General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsSo apparently the market thinks the coming depression is the greatest thing since sliced bread...

https://www.google.com/search?tbm=fin&sxsrf=ALeKk00KWugDkkTGzs1qYLMNm31K-b2rTQ:1588987304458&q=INDEXDJX:+.DJI&stick=H4sIAAAAAAAAAONgecRozC3w8sc9YSmtSWtOXmNU4eIKzsgvd80rySypFBLjYoOyeKS4uDj0c_UNkgsry3kWsfJ5-rm4Rrh4RVgp6Ll4eQIAqJT5uUkAAAA&sa=X&ved=2ahUKEwiv2NL-zqXpAhURVs0KHTrNDFQQlq4CMAB6BAgDEAE&biw=1200&bih=649&dpr=2#scso=_rAW2XqbHJdS1tAadzICwDg1:0I mean what the F? I am calling it now. Major hardship is ahead and the market doesn't have a clue.

unblock

(56,081 posts)So,... no, market doesn't think it's great.

jimlup

(8,009 posts)you didn't notice today's number. They think it is really peachy that so many Americans are unemployed. Dow was up more than 400 points. S&P up 48 points. Those are today's numbers May 8th 2020.

unblock

(56,081 posts)is the market's assessment of whether or not it likes the coming depression?

The amounts I said the market is down included today's activity, that's down quite a lot.

The market does not like this whole crisis. Just because it includes some up days doesn't mean it likes the crisis.

but the market seemed to celebrate the unemployment numbers. I didn't say why. It was only an observation. Why are you so sure that you want to denounce my point?

unblock

(56,081 posts)Which is just wrong and presents a very misleading view of Wall Street.

If you want to write a post noting the irony some daily stock movement, when Wall Street focuses on different news than Main Street focuses on, or when Main Street looks at a number and says "that's terrible" while Wall Street looks at that same number and says "well it's not as bad as I thought it was going to be", sure, go ahead.

But to suggest that Wall Street loves a depression, no, I have to object to that.

jimlup

(8,009 posts)I'm sorry but I have to block you given this conversation it is clear to me that further contact with you can serve no constructive purpose.

You jump down someone's throat far too quickly. It would be more reasonable if you explained yourself without implying that the other party to whom you are addressing your response is stupid or ignorant.

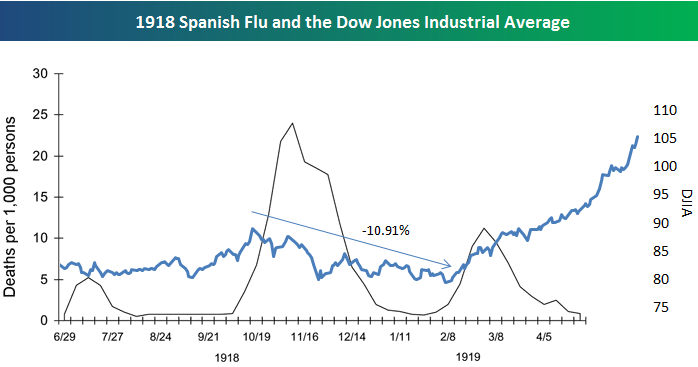

![]()

unblock

(56,081 posts)i'm really not understanding how my posts above have suggest anyone is stupid or ignorant or that i was jumping down anyone's throat, to the point where the only remedy is to block me.

but if you think there's no constructive purpose in further contact, you're probably right.

uponit7771

(93,504 posts)unblock

(56,081 posts)this contraction is like no other in a number of ways. first, it started like the economy hit a brick wall. recessions don't normally start all of a sudden, they start gradually as people wonder if it's a recession or just a slowdown, businesses have sales or cutbacks to try to stay profitable, etc.

not this time, nope, businesses went from doing ok or getting by or even doing great to just plain closed in about a week. very unusual. and the stock market is unusual because it's usually 6 months or so ahead of the game, predicting recession, then evaluating how much and how long while we're in it. and then, the government usually throws money at the problem way too late. not this time, governments around the world, even our own, threw a ton of money at it very early on. much of it foolishly, but nevertheless, throwing a ton of money early on changes things.

most relevant to your comment, this contraction is affecting different parts of the economy very differently. it's affecting small businesses more than big ones, local businesses more than national or global businesses, private businesses more than public ones. generally because people are willing and able to spend, but they have to do so consistent with "social distancing", which hits small, local, private businesses more than big, global, public ones.

nasdaq in particular, includes amazon.com, which does indeed love the present circumstances because it severely hurts its main competition, the local grocery store. other big public internet-oriented businesses are doing great because everyone who can is working from home. yes, there are a few companies that are doing great right now, and they tend to be concentrated in the nasdaq. that said, the nasdaq is still 7% down off its peak, though this is less of a drop than the other indexes.

it will take the second wave effect before some of these businesses are affected. when main street workers run out of money, it will start to affect their suppliers and others businesses upstream. that's why the right wing wants everything to reopen, they want consumers to be able to keep consuming like normal. if this goes on long enough, there will be lasting damage to the consumer, which will affect eventually affect nearly all businesses. but for now, there's a fair chunk of the business world that is largely immune, if the product and work environment is well suited to the social distancing restrictions.

uponit7771

(93,504 posts)unblock

(56,081 posts)which benefits mostly the companies that need it least. restaurants can't just reopen because of low interest rates.

KPN

(17,201 posts)of stock shares. This is the profit making before the profit taking and then the total collapse. The total collapse will be about the economy. But the profit takers have learned from history — like tRump learning from Nixon — and will be long gone and their profits hidden in secret trusts and overseas accounts by the time we all get hammered by the total collapse. It’s not about the economy, it’s about “winning”.

jimlup

(8,009 posts)and these fools think winning is making big $'s even though big $'s may be valueless soon enough.

Blue_true

(31,261 posts)The Funds and IBANKs make money in both directions, up or down. The people with the retirement money only see one thing, loss of money once the shit hits the fan.

struggle4progress

(125,682 posts)maxrandb

(17,285 posts)The 1% are just fucking salivating about how little they are going to be able to pay folks desperate for work, and how much they can screw over and steal from pensions.

Mark my word. It's going to happen, unless we elect people that will prevent it.

uponit7771

(93,504 posts)... what is putting a floor on the indexes.

Anyone telling you the opposite has no real facts to back up why the 1 yr out forward looking indexes are up so high.

OilemFirchen

(7,288 posts)

Maxheader

(4,419 posts)stimulus packages..propping up