| Latest | Greatest | Lobby | Journals | Search | Options | Help | Login |

|

|

|

This topic is archived. |

| Home » Discuss » Editorials & Other Articles |

|

| Demeter

|

Fri Oct-09-09 05:04 PM Original message |

| Weekend Economists" Leif Ericson Weekend (and What's His Name, Too!) Oct. 9-11, 2009 |

|

Well, it's another Friday! I think we get too many of them, and not enough Saturdays....

In 1964, the United States Congress authorized and requested the president to proclaim October 9 of each year as "Leif Erikson Day". That date was chosen for its connection to the first organized immigration from Norway to the United States (the ship Restauration, coming from Stavanger, Norway, arrived in New York Harbor on October 9, 1825), not for any event in the life of the explorer. The day is also an official observance of several U.S. states. Leif (or as the Old Norse would Have it: Leifr Eir�ksson (c. 970 � c. 1020) was a Norse<2> explorer who is currently regarded as the first European to land in North America (excluding Greenland) 492 years before Christopher Columbus.<3> According to the Sagas of Icelanders, he established a Norse settlement at Vinland, which has been tentatively identified with the L'Anse aux Meadows Norse site on the northern tip of the island of Newfoundland in Newfoundland and Labrador, Canada. Early life It is believed that Ericson was born about AD 970 in Iceland, the son of Erik the Red (Old Norse: Eir�kr inn rau�i), a Norse explorer from Western Norway and outlaw and himself the son of an outlaw, �orvaldr �svaldsson. Leif's mother was Thjodhild (�j��hildr).<4> Erik the Red founded two Norse colonies in Greenland, the Western Settlement and the Eastern Settlement, as he named them. In both Eir�ks saga rau�a and Landn�ma, Ericson's father is said to have met and married Leif's mother �j��hildur in Iceland; no official site is known for Leif's birth.<5> Leif Ericson had two brothers, Thorvald and Thorsteinn, and one half sister, There WILL be a test on this. And of course there is the Other European, the Italian fellow who sailed for Ferdinand and Isabella of Spain, found the Carribean Islands, concluded he had landed in India, and forever messed up a continent, several nations, the European economy, and the course of history. You know, What's His Name? Yes, the economy does fit in there--eventually. Spain's pillaging of the New World led to massive inflation, the Spanish Armada, and the English Empire. It's all connected, and it's all grist for our mills. So grind out those interesting, gloomy or dark-humor posts, folks. We got a lot of gorund to cover, and it isn't a 3 day weekend.... |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Oct-09-09 05:06 PM Response to Original message |

| 1. 6 PM and No Bank Closing Yet |

|

The FDIC MIGHT be taking the weekend off, since they DO have a 3 day weekend, but we shall see...I have a pizza riding on this weekend, after all....

|

| Printer Friendly | Permalink | | Top |

| DemReadingDU

|

Fri Oct-09-09 05:31 PM Response to Reply #1 |

| 2. Maybe waiting to announce a big bank to process on the 3-day weekend? |

|

:shrug: |

| Printer Friendly | Permalink | | Top |

| Bobbieo

|

Fri Oct-09-09 05:37 PM Response to Reply #2 |

| 6. Another Columbus Day weekend and my Native Unity column is buzzing with |

|

readers on a 2004 story entitled "Why Do We Celebrate Columbus Day?"

When are we going to celebrate Native American Day? |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat Oct-10-09 12:52 AM Response to Reply #2 |

| 35. Looks Like Sheila Gave Everybody the Weekend Off |

|

No closings this weekend!

|

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat Oct-10-09 02:05 AM Response to Reply #35 |

| 45. Latest Tally: 112 Failed Banks, Credit Unions in 2009 |

|

http://www.bankinfosecurity.com/articles.php?art_id=1833

TWO CREDIT UNIONS CLOSED IN SEPTEMBER http://www.bankinfosecurity.com/articles.php?art_id=1827 |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat Oct-10-09 02:06 AM Response to Reply #45 |

| 46. Interactive Map: See Exactly Where Institutions Have Closed or Been Acquired |

| Printer Friendly | Permalink | | Top |

| DemReadingDU

|

Sat Oct-10-09 07:17 AM Response to Reply #46 |

| 54. Map includes failed credit unions too |

|

First time I have seen a map include both failed banks and credit unions. |

| Printer Friendly | Permalink | | Top |

| BR_Parkway

|

Sat Oct-10-09 06:35 AM Response to Reply #35 |

| 48. Maybe she's waiting for the checks to clear for the new fees to replenish |

|

her accounts.

|

| Printer Friendly | Permalink | | Top |

| DemReadingDU

|

Sat Oct-10-09 07:10 AM Response to Reply #35 |

| 51. It's not for the lack of insolvent banks |

|

Doubling up next weekend? |

| Printer Friendly | Permalink | | Top |

| DemReadingDU

|

Fri Oct-09-09 05:32 PM Response to Original message |

| 3. Bill Moyers tonight |

|

A Moment of Truth with Bill Moyers, Marcy Kaptur, and Simon Johnson Bill Moyers' show is always illuminating, but tonight's is one that no one should miss. When I spoke to Bill yesterday he described it as "a moment of truth-telling that could ignite the public's passion for Wall Street reforms that have been strangled in the crib by the big banks and their bought-and-paid-for politicians." Below are two clips from the show and the transcript of an exchange Moyers has with Kaptur and Johnson about the special phone-a-friend relationship Tim Geithner has with the heads of Citigroup, J.P. Morgan, Goldman Sachs, and what it says about how the system works -- for Wall Street. And tune in to PBS tonight at 9:00 pm ET to watch. click link for 2 short pre-view videos http://www.huffingtonpost.com/arianna-huffington/a-moment-of-truth-with-bi_b_314797.html |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Oct-09-09 05:36 PM Response to Reply #3 |

| 5. Sounds Like Trick or Treat This Weekend, Doesn't It? |

|

Nobel Peace Prize, canceled leases, the revolt of the grassroots, shocking revelations, etc. Maybe a little less gloomy for us this time? Maybe earth-shattering things are happening, not just in the south Pacific!

|

| Printer Friendly | Permalink | | Top |

| DemReadingDU

|

Fri Oct-09-09 08:39 PM Response to Reply #5 |

| 32. It's a great program |

|

Edited on Fri Oct-09-09 08:50 PM by DemReadingDU

Not sure if there are TV replays, but the video and transcript are posted on the website

http://www.pbs.org/moyers/journal/10092009/profile.html |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Oct-09-09 05:33 PM Response to Original message |

| 4. Few Bush-era energy leases are valid, report finds |

|

NOW THERE'S A NON-SURPRISE!

Interior Secretary Ken Salazar says his agency will prevent further development on the problematic parcels on Utah's public land. http://www.latimes.com/news/nationworld/nation/la-na-utah-leases9-2009oct09,0,580832.story Reporting from Denver - Interior Secretary Ken Salazar said Thursday that only 17 of 77 oil and gas leases on Utah public lands that the Bush administration auctioned off in December were valid and that his agency would prevent development on the remaining parcels, at least in the near future. Salazar spoke at a Washington news conference to announce the findings of a report he commissioned this year on the parcels, which became the subject of a fierce controversy during the waning days of George W. Bush's presidency. Environmentalists contended that the auction of drilling rights on 100,000 acres of federal land in southeastern Utah were a last-minute giveaway to the energy industry. The environmentalists won a restraining order from a federal judge halting the sales. Salazar revoked most of the leases upon entering office and said his staff would study which were appropriate. On Thursday, he said the review found that few were. "There was a headlong rush to leasing in the prior administration," Salazar said. "There were areas that should not have been leased." He said eight of the parcels should never be leased and the remainder could be leased someday after additional review and regulations. The problematic parcels included lands within view of Arches and Canyonlands national parks. One lease was directly on the Colorado River, in a cliff face above a popular campground. The report, based on nine days of on-site investigation, found that people in the Bureau of Land Management's Utah office, which oversaw the sales, believed that energy concerns should override environmental or recreational ones. "There is no such preference for the use of the land," Salazar said. Energy groups said the findings continued a troubling trend -- a hesitancy in the Obama administration to foster American energy sources. Salazar has also reversed a Bush administration effort to open swathes of Western land to oil shale development. "We wonder why the administration continues to undertake actions that limit economic development in the West, decrease energy security and make addressing climate change even more difficult," Kathleen Sgamma of the Independent Petroleum Assn. of Mountain States said in a statement. Environmental groups hailed the report's findings but cautioned that even if the Obama administration wanted to rebid the 17 leases it found appropriate, it would need to follow procedures laid down by the federal judge. "The report is a resounding rejection of the 'drill here, drill now' approach of the Bush administration," said Steve Bloch of the Southern Utah Wilderness Alliance. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Oct-09-09 05:39 PM Response to Original message |

