwitz, Hiroshima? No one saw those coming, and only a few people even guessed that something resembling one or another of these things might be in the offing.

Thus trying to foresee the future of industrial society in detail is an impossible task. Sketching out the sort of future that we could get is considerably less challenging. History has plenty to say about the things that happen when a civilization begins its long descent into chaos and barbarism, and it’s not too difficult to generalize from that evidence. I don’t claim that the events outlined below are what will happen, but I expect things like them to happen; further than that, the lessons of history will not go.

With those cautions, here’s a narrative sketch of the kind of future that waits for us.

YOU'LL HAVE TO GO TO THE LINK...IF YOU DARE!

Experts Say Best Option Now Is Keeping Nation As Comfortable As Possible Till End ONION

http://www.theonion.com/article/experts-say-best-option-now-keeping-nation-comfort-50617Saying there were no other options remaining and that continued intervention would only prolong the nation’s suffering, experts concluded Tuesday that the best course of action is to keep the United States as comfortable as possible until the end. According to those familiar with its condition, the country’s long, painful decline over the past several decades has made it clear that the most compassionate choice at this juncture is to do whatever is possible to ensure America is at ease during its last moments.

“We need to accept the fact that the U.S. doesn’t have long—simply helping it pass that time in comfort is the humane thing to do,” said economist Danielle Martin, speaking on behalf of a large group of experts ranging from sociologists and historians to lawmakers and environmentalists, all of whom confirmed they had “done everything [they] could.” “Attempting to stabilize the country in its current enfeebled state would not only be extremely expensive, but it would also cause unnecessary agony as it enters this final stage. With how hard the nation is struggling to perform even basic functions, letting it meet its end naturally is the merciful decision here.”...Added Martin: “At the end of the day, it’s nearly 240 years old—what can you reasonably expect?”

Others agreed with Martin, saying that, with America having gradually become a weak, almost unrecognizable shadow of its former self, the priority now should be ensuring that it is given whatever palliative support it needs and using the remaining time to put the nation’s affairs in order. Sources also emphasized that citizens who have not already begun to emotionally prepare themselves for the country’s demise should begin to do so.

“At a time like this, it’s completely understandable to wish for some kind of 11th-hour miracle, but expecting the U.S. to somehow magically return to the way it was in its prime isn’t healthy or realistic,” said Georgetown University researcher Andrew Fischer, who later stressed that just because the nation still has “the occasional good day,” this should not cause anyone to get their hopes up for a sudden recovery. “It’s important to manage expectations and realize that sometime very soon, we’re all going to have to say goodbye.”

“We just need to remember all the good times we had,” Fischer continued. “Like the moon landing—that was really nice, wasn’t it?”

Many of those with close ties to the United States said they were having difficulty coming to terms with the country’s imminent passing, but that letting it go peacefully was ultimately for the best.

“At one point, I would’ve done anything if it meant having America around for just a little longer, but I can’t watch it slowly waste away like this anymore,” said Tampa, FL resident Kathy Muniz, adding that it “breaks [her] heart” when she sees how hard the U.S. struggles to put on a brave face and pretend that everything is fine. “The kindest thing now is to just do what we can to keep the nation’s spirits up while nature takes its course.”

“Really, I think any country in America’s position would want the same,” Muniz added.

All 50 US states fail to meet global police use of force standards, report finds

http://www.theguardian.com/us-news/2015/jun/18/us-states-police-use-of-force-standards-amnestyEvery state in the US fails to comply with international standards on the lethal use of force by law enforcement officers, according to a report by Amnesty International USA, which also says 13 US states fall beneath even lower legal standards enshrined in US constitutional law and that nine states currently have no laws at all to deal with the issue.

The stinging review comes amid a national debate over police violence and widespread protest following the high-profile deaths of 18-year-old Michael Brown in Ferguson, Missouri; 43-year-old Eric Garner in New York; 50-year-old Walter Scott in South Carolina; and 25-year-old Freddie Gray in Baltimore – all unarmed black men killed by police within the past 11 months.

Amnesty USA’s executive director, Steven Hawkins, told the Guardian the findings represented a “shocking lack of fundamental respect for the sanctity of human life”.

“While law enforcement in the United States is given the authority to use lethal force, there is no equal obligation to respect and preserve human life. It’s shocking that while we give law enforcement this extraordinary power, so many states either have no regulation on their books or nothing that complies with international standards,” Hawkins said.

