General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWells Fargo hit with a brutal 100-page notice as regulators finally crack down on the 'lawless' bank

Note: This is a rare original Raw Story column.By Phil Mattera, DC Report @ Raw Story - Commentary

Published 22 mins ago on February 5, 2020

It took three years but a leading U.S. regulator finally got tough with probably the most lawless large U.S. financial institution.

The Office of the Comptroller of the Currency, an arm of the Treasury Department, recently took action against a former chief executive of Wells Fargo. The action was in connection with the scandal in which the bank pressured employees to create bogus accounts to extract millions in fees from unsuspecting customers.

Many observers were surprised. The OCC, not known for aggressive action, fined John Stumpf $17.5 million. That’s the largest penalty it has ever imposed on an individual. And, the regulator banned Stumpf for life from the banking industry.

The agency also penalized two other former senior officials at Wells and charged five others. Among them is Carrie Tolstedt, the former head of retail banking. The OCC is seeking a penalty of $25 million for Tolstedt, $7.5 million more than Stumpf.

snip

https://www.rawstory.com/2020/02/wells-fargo-hit-with-a-brutal-100-page-notice-as-regulators-finally-crack-down-on-the-lawless-bank/

Sherman A1

(38,958 posts)Cirque du So-What

(29,525 posts)Wells Fucko gets its comeuppance.

uponit7771

(93,504 posts)mr_lebowski

(33,643 posts)from working in their field again.

But no jail.

Must be nice.

Sgent

(5,858 posts)Wells didn't actually steal any money. They just opened a lot of fake accounts that nobody asked for, thereby gaining themselves bonuses.

mr_lebowski

(33,643 posts)But why would the company hand out bonuses JUST for opening accounts that involved $0 fees?

Seems like they would only do so for accounts that have some sort of 'guaranteed income' from them.

And if no customers were ever charged any money for these accounts, cause they're fake, seems like the whole thing wouldn't have become the big ta-do that it become.

Again, I could be wrong but it SEEMS like money must've been made by the bank somehow in this scenario, at the expense of customers.

Midnightwalk

(3,131 posts)I’ve been reading up on it today. The problem isn’t the fees which amounted to a few million dollars. This is what I’ve gleaned.