| 7. Letter from India: Pollution as Another Form of Poverty |

|

http://www.nytimes.com/2009/10/09/world/asia/09iht-letter.html?_r=2

...India faces some of the most severe environmental challenges in the world. A government report published earlier this year estimates that 45 percent of the country�s geographic area suffers some form of land degradation; three million deaths a year are attributable to air pollution; and almost 70 percent of the nation�s surface water is contaminated. According to the World Bank, environmental sustainability could represent the biggest obstacle to the nation�s development. But the politics � and morality � of environmentalism in a country as poor as India are complicated. Indira Gandhi, a former prime minister, famously announced at the United Nations� first environmental conference, in 1972, that �poverty is the biggest polluter.� Those sentiments were echoed recently when Environment Minister Jairam Ramesh snubbed the U.S. secretary of state, Hillary Rodham Clinton, by telling her in public that India could not accept binding carbon emission targets because doing so would stunt the nation�s economic growth. It�s a widely held view in a country where the global environmental movement has sometimes been seen as a form of colonialism � a Western attempt to slow India�s development, to deny the country the fruits of industrialization enjoyed by the developed world. The United States, with under 5 percent of the world�s population, accounts for more than 20 percent of total carbon emissions. India, with more than 17 percent of the global population, accounts for just 5.3 percent of emissions. Why, people ask, should India pay a price for the West�s profligacy? It�s a fair question; the American and European positions have a whiff of hypocrisy. Still, when I see what�s going on around me � when I see how the farms are drying up, how forests and the coastline are disappearing, when I smell the dioxins in my house � I can�t help but feel that it�s a form of hypocrisy we had better learn to live with. If we sacrifice nature at the altar of material progress and global fairness, we risk, as Murugayian put it to me, losing a part of ourselves. Poverty is a serious problem. But pollution, I�ve come to believe, is itself a form of poverty. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Oct-09-09 05:45 PM Response to Original message |

| 8. John Kasich Blaming Economic Meltdown on Britney Spears Instead of His Former Boss, Lehman |

|

John Kasich Wins GOP Hypocrite of the Week for Blaming Economic Meltdown on Britney Spears Instead of His Former Boss, Lehman

http://blog.buzzflash.com/honors/231 Former Republican Congressman John Kasich has been really busy running for the Republican nomination to challenge Ted Strickland's spot as governor of Ohio in 2010. He's been so busy, in fact, that he seems to have forgotten who he is and how he got here. Or maybe it's just that he doesn't want to talk about it. Of course, no one is too busy to take a quickie trip to the Strip. Kasich gave a paid speech at the Bellagio in Las Vegas before the Nevada Development Authority Wednesday, in which he identified virtually everyone but himself as the root of the country's financial crisis. He went back to the old standard enemies of WorldCom and Enron, even going so far as to blame the downturn on Britney Spears and Paris Hilton. Come on, John; that is so last decade. Wall Street is everyone's favorite economic enemy now, remember? Indeed, somehow Kasich even forgot all about Lehman Brothers, the firm that went down in flames and got the panic train rolling last September. Maybe that's because Kasich was the firm's managing director of investments from 2001 until the company collapsed? While he worked at Lehman, Kasich's salary often topped $1 million, and he had a confidential contract as a commentator for FOX News after leaving Congress in 2000. And, as if a tie to the economic meltdown weren't enough, he's involved with the board of a medical device company and has received copious donations from the healthcare industry in the recent past. No, no. I'm sure what is really driving this country into the ground is the lack of bipartisanship, honesty, integrity, blah, blah, blah, where's my check? Clearly, it's our morals that are keeping us from succeeding as a country. Oh, and golden parachutes are also bad, according to Kasich's recent Vegas speech. So bad that he doesn't want to disclose how much money he got when he left Lehman. Kasich apparently prefers to rant on about the core values of this great country and to promise that Ohioans won't have to pay income or estate taxes anymore once he's governor (so much the better for not disclosing one's net worth, eh, Johnny?). Of course, Kasich won't say how he'll replace the third of the budget Ohio will lose if he actually does eliminate these taxes. And Ohio will also magically get a better educational system. Another thing Kasich doesn't want to talk about is the state's budget deficit topping $3 billion. He told local reporters when they questioned his sketchy proposals that he'd rather talk about how this is all Strickland's fault. After being so tight-lipped in Ohio, Kasich might be surprised his loose talk in Sin City made it back to the Midwest so quickly. But what is falsely blamed on others in Vegas does not stay in Vegas. And that's why John Kasich is BuzzFlash's GOP Hypocrite of the Week. Remember our motto: So many Republican hypocrites, so little time. |

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Fri Oct-09-09 05:59 PM Response to Original message |

| 9. Thirty-three TARP Recipients Miss Scheduled Dividend Payments |

|

While we wait for the FDIC, from Rolfe Winkler at Reuters: TARP deadbeats

Thirty-three TARP recipients missed a scheduled dividend payment to taxpayers last month, according to the Treasury Department, including 18 banks that missed a payment for the first time. ... The 33 banks that missed dividend payments in August have received $4.5 billion of TARP money. The biggest is CIT. Previously it paid $44 million of dividends, but with a bankruptcy filing looking likely, Treasury�s $2.3 billion investment seems headed toward zero. http://www.calculatedriskblog.com/2009/10/thirty-three-tarp-recipients-miss.html Jeebus! What a mess. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Oct-09-09 06:13 PM Response to Reply #9 |

| 12. More Detail |

|

http://www.usatoday.com/money/industries/banking/2009-10-07-banks-tarp-dividends_N.htm?loc=interstitialskip

The number almost doubled from 19 in May when payments were last made, and also raised questions about Treasury's judgment in approving these banks as "healthy," a necessary step for them to get TARP funding. "The banks are not paying their dividends because they are worried about preserving capital," says Eric Fitzwater, associate director of research at SNL Financial. The Treasury Department says it cannot force an institution to pay dividends. "For some banks, it may be prudent to exercise their right not to pay dividends in a particular month, and we respect their right to do so," says Meg Reilly, a Treasury spokeswoman. "To draw any broader conclusions about the state of the banking sector from one month is highly premature and speculative." However, a lot of smaller banks are already under stress. Weighed down by foreclosures and delinquencies, 98 banks have failed so far this year, vs. 25 for all of last year. Besides insurer American International Group and lender CIT Group, most of the other non-payers are smaller institutions that received $400 million or less in TARP funds. Top Republican on the House Financial Services Committee, Rep. Spencer Bachus, R-Ala., says: "We must ensure taxpayers are repaid." Some say Treasury might have been too hasty in approving some banks for TARP funds. "Perhaps the Treasury made assumptions that were a little bit too rosy," says Walter Todd, who invests in banks at Greenwood Capital. "My question is also whether the Treasury is staffed adequately to handle this tremendous undertaking." Treasury has given $365 billion to 700 institutions from TARP. AIG, to which the government has pledged $180 billion, has accumulated $1.6 billion in unpaid dividends. And CIT, which received $2.3 billion from TARP, said in a regulatory filing that it is restructuring its debt and seeking approval from bondholders for a pre-packaged bankruptcy. If that happened, it would wipe out the entire government investment. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat Oct-10-09 08:51 AM Response to Reply #12 |

| 65. 34 Banks Miss TARP Dividends and Almost No One Notices |

|

BUT OZY AND YVES DID!

