General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsKlarna, a Swedish payments unicorn, wants to conquer America

The “buy now, pay later” firm has grown rapidly

https://www.economist.com/finance-and-economics/2020/11/12/klarna-a-swedish-payments-unicorn-wants-to-conquer-america

As a child, when you see your parents struggling, it creates a drive,” says Sebastian Siemiatkowski, the chief executive and co-founder of Klarna, an online-payment-processing firm. His family moved to Sweden from Poland in 1981, the year he was born; his university-educated father was unemployed for long spells or just got by behind the wheel of a cab. The experience nurtured a strong ambition “to fix the economy for the family”. Today, just shy of 40, Mr Siemiatkowksi is at the helm of one of Europe’s biggest fintech firms. A funding round in September raised $650m and valued Klarna at $10.65bn. Investors include Sequoia Capital, a venture-capital firm; Visa, a credit-card firm; and Snoop Dogg, a rapper who performs as “Smoooth Dogg” in a pepto-pink ad for the payments firm. Having gained a foothold in Europe, Klarna has its sights set on America.

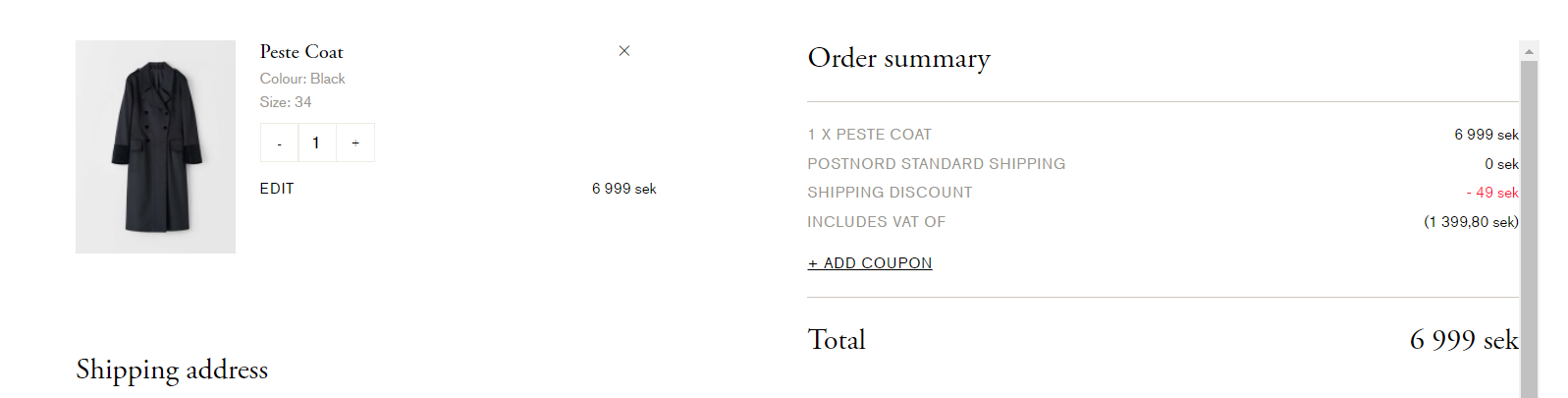

Klarna is one of several “buy now, pay later” (bnpl) services that have grown rapidly in recent years. Its attraction, for both online retailers and their customers, is simplicity. Instead of entering their card details at checkout, shoppers sign up to Klarna’s app with their email and delivery address, and leave payment to be made in 14 or 30 days. Klarna pays the retailer in the meantime, bearing the risk that shoppers do not pay—something few other fintechs do—while charging the merchant a fee. Customers are recognised when they use the app again, without needing to re-enter their details. Algorithms use publicly available credit information and details of the size, type and timing of the purchase to calculate the chance of fraud, and offer extended-payment plans, for a charge.

The ease of the process hugely increases the “conversion” rate—the share of customers who go ahead and buy an item after putting it into their virtual basket. That is why Klarna attracts retailers like bees to a honeypot. It has signed up 200,000 sellers in 17 countries and captured 10% of the e-commerce market in northern Europe. Etsy, an online marketplace for arts-and-crafts items, signed up on October 26th. Last year Klarna’s revenue jumped by almost one-third to Skr7.2bn ($840m) as the value of wares sold through it rose by 32%. Merchant fees are the main source of its income; it also runs checkout infrastructure for some retailers. Late fees from customers make a smaller contribution.