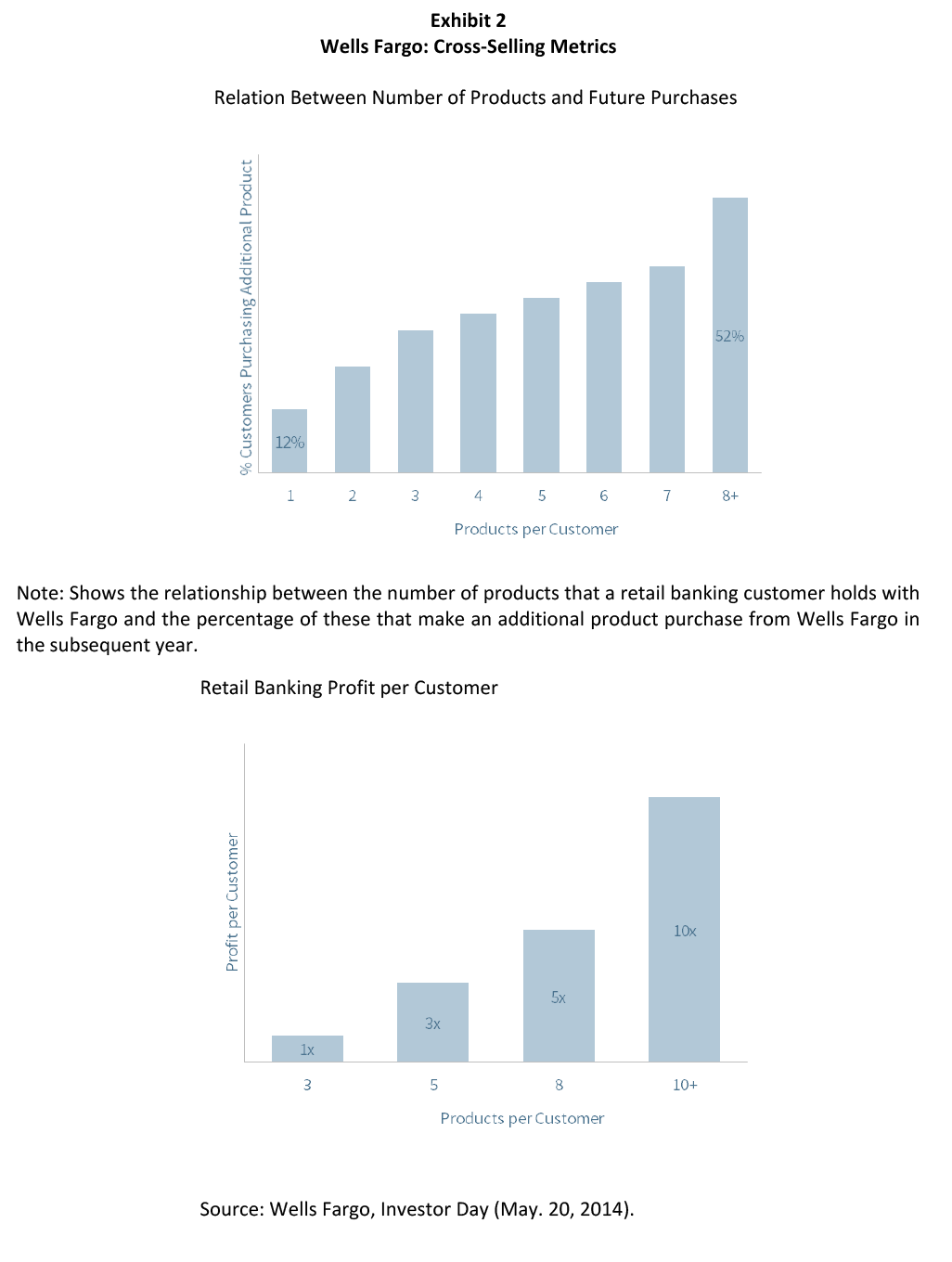

Apparently some accounting geniuses figured out that people with multiple accounts were more likely to do more business with the bank and generated more bank profit. See exhibit 2

]

]

So in a classic case of mistaking cause and effect they decided to incentivize that. (My opinion)

At the same time as they demanded results they pushed authority down the management chain

https://sites.duke.edu/thefinregblog/2017/04/26/phony-accounts-scandal-a-case-study-for-bank-board-directors/]

Warning signs appeared but ignored. Then there was there was a story by the LA Times in 2013

https://www.google.com/amp/s/www.latimes.com/business/la-fi-wells-fargo-sale-pressure-20131222-story.html%3f_amp=true]

Then in 2015 they were sued

(Snip)

But somehow the scope of the problem was never presented to the board.

(duke link)

Senior management wanted great sales figures. They set up a system where they demanded unobtainable results and didn’t care how that was achieved.

One might ask why that is so bad. 2008 wasn’t that long ago. Liar loans were a big part of that. Also triggered by unrealistic sales targets and free wheeling subordinates. The fact that in 2015 the board still didn’t demand and get an honest accounting says to me they didn’t want to know.

One might blow this off as a stupid scandal, but it wasn’t for the perpetrators. They all had millions in stock options and the fraudulent growth of retail banking drove up stock prices which made them filthier rich.

The perpetrators also got raises, promotions and more stock options on the back of those fraudulent accounts.

I posted a reply below. Even after clawbacks and fines the two people in the article made out fine.

Sorry for the ramble. Reading was interesting.

mr_lebowski

(33,643 posts)I was curious in fact and you did the leg work, so ... thanks!

Midnightwalk

(3,131 posts)What? you say. 25 million and 17 million are tiny?

https://www.mercurynews.com/2017/03/15/wells-fargo-ex-ceo-gained-29-million-from-stock-sales-amid-scandal

Oh there were clawbacks, for the years 2013-16. But the real story is how much they made. One still cleared 15M. The other took home 36M but forfeited stock options.

I am sure they didn’t start making over 10M a year in 2013. Doesn’t sound like that got touched.

They still got compensation more than double what the fines are.

https://fortune.com/2017/04/10/wells-fargo-carrie-tolstedt-clawback-net-worth-fortune-mpw]

stopdiggin

(15,178 posts)levied against individuals .. and not, as is more typical, institutions and so failing to impact either the organization or actual malefactors .. by a regulator that, as the posts points out, has hardly been noted for enforcement in the past. I think you have to go for "credit where credit is due" here .. and offer what encouragement we can for more robust regulations and enforcement going forward.

Midnightwalk

(3,131 posts)I agree the regulator deserves credit for going further than ever.

But that’s a sad commentary on how biased the system is for rich people.

They are keeping huge fortunes after committing huge frauds.

It’s like playing high stakes poker, but without the risk of losing. They got caught and fined but that just means they don’t win as much as they would have.

They should have done time. That’s more valuable than money and what ordinary criminals face. That’s the only deterrent that would work.

stopdiggin

(15,178 posts)I'm totally with you on larger penalties (including possible incarceration).

Isn't interesting how we don't have any trouble confiscating some low level mope's car or house ...?