Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

marmar

marmar's Journal

marmar's Journal

August 24, 2015

Professor Richard Wolff on capitalism, in this week's Labor Day-focused "Economic Update"

Audio Link: http://rdwolff.com/content/economic-update-labor-day-economics

"It's unstable, it's inefficient, it produces inequality, and it's fundamentally undemocratic."

Professor Richard Wolff on capitalism, in this week's Labor Day-focused "Economic Update"

Audio Link: http://rdwolff.com/content/economic-update-labor-day-economics

August 24, 2015

Published on Aug 20, 2015

Two men in Boston have been arrested for urinating and beating up a homeless Latino man who they say were inspired to assault because of Donald Trump. The two guys are Scott and Steve Leader and when they were arrested they were also making threats to police officials, which is kind of interesting. When two white men make threats to police officials they just get thrown into a cell.

Cenk Uygur and Ana Kasparian (The Point) hosts of The Young Turks discuss. What other horrible acts do you think Donald Trump’s rhetoric might inspire? Tell us what you think in the comments.

http://www.rawstory.com/2015/08/donald-trump-brothers-who-beat-and-urinated-on-latino-man-want-this-country-to-be-great-again/

Cenk's rant re: the Boston thugs who beat up the homeless Latino man

Published on Aug 20, 2015

Two men in Boston have been arrested for urinating and beating up a homeless Latino man who they say were inspired to assault because of Donald Trump. The two guys are Scott and Steve Leader and when they were arrested they were also making threats to police officials, which is kind of interesting. When two white men make threats to police officials they just get thrown into a cell.

Cenk Uygur and Ana Kasparian (The Point) hosts of The Young Turks discuss. What other horrible acts do you think Donald Trump’s rhetoric might inspire? Tell us what you think in the comments.

http://www.rawstory.com/2015/08/donald-trump-brothers-who-beat-and-urinated-on-latino-man-want-this-country-to-be-great-again/

August 24, 2015

Published on Aug 23, 2015

"Many millennials have never known a world without mobile devices. Now employers are forced to deal with younger workers who want to be able to text and use social media on the job. 3 On Your Side Consumer Reporter Jim Donovan looks at how this group is blurring the lines between work time and personal time.

Twenty-five-year-old Jonathan Perez always has his smartphone by his side at work. He says it makes juggling his job and his personal life easier. In fact, younger workers have spent most of their life with mobile technology at their fingertips and according to a new survey from MobilIron most don’t want to stop texting or using social media at work. Sixty percent of workers 18-34 say if their boss prevented them from using a mobile device to take care of personal tasks, they would quit!"

http://philadelphia.cbslocal.com/2015/07/08/3-on-your-side-many-millennials-would-quit-if-not-allowed-to-do-personal-tasks-at-work/

Millennials Would Quit Job If Phones Were Banned At Work

Published on Aug 23, 2015

"Many millennials have never known a world without mobile devices. Now employers are forced to deal with younger workers who want to be able to text and use social media on the job. 3 On Your Side Consumer Reporter Jim Donovan looks at how this group is blurring the lines between work time and personal time.

Twenty-five-year-old Jonathan Perez always has his smartphone by his side at work. He says it makes juggling his job and his personal life easier. In fact, younger workers have spent most of their life with mobile technology at their fingertips and according to a new survey from MobilIron most don’t want to stop texting or using social media at work. Sixty percent of workers 18-34 say if their boss prevented them from using a mobile device to take care of personal tasks, they would quit!"

http://philadelphia.cbslocal.com/2015/07/08/3-on-your-side-many-millennials-would-quit-if-not-allowed-to-do-personal-tasks-at-work/

