marmar

marmar's JournalRethinking Agriculture: National Climate Assessment Provides (Another) Reason

from Civil Eats:

Rethinking Agriculture: National Climate Assessment Provides (Another) Reason

By Mia Macdonald on April 30, 2013

Pastoralists in Kenya, rice farmers in India, and industrial feedlot operators in the U.S. have all contended with the increased frequency of drought and erratic weather. New agricultural ideas and actions are essential amid rising climate stress, a growing human population, widespread degradation of ecosystems, and rampant food insecurity; nearly one billion people regularly don’t get enough to eat.

Agriculture isn’t just affected by the effects of climate change. It’s also a significant source of greenhouse gas emissions (GHGs). According to the U.S. Environmental Protection Agency (EPA), the U.S. agricultural sector was responsible in 2011 for 7.2 percent of U.S. GHGs. This doesn’t include emissions from indirect agricultural activities, like clearing grasslands or forests to create farmland, or the fossil fuels burned when transporting agricultural products.

U.S. agriculture is heavily tilted toward large-scale, resource-intensive production of animals and the corn and soybeans that feed them. Corn, soybeans, and hay are the U.S.’s three largest crops. It might be hard to believe, but less than 2 percent of U.S. farm acres grow vegetables or pulses (beans and legumes) and less than 2 percent are planted with fruit or tree nuts.

The U.S. food system is also vulnerable to global warming. The draft National Climate Assessment, prepared by more than 200 scientists for the U.S. government and recently released for public comment, says this: “Production of all commodities will be vulnerable to direct impacts from changing climate conditions on crop and livestock development and yield.” ...................(more)

The complete piece is at: http://civileats.com/2013/04/30/rethinking-agriculture-national-climate-assessment-provides-another-reason/

Bail-Out Is Out, Bail-In Is In

Bail-Out Is Out, Bail-In Is In

Posted on Apr 30, 2013

By Ellen Brown, Web of Debt

This piece first appeared at Web of Debt.

“With Cyprus . . . the game itself changed. By raiding the depositors’ accounts, a major central bank has gone where they would not previously have dared. The Rubicon has been crossed.”

—Eric Sprott, Shree Kargutkar, “Caveat Depositor”

The crossing of the Rubicon into the confiscation of depositor funds was not a one-off emergency measure limited to Cyprus. Similar “bail-in” policies are now appearing in multiple countries. (See my earlier articles here.) What triggered the new rules may have been a series of game-changing events including the refusal of Iceland to bail out its banks and their depositors; Bank of America’s commingling of its ominously risky derivatives arm with its depository arm over the objections of the FDIC; and the fact that most EU banks are now insolvent. A crisis in a major nation such as Spain or Italy could lead to a chain of defaults beyond anyone’s control, and beyond the ability of federal deposit insurance schemes to reimburse depositors.

The new rules for keeping the too-big-to-fail banks alive: use creditor funds, including uninsured deposits, to recapitalize failing banks.

But isn’t that theft?

Perhaps, but it’s legal theft. By law, when you put your money into a deposit account, your money becomes the property of the bank. You become an unsecured creditor with a claim against the bank. Before the Federal Deposit Insurance Corporation (FDIC) was instituted in 1934, U.S. depositors routinely lost their money when banks went bankrupt. Your deposits are protected only up to the $250,000 insurance limit, and only to the extent that the FDIC has the money to cover deposit claims or can come up with it. .....................(more)

The complete piece is at: http://www.truthdig.com/report/item/bail-out_is_out_bail-in_is_in_20130430/?ln

Bail-Out Is Out, Bail-In Is In

Bail-Out Is Out, Bail-In Is In

Posted on Apr 30, 2013

By Ellen Brown, Web of Debt

This piece first appeared at Web of Debt.

“With Cyprus . . . the game itself changed. By raiding the depositors’ accounts, a major central bank has gone where they would not previously have dared. The Rubicon has been crossed.”

