http://brucekrasting.blogspot.com/2010/01/social-security-trust-fund-issued-their.htmlThe Social Security Trust Fund issued their November and December reports today. They also provided the payment data for January 2010. I think there is some significant information.

From my writings on the Trust Fund I have received many comments from those who believe that the SS is a bankrupt Ponzi scheme. That is not correct. The SSTF did an admirable job in a very tough year. They paid a total of $675 billion in benefits and ended the year with an even $100 billion surplus. On December 31st they were sitting on $2.5 Trillion of US Treasury IOUs.

That said there are some very disturbing trends at the Fund. First a Macro Economic thought:

There was a onetime negative COLA adjustment that kicked in January 1. Rather than the usual increase, beneficiaries are getting smaller checks. The difference between the December and January payments comes to $475 million. That re-base means a reduced outlay for the full year of $6 billion. In the scheme of things that is peanuts. But this is going to be felt most in the Sunbelt states where the bulk of the beneficiaries reside. I believe that a significant percentage of SS payments goes right into consumption. Given that fixed costs are actually rising for this group of consumers (the hell with COLA) the 65+ set might not be going to the Wal-Mart in Boca as much as they used to. A year ago we were talking of green shoots. This shoot is decidedly brown.

On the Fund itself:

I think that the recession of 08 and 09 and the anticipated high unemployment (low employment) in 2010 has crippled the Fund. Nothing short of a major overhaul can turn it around at this point. The damage has been too great.

In the 2009 Trustee Report to Congress (signed by Chairman Tim Geithner) the following information was provided:

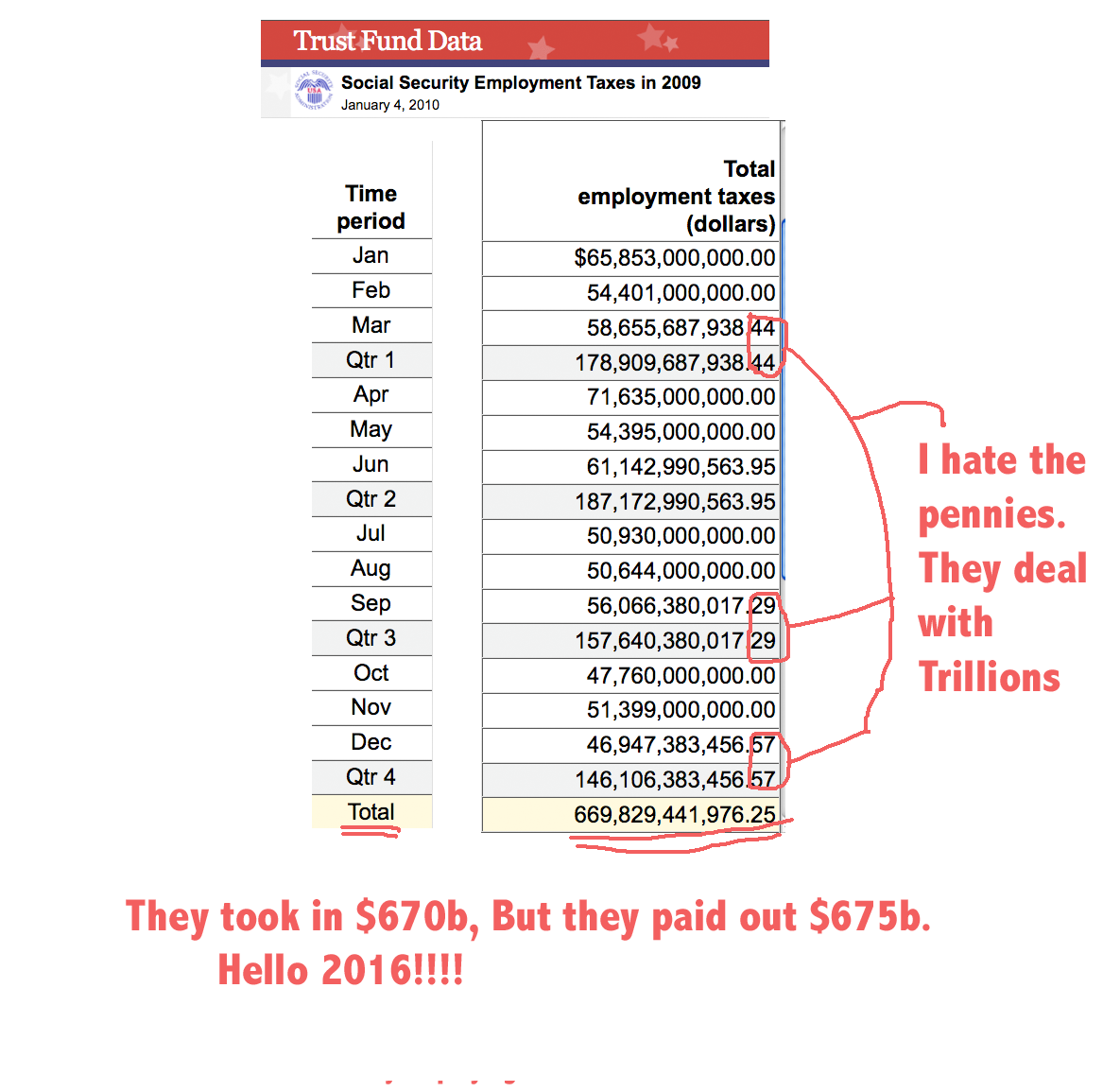

http://1.bp.blogspot.com/_5JJarCb6DPo/S0KhE1oFN8I/AAAAAAAAAsE/ku0r7qAvkaM/s400/outgo-tax+income.pngNow look at the reports released today. Total tax receipts were less than the disbursements. This was not supposed to happen until 2016. It happened last year.

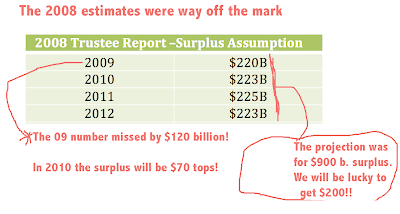

There was a $100 billion surplus for the year. But compare that to the $190 Billion surplus in 2007. We have lost $90 Billion in just two years. But this number should be much higher than the 07 surplus. It was assumed that the Fund would have larger and larger surpluses for years to come. The 2008 Trustee Report (signed by then Chairman Hank Paulson) provided a set of Intermediate Assumptions for the Fund's surpluses looking forward. As you can see we missed the 2009 target of a $220b surplus by a cool $120 billion. As of 12/31/09 the funds assets are behind that 08 schedule by $155 billion.

In prior years the SSTF has financed up to 50% of the deficit through their purchases of Treasury paper. In 2009 that ratio fell to a measly 7% of the total new issuance. It will be a rounding error in a few years. At some point someone is going to look at this and conclude it is not a plus for the bond market.

We are in an election year. Any significant legislation on SS changes will have to be completed by June. After that no one will want to touch this. Given that Health Care is far from resolved and there is that thorny problem with the mortgages Agencies I can easily see that the problems at SS get buried for another year. It will be very difficult to fix this beast if we wait another year.

The most optimistic scenario is that out of the ether comes a bi-partisan effort to address the issue head on and make the necessary fixes. By my calculation that would require a 2% increase in payroll taxes and as much as a 20% reduction in benefits (over time). Taxes on benefits would have to increase as well.

Those combined actions are extremely deflationary. It would directly cut consumer demand. It would be another blow to the head of small businesses. This would not be a brown shoot. Think of this development as being Amber Waves of Grain. And that is the optimistic scenario.

My solution has always been a means test. If you have $100k in taxable income you dont get paid. Finished. Im not sure that is legally possible. But to me it is the only option. The alternative will impoverish those that are/will be dependent on SS benefits. Raising taxes on Americas 90 million workers and their employers is just bad economics. It should not be considered.

I am not the only one looking at these numbers. This issue will have to come on the table before June. The 2009 results of the Fund are like an elephant in a room. It's too big to ignore.