August 24, 2015

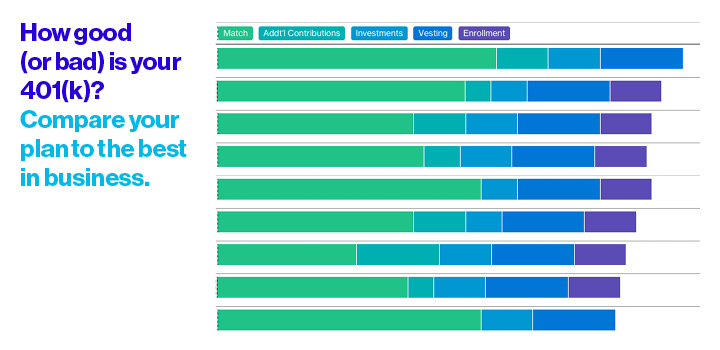

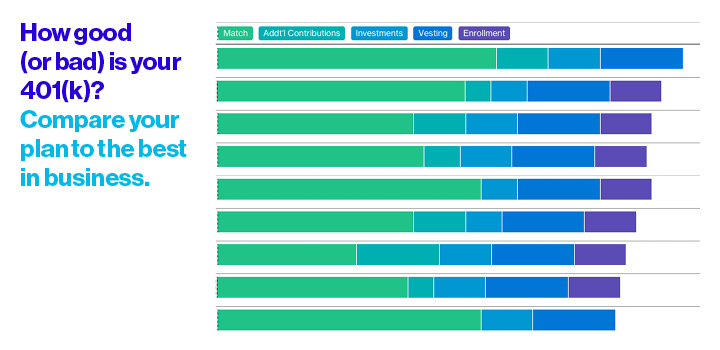

(Bloomberg) To judge by Amazon's 401(k) plan, the giant online retailer doesn't have much in common with its more benevolent Silicon Valley peers. The workplace culture now under scrutiny for its reportedly brutal tendencies is paired with a comparatively stingy and risky retirement plan.

The match of employee contributions into their 401(k) plans is below average and made entirely in Amazon stock, which leaves employees dangerously exposed to the company's fortunes.1 In fact, Amazon's 401(k) came last in Bloomberg's ranking of the plans offered by the top 50 companies in the S&P 500.

The general trend in this group has been to move away from matching employee contributions with stock. Part of the reason stretches back to the collapse of Enron, when workers saw retirement savings, which were heavily invested in Enron stock, destroyed right alongside their employer. A survey by Aon Hewitt of 400 large employers found that one in every eight plans with a company stock fund in their 401(k) made matching contributions in company stock. ................(more)

http://www.bloomberg.com/news/articles/2015-08-24/amazon-s-401-k-plan-is-pretty-brutal-too-idpw28hz

Amazon's 401(k) Plan Is Pretty Brutal, Too

(Bloomberg) To judge by Amazon's 401(k) plan, the giant online retailer doesn't have much in common with its more benevolent Silicon Valley peers. The workplace culture now under scrutiny for its reportedly brutal tendencies is paired with a comparatively stingy and risky retirement plan.

The match of employee contributions into their 401(k) plans is below average and made entirely in Amazon stock, which leaves employees dangerously exposed to the company's fortunes.1 In fact, Amazon's 401(k) came last in Bloomberg's ranking of the plans offered by the top 50 companies in the S&P 500.

The general trend in this group has been to move away from matching employee contributions with stock. Part of the reason stretches back to the collapse of Enron, when workers saw retirement savings, which were heavily invested in Enron stock, destroyed right alongside their employer. A survey by Aon Hewitt of 400 large employers found that one in every eight plans with a company stock fund in their 401(k) made matching contributions in company stock. ................(more)

http://www.bloomberg.com/news/articles/2015-08-24/amazon-s-401-k-plan-is-pretty-brutal-too-idpw28hz

August 24, 2015

HONG KONG (MarketWatch) — To many investors, the problem with China is a suspicion that things could be much worse than is officially being let on.

My own experience with a Bank of China ATM at the Hong Kong-Shenzhen border last Friday certainly got me thinking — just how bad is China’s liquidity crunch?

The problem was the ATM menu options had been limited to funds balance, transfer and deposit but none for withdrawal. And it did not appear personal, as all three cash machines were the same, refusing locals and foreigners alike.

This might be dismissed as merely anecdotal but it comes in the same week that global markets have zeroed in on Chinese capital flight risks and authorities have been scrambling to inject liquidity into the banking system.