—Eric Sprott, Shree Kargutkar, “Caveat Depositor”

The crossing of the Rubicon into the confiscation of depositor funds was not a one-off emergency measure limited to Cyprus. Similar “bail-in” policies are now appearing in multiple countries. (See my earlier articles here.) What triggered the new rules may have been a series of game-changing events including the refusal of Iceland to bail out its banks and their depositors; Bank of America’s commingling of its ominously risky derivatives arm with its depository arm over the objections of the FDIC; and the fact that most EU banks are now insolvent. A crisis in a major nation such as Spain or Italy could lead to a chain of defaults beyond anyone’s control, and beyond the ability of federal deposit insurance schemes to reimburse depositors.

The new rules for keeping the too-big-to-fail banks alive: use creditor funds, including uninsured deposits, to recapitalize failing banks.

But isn’t that theft?

Perhaps, but it’s legal theft. By law, when you put your money into a deposit account, your money becomes the property of the bank. You become an unsecured creditor with a claim against the bank. Before the Federal Deposit Insurance Corporation (FDIC) was instituted in 1934, U.S. depositors routinely lost their money when banks went bankrupt. Your deposits are protected only up to the $250,000 insurance limit, and only to the extent that the FDIC has the money to cover deposit claims or can come up with it. .....................(more)

The complete piece is at: http://www.truthdig.com/report/item/bail-out_is_out_bail-in_is_in_20130430/?ln

Urban rat hunting, New York City style

NEW YORK—Bodies tensed and noses twitching, the dogs sniff the hunting ground before them: a lower Manhattan alley, grimy, dim and perfect for rats. With a terse command — “Now!” — the chase is on.

Circling, bounding over and pawing at a mound of garbage bags, the four dogs quickly have rodents on the run.

“Come on ... I mean, ‘tally ho!’ says one of their owners, Susan Friedenberg. In a whirl of barks, pants and wagging tails, dogs tunnel among the bags and bolt down the alley as their quarry tries to scurry away.

Within five minutes, the city has two fewer rats. ...................(more)

The complete piece is at: http://www.thestar.com/news/world/2013/04/30/urban_rat_hunting_new_york_city_style.html

Robert Reich: Public Debt and Economic Growth

Public Debt and Economic Growth

Monday, April 29, 2013

In the election of 1952 my father voted for Dwight Eisenhower. When I asked him why he explained that “FDR’s debt” was still burdening the economy — and that I and my children and my grandchildren would be paying it down for as long as we lived.

I was only six years old and had no idea what a “debt” was, let alone FDR’s. But I had nightmares about it for weeks.

Yet as the years went by my father stopped talking about “FDR’s debt,” and since I was old enough to know something about economics I never worried about it. My children have never once mentioned FDR’s debt. My four-year-old grandchild hasn’t uttered a single word about it.

By the end of World War II, the national debt was 120 percent of the entire economy. But by the mid-1950s, it was half that. ...................(more)

The complete piece is at: http://robertreich.org/post/49186529038

CEO Pay 1,795-to-1 Multiple of Wages Skirts U.S. Law

(Bloomberg) Former fashion jewelry saleswoman Rebecca Gonzales and former Chief Executive Officer Ron Johnson have one thing in common: J.C. Penney Co. (JCP) no longer employs either.

The similarity ends there. Johnson, 54, got a compensation package worth 1,795 times the average wage and benefits of a U.S. department store worker when he was hired in November 2011, according to data compiled by Bloomberg. Gonzales’s hourly wage was $8.30 that year.

Across the Standard & Poor’s 500 Index of companies, the average multiple of CEO compensation to that of rank-and-file workers is 204, up 20 percent since 2009, the data show. The numbers are based on industry-specific estimates for worker compensation.

Almost three years after Congress ordered public companies to reveal actual CEO-to-worker pay ratios under the Dodd-Frank law, the numbers remain unknown. As the Occupy Wall Street movement and 2012 election made income inequality a social flashpoint, mandatory disclosure of the ratios remained bottled up at the Securities and Exchange Commission, which hasn’t yet drawn up the rules to implement it. Some of America’s biggest companies are lobbying against the requirement. ............(more)

The complete piece is at: http://www.bloomberg.com/news/2013-04-30/ceo-pay-1-795-to-1-multiple-of-workers-skirts-law-as-sec-delays.html

Vermont Time Bankers Build a More Personal Economy

http://vimeo.com/63034955

Video: Whatever service you might need, you’re likely to be able to get it at Onion River Time Bank, where you pay by doing what you love.

