General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe individual mandate: I and others warned that this was coming, too.

The ACA isn't what's going to destroy the finances of the working poor. It's the Individual Mandate. And this, too.

People were warned this was coming.

http://online.wsj.com/article/SB10000872396390443437504577545770682810842.html

Around one in 10 employers in the U.S. plans to drop health coverage for workers in the next few years as the bulk of the federal health-care law begins, and more indicated they may do so over time, according to a study to be released Tuesday by consulting company Deloitte.

It is also safe to add that everyone responding to this will die of old age before Medicare for All is ever passed in America. That is, assuming it is ever passed in America.

DURHAM D

(33,019 posts)Zalatix

(8,994 posts)Ah, I don't expect a direct answer to that. ![]()

DURHAM D

(33,019 posts)I understand what you are doing.

Zalatix

(8,994 posts)And you don't know what I'm doing. I'm advocating for all the working poor folks who are going to be unable to meet their basic living expenses because they'll be FORCED to pay for health insurance on pain of a nasty tax penalty.

Those people are going to be hurt by the individual mandate, which was a Heritage Foundation idea to begin with.

southernyankeebelle

(11,304 posts)Zalatix

(8,994 posts)Voice for Peace

(13,141 posts)XemaSab

(60,212 posts)freedom fighter jh

(1,784 posts). . . or in regulations written to implement it, indicating who has to pay the whole thing and who gets help. A lot of DU people seem to know a lot about the ACA. Can anyone say something about this?

Voice for Peace

(13,141 posts)XemaSab

(60,212 posts)southernyankeebelle

(11,304 posts)bvar22

(39,909 posts)but here in the United States on Planet Earth,

there is indeed a Mandate to Buy Health Insurance.

It is THE LAW.

southernyankeebelle

(11,304 posts)should makeup what you can't.

bvar22

(39,909 posts)The Traditional Democratic Party Approach:

A Publicly Owned, Government Administered National Health Insurance Plan.

Everybody IN at birth.

Republican Plan:

Everybody forced to buy Health Insurance from For Profit Corporations

on a State by State basis with government panels deciding who can afford what in 50 different states.

No sale.

I have been on DU since early 2000,

and your post insisting there is no Mandate is one of the most absurd, completely wrong posts I have ever read on this board.

southernyankeebelle

(11,304 posts)So I'm suppose to think because you have been on DU since 2000 that your opinion is more than anyoneelses?

cthulu2016

(10,960 posts)I do not know the answer to that question.

Zalatix

(8,994 posts)after threatening to drop their employees if they didn't get the waivers.

(McDonald's is listed further down in this article)

http://www.lvrj.com/business/businesses-get-waivers-to-opt-out-of-health-care-mandate-122412389.html

It's hard to determine how many locals fall under the waived plans, though, because few local operations would discuss the exemptions.

Waivers are temporary and are granted a year at a time to businesses, labor groups and government agencies that say they can't offer employees affordable insurance based on the reform law's mandates.

http://usatoday30.usatoday.com/money/industries/health/2010-10-07-healthlaw07_ST_N.htm

Thirty companies and organizations, including McDonald's (MCD) and Jack in the Box (JACK), won't be required to raise the minimum annual benefit included in low-cost health plans, which are often used to cover part-time or low-wage employees.

The Department of Health and Human Services, which provided a list of exemptions, said it granted waivers in late September so workers with such plans wouldn't lose coverage from employers who might choose instead to drop health insurance altogether.

All these workers are getting SCREWED by the Individual Mandate. Badly.

1StrongBlackMan

(31,849 posts)to mention that Papa John's owner said ObamaCare would add 14 cents to the cost of its pizza.

OH wait ... 90+ % of the businesses of the companies that you mention are franchises which typically do not provide health insurance coverage for their, largely Part-time, staff.

And, even if they did ... they would be exempt under Obamacare because they employ far less than the 50 full-time employee number.

Zalatix

(8,994 posts)And Papa John's has no relevance here.

If McDonald's didn't have employees they wouldn't be asking for a waiver.

There are consultants out there ADVISING companies to drop their coverage.

http://online.wsj.com/article/SB10001424052702304811304577367833267990666.html

1StrongBlackMan

(31,849 posts)But the number of McDonald's Corporate employees is dwarfed by the number of employees that work under the franchises. And if it dropped every single one of its corporate employees ... that number would be dwarfed, to the point of irrelevance, by the number of people benefitted by Obamacare.

There are consultants out there ADVISING companies to drop their coverage.

And Deloitte is one of them ... and that was the point of my post regarding their study.

But my larger point is ... WE GET IT! YOU DON'T LIKE OBAMACARE ... BUT, AS IS OFTEN THE CASE, SOMETHING IS BETTER THAN NOTHING; INCLUDING WHAT WE HAD.

Zalatix

(8,994 posts)I said, I don't like the Individual Mandate. That is NOT the entire ACA. Know the difference.

Let me explain to you how this plays out.

You have lots of McDonald's franchise employees who will never see employer coverage. They are, as of 2014, being told to pay for health insurance, which will EASILY hit the ceiling of $80 a month if they are working full time minimum wage, which comes out to ~$20K in California.

Seeing this big extra $80 a month hit on their budget, they won't pay for insurance.

So they'll be assessed a $695 a month tax penalty come 2016.

But some dreamy folks on here insist the IRS can't enforce that.

The good part of the ACA says that no pre existing conditions can be denied. Guess what that means? That means people who have no insurance will try to GET insurance for a short while when they get sick. And they will be able to because pre-existing conditions aren't cause for denial.

I'm sure you know what that leads to.

1StrongBlackMan

(31,849 posts)stop pushing that lie!

![]()

Zalatix

(8,994 posts)The Individual Mandate was first proposed by the HERITAGE FOUNDATION...

President Obama built his CAMPAIGN upon opposing the Mandate.

Please, learn your history.

On the Road

(20,783 posts)Without an individual mandate, you can't really require coverage of preexisting conditions.

This is something Romney, for example, appears not to understand.

Zalatix

(8,994 posts)It is claimed that the IRS cannot enforce the tax penalty for non-compliance.

You know what that means.

dkf

(37,305 posts)jeff47

(26,549 posts)The individual mandate is one of the key features of the ACA. To dislike it means you dislike the ACA.

Why would ANYONE buy insurance without the mandate?

They'd also just wait until they got sick to buy it. Even if they've got Mitt Romney's wealth.

Zalatix

(8,994 posts)There are many more important and critical parts of the ACA - like the law against discriminating against people with pre-existing conditions. Among many others.

Why would they buy it WITH the mandate? Many people - like those earning 20K a year - don't have the money to buy insurance, but they're being told to buy it. What do you expect them to do, bounce checks? Eat cat food?

Nope, they'll do neither. Even with the mandate they won't buy insurance. They won't even pay the tax penalty if the fantasy story posted downthread about the IRS being unable to enforce it ever comes true.

You must not have read the law, did you? The new law allows exactly that. If you don't pay for health insurance you can go buy it after you get sick. Sorry but that is the new law. What's worse? You've got pro-Mandate people downthread saying that you don't even have to pay the tax penalty if you decline to pay for insurance. According to their fantasy world, the IRS can't enforce the penalty.

Sorry to break that to you...

LiberalAndProud

(12,799 posts)I haven't studied this, but my intuition tells me that breaking that symbiosis is a necessary step in the evolution of our health care policy. Employer-provided healthcare insurance isn't my concept of ideal. Am I wrong?

Honeycombe8

(37,648 posts)for part of the premium, decreasing the quality of the coverage, or both.

It's because of the increasing costs of providing health care to employees. It's a huge expense. Now, with birth control coverage, the expense will grow (I guesstimated that would cost my former employer's ins. carrier about $12,000 a year in claims...every year...without fail...a guaranteed claim amount, except the amount would cont. to go up). That will add to premiums, of course.

I warned about the birth control thing. It will be a huge cost. It was not part of the ACA.

Fawke Em

(11,366 posts)How?

Mojorabbit

(16,020 posts)"The Ways and Means report, prepared for chairman Dave Camp (R., Mich.), surveyed companies in the Fortune 100, receiving 71 timely responses. The survey asked Fortune 100 CEOs how many full-time and part-time employees they had, and how much they spend on health insurance for those workers, among other questions. Based on this data, the Ways and Means staff calculated that these 71 companies could save $28.6 billion in 2014, and $422.4 billion between 2014 and 2023, if they paid Obamacare’s fines and dumped all of their workers onto the subsidized exchanges.