http://www.nakedcapitalism.com/2009/10/34-banks-miss-tarp-dividends-and-almost-no-one-notices.html I will confess I missed a post opportunity Thursday AM, when an alert reader sent a link to a USA Today story, �34 banks don�t pay their quarterly TARP dividends, � but I decided to return to it precisely because it has gotten little attention: Of the 34 miscreants, two are pretty large, namely AIG and CIT, But the next on the list is First Bancorp, which received a mere $400 million from the TARP. Probably more important than the number is the trend, since the number of institutions that skipped dividends nearly doubled. In a supposedly improving economy and with a steep yield curve (at least until very recently), things appear to be getting worse rather than better. I didn�t post on this because I assumed the MSM would be all over it. So I am pretty surprised to see it has gotten very little coverage. The usual suspects (Bloomberg, Financial Times, Wall Street Journal, New York Times) were silent. Huffington Post linked to the USA Today story. Reuters featured it only via Rolfe Winkler, who had some useful commentary: When stronger banks including Goldman Sachs, Morgan Stanley and American Express repurchased warrants at modest premiums after paying back TARP, most news reports suggested that taxpayers were profiting from the bailout. But those reports didn�t tell the whole story. For one, they ignored adverse selection, the propensity for the best borrowers to exit the program first, leaving Treasury holding the poorest performing investments. According to the latest data from Treasury, 42 banks have paid back some or all of the cash they got from TARP�s Capital Purchase Program, $70.7 billion in total. But more than 600 banks remain in the CPP program. Together, they still owe $134 billion. And this excludes other TARP bailout programs that are likely to cost billions. The automotive industry owes TARP $80 billion. And AIG owes TARP $69.8 billion. Much of that isn�t coming back. It�s also myopic to view TARP in isolation. Take Citigroup. After converting its preferred equity investment to 7.7 billion common shares at $3.25, Treasury is showing a paper profit of $11 billion. Sounds great, right? But Citigroup�s common equity would long ago have fallen to zero if other bailouts, in particular FDIC�s debt guarantee program, weren�t insulating shareholders from losses. Citigroup is the only large bank still using the FDIC�s program. Two weeks ago, the bank sold another $5 billion worth of guaranteed debt, bringing its total issued under the program to $49.6 billion. The bottom line is that the government still stands behind the banking sector. While the cost of this �no more Lehmans� policy may not be known for years, our experience with Fannie Mae and Freddie Mac tells us that such implicit guarantees ultimately prove very expensive. The fact that more banks are falling behind on dividend payments reminds us the tab is growing. Is this mere oversight? Financial crisis fatigue? Nary a bad word will be said about the TARP? Hard to say�. |

| Printer Friendly | Permalink | | Top |

| Tansy_Gold

|

Sat Oct-10-09 11:12 PM Response to Reply #12 |

| 74. associate director of research WHERE? |

|

Demeter, I just want to let you know that even though I haven't posted much lately, I do sincerely appreciate all you do to get the WEE postings up. AND I READ THEM.

This line just jumped out at me: "The banks are not paying their dividends because they are worried about preserving capital," says Eric Fitzwater, associate director of research at SNL Financial. Well, maybe it's not so bad. Al Franken was at SNL, too, and he hasn't turned out so bad. But I have to admit I get just a little nervous thinking that financial policy is being researched by SNL. . . . . . . What? That's SNL Financial??? I thought you said SNL is funny as hell. Never mind. Tansy Gold |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sun Oct-11-09 07:53 AM Response to Reply #74 |

| 78. I Just Post Them, Tansy |

|

Glad you can find anything humorous--and that you do read them!

I post until the depression gets personal, then stop. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Oct-09-09 06:03 PM Response to Original message |

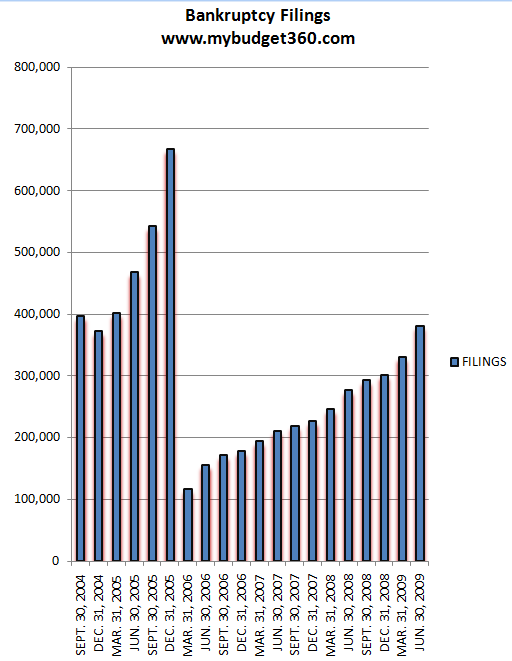

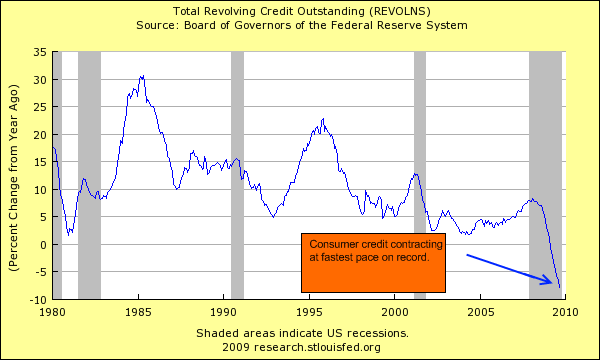

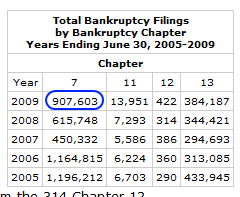

| 10. Bankruptcy Filings Spiking: Chapter 7 Booming, 8 Years of Credit Card Industry Lobbying and $100M |

|

Bankruptcy Filings Spiking: Chapter 7 Booming and 8 Years of Credit Card Industry Lobbying and $100 Million in Fees.

http://www.mybudget360.com/bankruptcy-filings-spiking-chapter-7-booming-and-8-years-of-credit-card-industry-lobbying-and-100-million-in-fees/ There is probably no bigger sign of economic distress than bankruptcy. It can be in the form of a business unable to pay debt obligations or an individual simply unable to keep up with former obligations. Most people that file for bankruptcy are not in a good economic spot. In fact, if you want a better indicator of economic health bankruptcy filings are a good measure. It is interesting what passes for good news in today�s market. For example, Alcoa announced a profit for the third quarter. Good news right? Well if you look into the details the company has cut 18,000 jobs in the 12 months ending on June 30th and also planned on cutting an additional $2.4 billion in costs. In this economic crisis people need to look at the details before assuming something is just good news. Bankruptcy data doesn�t hide this. Since new legislation went into law in 2005, bankruptcy has been harder to file. So the recent increase in filings makes it all the more troubling:  Since 2005 the rise in quarterly bankruptcy filings has been steady. This is indicative of the nature of the current deep recession. The average American is feeling the strain of the high unemployment rate and the country is combating a market that is not willing to hire (i.e., Alcoa cutting jobs). And recent bankruptcy filing data is showing the trend still moving up. The latest data that we have is for August and it showed 119,874 consumer bankruptcy filings and that is a jump of 24 percent from last year. You would think that with the massive amount of capital in banks, that lending would be easier so that would mitigate filings in the short-term but banks are not lending to consumers. Early this week we saw the continuing contraction in consumer credit:  Now these data points are important because they show what is really happening on Main Street. Wall Street is being pumped up by easy credit provided by the U.S. Treasury and Federal Reserve but most Americans don�t pay their monthly bills because the S&P 500 went up 10 points. Bankruptcy is the ultimate sign of distress. That is, someone has reached the point of financially being unable to meet obligations. This isn�t like missing one bill payment. This is someone sitting and looking at all their obligations and throwing in the towel. Keep in mind that this new change comes in light of the 2005 tougher bankruptcy laws. That is why in the above, the chart shows a dramatic spike. What changed in 2005? A wide group of consumer advocates, legal scholars, and retired bankruptcy judges questioned the soundness of the legislation and recommended against it. The credit card industry lobbied hard. The contention was that bankruptcy was wrought with fraud. There wasn�t much data backing up that assertion but remember that in 2005 the good times were going on so hardly anyone was paying attention and the legislation was jammed through. The major changes included means testing but also shifting people into Chapter 13 instead of Chapter 7. The big difference here is with Chapter 13 people filing have to work out some kind of agreement to rework their obligations while in Chapter 7, current debts are paid from current assets. Of course this shifts the burden completely on the consumer instead of lenders actually spending the time to be more diligent. This worked perfectly in a mega housing bubble world. Take a look at Chapter 7 even in light of the tougher legislation:  The biggest proponents of the bill were the credit card industry. In fact, the credit card industry spent 8 years and $100 million in lobbying for this effort. If you look at the legislation, it actually enforces a means test by looking at your state median income. If you are at your state median income, you will not be able to qualify for Chapter 7 if you can pay 25 percent of the unsecured debt. What it does is that it allowed for credit card companies to give anyone and anything credit while shifting the burden to the states and consumers. Once things go bad as they are right now, credit is yanked from the system and now debtors are being forced to pay any penny they have to the credit card companies. In the new legislation counseling is also required. Yet what about counseling for the credit card companies? The bill is a lobbyist dream and we are seeing the ramifications of this bill today. In fact, if it wasn�t for the bill we would be seeing tens of thousands more filing for Chapter 7 today but people are holding off because what use would it be to go into Chapter 13 and still need to pay off your debts? What many of the credit card companies didn�t see however was the massive rise in unemployment. In fact, with 26 million unemployed and underemployed I�m sure many will be falling below the state median income test thus allowing people to file for Chapter 7 and liquidate. Unsecured debt like credit card loans are usually washed away in court hence the big lobbying by the credit card industry. So this is becoming a more likely option and as the chart shows above, more are opting for this. Take a look at brief breakdown of how this plays out:  Only in some bizarre universe is spiking bankruptcies, foreclosures, and unemployment some sign of a rebounding economy. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat Oct-10-09 02:03 AM Response to Reply #10 |

