Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

marmar

marmar's Journal

marmar's Journal

February 15, 2016

from the film "The Corporation"

Noam Chomsky on consumerism and corporate propaganda

from the film "The Corporation"

February 15, 2016

IL: Record Number of Riders Take 'L,' But Bus Use Slips in 2015, CTA Says

Marwa Eltagouri On Feb 15, 2016

Source: McClatchy

Feb. 13--The Chicago Transit Authority has announced a record number of rail passengers during 2015, at more than 241 million riders.

But while rail ridership broke the 2014 record with 3.5 million more rides, bus ridership fell by about 1.8 million rides in 2015. Bus ridership was affected by February 2015's blizzard, which caused some of the coldest recorded temperatures in Chicago's history, officials said. Several months of downtown construction also affected bus ridership.

CTA ridership for bus and rail systems combined reached about 515 million, CTA officials said in a news release.

Among rail stations, the Red Line saw the largest number of rides in 2015, with 78.8 million, and the Blue Line came in second with 46.8 million rides, according to data released by CTA officials. Overall ridership for the Brown Line dipped 2.9 percent since 2014.

Ridership increased most at the Loop's Randolph/Wabash and Adams/Wabash stations, up 32.7 and 30.8 percent since 2014, respectively, in part due to the closure of the Madison/Wabash station, officials said. There was also a spike in rides at the Blue Line's California, Damen and O'Hare stations, up 22.5, 20.3 and 15.3 percent since 2014. ................(more)

http://www.masstransitmag.com/news/12169883/record-number-of-riders-take-l-but-bus-use-slips-in-2015-cta-says

Chicago: Record Number of Riders Take 'L,' But Bus Use Slips in 2015, CTA Says

IL: Record Number of Riders Take 'L,' But Bus Use Slips in 2015, CTA Says

Marwa Eltagouri On Feb 15, 2016

Source: McClatchy

Feb. 13--The Chicago Transit Authority has announced a record number of rail passengers during 2015, at more than 241 million riders.

But while rail ridership broke the 2014 record with 3.5 million more rides, bus ridership fell by about 1.8 million rides in 2015. Bus ridership was affected by February 2015's blizzard, which caused some of the coldest recorded temperatures in Chicago's history, officials said. Several months of downtown construction also affected bus ridership.

CTA ridership for bus and rail systems combined reached about 515 million, CTA officials said in a news release.

Among rail stations, the Red Line saw the largest number of rides in 2015, with 78.8 million, and the Blue Line came in second with 46.8 million rides, according to data released by CTA officials. Overall ridership for the Brown Line dipped 2.9 percent since 2014.

Ridership increased most at the Loop's Randolph/Wabash and Adams/Wabash stations, up 32.7 and 30.8 percent since 2014, respectively, in part due to the closure of the Madison/Wabash station, officials said. There was also a spike in rides at the Blue Line's California, Damen and O'Hare stations, up 22.5, 20.3 and 15.3 percent since 2014. ................(more)

http://www.masstransitmag.com/news/12169883/record-number-of-riders-take-l-but-bus-use-slips-in-2015-cta-says

February 15, 2016

Feb. 13--Change is no stranger to the Mission District, and this time it's the main drag -- Mission Street -- and the heavily ridden Muni lines that are set for transformation.

The bustling thoroughfare is gaining some red transit-only lanes, while losing a lane of traffic, in a bid to clear out many cars -- especially double-parkers -- and speed up buses that is reminiscent of transit-first efforts in other parts of the city, including Market Street downtown.

The shifts, which cover a 2 1/2 -mile stretch of Mission, begin Saturday, when Muni pares back what it considers an inefficient series of bus stops by eliminating 13 stops serving three bus lines -- the 14-Mission, 14R-Mission Rapid and 49-Van Ness/Mission -- and adding one.

Public-works crews will also break out paint and brushes and start adding red transit-only lanes between 11th and Randall streets.

The painting should be done by March or April, at which time the Municipal Transportation Agency will start banning left turns at every intersection between 14th and Cesar Chavez streets and requiring right turns off of Mission Street at 16th, 20th, 22nd, 24th and 26th streets. ...................(more)

http://www.masstransitmag.com/news/12169880/big-changes-coming-to-the-busy-lanes-of-sfs-mission-street

San Francisco: Mission Street and Muni Lines Set for Transformation

Feb. 13--Change is no stranger to the Mission District, and this time it's the main drag -- Mission Street -- and the heavily ridden Muni lines that are set for transformation.