In addition, the survey found that 84 percent of respondents believe that “future health costs will increase at rates that are greater than those they’ve experienced over the past five years.” They expect insurance costs to grow at 7.6 percent, on average, over the next five years, compared to 5.9 percent for the previous period."

http://www.forbes.com/sites/aroy/2012/05/01/fortune-100-survey-employers-could-save-422-billion-by-dropping-health-coverage/

That being said. Employers have been dumping insurance coverage for workers for years. I saw a chart a while back and it was an alarming decrease.

BenzoDia

(1,010 posts)In fact, the idea was that employers just give their end of the premiums to the employee, and the employees go and get their own insurance. If I'm not mistaken, Obama traded that away to Boehner during last year's debt ceiling negotiations.

Anyways, if the employee is having trouble affording their premiums, they'll get subsidies from the government. And ideally, they'll be purchasing insurance from the same insurance pools. This is possible in part due to the individual responsibility clause.

1StrongBlackMan

(31,849 posts)"employers just giving their end of the premiums to the employee, and the employees go and get their own insurance."

And it probably was traded away by Obama during last year's debt ceiling negotiations.

But that was like trading away "the player to be named later", because there is no mechanism that would allow/require employers give their cost savings of no longer having to pay for healthcare coverage to their employees.

HiPointDem

(20,729 posts)BenzoDia

(1,010 posts)a larger pool of people to the negotiation table.

Letting people opt out weakens those employer's hand.

HiPointDem

(20,729 posts)BenzoDia

(1,010 posts)HiPointDem

(20,729 posts)individuals opting out, it's employers.

BenzoDia

(1,010 posts)I don't have time to find more substantial info, but check this link and click on the third bar after 2014:

http://www.healthcare.gov/law/timeline/

Workers meeting certain requirements who cannot afford the coverage provided by their employer may take whatever funds their employer might have contributed to their insurance and use these resources to help purchase a more affordable plan in the new Affordable Insurance Exchanges. These new competitive marketplaces will allow individuals and small businesses to buy qualified health benefit plans.

This ties back into my original comment that one of the goals of the ACA is to get people away from employer-based coverage.

HiPointDem

(20,729 posts)1StrongBlackMan

(31,849 posts)Just stop!

Did you miss (or just ignore) the frequently reported fact that the Deloitte study was produced to support the strategies that it is charging its clients?

Did you miss (or just ignore) the frequently reported fact that the Deloitte study only surveyed its current clients ... and then when called on its sample bias, extended the study to Chamber of Commerce members?

Did you miss (or just ignore) the frequently reported fact that the Deloitte study was a marketing piece/strategy that was conducted much like "push polling"? ... And when called on that, Deloitte admitted it?

So please post this B.S. elsewhere ... might I suggest freerepublic, the blaze or the fox network?

Zalatix

(8,994 posts)$80 or more per month in MANDATORY expenses to pay for health insurance.

No, I will never stop. Not until I am DEAD.

Deloitte is irrelevant. McDonald's and other companies have been cited by numerous publications as bullying their way into WAIVERS out of the ACA. It is sheer logic to deduce that many companies that DIDN'T get the waivers, just dumped their health care benefits altogether.

Arguing that is like arguing over whether a wolf ponders eating a lamb.

ProSense

(116,464 posts)It's the fastest way to the government taking over health care altogether.

Zalatix

(8,994 posts)The only way that's happening in America is for America itself to collapse and be re-organized... with the Republican-dominated states being part of another country.

ProSense

(116,464 posts)Zalatix

(8,994 posts)You said: "It's the fastest way to the government taking over health care altogether."

I said, quite plainly and relevantly: "There will be no single payer in America. Period."

I said, quite plainly and relevantly: "There will be no single payer in America. Period."

...where does it say that government-run is single payer? The exchanges qualify, as does a public option.

Zalatix

(8,994 posts)I'm quite sure the Kaiser Foundation figures count in exchanges.

It may be less if you are in a state that opts to expand Medicaid. Which means it sucks to live in Texas.

ProSense

(116,464 posts)Since that's fucking unrealistic. What's your point?

Just throwing shit out there?

Zalatix

(8,994 posts)What part of "there will never be Medicare for All in America" did you not understand?

You will not live to see it. I will not live to see it. None of our children will live to see it. America will not live to see it.

Have I made my point clear enough? It's not happening. It's not happening. Medicare for All is NEVER happening in THIS United States of America.

ProSense

(116,464 posts)This is pure shit stirring base on fact-free nonsense.

Zalatix

(8,994 posts)ProSense

(116,464 posts)Zalatix

(8,994 posts)RegieRocker

(4,226 posts)many things come and go. You make a statement that is ludicrous. This country was formed and went through many changes before you even existed. It will go through many more after you're gone. So..... Your statement that it will never happen is mental folly.

Zalatix

(8,994 posts)I'm not saying I won't be pushing for it, but I am realistic: the last time we tried to put up even the pale Public Option, we had hundreds of thousands of men out in a zombie horde ragefest, some packing assault rifles.

RegieRocker

(4,226 posts)eridani

(51,907 posts)There is no reason why VT, CA, OR, WA etc should wait for MS and WV to act.

Zalatix

(8,994 posts)BenzoDia

(1,010 posts)Zalatix

(8,994 posts)Plug it in right here, the numbers don't lie.

http://healthreform.kff.org/SubsidyCalculator.aspx

ProSense

(116,464 posts)Zalatix

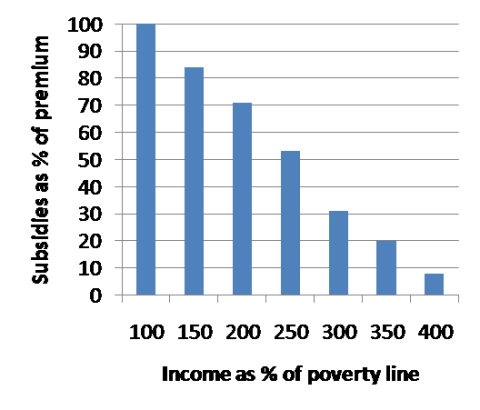

(8,994 posts)[img] [/img]

[/img]

$1,019 divided by 12 months equals ~$84 a month.

So, yes, it does say that.

ProSense

(116,464 posts)"you will be ordered to pay over $80 a month for insurance"?

You can opt out. Pay the less $95 annual penalty. What does a person earning $20,000 with an employer's plan pay now?

You better believe some can't afford it, and those who choose to are like paying a lot more than $80.

Zalatix

(8,994 posts)A mandate to pay upon pain of a monetary penalty is the definition of compulsion. It may not mean that you'll be killed by a drone strike if you don't pay, but it is still force. And those tax penalties per person are UGLY, especially after 2016. Unlike their wages, those penalties grow with the cost of living, too!

It is still a Mandate that Obama was RAILROADED into. The Mandate is still the brainchild of the Heritage Foundation and originally a law that Mitt Romney passed. It is a Republican idea through and through.

Somehow I suspect you believe criticizing the Mandate is the same as criticizing the entire ACA? It is not.

ProSense

(116,464 posts)You will not!

Zalatix

(8,994 posts)Response to Zalatix (Reply #70)

AnotherMcIntosh This message was self-deleted by its author.

Zalatix

(8,994 posts)I know, it's absurd bordering on silly hour, but someone claims this to be true downthread.

dflprincess

(29,283 posts)1% of $20,000 is $200. In 2015 the penalty goes to 2% (or $400 on a $20,000) and 2.5% in 2016 ($500).

The maximum penalty starts at $285 but by 2016 it's $2,085.

Zalatix

(8,994 posts)ProSense

(116,464 posts)the 1 percent is for a family income. The individual charge is $95.

A family earning $20,000 would not pay a penalty.

Zalatix

(8,994 posts)A family of 2 is majorly screwed.

ProSense

(116,464 posts)If a two people each earn up to $15,000, they still qualify for Medicaid.

Zalatix

(8,994 posts)My girlfriend (now wife) and I were JUST THAT scenario in the late 1990s before fortune smiled upon us.