In the past week the central bank made three interventions to boost liquidity, totaling some 350 billion yuan. Despite this interbank rates have remain elevated and reports suggest the People’s Bank of China’s next move will be to cut bank-reserve ratios to free up potentially another 678 billion yuan for lending. ................(more)

http://www.marketwatch.com/story/the-next-shoe-to-drop-in-china-the-banks-2015-08-24

The next shoe to drop in China? The banks

HONG KONG (MarketWatch) — To many investors, the problem with China is a suspicion that things could be much worse than is officially being let on.

My own experience with a Bank of China ATM at the Hong Kong-Shenzhen border last Friday certainly got me thinking — just how bad is China’s liquidity crunch?

The problem was the ATM menu options had been limited to funds balance, transfer and deposit but none for withdrawal. And it did not appear personal, as all three cash machines were the same, refusing locals and foreigners alike.

This might be dismissed as merely anecdotal but it comes in the same week that global markets have zeroed in on Chinese capital flight risks and authorities have been scrambling to inject liquidity into the banking system.

In the past week the central bank made three interventions to boost liquidity, totaling some 350 billion yuan. Despite this interbank rates have remain elevated and reports suggest the People’s Bank of China’s next move will be to cut bank-reserve ratios to free up potentially another 678 billion yuan for lending. ................(more)

http://www.marketwatch.com/story/the-next-shoe-to-drop-in-china-the-banks-2015-08-24

August 24, 2015

Crazy. Dow down -1000 at opening

August 24, 2015

(Bloomberg) A wave of selling gripped global markets as the rout in all but the safest assets deepened.

Chinese shares tumbled by the most since 2007, stocks in Germany headed for a bear market and commodities fell to a 16-year low. Russia’s ruble led a selloff in emerging-market currencies, while the yen strengthened and 10-year Treasury yields slid below 2 percent for the first time since April. Futures signaled U.S. equities will retreat for a fifth day.

“Everyone seems to be selling off, and there’s panic,” said Michael Woischneck who helps oversee the equivalent of $7.1 billion at Lampe Asset Management GmbH in Dusseldorf, Germany. “There’s no rational choice anymore, no rational reaction. The Americans will add to the European selling.”

More than $5 trillion has been erased from the value of global equities since China unexpectedly devalued the yuan on Aug. 11, fueling concern that the slowdown in the world’s second-largest economy is worse than anticipated. The rout is shaking confidence that the global economy will be strong enough to withstand higher U.S. interest rates, even as bets ease on a September increase. ..................(more)

http://www.bloomberg.com/news/articles/2015-08-23/asia-braces-for-more-selling-as-deepening-stock-rout-boosts-yen

Stock Rout Spreads Through Europe After China Plunge

(Bloomberg) A wave of selling gripped global markets as the rout in all but the safest assets deepened.

Chinese shares tumbled by the most since 2007, stocks in Germany headed for a bear market and commodities fell to a 16-year low. Russia’s ruble led a selloff in emerging-market currencies, while the yen strengthened and 10-year Treasury yields slid below 2 percent for the first time since April. Futures signaled U.S. equities will retreat for a fifth day.

“Everyone seems to be selling off, and there’s panic,” said Michael Woischneck who helps oversee the equivalent of $7.1 billion at Lampe Asset Management GmbH in Dusseldorf, Germany. “There’s no rational choice anymore, no rational reaction. The Americans will add to the European selling.”

More than $5 trillion has been erased from the value of global equities since China unexpectedly devalued the yuan on Aug. 11, fueling concern that the slowdown in the world’s second-largest economy is worse than anticipated. The rout is shaking confidence that the global economy will be strong enough to withstand higher U.S. interest rates, even as bets ease on a September increase. ..................(more)

http://www.bloomberg.com/news/articles/2015-08-23/asia-braces-for-more-selling-as-deepening-stock-rout-boosts-yen

August 24, 2015

Whose Capital Is Getting Destroyed in US Natural Gas?

by Wolf Richter • August 24, 2015

Chesapeake Energy, the second largest natural gas producer in the US, after Exxon, is the biggest exclamation mark in a special Fed-designed phenomenon: for years, QE-besotted, ZIRP-blinded, yield-hungry investors kept funding an industry that dished out nothing but hype, false hopes, and losses.