The bustling thoroughfare is gaining some red transit-only lanes, while losing a lane of traffic, in a bid to clear out many cars -- especially double-parkers -- and speed up buses that is reminiscent of transit-first efforts in other parts of the city, including Market Street downtown.

The shifts, which cover a 2 1/2 -mile stretch of Mission, begin Saturday, when Muni pares back what it considers an inefficient series of bus stops by eliminating 13 stops serving three bus lines -- the 14-Mission, 14R-Mission Rapid and 49-Van Ness/Mission -- and adding one.

Public-works crews will also break out paint and brushes and start adding red transit-only lanes between 11th and Randall streets.

The painting should be done by March or April, at which time the Municipal Transportation Agency will start banning left turns at every intersection between 14th and Cesar Chavez streets and requiring right turns off of Mission Street at 16th, 20th, 22nd, 24th and 26th streets. ...................(more)

http://www.masstransitmag.com/news/12169880/big-changes-coming-to-the-busy-lanes-of-sfs-mission-street

February 15, 2016

Italy’s Banking Crisis Spirals Elegantly out of Control

by Wolf Richter • February 14, 2016

How to dump toxic waste on the public through the backdoor.

Back during the euro debt crisis, while the ECB was buying government debt from Member States to keep Italian and Spanish government debt from imploding, German politicians fretted out loud about what exactly the ECB was buying. Among them was Frank Schäffler, at the time Member of the Federal Parliament, who in September 2011 said with uncanny accuracy:

This is now coming to pass.

Italy, the Eurozone’s third largest economy, is in a full-blown banking crisis. Four small banks were rescued late last year. The big ones are teetering. Their stocks have crashed. They’re saddled with non-performing loans (defined as in default or approaching default). We’re not sure that the full extent of these NPLs is even known.

The number officially tossed around is €201 billion. But even the ECB seems to doubt that number. Its new bank regulator, the Single Supervisory Mechanism, is now seeking additional information about NPLs to get a handle on them.

Other numbers tossed around are over €300 billion, or 18% of total loans outstanding. .............(more)

http://wolfstreet.com/2016/02/14/italys-banking-crisis-spirals-elegantly-out-of-control/

Italy’s Banking Crisis Spirals Elegantly out of Control

Italy’s Banking Crisis Spirals Elegantly out of Control

by Wolf Richter • February 14, 2016

How to dump toxic waste on the public through the backdoor.

Back during the euro debt crisis, while the ECB was buying government debt from Member States to keep Italian and Spanish government debt from imploding, German politicians fretted out loud about what exactly the ECB was buying. Among them was Frank Schäffler, at the time Member of the Federal Parliament, who in September 2011 said with uncanny accuracy:

“If the ECB continues like this, it will soon buy old bicycles and pay for them with new paper money.”

This is now coming to pass.

Italy, the Eurozone’s third largest economy, is in a full-blown banking crisis. Four small banks were rescued late last year. The big ones are teetering. Their stocks have crashed. They’re saddled with non-performing loans (defined as in default or approaching default). We’re not sure that the full extent of these NPLs is even known.

The number officially tossed around is €201 billion. But even the ECB seems to doubt that number. Its new bank regulator, the Single Supervisory Mechanism, is now seeking additional information about NPLs to get a handle on them.

Other numbers tossed around are over €300 billion, or 18% of total loans outstanding. .............(more)

http://wolfstreet.com/2016/02/14/italys-banking-crisis-spirals-elegantly-out-of-control/

February 15, 2016

from Dissent magazine:

The Right vs. The Family

Arlie Hochschild ▪ Winter 2016

[font size="1"]Women’s participation in the workforce has grown dramatically since the 1940s, but public services haven’t kept up—putting more strain than ever on working families. (National Archives)[/font]

Americans have long been stuck in an unfinished revolution for women’s equality. Even though women now make up nearly half the workforce, we are “leaning in” to jobs with longer hours and without a national system of good care for our young.