ProSense

(116,464 posts)I made $20,000 in the 1990s.

That's like seeing Russia from your house.

Zalatix

(8,994 posts)What it really is, is something I can't say for fear of a jury action.

BenzoDia

(1,010 posts)Zalatix

(8,994 posts)BenzoDia

(1,010 posts)So no, you don't have to pony up if money is tight.

ProSense

(116,464 posts)That's from the statement at at the link provided.

You have no idea what you're talking about. You're taking estimates and calculators that don't factor in variables to make ridiculous statements.

On top of that, you're stuck on a $20,000 and pretending that anyone earning that amount now is able to afford health care.

Zalatix

(8,994 posts)You're the one who doesn't know what you're talking about. There'll be NO WAIVERS for anyone earning $20K a year. Period. Will not happen. Mark my words on that. It's a red herring.

And you totally did not read me at all if you think I'm saying people earning that little money are able to afford health care now. They can't. They can't afford the Individual Mandate premium limits, they can't afford health insurance under today's rules, and they can't afford the ER. They can't afford any of those extra expenses.

ProSense

(116,464 posts)treestar

(82,383 posts)What if you get sick? And there are subsidies so it's not supposed to work out to more than you can pay.

Zalatix

(8,994 posts)If you don't pay, you get a tax penalty.

If you get sick it doesn't matter either way, a person earning only $20k a month can't afford health care premiums or a medical bill. Neither is affordable. Both will put you under... unless you live in a place with no lights and eating cat food.

ProSense

(116,464 posts)You're spreading all types of misinformation in the name of single payer, as if anyone with an income wouldn't have to pay for coverage even under single payer. Medicare for all? Do you really think that it's going to be less than subsidized coverage?

Zalatix

(8,994 posts)I never said single payer would be totally free.

It would, however, cost FAR LESS than private or even statewide health insurance.

First of all, Single Payer, aka Medicare for All, would be nationwide. That's an insurance pool of roughly 300 million. That means the premium will be smaller because the costs would be smaller. The insurance rule of large numbers applies.

Second of all, Medicare for All runs with lower overhead. Less than 5%, versus 20% for private companies. Fewer CEOs to pay and all that.

Third of all, Medicare for All will never happen. No universal single payer is going to happen unless America is split in two, with the baggers going their separate ways.

ProSense

(116,464 posts)"It would, however, cost FAR LESS than private or even statewide health insurance."

How much would a person earning $20,000 have to pay?

You have no idea!

Zalatix

(8,994 posts)Show me where I ever said that "anyone with an income wouldn't have to pay for coverage even under single payer."

Put the quoted text where I said ANYTHING like that right here:

.

Then you said: "Do you really think that it's going to be less than subsidized coverage?"

You did not ask exactly how much a person would pay for Medicare for All. You asked me if I think it's going to be less.

I gave you a solid explanation for why it would be less. You either accept that the insurance law of large numbers is valid or not. You either accept that Medicare has a lower overhead than private insurance or not. But I did in fact give you solid points on why M4A would cost less than what we have now.

ProSense

(116,464 posts)For having a discussion with you?

You sound like Mitt.

Your argument is flawed. Face it.

Zalatix

(8,994 posts)You want to be brazenly dishonest about what I said then that's on you, but don't go whining about how you're being "Mitt Romney'd".

You lied about me, and I am challenging you on that lie. Persistently, because I do not appreciate someone making up falsehoods about my comments.

Show me where I ever said that "anyone with an income wouldn't have to pay for coverage even under single payer." You cannot, and you know it.

ProSense

(116,464 posts)credibility took a hit in this thread.

Yes, it did.

Zalatix

(8,994 posts)You want to be brazenly dishonest about what I said then that's on you, but don't go whining about how you're being "Mitt Romney'd".

You lied about me, and I am challenging you on that lie. Persistently, because I do not appreciate someone making up falsehoods about my comments.

Show me where I ever said that "anyone with an income wouldn't have to pay for coverage even under single payer." You cannot, and you know it.

I'm going to keep repeating this no matter how many people dislike me because of it. Because I am right and you are flat out wrong.

My credibility is undamaged.

treestar

(82,383 posts)And my insurance is more than that. $400 a quarter. And I pay it now without government subsidy. It has a high deductible and pays for nothing so far, well, thank God I've never been sick enough yet for it to pay, but I have the peace of mine that if something horrid happens, it is there.

eridani

(51,907 posts)It is actual sick people in your situation who account for most of the ongoing medical bankruptcies in MA--80% of whom have insurance.

http://www.bostonglobe.com/metro/massachusetts/2012/09/09/medical-debt-massachusetts-persists-despite-health-law/QztpbflGjmUfVcf8J8tjbI/story.html

Architects of the pioneering 2006 Massachusetts health law, which required most residents to have insurance, expected it would reduce families’ medical debt. But the most recent data suggest the scope of medical debt has remained largely unchanged.

Temporary lapses in insurance coverage and increasingly common plans with high deductibles and copayments have contributed to medical debt, leaving some people struggling to pay bills for hospitals, doctors, and ambulance companies. Rising health costs and the recession also probably played a role.

treestar

(82,383 posts)I'm all for single payer or Medicare for all if we can get it. So far the right wingers have enough power they can stop it.

eridani

(51,907 posts)darkangel218

(13,985 posts)And my hmo montly premium is $160!!!! And that's with no pre existing condition. I can only imagine what premiums those who have chronic ailments pay, if they have any coverage at all!

Stop bringing silly arguments against the best thing that ever happpend to our country! It's sickening!

TheKentuckian

(26,314 posts)It will vary according to actual individual expenses and cost of living in a given area.

I've made under 20k and could afford it and have made over when it would be tight.

I also wonder why one person making 20k is thought to be able to afford it, while another under the exact same circumstances but who has parents that will carry them cannot. Why would that eligibility not also be income based?

Response to Zalatix (Reply #7)

JaneyVee This message was self-deleted by its author.

Honeycombe8

(37,648 posts)Don't you get it? It's a scare tactic.

Employers have NEVER based business decisions, like the cost of health care, on whether their employees can easily get it elsewhere and be taken care of. Employers don't care about that. It's strictly a MONEY decision.

They've been dropping ins. and changing it for several years now. Has your head been in the sand?

If this comes to pass - and I suspect it will, because it has in the past already - it will have nothing to do with the mandate. That does not affect an employer's decision about health care one bit.

Honeycombe8

(37,648 posts)I'm guessing the person earning $20,000 in a medium-COLA area will be happy to be able to have coverage for that amount. It's much better than not having any health care at all, which is currently the case.

How much do you think one hospital stay for a diabetes-related complication will cost him? More than $80, I bet. If he gets an annual exam (those are FREE under the ACA), he will be able to get treatment for his condition and avoid a complication.

This is a very, very good thing.

You wouldn't be so upset if you spent the time to research and learn about this more, and apply it to specific situations, so you can see the good effects. And ask a few people if they want coverage for $80 a month.

They will have several options: they can get a job where an employer provides coverage; they can scrape together the $ to pay the premium of $80/month (they'll get FREE annual exams, free mammagrams, etc.); they can pay the penalty. But as adults, we ALL must pay at least something for our own health care. It's like food, gas for your car, rent.

They are so lucky to have a subsidy to pay part of their health care. Most people won't get that. Like me.

Zalatix

(8,994 posts)I'm not sure if you're up on current events as of late, but a job is rare to begin with. A job where you get benefits? Really? Surely you jest. If you had done even a minute's worth of research on this economy you'd know that.

It doesn't matter if today's health insurance is more expensive than it will be in 2014. It doesn't matter what it costs to go to the hospital for a diabetes-related complication. The working poor are in over their heads with paying for insurance, financially speaking they're dead long before there's a hospital stay involved.

The working poor will have to bounce checks to pay for this.

What will happen is that they'll be unable to pay for insurance and they'll be unable to pay the added tax penalty. And according to some here, the IRS can't even enforce the tax penalty. So guess what? Nothing changes for millions of people. They will still just go to the ER.

ProSense

(116,464 posts)And yes, Republicans are freaking out over the mandate. In fact, this whole argument reeks of centrist fear mongering, an attempt to claim the ACA is a bad thing that's going to ruin the status quo.