Rethinking Agriculture: National Climate Assessment Provides (Another) Reason

from Civil Eats:

Rethinking Agriculture: National Climate Assessment Provides (Another) Reason

By Mia Macdonald on April 30, 2013

Pastoralists in Kenya, rice farmers in India, and industrial feedlot operators in the U.S. have all contended with the increased frequency of drought and erratic weather. New agricultural ideas and actions are essential amid rising climate stress, a growing human population, widespread degradation of ecosystems, and rampant food insecurity; nearly one billion people regularly don’t get enough to eat.

Agriculture isn’t just affected by the effects of climate change. It’s also a significant source of greenhouse gas emissions (GHGs). According to the U.S. Environmental Protection Agency (EPA), the U.S. agricultural sector was responsible in 2011 for 7.2 percent of U.S. GHGs. This doesn’t include emissions from indirect agricultural activities, like clearing grasslands or forests to create farmland, or the fossil fuels burned when transporting agricultural products.

U.S. agriculture is heavily tilted toward large-scale, resource-intensive production of animals and the corn and soybeans that feed them. Corn, soybeans, and hay are the U.S.’s three largest crops. It might be hard to believe, but less than 2 percent of U.S. farm acres grow vegetables or pulses (beans and legumes) and less than 2 percent are planted with fruit or tree nuts.

The U.S. food system is also vulnerable to global warming. The draft National Climate Assessment, prepared by more than 200 scientists for the U.S. government and recently released for public comment, says this: “Production of all commodities will be vulnerable to direct impacts from changing climate conditions on crop and livestock development and yield.” ...................(more)

The complete piece is at: http://civileats.com/2013/04/30/rethinking-agriculture-national-climate-assessment-provides-another-reason/

Donít Worry, GE Labeling Will Not Cause World Hunger

from Civil Eats:

Don’t Worry, GE Labeling Will Not Cause World Hunger

By Marcia Ishii-Eiteman on April 26, 2013

The movement to label genetically engineered (GE) foods in the U.S. is gaining momentum by the day. Just this week, a federal bill to require labeling of GE foods was introduced in Washington D.C. with strong bipartisan support —including that of over 30 Congressional co-sponsors from House and Senate. And more states have introduced GE labeling bills this year than ever before. Whether or not these initiatives pass in 2013, this much seems clear: we will win labeling of GE foods. It’s just a matter of time.

Naturally, the pesticide and biotech industry players have come out swinging with a host of dire but false predictions that food prices will rise and the sky will fall if people are allowed to know what’s in our food. The latest evidence of desperation comes from a long-time GE apologist, who now claims that labeling GE foods in the U.S. will exacerbate world hunger and poverty. Seriously?

GE’s broken promises

When I got to the end of Robert Paarlberg’s latest pro-GE article in the Wall Street Journal — where he makes the acrobatic leap from labeling GE foods in the U.S. to world hunger — I literally shook my head and said, “Really, Rob?” My tone mirrored that of my 12 year old when he says, “Really, Mom?” if I make a particularly inane or utterly ridiculous (to his mind) comment. ...................(more)

The complete piece is at: http://civileats.com/2013/04/26/dont-worry-ge-labeling-will-not-cause-world-hunger/