In the majority of households with young children today, all the adults work. Yet while researchers share exciting discoveries about busy baby brains and the importance of emotional closeness and mental stimulation, much childcare suffers from interruption and distraction. Caregivers are poorly paid, often lack training, and turnover is high. Workplace reforms to shorten the workday or allow flexibility for family demands have also been slow in coming, and for hourly workers, work hours have grown more uncertain and ill paid.

In my 1989 book The Second Shift I called this a stalled revolution, never dreaming we’d still be stuck in it over a quarter of a century later. In truth, we’re out of the old stall and into a new one. Twenty-five years ago, the obstacles we faced were across the board. Men married to women who worked full time weren’t sharing the work at home. The workplace was not “family friendly” and the government didn’t authorize family leave of any sort. Today, we’ve moved into a split-level stall. We’ve made real progress in the private realm—many men are changing diapers and vacuuming rugs without compromising their male identities. The hold-up is in the public sphere, especially federal support for childcare.

Congress controls the agenda and the public purse strings, and has moved farther and farther to the right. It has taken many programs—including those that would improve childcare—off the table. Among many Republican congressmen, the talk instead is about how many cabinet-level departments to abolish—Education, Health and Human Services, Housing and Urban Development, the EPA—not to mention federal funding for Planned Parenthood. Many even deride Michelle Obama’s fight against junk food and obesity and threaten to cut off its funding. So while many of us have moved forward in our personal lives, we’ve moved backward in the public sphere. ................(more)

https://www.dissentmagazine.org/article/free-markets-vs-family-inequality-right-wing-hypocrisy

The Right vs. The Family

from Dissent magazine:

The Right vs. The Family

Arlie Hochschild ▪ Winter 2016

[font size="1"]Women’s participation in the workforce has grown dramatically since the 1940s, but public services haven’t kept up—putting more strain than ever on working families. (National Archives)[/font]

Americans have long been stuck in an unfinished revolution for women’s equality. Even though women now make up nearly half the workforce, we are “leaning in” to jobs with longer hours and without a national system of good care for our young.

In the majority of households with young children today, all the adults work. Yet while researchers share exciting discoveries about busy baby brains and the importance of emotional closeness and mental stimulation, much childcare suffers from interruption and distraction. Caregivers are poorly paid, often lack training, and turnover is high. Workplace reforms to shorten the workday or allow flexibility for family demands have also been slow in coming, and for hourly workers, work hours have grown more uncertain and ill paid.

In my 1989 book The Second Shift I called this a stalled revolution, never dreaming we’d still be stuck in it over a quarter of a century later. In truth, we’re out of the old stall and into a new one. Twenty-five years ago, the obstacles we faced were across the board. Men married to women who worked full time weren’t sharing the work at home. The workplace was not “family friendly” and the government didn’t authorize family leave of any sort. Today, we’ve moved into a split-level stall. We’ve made real progress in the private realm—many men are changing diapers and vacuuming rugs without compromising their male identities. The hold-up is in the public sphere, especially federal support for childcare.

Congress controls the agenda and the public purse strings, and has moved farther and farther to the right. It has taken many programs—including those that would improve childcare—off the table. Among many Republican congressmen, the talk instead is about how many cabinet-level departments to abolish—Education, Health and Human Services, Housing and Urban Development, the EPA—not to mention federal funding for Planned Parenthood. Many even deride Michelle Obama’s fight against junk food and obesity and threaten to cut off its funding. So while many of us have moved forward in our personal lives, we’ve moved backward in the public sphere. ................(more)

https://www.dissentmagazine.org/article/free-markets-vs-family-inequality-right-wing-hypocrisy

February 15, 2016

from Dissent magazine:

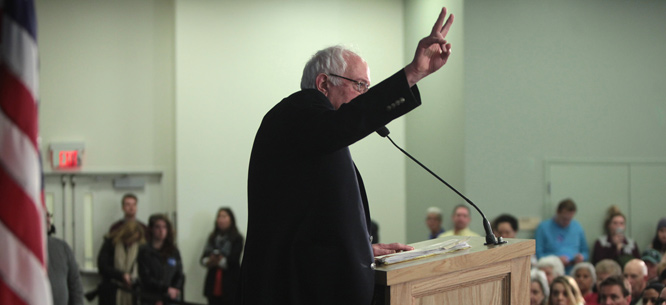

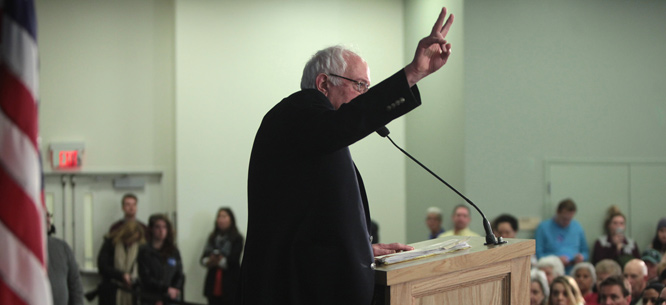

Sanders and the S Word

Michael Kazin ▪ February 12, 2016

[font size="1"]Bernie Sanders speaking in Hooksett, New Hampshire, January 21 (Gage Skidmore / Flickr)[/font]

Last November, Bernie Sanders told an enthusiastic audience packed into the largest hall at Georgetown University what “democratic socialism” means to him. He drew largely on the examples of two presidents, a civil rights leader, and a Pope—not one of whom identified himself as a socialist. Sanders praised Franklin Roosevelt for creating jobs and enacting Social Security and hailed Lyndon Johnson for initiating Medicare and Medicaid. He cited Martin Luther King, Jr.’s conviction that true freedom requires economic security. He quoted Pope Francis’s censure of “the worship of money.” Then Sanders repeated his familiar attack on the “billionaire class” and his call for universal health care and an end to tuition at public colleges.

One can easily imagine a liberal stalwart like Senator Elizabeth Warren or Senator Sherrod Brown making the same speech, yet without embracing the “S” word. Why does the white-haired firebrand from Vermont insist on identifying himself with socialism, a political faith that has never been popular in the United States?

I have never met or spoken to Bernie Sanders. So I can only speculate about his reasons. But they probably have a lot to do with the surprising influence of democratic socialists in modern U.S. history and his desire to be part of that long, if largely unheralded, tradition.

Until Sanders, the most popular American socialist was Eugene Victor Debs—a charismatic orator and erstwhile union leader whom Sanders respected so much that, in 1979, he made an earnest audio documentary about him. Unlike his latter-day admirer, Debs ran for president—five times!—as the nominee of an actual Socialist party. He never won more than 6 percent of the popular vote, but Debsian Socialists headed several major unions, did much to organize the broad coalition that almost kept the United States out of World War I, and launched the movement for birth control. Their prominence in social movements spurred progressive officeholders like Theodore Roosevelt and Woodrow Wilson to advocate economic and political reforms, in part to stop the radicals from gaining more support from the discontented.

.......(snip).......

In any European nation, to call someone a socialist is not a slur but a simple political fact. By running as a Democrat, Sanders has paradoxically gained more attention for socialism and its history in the United States than if he had remained an independent party of one, known mostly to his fellow leftists. He remains a long shot to win the presidency. But if he loses, he can take solace in the response Debs often made to people who asked why they should “throw away” their votes on a radical: “better to vote for what you want and not get it than to vote for what you don’t want and get it.” ..............(more)

https://www.dissentmagazine.org/blog/why-bernie-sanders-socialist-tradition-debs

Sanders and the S Word

from Dissent magazine:

Sanders and the S Word

Michael Kazin ▪ February 12, 2016

[font size="1"]Bernie Sanders speaking in Hooksett, New Hampshire, January 21 (Gage Skidmore / Flickr)[/font]

Last November, Bernie Sanders told an enthusiastic audience packed into the largest hall at Georgetown University what “democratic socialism” means to him. He drew largely on the examples of two presidents, a civil rights leader, and a Pope—not one of whom identified himself as a socialist. Sanders praised Franklin Roosevelt for creating jobs and enacting Social Security and hailed Lyndon Johnson for initiating Medicare and Medicaid. He cited Martin Luther King, Jr.’s conviction that true freedom requires economic security. He quoted Pope Francis’s censure of “the worship of money.” Then Sanders repeated his familiar attack on the “billionaire class” and his call for universal health care and an end to tuition at public colleges.