Zalatix

(8,994 posts)Learn your history!!!

http://www.huffingtonpost.com/chris-weigant/the-individual-mandates-c_b_1386716.html

Stuart M. Butler, who at the time was Heritage's Director of Domestic Policy Strategies, wrote the second chapter of a position paper with the title "A National Health System for America." (Heritage has a PDF version of this document you can download from their website.) The document was over 100 pages long, and envisioned a "consumer-oriented, market-based, comprehensive American health system" that would become "the model for the entire industrialized world." It was a strictly conservative plan, as evidenced by the inclusion of the idea of replacing Medicare with a voucher system (the same thing Paul Ryan is now championing, in other words).

Opposition to the mandate was a part of (then) Presidential candidate Obama's campaign!

http://abcnews.go.com/blogs/politics/2012/03/candidate-obama-opposed-health-care-mandate/

Oh but I'm sure you're going to deny this and call all these sources Republican, too.

Honeycombe8

(37,648 posts)even for those who don't pay any taxes at all. They get back $ from the IRS, as an entitlement benefit, even though they paid nothing in. Reagan and the Republicans did that.

Look, my sister is on Medicaid in a nursing home, having had a major stroke at a young age, coming on the heels of complications from undiagnosed diabetes, after not having access to health care previously. I was very poor, when I was younger. I get the money thing. But getting SUBSIDIZED HEALTH CARE is a wonderful thing. I'm perplexed why you would want to take that away from people, who right now have NO MEDICAL CARE AT ALL.

I mentioned get another job where the employer provides insurance, because that IS an option. It's not an option many will be able to do, but it is nonetheless an option for some.

But letting these people go without any health care at all because YOU don't like it is not an option.

enlightenment

(8,830 posts)learn the difference between the words 'insurance' and 'care'.

Honeycombe8

(37,648 posts)Letting people who have no health care at all right now go without subsidized health care because YOU don't like it, is not an option. We have to deal with reality.

I have people in my family who could've used subsidized health care. There was a time when I would have welcomed it. Thank goodness I was young and was able to go without health care without running into too much trouble. It's too late for me and my relatives, now. But there are millions who will welcome this benefit. It IS a benefit. It's a very good thing.

And there's nothing wrong with having people who can afford it contribute towards their health care. If you earn $20k a year in a medium-COLA area, with no children, it'll be rough, but you can manage $80/month. I know this because I lived it (of course I got paid a lot less than $20k, since it was many years ago). It's a cost of living, like food, car gas, rent. And like food, it is susidized, if you can't afford it.

We need everyone in the medical care wagon. Why? Because they are already in it. EVERYONE is in the medical care wagon, whether they want to be or not. If anyone has ever been to a doctor or will ever go to a doctor or care provider, that person is in the medical care wagon. They need care (or in our system, that means coverage).

Having this coverage will prevent them from losing everything because of one hospital stay or one long illness, which happens.

Nye Bevan

(25,406 posts)slamming Obama's signature achievement?

I'm not alerting, but I'm not sure that this is appropriate at this time.

CitizenPatriot

(3,783 posts)undisclosed writing articles for it, I would have to agree that it's not the best source.

I'd also say that 80 dollars a month (re Kaiser) for health insurance is a lot less than what I pay now, via an employee package, and a hell of a lot less than I would pay for one doctor's visit without health insurance.

Zalatix

(8,994 posts)I'm not sure how slamming a Heritage Foundation idea is attacking Obama.

Obama was railroaded into the Mandate.

BenzoDia

(1,010 posts)Zalatix

(8,994 posts)jeff47

(26,549 posts)Since the rest of the bill means there's no reason to buy insurance until you are sick.

And, btw, single-payer is also a mandate.

JoePhilly

(27,787 posts)The WSJ goal is to get Dems to stay home.

And some knowingly, or unknowingly, push the WSJ nonsense into the Dem internet sites.

The GOP needs to get their base angry enough to vote, and get our Dem voters discouraged enough to stay home.

Been going on for months now.

freshwest

(53,661 posts)All the easier for them to take over faster. The revolution is in process, and belongs to the rich.

Apply liberally where needed: ![]()

bhikkhu

(10,789 posts)the worst case is for a middle-aged single man living alone, who would be liable for $85 a month. I think if I made $20k a year and lived alone I'd be ok with that. If there are any dependents, the amount drops to zero at that income level.

I checked for my co-workers back when the supreme court first upheld the law, as there was plenty of hoopla. Nobody with dependents actually wound up with a payment, while one person whose family had two incomes - so making $35k combined and no kids at home - wound up with a $200 a month payment. Which also seems reasonable...

Zalatix

(8,994 posts)What do you think they are, Mitt Romney?

And $200 a month for 35K? That's highway robbery.

I guess you could do that if you lived on CAT FOOD...

cthulu2016

(10,960 posts)If all the money is considered to be in addition to current expenditures, does that mean that nobody in that group would be saving any money whatsoever due to being covered?

Zalatix

(8,994 posts)Now we're asking them to add $80+ when they already have basic living expenses that they can't pay.

It's going to come as a huge shock to everyone when people simply don't pay and just keep going to the ER.

A huge shock. But I warned you about companies dropping coverage and no one listened... I'm warning about this one, too, and I expect a bunch of naysaying.

Shit just keeps going wrong and either no one believes it will, or they don't care.

ProSense

(116,464 posts)Now we're asking them to add $80+ when they already have basic living expenses that they can't pay.

No one is asking anyone to spend anything they don't want to. If they don't have health care now and don't want it in the future, they don't have to take it. They do not have to pay $80 per month.

Zalatix

(8,994 posts)Yes, the government is telling people to spend money that many do not want to. They will be assessed an increasingly UGLY tax penalty for non-compliance. $695 after 2016, that's pretty nasty to throw at a working poor person.

And that joke about the IRS not enforcing the $695 penalty...? LOL I can see it now... "Dear IRS, my taxes were normally $0 for $20k but you're telling me to pay a $695 penalty... I ain't paying." Yeah, you think that's going to fly??? ![]()

![]()

![]()

ProSense

(116,464 posts)"Yes, the government is telling people to spend money that many do not want to. They will be assessed an increasingly UGLY tax penalty for non-compliance. $695 after 2016, that's pretty nasty to throw at a working poor person. "

You know that ridiculous claim you made: "you will be ordered to pay over $80 a month for insurance"?

http://www.democraticunderground.com/?com=view_post&forum=1002&pid=1438975

Even after 2016, a person will only be liable for $58 per montn ($695/12). In 2014, it $8 per month. And even then, it's not taken out of their paycheck, but assessed at tax time.

You don't know what you're talking about. So stop laughing and learn something.

Zalatix

(8,994 posts)Zero error. Your argument is downright laughable.

Pay up. $80 a month. Or get slapped with a tax penalty. Period.

It is you who don't know what you're talking about. It is you who are in denial.

ProSense

(116,464 posts)You're out of your league spreading nonsense.

Zalatix

(8,994 posts)By 2016 the penalty will rise to $695, which is far above $8 a month. Get a calculator and divide 695 by 12. ![]()

"By 2016 the penalty will rise to $695, which is far above $8 a month. Get a calculator and divide 695 by 12."

Read this again and see what you're missing:

You know that ridiculous claim you made: "you will be ordered to pay over $80 a month for insurance"?

http://www.democraticunderground.com/?com=view_post&forum=1002&pid=1438975

Even after 2016, a person will only be liable for $58 per montn ($695/12). In 2014, it $8 per month. And even then, it's not taken out of their paycheck, but assessed at tax time.

You don't know what you're talking about. So stop laughing and learn something.

Zalatix

(8,994 posts)You will in fact be ordered to pay $80 a month or more for insurance.

That is a fact.

If you do not pay, you will be assessed a tax PENALTY of $695 a month as of 2016, for non-compliance.

That is also indisputable.

Your ridiculous denials prove that you clearly do not understand what you read.

ProSense

(116,464 posts)That is a fact.

If you do not pay, you will be assessed a tax PENALTY of $695 a month as of 2016, for non-compliance.

That is also indisputable.

...penalty in 2014?

Do you think these nonsensical definitive statements amounting to obfuscation and a circular argument bolsters your flawed point?