| 44. Personal bankruptcies up 41 percent (OVER ONE YEAR) |

|

http://www.msnbc.msn.com/id/33143632/ns/business-personal_finance/

...The American Bankruptcy Institute said it expects consumer bankruptcies to climb to more than 1.4 million this year.... |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Oct-09-09 06:05 PM Response to Original message |

| 11. Fed Ratchets Up Warnings on Commercial Real Estate Debt |

|

Edited on Fri Oct-09-09 06:07 PM by Demeter

http://www.costar.com/News/Article.aspx?id=5F360267D837D816D8AC1AA2C5FE26F4

CRE Under Pressure Due to Sharp Erosion in Fundamentals, Grubb & Ellis Economist Bach Less Bearish on Sector Outlook Two officials from the U.S. Federal Reserve issued strong signals this week that the central bank is very concerned over the banking industry's exposure to commercial real estate loans and considers it to be a major stumbling block to the road to economic recovery. In a speech Monday assessing the state of the U.S. economic recovery, Federal Reserve Bank of New York President and CEO William Dudley said he expects that "more pain lies ahead" for the commercial real estate sector and for banks with heavy exposure to CRE loans. "The commercial real estate sector is under particular pressure because the fundamentals of the sector have deteriorated sharply and because the sector is highly dependent upon bank lending," Dudley said in the speech at the Fordham Corporate Law Center in New York. Unemployment remains much too high and "it seems the recovery will be less robust than desired," with "significant excess slack" in the economy, Dudley said. Also, in something of a departure from recent Fed pronouncements, Dudley said the economy faces "meaningful downside risks to inflation over the next year or two." Additionally, on Wednesday, The Wall Street Journal reported that a Fed official told banking industry regulators in a Sept. 29 presentation that "banks will be slow to recognize the severity of the loss" from commercial real estate loans, "just as they were in residential." The presentation by K.C. Conroy, an Atlanta Fed official who is reportedly part of the central bank's "rapid response" program to spread information about looming economic problem areas to federal and state bank examiners, indicated that slumping property values and rising vacancy rates have exceeded those seen in the early 1990s recession and CRE losses would reach about 45% next year. Further, a WSJ analysis of regulatory filings found that banks with heavy exposure to CRE loans set aside just 38 cents in reserves during the second quarter for every $1 in bad loans -- a sharp decline from $1.58 in reserves for every $1 in bad loans from the beginning of 2007. Grubb & Ellis Chief Economist Robert Bach told CoStar that, although he's far from optimistic about the market, he doesn't share the Fed's high level of pessimism, either. "One reason I'm not as pessimistic is that I don't think that it's comparable to the residential crisis," Bach said. "Banks will have to declare more losses, but is it the type of crisis that will re-threaten the global financial architecture? I don't think so." Bach notes that about $3.4 trillion in commercial mortgage loans are outstanding -- about one-third of the $10-$11 trillion in outstanding residential mortgages. A lot of the CRE loans losses will be concentrated in regional banks, and the FDIC has a time-tested procedure for shutting down, stabilizing and reopening such institutions with "a minimum of drama." When the residential and subprime asset-backed securities market crumbled more than two years ago, the collapse threatened the major "too big to fail" institutions and caught everyone by surprise, sending the Treasury, the Fed and the world's other central banks scrambling for a plan to deal with the emergency, Bach said. "Now, we know what to do. It's not going to be pleasant, it will be slogging through more losses" for two or three more years, he said. In his remarks Monday, Dudley noted that financial markets are performing better and the economy is now recovering, if not at the rate regulators would like. He cited three forces restraining the pace of the recovery. Household net worth hasn't yet recovered from the housing price decline. Second, the fiscal stimulus that is currently providing support to economic activity is temporary rather than permanent and will abate over the next year. Third, and perhaps most importantly, bank credit losses lag the business cycle and are still climbing, and the banking system has still not fully recovered. While banks� access to the capital markets has sharply improved, institutions are still capital constrained and hesitant to expand their lending. Most significantly, significant classes of borrowers -- namely commercial real estate and small business -- are almost wholly dependent on the banking sector for funds that are not easily forthcoming, Dudley said. Dudley said two main problems plague CRE fundamentals. First, capitalization rates had climbed sharply during the boom. At the peak, cap rates for prime properties were in the range of 5%. Today, the average cap rate appears to have risen to about 8%. Second, income generated by commercial property has generally been falling, Dudley noted. As the recession has pushed up the jobless rate, office demand has declined, and as the recession has led to a reduction in discretionary travel, hotel occupancy rates and room prices have declined. Retail sales have weakened, reducing demand for prime retail property. Dudley said the decline in valuations has created a significant amount of rollover risk when loans and mortgages mature and need to be refinanced. The slump in valuations pushes up loan-to-value ratios, making lenders wary about extending new credit -- even in the case when these loans are performing on a cash-flow basis, the New York Fed president noted. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Oct-09-09 06:16 PM Response to Original message |

