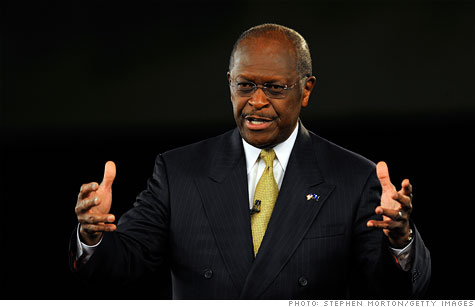

Much less attention is paid to the fact that his 9-9-9 plan is just an early step in his tax reform plans. (Taxes you'll still pay under Cain's plan)

Ultimately, Cain wants the country to adopt a Fair Tax. He's not the first presidential candidate to propose it. In 2008, for instance, Mike Huckabee made it a central part of his economic plan.

So what's a Fair Tax exactly?

In essence, it's a national sales tax that would replace the current tax code entirely and all the credits, deductions and exemptions that go along with it.

http://money.cnn.com/2011/10/17/news/economy/cain_999_plan/index.htmHere's what Bruce Bartlett had to say about a National Sales Tax in 2004:

August 09, 2004, 8:47 a.m.

A National Sales Tax No Vote

The rates would be vastly higher than what you might suspect.

http://old.nationalreview.com/nrof_bartlett/bartlett200408090847.asp***

An unstated assumption is that the 23 percent rate proposed by Linder is comparable to existing state and local sales taxes, where the tax comes on top of the purchase price. Thus, a 5 percent sales tax on a $1 purchase comes to $1.05. But that�s not the way the Linder plan works. He deceptively calculates the rate as if the tax is part of the purchase price. He calls this the tax-inclusive rate. Calculating the rate the normal way people are accustomed to with state and local sales taxes would require a 30 percent tax rate, not 23 percent.

When Congress�s Joint Committee on Taxation scored the Linder proposal four years ago it estimated that it would actually require a tax-inclusive rate of 36 percent, not 23 percent, to equal current federal revenues. Calculating the rate in a normal, tax-exclusive manner would mean a 57 percent rate.

Economist Bill Gale of the Brookings Institution notes that supporters of the sales tax assume that there will be no tax evasion under their proposal and that the size of government will not grow, even though they would send a large annual check to every American in order to offset the regressivity of the tax. Making realistic assumptions, Gale estimates that the tax-inclusive rate, comparable to Linder�s proposed 23 percent rate, would actually have to be about 50 percent. A rate comparable to existing sales taxes would be close to 100 percent. And let us not forget that state and local sales taxes would come on top of the federal sales tax, pushing the total rate even higher.

***

This means that if you are sick and have large doctor bills, you are going to pay 30 percent on top to the federal government. (Alternatively, you would pay 30 percent more for health insurance.) If you buy a new house listed for $150,000, your actual purchase price is going to be $195,000, including the sales tax. (Alternatively, there could be a tax on the imputed rent homeowners pay themselves for living in their own homes.) And if your children receive $20,000 worth of education each year from the local public schools, somehow or other you are going to have to pay an additional $6,000 to the federal government.