No. They. Don't.

Zalatix

(8,994 posts)You think the world ends in 2014. Which is better than the ones who believe it ends in 2012, of course.

The tax penalty will only be $8 a month in 2014, so you just want to deny that it'll RISE to just under $58 a month or $695 a year in 2016.

You just can't see as far as 2016, can you? 2016 is irrelevant in your world, isn't it?

Of course it is.

Allow me to repeat, since I am absolutely correct in what I say: If you do not pay, you will be assessed a tax PENALTY of $695 a month as of 2016, for non-compliance.

I would cite the passage in the law where it says this but you would just come up with some new type of denial.

ProSense

(116,464 posts)You think the world ends in 2014. Which is better than the ones who believe it ends in 2012, of course.

The tax penalty will only be $8 a month in 2014, so you just want to deny that it'll RISE to just under $58 a month or $695 a year in 2016.

Nope, but your argument just fell apart.

Zalatix

(8,994 posts)ProSense

(116,464 posts)Zalatix

(8,994 posts)eridani

(51,907 posts)--they would otherwise use for out of pocket medical expenses is gone.

bhikkhu

(10,789 posts)not that its all smooth sailing or easy, but its not a big deal where I live, and we don't get food assistance or anything. If I were single, it would be a breeze, and in any case health insurance is well worth it. If you look at it like a tax that allows everyone to have health care, its a huge thing.

I think people get used to spending whatever money they do have. I wouldn't criticize anyone for spending their extra money on cable tv, or car payments, or dining out, or booze or cigarettes or golf or whatever, but I think it would be reasonable to look at whether a person could afford healthcare before those expenses, and go from there.

Zalatix

(8,994 posts)You cannot add rent, keeping the lights on, and basic nutrition, and come up with less than 28K.

28K and a family of 4 means no lights on in America.

It's about time we buried that fairy tale.

ProSense

(116,464 posts)Zalatix

(8,994 posts)with BIG additional living expenses, not me.

That word 'callous', it doesn't mean what you think it does.

ProSense

(116,464 posts)Clearly it's very active.

The ACA makes health care more affordable for low income workers.

http://krugman.blogs.nytimes.com/2009/12/26/numerical-notes-on-health-care-reform/

Zalatix

(8,994 posts)Many of the people earning $20k a month now don't have insurance at all. They can't afford it.

They won't be able to afford an EXTRA $80 a month as of 2014. They won't be able to afford a $695 a year tax penalty as of 2016.

Your chart is utterly tangential to that.

ProSense

(116,464 posts)you know it, but to admit it after boxing yourself in, appears not a good thing.

I suspect that's why you've taken to insisting on the $80 in 2014 and the penalty in 2016.

"They won't be able to afford an EXTRA $80 a month as of 2014. They won't be able to afford a $695 a year tax penalty as of 2016. "

Can't admit that the penalty in 2014 is only $8 per month, but assessed as a one-time annual fee at tax time.

Zalatix

(8,994 posts)The Individual Mandate puts $80 a month of expenses on the backs of the working poor in 2014 when the tax penalty for noncompliance is $8 a month.

The Individual Mandate ALSO puts $80 a month of expenses on the backs of the working poor in 2016 when the tax penalty for noncompliance is $58 a month.

Please show where I am wrong.

You cannot.

You fail.

ProSense

(116,464 posts)Zalatix

(8,994 posts)ProSense

(116,464 posts)they should continue not having insurance because they can't afford it rather than be given a choice to pay $80 for coverage?

Zalatix

(8,994 posts)unless, of course, they choose to bounce checks to meet their newly-assigned obligations. Or resort to digging in the trash while cutting out their electricity, food budget and of course walking 20 miles to their minimum wage McDonald's job which, at a full time schedule, would put them past the poverty level, and in some places could get them close to 20K a year.

Oh, I'm sorry, you don't like the word obligation. Because on your planet the word "tax penalty for non-compliance" means, well, a ball of cotton candy floating in the sky. ![]()

ProSense

(116,464 posts)"More like, they have no choice but not to have it. unless, of course, they choose to bounce checks to meet their newly-assigned obligations. "

...have a choice. They can still remain uninsured, which is what you seem to be advocating: their right to remain uninsured.

Zalatix

(8,994 posts)Pigs cannot fly, and the working poor cannot afford these new obligations.

BTW upthread, you accused me of saying that single payer would be totally free.

I am still demanding you show where I said that.

ProSense

(116,464 posts)"BTW upthread, you accused me of saying that single payer would be totally free."

be more than $80 a month?

BTW, here's what I said:

http://www.democraticunderground.com/?com=view_post&forum=1002&pid=1439070

You can stop pretending that you were wronged.

And purchasing health care is a choice, now and when ACA is implemented. Your self-righteous denials don't change that.

Zalatix

(8,994 posts)I never, ever said that. And my argument was not in favor of single payer, because single payer would never happen.

You will not ever show where I said that.

You made up lies about what I said.

Purchasing health care is not a choice when all you can do is bounce checks to pay for it. Your Right Wing "make the poor pay!" arguments don't change that.

ProSense

(116,464 posts)"I never, ever said that. And my argument was not in favor of single payer, because single payer would never happen. "

Right, you have no point.

Zalatix

(8,994 posts)I have a point - the problem is you don't understand what you're reading.

You still think 2016 will never come.

ProSense

(116,464 posts)Zalatix

(8,994 posts)ProSense

(116,464 posts)let's say "we split up the country"?

Zalatix

(8,994 posts)But I've already explained to you why. Look up the insurance law of large numbers, and then get back to me.

Also look up Medicare overhead versus private insurance overhead.

The clues are out there... and I've even given them to you!

ProSense

(116,464 posts)That's more than $80.

"The clues are out there..."

You haven't found them.

Zalatix

(8,994 posts)freshwest

(53,661 posts)Last edited Sun Sep 30, 2012, 01:59 AM - Edit history (1)

Out of an income less than $20K/year. Am I missing something? Is it time to panic or not?

Isn't a single payer program literally an individual mandate? If everyone is paying, singly, paying, isn't that a mandate on individuals?

I would like to see a program such as Europe has, where it seems to be 'free' to go to the doctor. But it isn't free. They pay income taxes and they don't scream for blood to water the tree of liberty because of it. They accept it as part of the social contract.

Some pay a lot, others don't, but they pay taxes, and the government finances healthcare from income taxes, not premiums. But there is no free healthcare. Insurance is not healthcare. it's a way of financing it, which Europe does with income taxes.

Are those complaining about the price of premiums for insurance ready to pay higher taxes? Our for-profit system sucks, and always has.

Conyers introduced HR 676, which is 'Medicare for all,' and he even terms it as 'single payer.'

http://www.democraticunderground.com/10021439126#post5

We don't have enough Democratic power to get it done right now, but might if we don't give in to the Randians and let them make everyone go after each other. But nothing's free. Never.

ProSense

(116,464 posts)You're right. People forget that no one cares if single payer cost a little more out of pocket, it's the accessibility, efficiency, portability and quality of the care that's important.

bhikkhu

(10,789 posts)and could get a tax credit for most of that?

I know my employer would sign up and get us all health insurance in a second; one of his worries is the same as mine - if one of us gets injured, we're both screwed without insurance.

Currently, the cost for a single individual to get employee-provided insurance where we live is about $300 a month, which neither employer nor employee is able to afford.

freshwest

(53,661 posts)But your scenario may be the reason why in my blue state, employers wanted the ACA enforced here, to save them money. It would be wonderful to have the insurance most employees have for $80 a month.

But single payer from income taxes paid as a nation, is why it is said many start-up companies like to locate in Europe. That, and their income tax-funded educational system where anyone who can make the grade can go to college, get ahead and eventually pay more taxes. Also their highly unionized work force makes for productivity and loyalty to their jobs, in theory. We used to be that way here. The USA seems to be operated now on the use 'em and lose 'em theory.

I know of employers like yours, who do want to keep their people able to work and even have wellness programs. The OP seems to be about people at McDonald's, who must be offering some perks to work there, or they wouldn't keep their work force for long. On my occasional forays through the Golden Arches for coffee, the same faces seem to be there year in and year out. But we also have a minimum wage of $9+ an hour.