Two natural gas producers have already thrown in the towel: Quicksilver Resources filed for Chapter 11 bankruptcy in March, listing $1.21 billion in assets and $2.35 billion in debts. Much larger Samson Resources has scheduled its date with bankruptcy court for September 15.

In 2007, the hype around fracking for natural gas got started in earnest, and billions poured into the industry month after month. The price of natural gas soared, and by June 2008 exceeded $13 per million Btu at the Henry Hub. Then the price collapsed. But not the hype and false hopes. Investors still cling to them.

By September 2009, natural gas was below $3 per million Btu at the Henry Hub, and that’s where it is today ($2.67). No one can profitably frack for dry natural gas at these prices, regardless of what they claim.

The most productive US natural gas field, the miraculous Marcellus Shale, where Chesapeake is a big player… well, there are pipeline constraints and other issues, and the gas is traded at local hubs, not at the Henry Hub, and prices are even lower. ....................(more)

http://wolfstreet.com/2015/08/24/whose-capital-is-getting-destroyed-in-us-natural-gas-chesapeake/

Whose Capital Is Getting Destroyed in US Natural Gas?

Whose Capital Is Getting Destroyed in US Natural Gas?

by Wolf Richter • August 24, 2015

Chesapeake Energy, the second largest natural gas producer in the US, after Exxon, is the biggest exclamation mark in a special Fed-designed phenomenon: for years, QE-besotted, ZIRP-blinded, yield-hungry investors kept funding an industry that dished out nothing but hype, false hopes, and losses.

Two natural gas producers have already thrown in the towel: Quicksilver Resources filed for Chapter 11 bankruptcy in March, listing $1.21 billion in assets and $2.35 billion in debts. Much larger Samson Resources has scheduled its date with bankruptcy court for September 15.

In 2007, the hype around fracking for natural gas got started in earnest, and billions poured into the industry month after month. The price of natural gas soared, and by June 2008 exceeded $13 per million Btu at the Henry Hub. Then the price collapsed. But not the hype and false hopes. Investors still cling to them.

By September 2009, natural gas was below $3 per million Btu at the Henry Hub, and that’s where it is today ($2.67). No one can profitably frack for dry natural gas at these prices, regardless of what they claim.

The most productive US natural gas field, the miraculous Marcellus Shale, where Chesapeake is a big player… well, there are pipeline constraints and other issues, and the gas is traded at local hubs, not at the Henry Hub, and prices are even lower. ....................(more)

http://wolfstreet.com/2015/08/24/whose-capital-is-getting-destroyed-in-us-natural-gas-chesapeake/

August 23, 2015

from YES! Magazine:

“Don’t Owe. Won’t Pay.” Everything You’ve Been Told About Debt Is Wrong

With the nation’s household debt burden at $11.85 trillion, even the most modest challenges to its legitimacy have revolutionary implications.

Charles Eisenstein posted Aug 20, 2015

The legitimacy of a given social order rests on the legitimacy of its debts. Even in ancient times this was so. In traditional cultures, debt in a broad sense—gifts to be reciprocated, memories of help rendered, obligations not yet fulfilled—was a glue that held society together. Everybody at one time or another owed something to someone else. Repayment of debt was inseparable from the meeting of social obligations; it resonated with the principles of fairness and gratitude.

The moral associations of making good on one’s debts are still with us today, informing the logic of austerity as well as the legal code. A good country, or a good person, is supposed to make every effort to repay debts. Accordingly, if a country like Jamaica or Greece, or a municipality like Baltimore or Detroit, has insufficient revenue to make its debt payments, it is morally compelled to privatize public assets, slash pensions and salaries, liquidate natural resources, and cut public services so it can use the savings to pay creditors. Such a prescription takes for granted the legitimacy of its debts.

Today a burgeoning debt resistance movement draws from the realization that many of these debts are not fair. Most obviously unfair are loans involving illegal or deceptive practices—the kind that were rampant in the lead-up to the 2008 financial crisis. From sneaky balloon interest hikes on mortgages, to loans deliberately made to unqualified borrowers, to incomprehensible financial products peddled to local governments that were kept ignorant about their risks, these practices resulted in billions of dollars of extra costs for citizens and public institutions alike.