| 13. Treasuries Fall After Weaker-Than-Average Demand at Bond Sale |

|

http://www.bloomberg.com/apps/news?pid=20601087&sid=aoRzFRtXIRdA

Treasuries declined, with 30 year bonds falling the most in two weeks after the government�s $12 billion auction of the debt drew weaker- than-average demand. The bid-to-cover ratio, which gauges demand by comparing total bids with the amount of securities offered, was 2.37, compared with 2.92 at the September auction and an average of 2.42 at the last 10 auctions. The 30-year bond yield touched 3.89 percent on Oct. 2, the lowest level since April. �The auction was very tepid,� said Tom di Galoma, head of fixed-income rates trading at Guggenheim Capital Markets LLC, a New-York based brokerage for institutional investors. �The auction shows that the market can sell off when levels are overpriced. This can be a disappointment in these reopened issues.� The 30-year bond yield rose eight basis points to 4.08 percent at 4:04 p.m. in New York, according to BGCantor Market Data. The 4.5 percent security due August 2039 fell 1 13/32, or $14.06 per $1,000 face amount, to 107 5/32. The securities sold today drew a yield of 4.009 percent, more than the 3.994 forecast by six of the Federal Reserve�s 18 primary dealers in a Bloomberg News survey. The previous sale of 30-year debt on Sept. 10 drew a yield of 4.238 percent. Its bid- to-cover was the highest since November 2007. Stocks Versus Bonds An investor class that includes foreign central banks bought 34.5 percent of the notes, compared with 46.5 percent at the last auction and an average of 45.36 percent at the past five auctions. �We continue to see a lot of cash that was on the sidelines during the volatility in the markets being redeployed,� said Richard Bryant, senior vice president in fixed income at in New York at MF Global Inc. �Given the relative returns of other asset classes, Treasuries at these yield levels are not unattractive.� The U.S. sold $7 billion in 10-year Treasury Inflation Protected Securities on Oct. 5, $39 billion in three-year notes the following day and $20 billion in 10-year notes yesterday as President Barack Obama borrows record amounts to spur economic growth. �The bond market is telling you the recovery is weak and it will take a long time,� said Ray Remy, head of fixed income in New York at Daiwa Securities America Inc., one of 18 primary dealers that trade directly with the Federal Reserve. �It is concerned about the jobless picture. Stocks are saying earnings are in good shape. I don�t know which will win.� The Standard & Poor�s 500 Index rose 0.9 percent, its fourth straight day of gains. Real Yields Thirty-year bonds yielded 3.96 percent, or 3.09 percentage points more than two-year government securities, before the sale, compared with an average of about 1.27 percentage points over the past five years. �People are throwing in the towel and moving out the yield curve to capture some yield,� said Arthur Bass, a managing director of derivatives in New York at the brokerage Newedge USA LLC. �The market�s been rallying no matter what.� Bonds are still attractive compared with similar securities in Europe and Japan when measured by real yields, said David Ader, head of U.S. government bond strategy in Stamford, Connecticut, at CRT Capital Group LLC, in an interview with Bloomberg Radio. Long bonds �look rich but the buying we are seeing there may not be based on them being rich or cheap, but relatively speaking it looks better than everything else,� Ader said. Thirty-year bonds yield 3.85 percent in Germany and 3.97 percent in the U.K. Central Bank Rates The real yield, or the difference between rates on government securities and inflation, for 30-year bonds is 5.47 percentage points today, compared with an average of 3.17 percentage points over the past 20 years. Policy makers around the world have reduced rates to record lows, including coordinated cuts by six central banks a year ago, to stabilize economies following a squeeze on credit that led to the collapse of Lehman Brothers Holdings Inc. The European Central Bank left interest rates at a record low to nurture an economic recovery that is being threatened by the appreciation of the euro. ECB officials meeting in Venice today kept the benchmark rate at 1 percent, as predicted by all 53 economists in a Bloomberg News survey. Separately, the Bank of England held its key rate at 0.5 percent. The ECB, led by President Jean-Claude Trichet, won�t raise rates before the third quarter of 2010, another survey shows. Futures on the Chicago Board of Trade show a 57 percent chance the Fed will refrain from raising its target rate for overnight lending between banks by April, compared with 64 percent odds a month earlier. The Fed cut its benchmark rate to a range of zero to 0.25 percent at the end of 2008. Dollar�s Decline Fed Bank of Richmond President Jeffrey Lacker said the risk that the U.S. economy will slide back into recession has declined without disappearing entirely. �That risk has diminished quite substantially since several months ago,� Lacker told reporters today in Washington. �It�s not entirely zero.� Credit-market yields indicate the central bank is having some success. The London interbank offered rate, or Libor, for three-month dollar loans stayed at 0.284 percent for a sixth day, down from 4.52 percent a year ago. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Oct-09-09 06:26 PM Response to Original message |

| 14. I Apologize for the Typing Errors In Advance, Folks |

|

There's a reason why I got a D in typing in high school. Can't play piano, either.

I've also been imbibing apple cider, which is good for what ails you, until you overdo it. Due to my disinclination to move while the damp and arthritis make a mockery of life, it's taking a while to post. I was not prepared, today, for today. There are years like that. The weather is supposed to turn sunny tomorrow--we will see. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Oct-09-09 06:28 PM Response to Original message |

| 15. California Hotel Foreclosures Triple in Travel Slump |

|

http://www.bloomberg.com/apps/news?pid=20601087&sid=a5nTehuUgKfQ

Hotel foreclosures in California more than tripled in the first nine months of this year as business travelers and vacationers cut spending. Foreclosures including the 400-room St. Regis Monarch Beach resort in Dana Point climbed to 47 in January through September from 15 a year earlier. Properties in default more than quadrupled to 259, Irvine, California-based Atlas Hospitality Group said in a statement. Atlas specializes in selling hotels. The survey didn�t include states other than California. Declining occupancy rates and a dearth of credit for refinancing loans obtained during the U.S. real estate boom are squeezing the travel industry. Loans secured by more than 1,500 hotels with a total outstanding balance of $24.5 billion may be in danger of default, according to Realpoint LLC, a credit rating company that tracks the performance of securities tied to mortgages on commercial property. �Urban areas are dependent on a mix of business, convention and leisure travel,� said Robert Mandelbaum, research director for PKF Hospitality Research in Atlanta. �There�s been a tremendous decline in business and convention travel.� Lodging owners are struggling after adding rooms and properties from 2004 to 2007, when financing was easy to come by because banks could bundle loans into commercial mortgage-backed securities and sell them on to investors. About $83.4 billion in hotel-backed securities were issued in those years, according to Realpoint. Trouble in L.A. �We see higher default numbers in L.A. County and San Diego County because of the sheer volume of hotels,� Alan Reay, president of Atlas Hospitality, said in a telephone interview. �A lot of new product has been added in those counties.� More than 70 percent of troubled California hotel loans originated between 2005 and 2007, Reay said. Nearly 2,500 of the state�s hotels were financed or refinanced during those years, accounting for about 25 percent of the entire supply, he said. Occupancy in the top 25 U.S. travel markets fell to 61 percent in the first eight months of the year from 69 percent a year earlier, according to Smith Travel Research in Hendersonville, Tennessee. Riverside, California, outside of Los Angeles, had nine hotels in foreclosure through September. San Bernardino was home to six and Los Angeles had five, Atlas said. Another 28 Los Angeles hotels were in default, according to Atlas. Occupancy there dropped to 65 percent in January through August from 75 percent a year earlier, according to Smith Travel. �Los Angeles is a gateway city,� Mandelbaum said in a telephone interview. �Prior to 2009, we were enjoying the influx from foreign travelers. That also has tapered off due to this global economic decline.� San Diego had 26 hotels in default and San Bernardino had 23, Atlas said. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Oct-09-09 06:29 PM Response to Original message |

| 16. Study Exposes How Taxpayers Are Subsidizing Bank of America, Citigroup, Wells Fargo and Other Large |

|

A Hidden $34 Billion Bank Subsidy? Study Exposes How Taxpayers Are Subsidizing Bank of America, Citigroup, Wells Fargo and Other Large Banks

One of the key terms to come out of the nation�s economic meltdown has been �too big to fail.� The government has funneled billions of dollars to large financial firms by arguing that their collapse would deal an irreparable blow to economic recovery. A new study has calculated the tab of the �too big to fail� approach, and it amounts to a far larger taxpayer-funded subsidy than previously thought. The Center for Economic and Policy Research says the bailout has allowed �too big to fail� banks to pay significantly lower interest rates than those paid by smaller banks. According to one estimate, that�s meant a subsidy for the nation�s eighteen largest bank holding companies of $34.1 billion a year. That amount represents nearly half these companies� combined annual profits. We speak to the study�s author, Dean Baker. SEE VIDEO ARTICLE AT LINK! |

| Printer Friendly | Permalink | | Top |

| Tansy_Gold

|

Sun Oct-11-09 09:29 AM Response to Reply #16 |

| 83. No link???? n/t |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sun Oct-11-09 01:36 PM Response to Reply #83 |

| 85. oops / this is what I found via google |

|

Edited on Sun Oct-11-09 01:40 PM by Demeter

http://www.nytimes.com/2009/10/04/business/economy/04gret.html

http://www.democracynow.org/2009/10/6/a_hidden_34_billion_bank_subsidy The second one has the video. Sorry about that, chief. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Oct-09-09 06:32 PM Response to Original message |

| 17. China calls time on dollar hegemony |

|

http://www.telegraph.co.uk/finance/china-business/6266790/China-calls-time-on-dollar-hegemony.html#