MORE

Stealth Block to Monetary Reform: Fast-Tracking TiSA by ELLEN BROWN

http://www.counterpunch.org/2015/06/12/fast-tracking-tisa/— Attributed to Henry Ford

In March 2014, the Bank of England let the cat out of the bag: money is just an IOU, and the banks are rolling in it. So wrote David Graeber in The Guardian the same month, referring to a BOE paper called “Money Creation in the Modern Economy.” The paper stated outright that most common assumptions of how banking works are simply wrong. The result, said Graeber, was to throw the entire theoretical basis for austerity out of the window...The revelation may have done more than that. The entire basis for maintaining our private extractive banking monopoly may have been thrown out the window. And that could help explain the desperate rush to “fast track” not only the Trans-Pacific Partnership (TPP) and the Trans-Atlantic Trade and Investment Partnership (TTIP), but the Trade in Services Agreement (TiSA). TiSA would nip attempts to implement public banking and other monetary reforms in the bud.

The Banking Game Exposed

The BOE report confirmed what money reformers have been saying for decades: that banks do not act simply as intermediaries, taking in the deposits of “savers” and lending them to borrowers, keeping the spread in interest rates. Rather, banks actually create deposits when they make loans. The BOE report said that private banks now create 97 percent of the British money supply. The US money supply is created in the same way.

Graeber underscored the dramatic implications:

Politically, said Graeber, revealing these facts is taking an enormous risk:

If money is just an IOU, why are we delivering the exclusive power to create it to an unelected, unaccountable, non-transparent private banking monopoly? Why are we buying into the notion that the government is broke – that it must sell off public assets and slash public services in order to pay off its debts? The government could pay its debts in the same way private banks pay them, simply with accounting entries on its books. What will happen when a critical mass of the populace realizes that we’ve been vassals of a parasitic banking system based on a fraud – that we the people could be creating money as credit ourselves, through publicly-owned banks that returned the profits to the people?

Henry Ford predicted that a monetary revolution would follow. There might even be a move to nationalize the whole banking system and turn it into a public utility...It is not hard to predict that the international bankers and related big-money interests, anticipating this move, would counter with legislation that locked the current system in place, so that there was no way to return money and banking to the service of the people – even if the current private model ended in disaster, as many pundits also predict. And that is precisely the effect of the Trade in Services Agreement (TiSA), which was slipped into the “fast track” legislation now before Congress. It is also the effect of the bail-in policies currently being railroaded into law in the Eurozone, and of the suspicious “war on cash” seen globally; but those developments will be the subject of another article.

TiSA Exposed

On June 3, 2015, WikiLeaks released 17 key documents related to TiSA, which is considered perhaps the most important of the three deals being negotiated for “fast track” trade authority. The documents were supposed to remain classified for five years after being signed, displaying a level of secrecy that outstrips even the TPP’s four-year classification. TiSA involves 51 countries, including every advanced economy except the BRICS (Brazil, Russia, India, China, and South Africa). The deal would liberalize global trade in services covering close to 80% of the US economy, including financial services, healthcare, education, engineering, telecommunications, and many more. It would restrict how governments can manage their public laws, and it could dismantle and privatize state-owned enterprises, turning those services over to the private sector.

Recall the secret plan devised by Wall Street and U.S. Treasury officials in the 1990s to open banking to the lucrative derivatives business. To pull this off required the relaxation of banking regulations not just in the US but globally, so that money would not flee to nations with safer banking laws. The vehicle used was the Financial Services Agreement concluded under the auspices of the World Trade Organization’s General Agreement on Trade in Services (GATS). The plan worked, and most countries were roped into this “liberalization” of their banking rules. The upshot was that the 2008 credit crisis took down not just the US economy but economies globally. TiSA picks up where the Financial Services Agreement left off, opening yet more doors for private banks and other commercial service industries, and slamming doors on governments that might consider opening their private banking sectors to public ownership...

BUT WAIT! THERE'S MORE! SEE OP, AND ALSOFOLLOWING LINKS

The disturbing revelations concerning TiSA are yet another reason to try to block these secretive trade agreements.

For more information and to get involved, visit:

Flush the TPP http://www.flushthetpp.org/

The Citizens Trade Campaign http://www.citizenstrade.org/

Public Citizen’s Global Trade Watch http://www.tradewatch.org/

Eyes on Trade http://citizen.typepad.com/eyesontrade/

Ellen Brown is an attorney, founder of the Public Banking Institute, and author of twelve books including the best-selling Web of Debt. Her latest book, The Public Bank Solution, explores successful public banking models historically and globally. Her 300+ blog articles are at EllenBrown.com.

Weekend Economists: (Oh) Say, Can You See? June 19-21, 2015

http://3.bp.blogspot.com/-esdOygUQhl8/UqD1qKPTaUI/AAAAAAAADIo/Dul3D6cr60k/s1600/star+spangled+banner.pngThe original Star-Spangled Banner, the flag that inspired Francis Scott Key to write the song that would become our national anthem, is among the most treasured artifacts in the collections of the Smithsonian’s National Museum of American History in Washington, D.C.

