Conventional wisdom says that financial companies are having trouble borrowing because credit markets are broken. This is dangerously wrong. The credit market itself is fine. It's balance sheets that are broken. They have so little equity relative to their assets, there's no cushion to protect creditors from losses. With few good borrowers available and with the price of credit capped by government, naturally creditors have little inclination to lend. Washington's solution is to "guarantee" all manner of risky investments, to use the public's balance sheet to absorb trillions of dollars worth of private sector losses. We're told this will "restore confidence" in borrower balance sheets, leading to increased lending. But this policy is dangerously misguided and may very well lead to economic Armageddon.

In point of fact, our fractional reserve financial system is just a gigantic Ponzi scheme. It can only survive as long as it expands, which is to say, as long as new debt is flushed through the system to finance old debt. But like all Ponzi schemes, the larger it grows the more unstable it becomes. Eventually, it too will collapse of its own weight.

With this in mind, government should be concerned with paying down debt, not expanding it. Deficit-financed bailouts and stimulus only increase the size of the Ponzi. The bigger it grows, the harder it will crash.

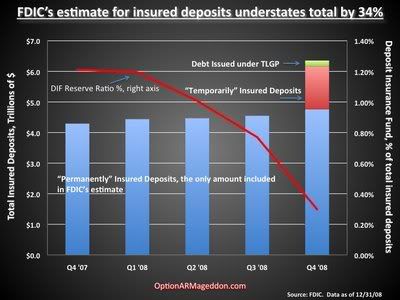

My thoughts came back to this recently when I looked at FDIC's 12/31/08 balance sheet. Note at the bottom of that link the estimate for total insured deposits: from Q3 to Q4 it increased only a smidge, to $4.8 trillion from $4.6 trillion.

Odd, no? Why such a small increase even though FDIC dialed up deposit insurance limits so significantly during Q4? FDIC Senior Banking Analyst Ross Waldrop told me during an interview last week that it's because so-called "temporary" increases in deposit insurance are excluded. If included, these would boost total insured deposits from $4.8 trillion to $6.2 trillion.

http://www.nakedcapitalism.com/2009/04/guest-post-fdics-insurance-commitments.htmlMore at the link.