You can date the end of dollar hegemony from China's decision last month to sell its first batch of sovereign bonds in Chinese yuan to foreigners. Beijing does not need to raise money abroad since it has $2 trillion (�1.26 trillion) in reserves. The sole purpose is to prepare the way for the emergence of the yuan as a full-fledged global currency. "It's the tolling of the bell," said Michael Power from Investec Asset Management. "We are only beginning to grasp the enormity and historical significance of what has happened." It is this shift in China and other parts of rising Asia and Latin America that threatens dollar domination, not the pricing of oil contracts. The markets were rattled yesterday by reports � since denied � that China, France, Japan, Russia, and Gulf states were plotting to replace the Greenback as the currency for commodity sales, but it makes little difference whether crude is sold in dollars, euros, or Venetian Ducats. What matters is where OPEC oil producers and rising export powers choose to invest their surpluses. If they cease to rotate this wealth into US Treasuries, mortgage bonds, and other US assets, the dollar must weaken over time. "Everybody in the world is massively overweight the US dollar," said David Bloom, currency chief at HSBC. "As they invest a little here and little there in other currencies, or gold, it slowly erodes the dollar. It is like sterling after World War One. Everybody can see it's happening." "In the US they have near zero rates, external deficits, and public debt sky-rocketing to 100pc of GDP, and on top of that they are printing money. It is the perfect storm for the dollar," he said. "The dollar rallied last year because we had a global liquidity crisis, but we think the rules have changed and that it will be very different this time The self-correcting mechanism in the global currency system has been jammed until now because China and other Asian powers have been holding down their currencies to promote exports. The Gulf oil states are mostly pegged to the dollar, for different reasons. This strategy has become untenable. It is causing them to import a US monetary policy that is too loose for their economies and likely to fuel unstable bubbles as the global economy recovers. Lorenzo Bini Smaghi, a board member of the European Central Bank, said China for one needs to bite bullet. "I think the best way is that China starts adopting its own monetary policy and detach itself from the Fed's policy." Beijing has been schizophrenic, grumbling about the eroding value of its estimated $1.6 trillion of reserves held in dollar assets while at the same time perpetuating the structure that causes them to accumulate US assets in the first place � that is to say, by refusing to let the yuan rise at any more than a glacial pace. For all its talk, China bought a further $25bn of US Treasuries in June and $25bn in July. The weak yuan has helped to keep China's factories open � and to preserve social order � during the economic crisis, though exports were still down 23pc in August. But this policy is on borrowed time. Reformers in Beijing are already orchestrating a profound shift in China's economy from export reliance (38pc of GDP) to domestic demand, and they know that keeping the dollar peg too long will ultimately cause them to lose export edge anyway � via the more damaging route of inflation. For the time being, Europe is bearing the full brunt of Asia's currency policy. The dollar peg has caused the yuan to slide against the euro, even as China's trade surplus with the EU grows. It reached �169bn (�156bn) last year. This is starting to provoke protectionist rumblings in Europe, where unemployment is nearing double digits. ECB governor Guy Quaden said patience is running thin. "The problem is not the exchange rate of the dollar against the euro, but rather the relationship between the dollar and certain Asian currencies, to mention one, the Chinese Yuan. I say no more." France's finance minister Christine Lagarde said at the G7 meeting that the euro had been pushed too high. "We need a rebalancing so that one currency doesn't take the flak for the others." Clearly this is more than a dollar problem. It is a mismatch between the old guard � US, Europe, Japan � and the new powers that require stronger currencies to reflect their dynamism and growing wealth. The longer this goes on, the more havoc it will cause to the global economy. The new order may look like the 1920s, with four or five global currencies as regional anchors � the yuan, rupee, euro, real � and the dollar first among equals but not hegemon. The US will be better for it. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Oct-09-09 06:36 PM Response to Reply #17 |

| 18. �Dollar�s Demise Will Be Felt Worldwide� |

|

http://www.informationclearinghouse.info/article23665.htm

If the dollar collapses, it would spell economic disaster not just for the United States, but for the world, says Gerald Celente, director of the Trade Research Institute. �It is more than just the demise of the dollar � this is going to be felt worldwide. There�s a major financial crisis ahead. The United States, the world�s superpower, is failing on its most basic level,� Celente told RT. And the reason for the future demise of the American currency, Celente says, is the disproportionate financial system: �We can�t print money out of thin air, backed by nothing and producing practically nothing.� The researcher believes the crisis of the dollar is irreversible, since America is losing its gold � the value of its currency. SEE VIDEO AT LINK |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Oct-09-09 06:42 PM Response to Reply #18 |

| 21. A Financial Revolution with Profound Political Implications |

|

http://www.independent.co.uk/opinion/commentators/fisk/robert-fisk-a-financial-revolution-with-profound-political-implications-1798712.html

Such large financial movements will have major political effects in the Middle East By Robert Fisk October 07, 2009 "The Independent" -- The plan to de-dollarise the oil market, discussed both in public and in secret for at least two years and widely denied yesterday by the usual suspects � Saudi Arabia being, as expected, the first among them � reflects a growing resentment in the Middle East, Europe and in China at America's decades-long political as well as economic world dominance. Nowhere has this more symbolic importance than in the Middle East, where the United Arab Emirates alone holds $900bn (�566bn) of dollar reserves and where Saudi Arabia has been quietly co-ordinating its defence, armaments and oil policies with the Russians since 2007. This does not indicate a trade war with America � not yet � but Arab Gulf regimes have been growing increasingly restive at their economic as well as political dependence on Washington for many years. Of the $7.2 trillion in international reserves, $2.1trn is held by Arab countries � China holds about $2.3trn � and the nations interested in moving away from dollar-trading in oil are believed to hold over 80 per cent of international dollar reserves. Saudi Arabia's denials of any such ambitions were regarded by Arab bankers as a normal part of Gulf politics. The Saudis, of course, managed to deny that Iraq had invaded Kuwait in 1990 � even when Saddam Hussein's legions stood along the Saudi frontier, until the US broadcast the news of Iraq's aggression to the world. Saudi bankers are well aware that in nine years' time � the current timeframe for a transition away from the dollar in oil trading to Japanese and Chinese currencies, the euro, gold and a possible new Gulf currency � China will have doubled its national income to $10trn (assuming a growth rate of 7 per cent), at which point the US might hold no more than 20 per cent of the world's gross income. Such massive financial movements, encouraged by the de-dollarisation of oil, will have enormous political effects in the Middle East, especially if economic superpower rivalry between America and China comes to dominate the Arab world. Will American economic support for Israel remain as loyal in nine years' time if China and the Arabs are setting the pace in global financial markets? Indeed � perhaps with this in mind � some Israeli financiers have been expressing interest over the past two years in non-dollar Arab bank investments. Whenever a change of this magnitude takes place over a number of years, it has to be commenced in secrecy. Nor can it be denied that the very project to take oil trading away from the dollar market has deep political roots. The collapse of the Soviet Union has allowed the US to dominate the Middle East more than any other world region, and the Arabs � who can no longer contemplate an oil boycott of the kind they imposed on the West after the 1973 Middle East war � are still anxious to prove that they can flex their economic power to bring about change. Saudi Arabia's pan-Arab offer to recognise Israel and its security in return for an Israeli withdrawal from occupied Arab land is not � according to the Saudis themselves � indefinite. If they are ignored or rebuffed, then they can search for other allies through new financial institutions to force a new Middle East peace. China will be happy to help. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Oct-09-09 06:55 PM Response to Reply #21 |