One can easily imagine a liberal stalwart like Senator Elizabeth Warren or Senator Sherrod Brown making the same speech, yet without embracing the “S” word. Why does the white-haired firebrand from Vermont insist on identifying himself with socialism, a political faith that has never been popular in the United States?

I have never met or spoken to Bernie Sanders. So I can only speculate about his reasons. But they probably have a lot to do with the surprising influence of democratic socialists in modern U.S. history and his desire to be part of that long, if largely unheralded, tradition.

Until Sanders, the most popular American socialist was Eugene Victor Debs—a charismatic orator and erstwhile union leader whom Sanders respected so much that, in 1979, he made an earnest audio documentary about him. Unlike his latter-day admirer, Debs ran for president—five times!—as the nominee of an actual Socialist party. He never won more than 6 percent of the popular vote, but Debsian Socialists headed several major unions, did much to organize the broad coalition that almost kept the United States out of World War I, and launched the movement for birth control. Their prominence in social movements spurred progressive officeholders like Theodore Roosevelt and Woodrow Wilson to advocate economic and political reforms, in part to stop the radicals from gaining more support from the discontented.

.......(snip).......

In any European nation, to call someone a socialist is not a slur but a simple political fact. By running as a Democrat, Sanders has paradoxically gained more attention for socialism and its history in the United States than if he had remained an independent party of one, known mostly to his fellow leftists. He remains a long shot to win the presidency. But if he loses, he can take solace in the response Debs often made to people who asked why they should “throw away” their votes on a radical: “better to vote for what you want and not get it than to vote for what you don’t want and get it.” ..............(more)

https://www.dissentmagazine.org/blog/why-bernie-sanders-socialist-tradition-debs

February 15, 2016

from the Detroit Free Press:

[font size="4"]Wanted posters, angry sidewalk messages greet governor in downtown Ann Arbor[/font]

ANN ARBOR — Bitterly cold winds whip around Susan Fecteau as she reaches into a chalk-filled bucket, gets down on her hands and knees and writes a message to Gov. Rick Snyder on the sidewalk in front of his residential loft in the heart of downtown Ann Arbor.

"How are you sleeping up there, Rick? The moms in Flint not enjoying their rest, I think," Fecteau writes in green chalk.

The message is one of dozens Fecteau has written in the past six weeks outside Snyder's home on South Main Street and the various establishments he frequents in the city.

For Fecteau, sidewalk chalking has become a personal cathartic release of anger, but she's not alone.

.....(snip).....

Protests, wanted posters with the Snyder's face boldly affixed to utility poles around the city, and a well-publicized heckling incident at a local tavern are signs that the bustling college town where Snyder has spent a chunk of his adult life could be turning against him, Fecteau and other residents said. .............(more)

http://www.freep.com/story/news/local/michigan/flint-water-crisis/2016/02/14/snyder-faces-hometown-backlash-over-flint-water-crisis/80283278/

Rick Snyder faces hometown backlash over Flint water crisis

from the Detroit Free Press:

[font size="4"]Wanted posters, angry sidewalk messages greet governor in downtown Ann Arbor[/font]

ANN ARBOR — Bitterly cold winds whip around Susan Fecteau as she reaches into a chalk-filled bucket, gets down on her hands and knees and writes a message to Gov. Rick Snyder on the sidewalk in front of his residential loft in the heart of downtown Ann Arbor.

"How are you sleeping up there, Rick? The moms in Flint not enjoying their rest, I think," Fecteau writes in green chalk.

The message is one of dozens Fecteau has written in the past six weeks outside Snyder's home on South Main Street and the various establishments he frequents in the city.

For Fecteau, sidewalk chalking has become a personal cathartic release of anger, but she's not alone.

.....(snip).....

Protests, wanted posters with the Snyder's face boldly affixed to utility poles around the city, and a well-publicized heckling incident at a local tavern are signs that the bustling college town where Snyder has spent a chunk of his adult life could be turning against him, Fecteau and other residents said. .............(more)

http://www.freep.com/story/news/local/michigan/flint-water-crisis/2016/02/14/snyder-faces-hometown-backlash-over-flint-water-crisis/80283278/

February 15, 2016

Corporate PR Flacks Are Trying To Convince You the Trans-Pacific Partnership Will Benefit Workers

BY Jim Hightower

The basic problem facing the corporate and political powers that want you and me to swallow their Trans-Pacific Partnership deal is that they can't make chicken salad out of chicken manure.