A movement is arising to challenge these debts. In Europe, the International Citizen debt Audit Network (ICAN) promotes “citizen debt audits,” in which activists examine the books of municipalities and other public institutions to determine which debts were incurred through fraudulent, unjust, or illegal means. They then try to persuade the government or institution to contest or renegotiate those debts. In 2012, towns in France declared they would refuse to pay part of their debt obligations to the bailed-out bank Dexia, claiming its deceptive practices resulted in interest rate jumps to as high as 13 percent. Meanwhile, in the United States, the city of Baltimore filed a class-action lawsuit to recover losses incurred through the Libor rate-fixing scandal, losses that could amount to billions of dollars.

And Libor is just the tip of the iceberg. In a time of rampant financial lawbreaking, who knows what citizen audits might uncover? Furthermore, at a time when the law itself is so subject to manipulation by financial interests, why should resistance be limited to debts that involved lawbreaking? After all, the 2008 crash resulted from a deep systemic corruption in which “risky” derivative products turned out to be risk-free—not on their own merits, but because of government and Federal Reserve bailouts that amounted to a de facto guarantee. ....................(more)

http://www.yesmagazine.org/issues/the-debt-issue/don-t-owe-won-t-pay-charles-eisenstein-debt-20150820

“Don’t Owe. Won’t Pay.” Everything You’ve Been Told About Debt Is Wrong

from YES! Magazine:

“Don’t Owe. Won’t Pay.” Everything You’ve Been Told About Debt Is Wrong

With the nation’s household debt burden at $11.85 trillion, even the most modest challenges to its legitimacy have revolutionary implications.

Charles Eisenstein posted Aug 20, 2015

The legitimacy of a given social order rests on the legitimacy of its debts. Even in ancient times this was so. In traditional cultures, debt in a broad sense—gifts to be reciprocated, memories of help rendered, obligations not yet fulfilled—was a glue that held society together. Everybody at one time or another owed something to someone else. Repayment of debt was inseparable from the meeting of social obligations; it resonated with the principles of fairness and gratitude.

The moral associations of making good on one’s debts are still with us today, informing the logic of austerity as well as the legal code. A good country, or a good person, is supposed to make every effort to repay debts. Accordingly, if a country like Jamaica or Greece, or a municipality like Baltimore or Detroit, has insufficient revenue to make its debt payments, it is morally compelled to privatize public assets, slash pensions and salaries, liquidate natural resources, and cut public services so it can use the savings to pay creditors. Such a prescription takes for granted the legitimacy of its debts.

Today a burgeoning debt resistance movement draws from the realization that many of these debts are not fair. Most obviously unfair are loans involving illegal or deceptive practices—the kind that were rampant in the lead-up to the 2008 financial crisis. From sneaky balloon interest hikes on mortgages, to loans deliberately made to unqualified borrowers, to incomprehensible financial products peddled to local governments that were kept ignorant about their risks, these practices resulted in billions of dollars of extra costs for citizens and public institutions alike.

A movement is arising to challenge these debts. In Europe, the International Citizen debt Audit Network (ICAN) promotes “citizen debt audits,” in which activists examine the books of municipalities and other public institutions to determine which debts were incurred through fraudulent, unjust, or illegal means. They then try to persuade the government or institution to contest or renegotiate those debts. In 2012, towns in France declared they would refuse to pay part of their debt obligations to the bailed-out bank Dexia, claiming its deceptive practices resulted in interest rate jumps to as high as 13 percent. Meanwhile, in the United States, the city of Baltimore filed a class-action lawsuit to recover losses incurred through the Libor rate-fixing scandal, losses that could amount to billions of dollars.

And Libor is just the tip of the iceberg. In a time of rampant financial lawbreaking, who knows what citizen audits might uncover? Furthermore, at a time when the law itself is so subject to manipulation by financial interests, why should resistance be limited to debts that involved lawbreaking? After all, the 2008 crash resulted from a deep systemic corruption in which “risky” derivative products turned out to be risk-free—not on their own merits, but because of government and Federal Reserve bailouts that amounted to a de facto guarantee. ....................(more)

http://www.yesmagazine.org/issues/the-debt-issue/don-t-owe-won-t-pay-charles-eisenstein-debt-20150820

August 23, 2015

Picking Apart One of the Biggest Lies in American Politics: 'Free Trade'

It just enriches huge companies at everyone else's expense.