I don't think I can adequately answer your query, but I think ProSense can. Did you see her chart in this thread? There are older threads by the OP writer about this subject that have a lot of rebuttals and charts. There are so many variables in these insurance plans and the way that people's lives are constructed, I can't begin to give the best answers on this. There is a website that may help:

http://www.healthcare.gov/law/index.html

Good luck to everyone on this.

bhikkhu

(10,789 posts)we do pretty well so far, and it has been easier the past couple of years than 2008/09.

On edit - a rough monthly budget is: 1300 for mortgage and debt service, 600 for food, 200 for power, gas, water and garbage, 60 for cellphones and internet.

We're in the process of getting the whole debt redone under a new loan which will make things easier, but so far so good. There's very little room for extras, but we've been pretty good about finding things 2nd hand, and I can fix just about anything myself. One trick to living within your means is to really not want things very much. The kids have more trouble with that than me, but we do pretty well.

The one big thing is health insurance, which we don't have. Any bad luck on that front and we'd be pretty thoroughly screwed in a hurry, so I'm looking forward to finally getting health insurance as a "waiting to exhale" type of relief. We'll finally be secure in our home, and know that some little health problem won't cost us everything.

Zalatix

(8,994 posts)$1300 for a mortgage is $15600 a year.

$600 for food is $7200 a year... that's a grand total of over $20K right there.

$200 for utilities is 2400 a year.

If you're making $20K a year and you've got 1 other person in the house you can cut the food budget down to $300 a month, so that's $3600 a year. That's $19,200 a year.

2 people still means $80 per month. PER ADULT. Oh, snap.

Like I said, the lights gotta go off.

bhikkhu

(10,789 posts)The "worst case scenario" for a person earning 20K a year is $85 per year, according to my state's estimates (here again: http://www.orhix.org/calculator/index.php ).

By the same calculator, a person making $20k who supports a household of 2 pays nothing for health insurance. Two people doesn't mean $80 per month, two people means fully subsidized at that income level.

TreasonousBastard

(43,049 posts)at a time when the Republican plan is to eliminate it entirely.

We barely got Obamacare and just one vote on the Supreme Court kept it as law of the land, and to be trashing it at this point in the election cycle is something only Republicans or morons would do.

lumberjack_jeff

(33,224 posts)With ACA, he or she gets a 70% discount.

Further, if he or she *does* get sick, they get the opportunity to buy coverage at that time, without risk of being rejected for having a prexisting condition.

FURTHER, the "mandate" isn't. If you don't get coverage, and don't pay the penalty... nothing happens.

This hyperventilation is foolish.

Zalatix

(8,994 posts)Some workers would just not pay for insurance, because whether they're paying $3,400 a year or $1,000 a year, they just can't afford it regardless. Unless they plan on bouncing checks.

And... "don't pay the penalty... nothing happens"? Really? Do you know what you actually implied when you wrote this? You're implying that people could get away with saying "I'm paying my taxes but NOT this tax penalty." That's just... hilariously wrong.

lumberjack_jeff

(33,224 posts)ProSense

(116,464 posts)The poster was absolutely correct.

And... "don't pay the penalty... nothing happens"? Really? Do you know what you actually implied when you wrote this? You're implying that people could get away with saying "I'm paying my taxes but NOT this tax penalty." That's just... hilariously wrong.

And they can still do that. If the $95 a year is too much, nothing happens. The penalty is assessed at tax time, and most low-income Americans get exemptions.

Zalatix

(8,994 posts)"don't pay the penalty... nothing happens" is total nonsense. If you don't pay the tax penalty you will eventually get a visit from the IRS. You yourself admit, the penalty is assessed at tax time. You admit there is a penalty! Do you not even read what you write???

And you're not getting exemptions from the Mandate at $20k a year.

BenzoDia

(1,010 posts)Zalatix

(8,994 posts)The working poor will avoid paying the tax penalty AND avoid paying for insurance, and AFTER they get sick IF they decide to buy insurance, they'll do it for a few months just to get coverage to get to the hospital.

That will be utterly disastrous.

It will be even worse than what I outlined in my OP.

But in all likelihood you're flat out wrong.

BenzoDia

(1,010 posts)The US isn't unique in having an individual mandate. Other countries have it as well. A few people game the system, but most will not.

And you saying "in all likelihood" means you don't actually know. Therefore, you were unaware of this aspect of the law before you began your fear mongering here.

Zalatix

(8,994 posts)Other countries are not America. The system, as YOU describe it, will get gamed in America, to highly disastrous outcomes.

Remember I warned you.

hughee99

(16,113 posts)If they can't afford that, they then have to pay the tax for not having insurance, and then pay if something happens as well.

NashvilleLefty

(811 posts)The costs were getting out of control. They were looking at cutting plans long before the ACA. Blaming it on the ACA is something the RW likes to do, and is totally disingenuous.

As far as the mandate is concerned, there is no way the ACA would ever work unless everyone is in, one way or the other.

I want single-payer, but our country simply won't go for it under present conditions. However, people are slowing waking up to the idea. After the ACA is fully implemented, it will be a major step towards single-payer, and people will warm to the idea even more.

Zalatix

(8,994 posts)As in, split in half. Permanently.

NashvilleLefty

(811 posts)I'm upset we couldn't even get Public Option, but it's definitely better than it was.

1StrongBlackMan

(31,849 posts)earning under $20,000 don't pay/receive most if not all of any federal income tax back as a refund ... I wonder how the tax-penalty would figure in?

1StrongBlackMan

(31,849 posts)in the past 100 years that does not have "losers."

KoKo

(84,711 posts)but it will be hell for those of us wanting to have access to the the health care we used to have and expected until it al sorts out.

It's going to cause misery and pain for some...while some will see it as a good thing.

Sad thing is that they designed this with compromises that would cause "pain" as an unintended consequence...and that so many will suffer in the transition...maybe die, or be caused stress that causes illness because of the way this is set up to transition.

Many of us will be the Collateral Damage for the good of the system in place that won't be known until many years down the road when the effects and unintended consequences show up in studies.

Whatever....it's supposed to be a GOOD THING...as long as you aren't caught up in the MIDDLE TRANSITION..though. ![]()

ProSense

(116,464 posts)You "used to have" something good that ACA destroyed?

Really?

KoKo

(84,711 posts)will be hard on a group of Americans being thrown off their "Employee based Health Insurance" where they are now forced to choose a plan. It requires some thought and not all will be able to deal with this huge change as well as one might be able to expect.

There are already problems with the Generic Drug Makers shifting programs and ability for "average Americans" to be able to comply with the new changes and the "generics" aren't giving the same satisfactions for delivery of standard prescribed drugs ...because everything is to save money...and the patient is caught in a catch all and older American's will have trouble dealing with it all.

That's just a taste of what "Radical Change" does. It helps some or many...but harms, hurts others caught in the transition.

But, given that we are a Nation that believes that Collateral Damage of any of our policies is just the "Price of Change" that will help the Majority (Voters) going forward... this is not unexpected.

I don't know how old you are...but, sometimes it seems you really don't have experience with "Life Changes" and how hard this is on a populace and what the ramifications can be.

Just saying....

robinlynne

(15,481 posts)BenzoDia

(1,010 posts)"The Act provides that the penalty will be paid to the Internal Revenue Service with an individual’s taxes, and “shall be assessed and collected in the same manner" as tax penalties, such as the penalty for claiming too large an income tax refund. The Act, however, bars the IRS from using several of its normal enforcement tools, such as criminal prosecutions and levies."

No one is being forced to buy anything.

ProSense

(116,464 posts)derby378

(30,262 posts)...and the prohibition on those enforcement tools goes bye-bye.

BenzoDia

(1,010 posts)Not really a good argument if I'm understanding you correctly.

Zalatix

(8,994 posts)Let's assume we're really living in the dream world you just described. Here is what happens as a result:

People who are uninsured now won't pay for insurance in 2014, and if the IRS won't inflict levies or criminal action then they also won't pay the tax penalty, and when they get sick, they'll get insurance for a while since they can't be denied for a pre-existing condition, and they'll go to the hospital.

Millions of people will do exactly this. They will crush the system.