Quick Facts about the Star-Spangled Banner Flag

Made in Baltimore, Maryland, in July-August 1813 by flagmaker Mary Pickersgill

Commissioned by Major George Armistead, commander of Fort McHenry

Original size: 30 feet by 42 feet

Current size: 30 feet by 34 feet

Fifteen stars and fifteen stripes (one star has been cut out)

Raised over Fort McHenry on the morning of September 14, 1814, to signal American victory over the British in the Battle of Baltimore; the sight inspired Francis Scott Key to write “The Star-Spangled Banner”

Preserved by the Armistead family as a memento of the battle

First loaned to the Smithsonian Institution in 1907; converted to permanent gift in 1912

On exhibit at the National Museum of American History since 1964

Major, multi-year conservation effort launched in 1998

Plans for new permanent exhibition gallery now underway

Making the Star-Spangled Banner

In June 1813, Major George Armistead arrived in Baltimore, Maryland, to take command of Fort McHenry, built to guard the water entrance to the city. Armistead commissioned Mary Pickersgill, a Baltimore flag maker, to sew two flags for the fort: a smaller storm flag (17 by 25 ft) and a larger garrison flag (30 by 42 ft). She was hired under a government contract and was assisted by her daughter, two nieces, and an indentured African-American girl.

The larger of these two flags would become known as the “Star-Spangled Banner.” Pickersgill stitched it from a combination of dyed English wool bunting (red and white stripes and blue union) and white cotton (stars). Each star is about two feet in diameter, each stripe about 24 inches wide. The Star-Spangled Banner’s impressive scale (about one-fourth the size of a modern basketball court) reflects its purpose as a garrison flag. It was intended to fly from a flagpole about ninety feet high and be visible from great distances. At its original dimensions of 30 by 42 feet, it was larger than the modern garrison flags used today by the United States Army, which have a standard size of 20 by 38 feet.

The first Flag Act, adopted on June 14, 1777, created the original United States flag of thirteen stars and thirteen stripes. The Star-Spangled Banner has fifteen stars and fifteen stripes as provided for in the second Flag Act approved by Congress on January 13, 1794. The additional stars and stripes represent Vermont (1791) and Kentucky (1792) joining the Union. (The third Flag Act, passed on April 4, 1818, reduced the number of stripes back to thirteen to honor the original thirteen colonies and provided for one star for each state — a new star to be added to the flag on the Fourth of July following the admission of each new state.) Pickersgill spent between six and eight weeks making the flags, and they were delivered to Fort McHenry on August 19, 1813. The government paid $405.90 for the garrison flag and $168.54 for the storm flag. The garrison flag would soon after be raised at Fort McHenry and ultimately find a permanent home at the Smithsonian Institution’s National Museum of American History. The whereabouts of the storm flag are not known.

http://www.si.edu/encyclopedia_si/nmah/starflag.htm

A Restored Fort McHenry--outside Baltimore, Maryland

In eighth grade, I had music class with Mr. Butler, who required that we learn all three verses of the Star Spangled Banner, and sing it at the opening of every class as our vocal warm-up. Thank you, Mr. Butler of Clark Jr. High, wherever you may be now....apparently, the school is now called Henderson Academy, and appears to be a charter school....sic transit gloria mundi

Living with autism: year 33

Note to readers: I did not kill my child today. I did not kill her all this week. I deserve a medal, or a vacation, or at least the richest chocolate cake on earth. (Mainly, because I couldn't figure out how to dispose of the body, and I didn't have time anyway.)

Living with autism....call this living?....is not for the faint of heart. It's perpetual two-year-old cum adolescence.

When "helpful" people try to fill the PDD-NOS brain with ideas that cannot be understood safely, trouble results. Like wandering away unattended and getting picked up by the fire department and stuffed in an ambulance and carted to the ER because some concerned passer-by wondered what the crazy woman mumbling to herself was doing all alone...

Like screaming at the person who is trying to get food on the table after a hard day's work because ice cream, trips to the library or shopping, or a movie are not instantly forthcoming or promised....

Like raiding the freezer at night, leaving the door open and letting the ice cream melt all over the freezer and floor.

That kind of week. One in a series....

I think TPTB, the banksters and the 1% have decided on a Thelma and Louise Scenario

I cannot explain today's events with any other set up.

How, in the face of so much popular rage, they can choose to press on with their greed and need...to the point of the annihilation of themselves by the rest of the world.

And it will happen. Just not soon enough.

Profile Information

Gender: FemaleHometown: Ann Arbor, Michigan

Home country: USA

Member since: Thu Sep 25, 2003, 02:04 PM

Number of posts: 85,373