But that reality hasn't stopped their PR campaign, pitching their "salad" as good and good for you! For example, a recent article touted a study blaring the happy news that TPP will increase real incomes in the U.S. by $133 billion a year. Even if that were true (and plenty of other studies show that it's not), it's a statistic meant to dazzle rather than enlighten, for it skates around the real bottom line for the American public: An increase in income for whom?

In the past 15 years or so, and especially since 2008, it's been made perfectly clear to the workaday majority of people that the corporate mantra of "income growth" benefitting everyone is a deliberate lie. Practically all of the massive annual increases in U.S. income, which every worker helps produce, now gushes up to the richest 1 percent, with millionaires and billionaires (the richest 10 percent of 1-percenters) grabbing the bulk of it.

Economists have a technical term for this: "stealing." TPP is written specifically to sanction and increase the robbery of the many by the world's moneyed few, including provisions that give additional incentives to U.S. manufacturers to ship more of our middle-class jobs to places such as Vietnam with wages under 65 cents an hour (or around $155 a month). ...............(more)

http://inthesetimes.com/working/entry/18854/Trans-pacific-parntership_free-trade_income-inquality

Jim Hightower: PR Flacks Are Trying To Convince You the TPP Will Benefit Workers

Corporate PR Flacks Are Trying To Convince You the Trans-Pacific Partnership Will Benefit Workers

BY Jim Hightower

The basic problem facing the corporate and political powers that want you and me to swallow their Trans-Pacific Partnership deal is that they can't make chicken salad out of chicken manure.

But that reality hasn't stopped their PR campaign, pitching their "salad" as good and good for you! For example, a recent article touted a study blaring the happy news that TPP will increase real incomes in the U.S. by $133 billion a year. Even if that were true (and plenty of other studies show that it's not), it's a statistic meant to dazzle rather than enlighten, for it skates around the real bottom line for the American public: An increase in income for whom?

In the past 15 years or so, and especially since 2008, it's been made perfectly clear to the workaday majority of people that the corporate mantra of "income growth" benefitting everyone is a deliberate lie. Practically all of the massive annual increases in U.S. income, which every worker helps produce, now gushes up to the richest 1 percent, with millionaires and billionaires (the richest 10 percent of 1-percenters) grabbing the bulk of it.

Economists have a technical term for this: "stealing." TPP is written specifically to sanction and increase the robbery of the many by the world's moneyed few, including provisions that give additional incentives to U.S. manufacturers to ship more of our middle-class jobs to places such as Vietnam with wages under 65 cents an hour (or around $155 a month). ...............(more)

http://inthesetimes.com/working/entry/18854/Trans-pacific-parntership_free-trade_income-inquality

February 13, 2016

This is How Financial Chaos Begins

by Wolf Richter • February 12, 2016

[font color="blue"]It’s not contained.[/font]

There are over $1.8 trillion of US junk bonds outstanding. It’s the lifeblood of over-indebted corporate America. When yields began to soar over a year ago, and liquidity began to dry up at the bottom of the scale, it was “contained.”

Yet contagion has spread from energy, metals, and mining to other industries and up the scale. According to UBS, about $1 trillion of these junk bonds are now “stressed” or “distressed.” And the entire corporate bond market, which is far larger than the stock market, is getting antsy.

The average yield of CCC or lower-rated junk bonds hit the 20% mark a week ago. The last time yields had jumped to that level was on September 20, 2008, in the panic after the Lehman bankruptcy, as we pointed out. Today, that average yield is nearly 22%!

Today even the average yield spread between those bonds and US Treasuries has breached the 20% mark. Last time this happened was on October 6, 2008, during the post-Lehman panic:

At this cost of capital, companies can no longer borrow. Since they’re cash-flow negative, they’ll run out of liquidity sooner or later. When that happens, defaults jump, which blows out spreads even further, which is what happened during the Financial Crisis. The market seizes. Financial chaos ensues. ...............(more)

http://wolfstreet.com/2016/02/12/how-financial-chaos-begins/

This is How Financial Chaos Begins

This is How Financial Chaos Begins

by Wolf Richter • February 12, 2016

[font color="blue"]It’s not contained.[/font]

There are over $1.8 trillion of US junk bonds outstanding. It’s the lifeblood of over-indebted corporate America. When yields began to soar over a year ago, and liquidity began to dry up at the bottom of the scale, it was “contained.”

