General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsDavid Brin on the Economy from FB.

I am quoting his entire Facebook post because I think he makes crucial points. Especially how McConnell made sure this stimulus would be a transfer of money from the tax payers to the Rich with no oversight.

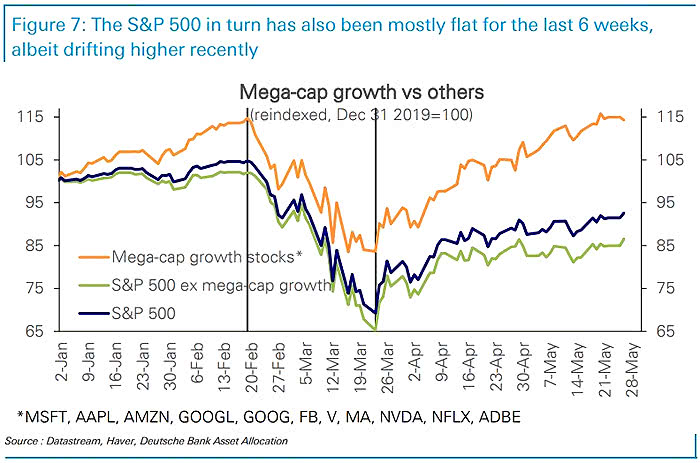

I know some investment guys. One is enraged at what the entire GOP has done to the economy. Another makes excuses or points at distractions. Interesting ones, like the fact that much of the S&P 500 returns lately come from just 10 companies: Microsoft, Apple, Amazon, Google, Facebook, Visa, Mastercard, Nvidia, Netflix, and Adobe. As a group they are up 35% since the beginning of the year. As a group, the other 490 are down more than 10%. (See chart below.) He suggests that a lot of people are using the stimulus money they got, beyond food and rent, by diving into stock markets and other forms of gambling.

Some further claims in his newsletter - and my answers - follow now:

“I think we actually have high inflation, but due to these side effects it is showing up in stock prices instead of consumer prices.”

This is not a side effect, John, it is what rentier castes do when they control politics and allocation of money. BOTH Adam Smith and Karl Marx agreed this is what rentier lords do.

Almost none of this money… “Supply Side” stimulus to the nth degree… is going to building “supply” infrastructure, factories, R&D, new products or services. It is going to the already wealthy, who then pour it into asset bubbles.

The explanation for low inflation is simple. MONEY VELOCITY is near zero. Because the cash infusions to the rich are not being spent, but are ‘invested’ in paper assets. Exactly as both Smith and Marx predicted.

When taxes on the oligarchy do legitimately go up, early next year we hope and pray, much of this money will ‘vanish” into shell companies rooted in shelter nations. And that is when we might see the “Helvetian War” I warned about, in EARTH.

My investment guru fried goes on: “But the specifics of what they bought are not so important.”

Of course they are. And here is the Elephant in the room that must be hammered again and again to any hypocritical "capitalist" you know:

In 2009's big Obama/Democrats Stimulus Bill, COLLATERAL was demanded for most loans and the taxpayer almost broke even on all of it. Inspectors and auditors hit the ground from day one.

Inspectors and collateral demands were SPECIFICALLY banned by Mitch McConnell, this time. Let me emphasize that. EVERY measure that would hold the aristocracy accountable, protect taxpayers and that worked in the 2009 bill was SPECIFICALLY excluded by demand of today's Republican Senate, and Pelosi & co. in the House had to give in, because the other half -- cash for the covid unemployed, was held hostage.

Those facts matter. They are pure and distilled difference between responsible adult citizens and outright, blatant thieves. Unless you can come up with some other explanation, this should be the shrieking, trumpeting elephant in the room.

tblue37

(68,344 posts)First Speaker

(4,858 posts)...it's given me hope when I felt hopeless, more than once...

ProfessorGAC

(76,145 posts)The GDP is $21.5 trillion.

There's $1.5 trillion of cash in circulation.

Add in the $4 trillion from the COVID relief & fed infusions, and we have $5.5 trillion. In reality, that $4 trillion shouldn't count as cash in circulation.

That's a velocity of money of nearly 4.

Bring says velocity is near zero. 4 is not near zero.

It's seldom been above 15.

He makes some terrific points, but consumer inflation is not low because velocity of money is near zero.

edhopper

(37,179 posts)because of how the Super Rich is spending their larger than acceptable share. The actually spending that is normally seen is near zero. Or something like that.

But it's beyond my Econ 101 knowledge.

ProfessorGAC

(76,145 posts)But, v is not close to zero.

Don't get me wrong. I like what he says.

I think he could have framed it better, leaving out the "near zero" part.

He appears to be diluting his own point by using this obviously flawed statistic.

edhopper

(37,179 posts)I guess he was being inexact to make a larger point. But should have been more accurate.