By Thom Hartmann / AlterNet August 19, 2015

In 1992, Ross Perot won almost 20% of the entire presidential vote on the single issue of stopping so-called “free trade.” Today, several presidential candidates are gaining huge traction with similar opposition to NAFTA, CAFTA, and the upcoming Southern Hemisphere Asian Free Trade Agreement (SHAFTA, now called the Trans-Pacific Partnership or TPP).

Time has proven Perot right, and his arguments were consistent with a long history of American industrial success prior to the “free trade” era of the past 30+ years.

Our radical experiment of so-called “free trade” has clearly failed America, although few Americans know why or how. Here’s the back-story.

George Washington on “Made In America” goods

On April 14, 1789, George Washington was out walking through the fields at Mount Vernon, his home in Virginia, when Charles Thomson, the Secretary of the Continental Congress, rode up on horseback. Thomson had a letter for Washington from the president pro-tempore of the new, constitutionally created United States Senate, telling Washington he’d just been elected president and the inauguration was set for April 30 in the nation’s capital, New York City.

.....(snip).....

How badly Reaganism and “free trade” have damaged us

When Ronald Reagan came into office, as the result of 190 years of Hamilton’s plan, the United States was the world’s largest importer of raw materials; the world’s largest exporter of finished, manufactured goods; and the world’s largest creditor.

After 34 years of Reaganomics, we’ve completely flipped this upside down. We’ve become the world’s largest exporter of raw materials, the world’s largest importer of finished goods, and the world’s largest debtor. We now export raw materials to China, and buy from them manufactured goods. And we borrow from them to do it. Our trade debt right now stands at over $11 trillion, and it’s the principle reason why one-seventh of all assets in the United States are foreign-owned. ...............(more)

http://www.alternet.org/economy/picking-apart-one-biggest-lies-american-politics-free-trade

Thom Hartmann: Picking Apart One of the Biggest Lies in American Politics: 'Free Trade'

Picking Apart One of the Biggest Lies in American Politics: 'Free Trade'

It just enriches huge companies at everyone else's expense.

By Thom Hartmann / AlterNet August 19, 2015

In 1992, Ross Perot won almost 20% of the entire presidential vote on the single issue of stopping so-called “free trade.” Today, several presidential candidates are gaining huge traction with similar opposition to NAFTA, CAFTA, and the upcoming Southern Hemisphere Asian Free Trade Agreement (SHAFTA, now called the Trans-Pacific Partnership or TPP).

Time has proven Perot right, and his arguments were consistent with a long history of American industrial success prior to the “free trade” era of the past 30+ years.

Our radical experiment of so-called “free trade” has clearly failed America, although few Americans know why or how. Here’s the back-story.

George Washington on “Made In America” goods

On April 14, 1789, George Washington was out walking through the fields at Mount Vernon, his home in Virginia, when Charles Thomson, the Secretary of the Continental Congress, rode up on horseback. Thomson had a letter for Washington from the president pro-tempore of the new, constitutionally created United States Senate, telling Washington he’d just been elected president and the inauguration was set for April 30 in the nation’s capital, New York City.

.....(snip).....

How badly Reaganism and “free trade” have damaged us

When Ronald Reagan came into office, as the result of 190 years of Hamilton’s plan, the United States was the world’s largest importer of raw materials; the world’s largest exporter of finished, manufactured goods; and the world’s largest creditor.

After 34 years of Reaganomics, we’ve completely flipped this upside down. We’ve become the world’s largest exporter of raw materials, the world’s largest importer of finished goods, and the world’s largest debtor. We now export raw materials to China, and buy from them manufactured goods. And we borrow from them to do it. Our trade debt right now stands at over $11 trillion, and it’s the principle reason why one-seventh of all assets in the United States are foreign-owned. ...............(more)

http://www.alternet.org/economy/picking-apart-one-biggest-lies-american-politics-free-trade

Profile Information

Gender: MaleHometown: Detroit, MI

Member since: Fri Oct 29, 2004, 12:18 AM

Number of posts: 77,067