Yet contagion has spread from energy, metals, and mining to other industries and up the scale. According to UBS, about $1 trillion of these junk bonds are now “stressed” or “distressed.” And the entire corporate bond market, which is far larger than the stock market, is getting antsy.

The average yield of CCC or lower-rated junk bonds hit the 20% mark a week ago. The last time yields had jumped to that level was on September 20, 2008, in the panic after the Lehman bankruptcy, as we pointed out. Today, that average yield is nearly 22%!

Today even the average yield spread between those bonds and US Treasuries has breached the 20% mark. Last time this happened was on October 6, 2008, during the post-Lehman panic:

At this cost of capital, companies can no longer borrow. Since they’re cash-flow negative, they’ll run out of liquidity sooner or later. When that happens, defaults jump, which blows out spreads even further, which is what happened during the Financial Crisis. The market seizes. Financial chaos ensues. ...............(more)

http://wolfstreet.com/2016/02/12/how-financial-chaos-begins/

February 13, 2016

This is How Financial Chaos Begins

by Wolf Richter • February 12, 2016

[font color="blue"]It’s not contained.[/font]

There are over $1.8 trillion of US junk bonds outstanding. It’s the lifeblood of over-indebted corporate America. When yields began to soar over a year ago, and liquidity began to dry up at the bottom of the scale, it was “contained.”

Yet contagion has spread from energy, metals, and mining to other industries and up the scale. According to UBS, about $1 trillion of these junk bonds are now “stressed” or “distressed.” And the entire corporate bond market, which is far larger than the stock market, is getting antsy.

The average yield of CCC or lower-rated junk bonds hit the 20% mark a week ago. The last time yields had jumped to that level was on September 20, 2008, in the panic after the Lehman bankruptcy, as we pointed out. Today, that average yield is nearly 22%!

Today even the average yield spread between those bonds and US Treasuries has breached the 20% mark. Last time this happened was on October 6, 2008, during the post-Lehman panic:

At this cost of capital, companies can no longer borrow. Since they’re cash-flow negative, they’ll run out of liquidity sooner or later. When that happens, defaults jump, which blows out spreads even further, which is what happened during the Financial Crisis. The market seizes. Financial chaos ensues. ...............(more)

http://wolfstreet.com/2016/02/12/how-financial-chaos-begins/

This is How Financial Chaos Begins

This is How Financial Chaos Begins

by Wolf Richter • February 12, 2016

[font color="blue"]It’s not contained.[/font]

There are over $1.8 trillion of US junk bonds outstanding. It’s the lifeblood of over-indebted corporate America. When yields began to soar over a year ago, and liquidity began to dry up at the bottom of the scale, it was “contained.”

Yet contagion has spread from energy, metals, and mining to other industries and up the scale. According to UBS, about $1 trillion of these junk bonds are now “stressed” or “distressed.” And the entire corporate bond market, which is far larger than the stock market, is getting antsy.

The average yield of CCC or lower-rated junk bonds hit the 20% mark a week ago. The last time yields had jumped to that level was on September 20, 2008, in the panic after the Lehman bankruptcy, as we pointed out. Today, that average yield is nearly 22%!

Today even the average yield spread between those bonds and US Treasuries has breached the 20% mark. Last time this happened was on October 6, 2008, during the post-Lehman panic:

At this cost of capital, companies can no longer borrow. Since they’re cash-flow negative, they’ll run out of liquidity sooner or later. When that happens, defaults jump, which blows out spreads even further, which is what happened during the Financial Crisis. The market seizes. Financial chaos ensues. ...............(more)

http://wolfstreet.com/2016/02/12/how-financial-chaos-begins/

Profile Information

Gender: MaleHometown: Detroit, MI

Member since: Fri Oct 29, 2004, 12:18 AM

Number of posts: 77,066