WTF do you think the bailout was about?

As it turned out, Paulson was incompetent, but did shore up the commercial banks enough to keep things going.

It was Bernanke -- the closet Keynesian who's been studying how to prevent the next Great Depression for decades and was unbelievably the right guy in the right place at the right time -- who has kept the banking system from collapsing entirely. He's the one who pumped $2 trillion into the commercial paper market (which is the flip side of money market funds).

On that date, the money market funds "broke the buck," which is to say, that although they're supposed to be like a checking/savings account on that day, if you put $100 "in the bank" you got a balance of $99 the next day. That's because several banks defaulted on their commercial paper, which is what the money market funds invest in.

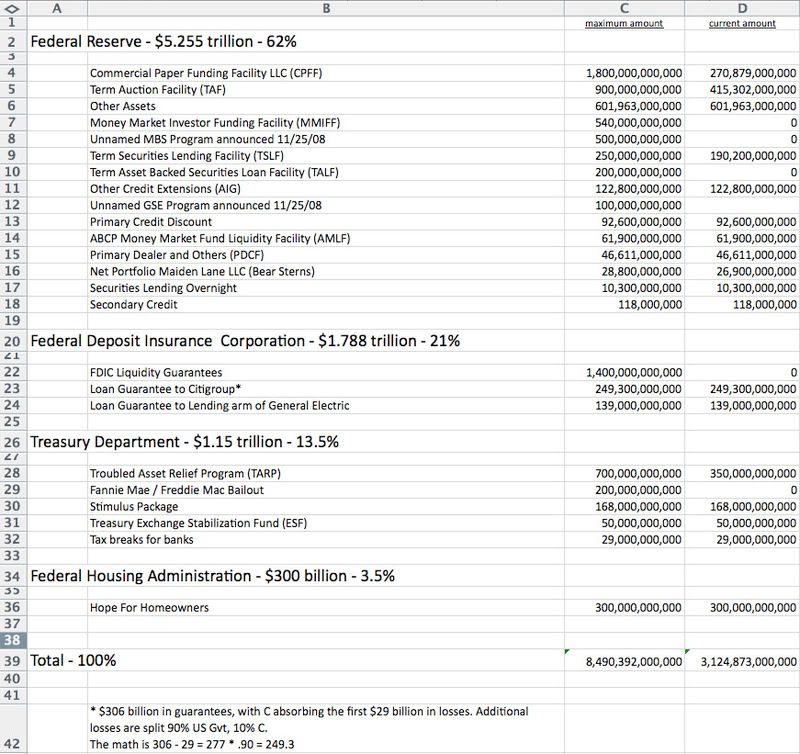

Here's a chart of the bailout so far:

Notice that the overwhelming bulk of the total multi trillion dollar bailout has gone to purchasing commercial paper. That means, keeping money market accounts from imploding and allowing businesses to "write checks" in the commercial paper market.

Although Bernanke has refused to tell us exactly what commercial paper he's buying (he doesn't want a run on those particular paper issuers), I assume that he hasn't lost any money, simply because the money market funds have not broken the buck since September 18.

That means that Bernanke not only saved the system, but is making money for the Fed -- to the tune annualized of around $40 billion per year.

Not bad, eh? Making $40 billion for the government while saving the global financial system at the same time?

And when people scream about Bernanke throwing money at corporations, giving money away, about where we're going to get the money to replace it, rarely do they realize that the answer to "where the money is going to come from" is: from the people who he lent it to, who have already paid it back (most of it is 30, 60 and 90 day paper), allowing Bernanke to buy yet more commercial paper, make more money for the Fed, and continue to keep the system from collapsing.

On edit: If some of my other data is right, then the 30, 60 and 90 day paper

has already been paid back to the tune of $1.5 trillion, with interest.

That emergency facility is being wound down rather than recycled (only $270 billion outstanding now), which means that the Fed won't make nearly as much as $40 billion on an annualized basis, unless the crisis hits again and is resolved in the same way.