| 26. Dollar Hysteria By Mike Whitney |

|

http://www.informationclearinghouse.info/article23647.htm

October 06, 2009 "Information Clearing House" -- - Robert Fisk has set off a firestorm with his unsettling narrative which appeared in Tuesday's UK Independent titled, "The Demise of the Dollar". The article went viral overnight spreading to every musty corner of the Internet and sending gold skyrocketing to $1,026 per oz. Now every doomsday website in cyber-world has headlined Fisk's "Shocker" and the blogs are clogged with the frenzied commentary of bunker-dwelling survivalists and goldbugs who're certain that the world as we know it is about to end. (Fisk's article IS POSTED ABOVE) Reports of the dollar's demise are greatly exaggerated. The dollar may fall, but it won't crash. And, in the short-term, it's bound to strengthen as the equities market reenters the earth's gravitational field after a 6 month ride through outer-space. The relationship between falling stocks and a stronger buck is well established and, when the market corrects, the dollar will bounce back once again. Bet on it. So why all the talk about Middle Eastern men huddled in "secret meetings" stroking their beards while plotting against the empire? Yes, the dollar will fall, (eventually) but not for the reasons that most people think. It's true that the surge in deficit spending has foreign dollar-holders worried. But they're more concerned about the Fed's quantitative easing (QE) program which adds to the money supply by purchasing mortgage-backed securities and US Treasuries. Bernanke is simply printing money and pouring it into the financial system to keep rigamortis from setting in. Naturally, the Fed has had to quantify exactly how much money it intends to "create from thin air" to placate its creditors. And, it has. (The program is scheduled to end by the beginning of 2010) That said, China and Japan are still buying US Treasuries, which indicates they have not yet "jumped ship". The real reason the dollar will lose its favored role as the world's reserve currency is because US markets, which until recently provided up to 25 percent of global demand, are in sharp decline. Export-dependent nations--like Japan, China, Germany, South Korea--already see the handwriting on the wall. The US consumer is buried under a mountain of debt, which means that his spending-spree won't resume anytime soon. On top of that, unemployment is soaring, personal wealth is falling, savings are rising, and Washington's anti-labor bias assures that wages will continue to stagnate for the foreseeable future. Thus, the American middle class will no longer be the driving force behind global consumption/demand that it was before the crisis. Once consumers are less able to buy new Toyota Prius's or load up on the latest China-made widgets at Walmart, there will be less incentive for foreign governments and central banks to stockpile greenbacks or trade exclusively in dollars. Here's a clip from the Globe and Mail cited on Washington's Blog: "A UBS Investment Research report says that while it would be wrong to write off the U.S. dollar as the global reserve currency, its roughly 90-year iron grip on that position is loosening. �The use of the U.S. dollar as an international reserve currency is in decline,� said UBS economist Paul Donovan. �The market share of the dollar in international transactions is likely to decline over the coming months and years, but only persistent policy error � or considerable fiscal strain � is likely to cause the dollar to lose reserve currency status entirely.� The UBS report maintains that the gradual slide of the U.S. dollar is being driven not by the world�s central banks, but by the private sector, as individual companies increasingly abandon the greenback as their international currency of choice. �The private sector�s use of reserves is more important than official, central bank reserves � anything up to 20 times the significance, depending on interpretation,� Mr. Donovan said. �There is evidence that the move away from the dollar as a private-sector reserve currency has been accelerating since 2000.� As private industry veers away from the dollar, governments, investors and central banks will follow. The soft tyranny of dollar dominance will erode and parity between currencies and governments will grow. This will be create better opportunities for consensus on issues of mutual interest. One nation will no longer be able to dictate international policy. So-called "dollar hegemony" has added greatly to the gross imbalance of power in the world today. It has put global decision-making in the hands of a handful of Washington warlords whose narrow vision never extends beyond the material interests of themselves and their constituents. As the dollar weakens and consumer demand declines, the United States will be forced to curtail its wars and adjust its behavior to conform to international standards. Either that, or be banished into the political wilderness. So, what exactly is the downside? Superpower status rests on the flimsy foundation of the dollar, and the dollar is beginning to crack. Fisk is right; big changes are on the way. Only not just yet. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri Oct-09-09 07:00 PM Response to Reply #26 |

| 27. UN Calls For New Reserve Currency |

|

http://www.breitbart.com/article.php?id=CNG.e272eaa74dccc30f21c6ff7638b0f37b.461&show_article=1 October 06, 2009 "Breitbart" -- The United Nations called on Tuesday for a new global reserve currency to end dollar supremacy which has allowed the United States the "privilege" of building a huge trade deficit. "Important progress in managing imbalances can be made by reducing the reserve currency country?s 'privilege' to run external deficits in order to provide international liquidity," UN undersecretary-general for economic and social affairs, Sha Zukang, said. Speaking at the annual meetings of the International Monetary Fund and World Bank in Istanbul, he said: "It is timely to emphasise that such a system also creates a more equitable method of sharing the seigniorage derived from providing global liquidity." He said: "Greater use of a truly global reserve currency, such as the IMF?s special drawing rights (SDRs), enables the seigniorage gained to be deployed for development purposes," he said. The SDRs are the asset used in IMF transactions and are based on a basket of four currencies -- the dollar, euro, yen and pound -- which is calculated daily. China had called in March for a new dominant world reserve currency instead of the dollar, in a system within the framework of the Washington-based IMF. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat Oct-10-09 01:35 AM Response to Reply #27 |