BenzoDia

(1,010 posts)Most people want insurance of some kind and most people will follow the rules.

eridani

(51,907 posts)Architects of the pioneering 2006 Massachusetts health law, which required most residents to have insurance, expected it would reduce families’ medical debt. But the most recent data suggest the scope of medical debt has remained largely unchanged.

Temporary lapses in insurance coverage and increasingly common plans with high deductibles and copayments have contributed to medical debt, leaving some people struggling to pay bills for hospitals, doctors, and ambulance companies. Rising health costs and the recession also probably played a role

In the Netherlands, the government dictates health care prices, which is why my husband got a root canal there for $25 American in 1996.

ProSense

(116,464 posts)Zalatix

(8,994 posts)If the law says the IRS can't enforce the tax penalty, people will wait until they get sick to get insurance to go to the hospital.

You have no counter argument to that. That is reality here on Earth. It's going to happen, if BenzoDia is at all correct.

ProSense

(116,464 posts)The Act, however, bars the IRS from using several of its normal enforcement tools, such as criminal prosecutions and levies."

Doesn't say anything about not assessing the fee. There will be people who opt out and pay the penalty.

Reading comprehension is good.

Zalatix

(8,994 posts)Millions of people who are uninsured now won't pay for insurance in 2014. This is basic human nature.

And if the IRS won't inflict levies or criminal action then they also won't pay the tax penalty. Again, basic human nature. The poor won't pay more than they're obliged to. They simply cannot, except by bouncing checks.

And when they get sick, IF they get insurance at all, they will get insurance for a while since they can't be denied for a pre-existing condition, and they'll go to the hospital.

Reading comprehension is indeed good, but you have not mastered it.

BTW you accused me of implying that Single Payer would be totally free. You dodged me when I asked you to show where I said that. Have you found where I said that yet? Do expect me to keep bringing up this question, since you did falsely accuse me.

ProSense

(116,464 posts)That's just absurd. Millions of people will qualify for Medicaid, 16 million more people to be exact.

You're making a flawed argument nitpicking over a mandate that will amount to $8 for an individual or about $22 for a family, assessed as a one-time fee at tax time.

Zalatix

(8,994 posts)A single person doing 20K a year won't qualify for Medicaid. There's millions of them, too. You are still not able to process that basic fact.

And the penalty will skyrocket to $58 per person in 2016... unless you are arguing that 2016 will never come.

BTW upthread, you accused me of saying that single payer would be totally free.

I am still demanding you show where I said that.

ProSense

(116,464 posts)That's a fact.

The ACA is the best thing to happen to low income Americans in this country since Medicaid was enacted.

Zalatix

(8,994 posts)And what does "16 million more will qualify for Medicaid" mean to those working poor who won't quality for Medicaid?

If you're a single person doing a measley 20K a year you don't get Medicaid under normal circumstances. Your argument lacks relevance.

ProSense

(116,464 posts)...mean to you? You apparently picked a group and decided to be its spokesperson, even deciding whether or not they will choose to pay $80 for coverage instead of remaining uninsured.

Hoyt

(54,770 posts)Hope you will too.

Swede Atlanta

(3,596 posts)some employers reducing or eliminating their programs. Some employers will keep them over time but likely only for executives.

But that has two effects.....

(1) Employers will lose the tax deduction for these programs

(2) Employers will be under pressure to pay out at least some of those savings in the form of wages

Personally I am not opposed to the elimination of employer-provided health insurance provided insurance can be purchased by all at an affordable rate and employers don't just pocket the entire savings from the elimination of these programs.

It must be noted that U.S. employers are at a competitive disadvantage to other companies because of the burden they carry for health insurance. That is one reason, according to several studies, vacation time is so limited in this country. It must be noted, however, that employers in other countries do pay higher taxes per employee that help offset the cost of national insurance programs.

Don't get me wrong......I see significant issues on the horizon as many companies just screw their employees. Once "no insurance" is the norm then there is no competitive disadvantage for employees with gutting or eliminating these programs. And of course executives will always get their proverbial balls licked at everyone else's expense.

But at some point we have to eliminate the notion that your health insurance is tied to your job. It is what keeps many people in jobs they don't like or people working beyond when they would like to retire (such as my sister) because of health insurance.

patrice

(47,992 posts)Zalatix

(8,994 posts)ProSense

(116,464 posts)Zalatix

(8,994 posts)bhikkhu

(10,789 posts)Plus its a beautiful place to live, with an excellent state government!

patrice

(47,992 posts)amount of effort can be something to build on and, then, at least instead of waiting for the best plan for you to spring fully clothed from the forehead of Zeus, you'll have earned the right to raise some authentic hell.

Zalatix

(8,994 posts)And I live in California, which will be nicer to the working poor than, say, Texas.

Excuse me for worrying about those who live outside of comfy California.

And if building upon efforts actually worked, I'd have fixed things by now.

patrice

(47,992 posts)worth any effort you put into it.

Zalatix

(8,994 posts)I

cannot

build

that

ALONE.

President Obama couldn't even do it and he PUSHED for the Public Option!

I ain't President Obama.

Edited to add: not that I'll get a response, but what have you achieved?

patrice

(47,992 posts)waiting for the old authoritarian power structure to deliver what you desire and bitching about it when it can't or gets it wrong.

Zalatix

(8,994 posts)You're sitting here bitching at me to do all the work to save the world, what have YOU done?

I've protested in the face of potentially getting my ass kicked and arrested in Oakland and other California locations, I've gotten out the voter registrations in both Obama campaigns, I've been donating like CRAZY...

What the hell do you want me to do? My magic wand is broken. How's yours doing?

patrice

(47,992 posts)the early '70s, though I was aware before that as it happened that the National Forensic League topic for the first year that I debated in high school was about controlling the proliferation of nuclear weapons.

I don't feel like going into all of it, but it ranges from tracking the White Train from weapons plants near Amarillo, to organizing a parade, with Plowshares, down Kansas Avenue in Topeka, Ks., chartering and filling multiple busses to D.C., going to Iowa for Howard Dean, grassroots environmental publishing and activism in and around Tulsa, Ok., Social Justice Chair in a couple of parishes when I still used to go to church, actively with and working for our local Occupy . . . are a few of the things that I've done.

I let loose of the idea of success a long time ago. You do your best, WITH OTHERS because it's NOT just about you, to figure out the best stuff to do and you all do that stuff as well as you can do it, always looking for somekind of concrete effect, but, though we all want success, you learn not to want it too much, because you can get discouraged at not seeing it and, thus, miss the very worthy, and perhaps even MORE worthy, things that you are pushing forward. So most of the people I know who do this kind of stuff steer toward large goals, but FOCUS on shorter range concrete results and do the work for the love of doing it with others who love it too.

Zalatix

(8,994 posts)If not, why are you putting all the burden of making it pass, on my shoulders?

BTW did Howard Dean win?

I've been working a lot over the years to make change happen. It hasn't always worked. Why? Because other people have free will and I can beat some of the walls of ignorance out there, but I can't beat them all. Apparently neither can you.

patrice

(47,992 posts)Bitch about how daddy hasn't delivered your pony and see how successful you get.

end of "conversation".

Zalatix

(8,994 posts)And I do mean AIMLESSLY.

Go find someone else to lecture.

patrice

(47,992 posts)power, so no wonder you're frustrated. You need authentic revolution, which is more about yourself than it is about others.

I think just about everything that is wrong right now can in one way or another be ascribed to authoritarian, top down, learned helplessness. Small things are not assumed to be valuable, so no one does them and great deficits of personal responsibility accrue until something really big breaks. And since it's something big, everyone looks once more to authority/daddy to fix it and kicks and screams when s/he doesn't get it what they think of as "right".

Zalatix

(8,994 posts)I define success as changing the status quo, particularly from a profits-over-people system to a people-over-profits system. If that's authoritarian in your confused universe then I've got no interest in trying to convince you otherwise.

You've achieved precious little, certainly not any more than me, so you're not one to lecture me on getting out and doing anything.

jberryhill

(62,444 posts)I define success as changing the status quo, particularly from a profits-over-people system to a people-over-profits system.

In the context of defining "success" of a national healthcare or health insurance system, there is only one rational way to define success - does the system provide coverage to people who didn't or couldn't obtain it previously, and at lower net cost?

Any move in the right direction in that parameter space is a positive step, which the ACA is.