It was Klarna’s success in Britain—where it has almost 10m customers and this year has opened some 95,000 accounts a week—that made it reckon that it could conquer America, where online-payments firms have typically struggled to gain market share. It began 2019 with its splashy “Smoooth Dogg” campaign and poured funds into its operations in New York, Los Angeles and Columbus, Ohio, ahead of its launch in America. The firm now has 9m customers there, and will probably go public there in the not-too-distant future. It is expanding in other ways, too. Back in Europe, it obtained a banking licence in 2017, and has launched new products in some countries, such as a credit card. It has opened a tech hub in Berlin’s trendy Mitte neighbourhood that employs 500. This helps explain why last year Klarna ran its first loss since it was set up in 2005. “Profitability is for later,” says Mr Siemiatkowski. Demand is certainly on Klarna’s side. According to Kaleido Intelligence, a research firm, bnpl will grow to $680bn in transaction value in 2025 worldwide, from $353bn in 2019, driven by young, credit-hungry shoppers. Covid-19 has only accelerated the rise in online shopping.

snip

Ferrets are Cool

(22,603 posts)Does he look like Snoop Dog or what? ![]()

brush

(61,033 posts)he appears in an ad for the firm.

Ferrets are Cool

(22,603 posts)msongs

(73,239 posts)marybourg

(13,598 posts)when they use credit cards. I just have to slip my card into the slot and take it out again when instructed. So I’ll just stick with that.

But I’m a late adopter anyway. I still haven’t cottoned to cable TV or bottled water.

XanaDUer2

(15,769 posts)I just use my CC or debit card

Celerity

(54,005 posts)marybourg

(13,598 posts)this was for online use. Thanks.

Celerity

(54,005 posts)I use Klarna all the time, most of the Swedish and UK sites I shop on offer it as an option. Never had any issues in years.

Moostache

(11,094 posts)These type of ventures - online commerce in general, but especially shipping and payment options that make the alternative brick and mortars essentially a dead model - are need of massive regulation and taxation. Now the initial response will of course be "AHHHH....Socialism!!! EKKK! You pinko radical!!!"...but bear with me for a moment...

This country is in the spasms of a tectonic shift in the overall consumer economy. Most corporate taxes have been hollowed out by unwise cuts and give aways and the newer models - online stuff mainly - has largely escaped taxation at all. This is enormously destabilizing to society in general as jobs become fewer and fewer and the downward wage pressure keeps many on the verge of poverty or one bad break away from bankruptcy.

Small businesses are opening a drastically reduced rate - as many of them have no chance of surviving beyond their first 12months ina competitive environment that has them bringing a metaphorical knife to a nuclear arms race. A VERY few - influencers and entrepreneurs or venture capitalists - are raking in fortunes, but the circulation of resources and wealth through the system are DYING. Too much concentrated at the top is not a new problem - its been building for 45 years already...but the internet and influence economies are accelerating the disparities at breath-taking speed. Throw in the pandemic and the corporate realization that the mere act of warehousing a work force at their expense is wasteful for their bottom line (as is international travel in the age of Zoom and Teams and other methods) - when the same amount(OR MORE) productivity can be squeezed out of workers who stay at home and work remotely - and we are at the cusp of a massive paradigm shift, no different from the steam engine to kick start the Industrial Age, the internal combustion vehicle to jump start the Suburban Commuter culture or the personal laptop, tablet or smart phone to really hammer lock everything into the Internet Age...

This is a serious issue that really, really needs to be advanced from any and all left-of-center think tanks and moved into the public dialogue like last year, but instead we have been obsessed with the grotesque clown and his circus sideshow and wanton cruelty.

Climate change, AI and the distribution of "work" (and therefore the assignation of 'value' to humans) is going to be the most toxic event of human history to date. The next 30 years are gonna blow everyone's mind, and if we're not careful, data-driven and compassionate, it WILL lead to the extinction of humanity within the next 125 years or less.

Celerity

(54,005 posts)shown in the price.

Moostache

(11,094 posts)Not in 'Murica...that would be too Socialist for the 'pukes to abide. Instead they blame immigrants and 'others'...