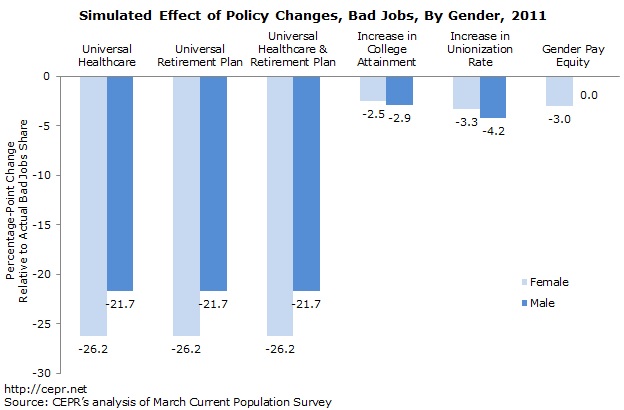

Making Jobs Good

http://www.cepr.net/index.php/publications/reports/making-jobs-goodfrom CEPR:

Making Jobs Good

April 2013, John Schmitt and Janelle Jones

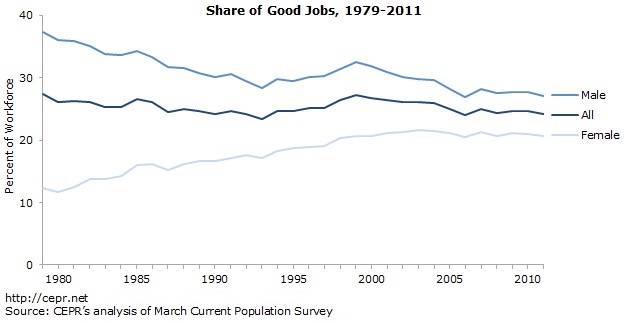

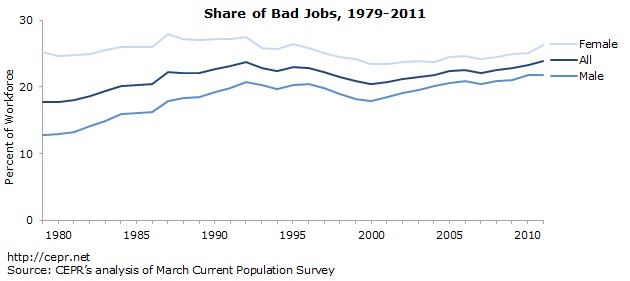

A series of earlier CEPR reports documented a substantial decline over the last three decades in the share of “good jobs” in the U.S. economy. This fall-off in job quality took place despite a large increase in the educational attainment and age of the workforce, as well as the productivity of the average U.S. worker.

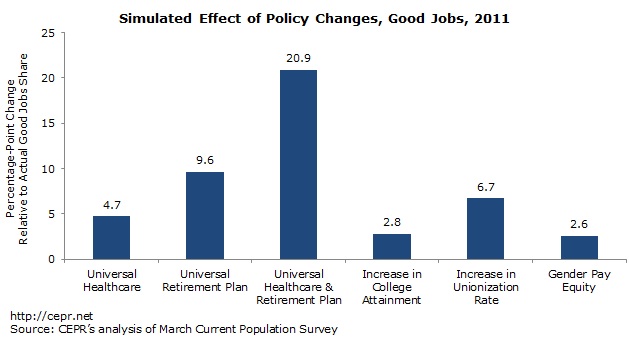

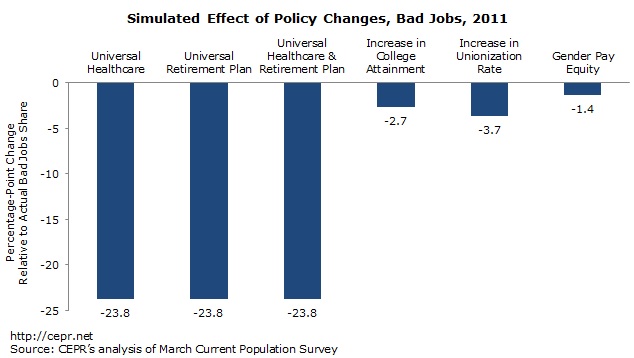

This report evaluates the likely impact of several policies that seek to address job quality, including universal health insurance, a universal retirement system (over and above Social Security), a large increase in college attainment, a large increase in unionization, and gender pay equity.

Profile Information

Gender: MaleHometown: Detroit, MI

Member since: Fri Oct 29, 2004, 12:18 AM

Number of posts: 77,077