| 42. What Not Being Able To Buy Oil In Dollars Means By Ian Welsh |

|

http://crooksandliars.com/ian-welsh/what-dollar-going-oil-means

October 09, 2009 "Crooks and Liars" -- The big news this week on the financial front was the Independent�s claim that Gulf Arabs and France, Japan, Russia and Japan were planning to move from buying oil in dollars to buying it in a basket of currencies, including gold and a new universal currency shared by the Gulf nations. Buying oil in dollars is one of the foundations of the dollar�s role as the world�s primary reserve currency. Because the the dollar is the world�s primary reserve currency Americans have been able to borrow money for significantly less than other countries are able to. This has both made America more prosperous, and through the perverse incentives of cheap money, helped lead to the high indebtedness of American citizens and the financial crisis. In addition, buying oil in dollars is one of the things which allowed strong dollar policies to drive the price of oil down. Making dollars extremely scarce in the 80�s and nineties was one key factor leading to a price per barrel under $20. Oil prices started their rise upwards after Greenspan�s Federal Reserve let loose the money spigot in the Asian crisis and the Long Term Capital fiasco. Greenspan essentially never took his foot off the pedal from that point onwards, and oil prices soared, until last year at one point they were over $150/barrel. So one consequence of going off the dollar is that a major benefit of the strong dollar play is taken off the table, and the US loses its ability to control the price of oil. Since at this time, contrary to what the Feds are saying, a strong dollar play isn�t in the cards (the US needs to borrow way too much money) that�s not a big deal in the short run�in the long run it is. But buying oil in dollars isn�t the only thing that underpins the dollar as the world�s reserve currency and to understand what buying oil in something other than dollars would mean we need to understand what else makes, or perhaps more accurately, made, the dollar so important. Technological Revolutions: Remember the internet boom of the nineties? Remember the way that money flooded in from the rest of the world to buy up internet stocks? Sure, most of them turned out to be worthless, but some didn�t. When the US was the nation most likely to create the next technological revolution you needed dollars so that when it occurred you could buy in on the ground floor. Whether microcomputers in the 80�s or the internet in the 90�s, odds were that America was going to create the next big tech. So foreigners needed to be in the dollar. At this point the US is the undisputed leader in almost nothing except military tech. As expected, US dominance of the arms sales market continues to increase, but the US can�t live on weapon sales alone. In most other fields, including telecom, the internet, large chunks of biotech, renewable energy, ground transportation and so on the US now lags other modern economies. THANK YOU, RONALD REAGAN AND THE GOP The structure of the US economy, with a few large oligopolistic firms dominating the market in key fields needn�t necessarily mean no technological advances, after all Japan and Korea certainly have high concentrations of large firms, but US firms such as the telecom giants essentially don�t engage in research, don�t believe in upgrading infrastructure more than they have to and are rent seeking corporations�they provide an inferior product to a captive audience (as with insurance companies) knowing that Americans have no other options. If they fail, they expect the US government to bail them out with huge subsidies. This structure means that the US, is unlikely to be the home of the next great technological revolution. The next tech reveolution could happen in the US, with the right policies, but the Obama administration has not engaged in those policies, instead spending trillions on propping up failed business models. Consumers of Last and Main Resort: For decades now Americans have bought a ton of consumer goods, from cars to electronics to clothes. As time went by, more and more of these goods were bought from foreign countries, and more and more of it was bought on credit. America and Americans have been the engine of development for Japan, the Asian Tigers, and most recently, China. China, Japan and Korea, in particular, used mercantalist policies�that is to say they generally used trade barriers to protect their internal economy and subsidies to help their exports. China�s main trade barrier and subsidy is its massive interventions to keep the Yuan cheap against the dollar, an intervention which has amounted to as much as 10% of China�s GDP. That intervention has left China with a huge number of dollars denominated assets. In effect the Chinese loaned America the money to consume Chinese goods, which simultaneously made American manufactured goods uncompetitive which meant that manufacturing employment in American dropped like a rock while new factories opened in China rather than the US. In exchange for the money they loaned America, China industrialized. Even if they don�t get most of the money back (and they won�t) it was a good deal for them. As for Americans, well, Americans were able to live above their means�those who didn�t lose their jobs, anyway. Many countries export a lot to the US. While US consumers have pulled back significantly, they still consume a lot. There is, as yet, no replacement for the US consumer. China and other countries may wish there was, but there isn�t. The American Security Product: One of the main reasons other countries were willing to, in effect subsidize the US, for decades, is that it provided the common security product�against the Soviets, then against real rogue nations, and always against pirates. In particular, America�s navy is as large as the next 13 navies combined. The US was responsible for keeping the world�s shipping lines open, and it was the core of the NATO hammer when a problem needed to be dealt with (for example, Serbia in the late nineties.) But lately the US hasn�t been delivering the product in a way that the rest of the world appreciates. Most of �old� Europe (ie. the countries with money and power) opposed it. So did most of Asia. So did America�s allies in the Middle East. Once in Iraq, the US couldn�t be defunded for fear of Iraq splintering, but now that it�s clear the US is leaving anyway, the possibility exists. And then there�s the Somali pirates. Because most of the US navy was occupied with the wars in Afghanistan, Pakistan and Iraq, the Somali pirates got completely out of hand and the US Navy didn�t do anything about it for a long long time. When the issue was finally dealt with, the US navy was only one of a number of navies doing so. The US let it get out of control, and then wasn�t key to fighting it. Now that the US no longer protects very well against the Soviets, rogue nations or pirates, and now that joint naval operations are how the Somali pirates are being dealt with, the rest of the world is wondering whether it�s worth paying for a US military which doesn�t do what they want it to do. Only the Afghan war, which has elite support in Europe (though not popular) makes some think that perhaps the US is worth keeping on as the world�s policeman. Buying Key Technologies Required Dollars: Yet another reason folks wanted to have lots of dollars and access to dollars was that you needed dollars to buy certain goods. For decades the only good commercial jet liners were Americans. Key computer technologies needed to be bought in dollars. Intellectual property needed to be bought in dollars. The best military technology had to be (and still has to be) bought in dollars. And so on. The US wasn�t just home to the next technological revolution, it was home to all the good things you wanted to buy and which you couldn�t buy in your currency. This is, with a few exceptions, no longer true. The Europeans and Japanese can sell you most high end capital goods. There is no real difference between Airbus and Boeing products (though both are essentially 30 year old technology). The Chinese can and will sell you middle and low end goods for less than America. You don�t need dollars to buy most of what you need and want, and if something comes up really worth buying (say General Motors) well, if you�re someone who really wants it, like the Chinese, you just won�t be allowed to buy it anyway. (The Chinese would have loved to buy GM.) A Safe Haven For Money and For You: For decades, if you wanted a safe place to put your money and put it to work, the US was probably the best. It was the most stable, it was impossible it could be conquered even if there was a World War III, it was the largest and could absorb the most money. Likewise, if things went really bad in your country, it was a great place to flee to. The financial crisis put the wisdom of placing your money in the US in question. Bush era immigration and travel policies, not rescinded by the Obama administration, put the utility of the US as a safe haven in question as well. And yet, to an extent, the US retains at least the first role, because there is simply no other country available. Europe did not avoid the financial crisis, China doesn�t allow that much investment in the country and is an unsafe place to put money, and so on. So the US retains some safe haven appeal. At the same time, however, foreign elites have become far more uneasy about the idea and want a different option. And for themselves, they�d rather vacation, have their second homes and educate their children in Europe. And at last, back to oil: Of course, the final and in some ways most important reason for the dollar�s reserve currency status is that oil was sold in dollars. This is a result of a decades long understanding between the key Gulf States, Saudi Arabia and America that the US both underwrote their security and could knock them over any time it wanted. In exchange for America�s security umbrella and help in maintaining their regimes, oil was priced in dollars. When they became rich in the 70s, their money flooded primarily through US banks. Indeed, in prior years, every time an OPEC nation talked about going off the dollar as the currency for buying oil, rumor has it that the Saudis were the ones to spike the move. Oil is the most important commodity in the world. Ultimately all economies are underpinned by oil. Oil is also the most important military resource. With oil your army can move and fight. Without it, it can�t. In many ways WWII was fought for oil and with oil, and the powers with the oil defeated those which didn�t have it. Which brings us back to the US military product. As long as oil is priced in dollars, the US military can always function at full capacity, because if push comes to shove, the US can always just print more dollars. If oil is not priced in dollars, then certain US access to oil is removed�both for the military and for the civilian population. Sure, the US can still print more dollars, but if oil isn�t priced in dollars, well, print too much and you may get inflation, even hyperinflation. And if the oilarchies don�t approve of a particular military action, well, they can make it much more expensive. Are the Dollar�s Days as Reserve Currency Over? No. They aren�t. But they are numbered. They aren�t over because other nations still need the US consumer. Until the Chinese manage to create a domestic consumer society, both they and other countries can�t cut themselves lose from the US consumer. What they will do, and what they are doing, is trying to manage how much the US borrows and to take away the US ability control the world�s money supply. They will still have to keep the US propped up for the time being, because in so doing they are propping up themselves. And remember always that Chinese citizens aren�t like Americans. Take their jobs or their land or their hope and they get violent�very violent. They have, do and will fight both the police and the military. China�s elites know that if they don�t keep economic growth coming, their heads could literally wind up rolling. In addition, while no one is happy with the US security product, the fact is that no one can really replace it. The European military is not strong enough, and their navy does not have the projection ability. Likewise with the Chinese military, who in any aren�t trusted half as much as the Europeans, though their moral flexibility is appreciated by many regimes, who still understand you don�t invite China to station large number of troops in your country if you have half a brain. Likewise, there is simply no replacement for the US as a haven of last resort. China�s currency and investment controls make it unsuitable. Europe managed its financial affairs no better than the US over the last decade, although they seem to have learned the regulatory lessons marginally better than the US. If you need a place to store your money, and put it to work, the US may not look good, but neither does anyone else who is large enough to absorb large amounts of money. The key break point, the end of the dollar hegemony, will come when the Chinese are able to move to a consumer economy. At that point, the Chinese will no longer need America as consumers, and they will let the Yuan float. The devastation this will wreck on the US economy is hard to overstate. Standards of living will crash. In the long run, being forced to live within its means, and no longer having to compete against massively subsidized foreign goods may turn out to be good for the US, but that won�t make you feel better as your effective income collapses or you lose your job. This is probably two economic cycles out. We�re talking 12 to 16 years. So there�s time yet. Probably. So what does oil not being priced in dollars mean to me now? Less money for everything. The US will not be able to afford as large a stimulus as it should have. It will mean borrowing costs higher than they would otherwise have been and more restricted credit (sure, theoretical interest rates may be low, but can you get a loan at those rates?) Oil prices, and gas prices will be more volatile for the US than they were before, which is saying something. And other countries will get more oil, relatively speaking. Which means they will get more growth. They will receive more investment from the oilarchies, and the US will receive less. Relatively speaking the US economy will not be as good as it was. This is a marginal effect, but marginal effects add up. This is, in short, not good news. You won�t be able to say �I lost my job because oil isn�t priced in dollars� but it will be true for some people. Lower wages, more restricted credit, and more restricted government policy will be the price paid for the massive incompetence which lead to this moment. And yet this does have a silver lining. Both for other countries who deserve to be able to pay in their own currencies and for America and Americans, who need to learn to live within their means, to emphasize production again rather than consumption and who need to wean off of oil as much as possible in any case. But it will hurt. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat Oct-10-09 08:52 AM Response to Reply #17 |

| 66. Asian Countries Intervene to Prop Up Greenback (Dollar Bind Edition) |

|

http://www.nakedcapitalism.com/2009/10/asian-countries-intervene-to-prop-up-greenback-dollar-bind-edition.html