Zalatix

(8,994 posts)jberryhill

(62,444 posts)Zalatix

(8,994 posts)jberryhill

(62,444 posts)Paraphrasing from memory... "The problem with ideologically driven solutions is that you already know the solution, and you go forth in search of facts to support it; instead of looking at the facts and finding the solution from there."

The crappy insurance provides a disincentive for living there. Whether that's important enough to you is up to you to decide.

patrice

(47,992 posts)of the ACA & that includes amongst its engineers and proponents, but also in your predictions about what can happen in the next decade.

Zalatix

(8,994 posts)patrice

(47,992 posts)porphyrian

(18,530 posts)Zalatix

(8,994 posts)porphyrian

(18,530 posts)...the Presidential candidate of the 2008 race!

Nope, the fail is yours. The Individual Mandate doesn't even have a penalty for not paying. It isn't the best way of doing things, it got multiple states to challenge it in the Supreme Court, but it got health care passed, which no other President of your life time has been able to do. And, once we regain control of Congress, I'm sure they will fix the broken part, like this. Nice second try, though. This is for you...

Honeycombe8

(37,648 posts)I don't know if those costs are real or imagined.

But it doesn't have anything to do with the mandate. The mandate applies to people whose employers do not provide ins.

Employers were already headed this way because of the increased cost of providing health care. They have been starting to make employees pay part of the premium, some have stopped providing ins. already, or they've lowered the quality of the plan.

Samantha

(9,314 posts)It really started to get rolling when Elaine Chao was Secretary of Labor under Bush* who re-wrote and skewed requirements that would allow employers to overall pay less per employee.

The last statistic I heard was that only 52 percent of employers currently offer it now. And it has nothing to do with the ACA; it has everything to do with the true white collar crime in the United States -- what health insurance companies and pharmaceuticals get away with overcharging.

Sam

Sekhmets Daughter

(7,515 posts)it's always nice to read something written by someone who understands the issue.

ProSense

(116,464 posts)how people only seem interested in the BS talking points about health care reform.

How Small Business Owners Get Health Insurance

http://www.democraticunderground.com/10021439415

Fact's don't count?

ecstatic

(35,042 posts)coverage regardless. They're really trying to do the right thing, but the costs are unreal. That is the problem.

patrice

(47,992 posts)control the costs. Plus there are authentic health care reforms implemented in the ACA to further bring down costs. Nonetheless, it's going to take at least a few years.

Loudestlib

(980 posts)This is a waste of time.

Zalatix

(8,994 posts)ProSense

(116,464 posts)You say they can't afford it now and choose to go without, but they're going to be "socked hard" by being given the choice to get coverage for $80 per month?

Zalatix

(8,994 posts)in 2014 and forever! ![]()

Or worse, that they won't need to pay anything at all because of that whole "the IRS can't enforce the tax penalty" fantasy, in which case there's no reason to buy insurance at all UNTIL YOU ARE SICK, which will bankrupt the insurance companies out of existence!

Loudestlib

(980 posts)What's is your plan here? It's done the Supreme Court of the United States said it's law. You want PO? So do I! It's not likely to happen for some time.

When Regan passed emtala WITHOUT a way to pay for it this set our healthcare system on a death spiral. We had two ways to cover the cost. One, the ACA a Republican plan or two single payer a Democratic plan.

Healthcare was 18% of GDP and rising. This will slow it down some.

I appreciate your energy. I just think it's misdirected.

Zalatix

(8,994 posts)You probably even wrote that with a straight face! ![]()

notadmblnd

(23,720 posts)so there is a disincentive for this action. Your best bet is to go read all the particulars of the Health care act before saying, "see, I told you so"

Zalatix

(8,994 posts)ASSUMING they even pay the tax penalty, since someone upthread claimed the IRS can't enforce the tax penalty. ![]()

Lex

(34,108 posts)ProSense

(116,464 posts)Fun to watch.

Zalatix

(8,994 posts)The tax penalty is cheaper than paying for health insurance. I am absolutely CERTAIN that employers will choose the cheaper option. ESPECIALLY small businesses.

ProSense

(116,464 posts)"The tax penalty is cheaper than paying for health insurance. I am absolutely CERTAIN that employers will choose the cheaper option. ESPECIALLY small businesses."

...guessing:

How Small Business Owners Get Health Insurance

http://www.democraticunderground.com/10021439415

You have no idea what you're talking about.

Zalatix

(8,994 posts)Small businesses won't get coverage for free for their employees or themselves, they still have to pay. And since upthread it is said that the tax penalty can't be enforced, they'll just choose the tax penalty.

Learn to read!!!

Lex

(34,108 posts)Zalatix

(8,994 posts)ProSense

(116,464 posts)Zalatix

(8,994 posts)Response to Zalatix (Reply #228)

Lex This message was self-deleted by its author.

ProSense

(116,464 posts)now arguing whatever you want to with red herrings unrelated to the point.

Zalatix

(8,994 posts)and no matter how much you try to force feed it to me, I will keep rejecting it. Forever.

ProSense

(116,464 posts)http://www.democraticunderground.com/10021439415

Save face!

You're embarrassing yourself.

Zalatix

(8,994 posts)Telling ME to save face? You're missing all your toes.

Keep posting that cite and I'll keep reminding you of reality: small businesses they PAY for coverage, just like everyone else. And they'll be JUST as likely to forego it.

Go on, post it again.

ProSense

(116,464 posts)Fact free noise of someone trapped in a flawed argument, spewing nonsense and defending that crap with aggressive nonsensical statements.

Really funny stuff.

Zalatix

(8,994 posts)Increasingly misinformed rants interrupted by the loud bang of bullets taking out your toes one at a time. I hope you do have insurance to cover that! ![]()

Lex

(34,108 posts)Zalatix

(8,994 posts)Come 2014, employers WILL choose the tax penalty over paying for coverage.

I am NOT guessing. This is an absolute MATHEMATICAL certainty.

notadmblnd

(23,720 posts)And those that can't afford the premiums, will either be subsidized or free. So the gnashing of teeth and the wailing over all of this is just wasted energy. Go read the ACA and learn the facts before yelling that the sky is falling.

Zalatix

(8,994 posts)What you are in fact trying to sell here is the idea that people can just go get insurance coverage AFTER THEY GET SICK.

I'm not sure you realize that this is the consequence of what you're arguing.

notadmblnd

(23,720 posts)You are the one making all the claims. Again, go read the act and inform yourself.

Response to Zalatix (Original post)

AnotherMcIntosh This message was self-deleted by its author.

ProSense

(116,464 posts)Response to ProSense (Reply #200)

AnotherMcIntosh This message was self-deleted by its author.

ProSense

(116,464 posts)Ludicrous.

Zalatix

(8,994 posts)ProSense

(116,464 posts)Zalatix

(8,994 posts)"If you doubt that the IRS will do this, let's meet back here in 3 years and compare notes as to whether the IRS collects money which some people claim will be un-collectible."

That's a pretty solid connection to the Individual Mandate right there. Perhaps you rush-read the post and didn't read it for comprehension?

ProSense

(116,464 posts)poster's opinion?

Oh my.

![]()

Zalatix

(8,994 posts)You seem to be falling behind here. I was citing the poster's opinion to explain the part that was most relevant.

You kept saying it's not relevant. Of all the reasons you were wrong, that quoted text was the biggest.

Really, please try to keep up! ![]()

ProSense

(116,464 posts)Still, if you want to meet the poster in three years and compare nonsense, go right ahead.

Zalatix

(8,994 posts)I can understand what with you having spent hours going at me, LOL.

In case you missed it, the poster was explaining why claims that the IRS can't enforce the tax penalty for the Individual Mandate are bullshit.

You, of course, failed to understand my explanation that the claim is bullshit because if the IRS can't enforce it, people will game it to death.

ProSense

(116,464 posts)I understood what was posted, and said it was nonsense, and it still is.

Zalatix

(8,994 posts)Response to ProSense (Reply #232)

AnotherMcIntosh This message was self-deleted by its author.

bvar22

(39,909 posts)...is one of the most preposterous things I have ever read on DU.

It would be funny if it wasn't so sad.

DU used to be a place for good information.

These Dishonest Brokers have inflicted a lot of damage to this place.

My hope is that the lurkers can see them for what they are.

Zalatix