General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsTime to repeal Reagan's taxes on Social Security/Unemployment Benefits

To quote a certain asshole, most people don’t realize that neither Social Security benefits nor unemployment benefits were subject to federal taxes until the 1980s, when President Reagan was forced to shop around for ways to fill the huge budget deficits being created by his massive tax giveaways to the rich.

It was the beginning of an overt and cynical R philosophy of shifting the nation’s tax burden from those who could most easily afford it to those the most unable to afford it. Forty years later, and the folly and cruelty of Reagan’s tax policies - policies R Senator Howard Baker at the time termed “a riverboat gamble” - continue to adversely impact Americans who are already living with the pressure of joblessness and/or fixed incomes. These are those Americans who we are told couldn’t pull together $400 to meet an emergency, yet their meager benefits are taxed while many multi-billion-dollar corporations pay nothing in federal taxes.

Want to really help the most-desperate among us? Repeal these taxes and forever exempt them from being taxed.

Hoyt

(54,770 posts)Nor do I see any effort to do it from anyone.

Voltaire2

(15,377 posts)The current situation is that taxes start at 25,000, just like they first did in 1985. That would be 63,844.21 if it had been COLA since then. Instead it is annual tax increase on elderly people.

SheltieLover

(78,281 posts)Trailrider1951

(3,574 posts)used to be deductible on your taxes: credit card interest, auto loan interest, home mortgage interest, etc. With the exception of home mortgage interest and student loan interest, that all went away during the Raygun administration. When I hear some GOPer crowing about how Raygun lowered taxes, I just have to point this out. That a$$hole RAISED my taxes. He lowered taxes for the WEALTHY, not working stiffs like you and me. ![]()

stopbush

(24,788 posts)which churns away month to month, costing Americans dearly.

Rich people can pay cash for everything. No need to carry auto loan or credit card debt. The rest of us are not so lucky, because Rs have made sure we’re not so lucky.

uponit7771

(93,504 posts)SCantiGOP

(14,681 posts)They raised the standard deduction, so it is now higher than what most people get if they itemize deductions.

You can still take the mortgage interest deduction if you choose to itemize.

uponit7771

(93,504 posts)... only interest for 2nd mort or Mortgage based LOC is if its related to the house.

We're talking about buying crap and getting righting off the interest...

Also, SD doesn't work if you have more than 2 children that live with you ... the families of 5 got kicked in the minerals because of caps.

winagawaukee

(14 posts)There is a little more to the Trump Tax bill. First the Trump Tax bill took away the Personal Exemptions which were around $6000 and increasing each year. They folded the Personal Exemption into the Standard Deduction and said look we increased the Standard Deduction. Classic Bait and Switch.

If you were already taking the standard deduction the new tax rates possibly reduced your tax burden. But for anyone who itemized you got screwed. Itemizers lost the personal exemptions. Now you only had your deductions which were either capped or eliminated.

Mortgage interest remained as a deduction. But Property Taxes and State Income Taxes were capped at $10,000. Any taxes above this were lost. And then other deductions were eliminated like moving expenses, union dues, tools, or educational expenses used in your profession.

So with the loss of personal exemptions and the cap on state and local taxes, itemizers pay more in taxes now. Biden has proposed removing the cap but we still have lost the personal exemptions.

fleabiscuit

(4,542 posts)Tax reminder for me...

Moral Compass

(2,353 posts)I’ve explained this to many Rs when they were going on and on about the great Reagan 1986 bipartisan tax if 1986.

If you stayed in the same bracket (as I did) your taxes went up sharply as you had lost most deductions that were available to the unpropertied. If you were really unlucky you jumped brackets (with $0 income gain) due to the collapsing of the number of brackets from 15 to 5.

But those with higher incomes saw huge double digit tax decreases which dwarfed any loss of tax deductions. Oh, and this real property owning demographic saw the value of the home owner’s mortgage deduction increase.

It was this arithmetic dichotomy that came close to causing two different fights between me and my substantially better off good friends.

Many of us got screwed but some of us made out like bandits because the top marginal rate dropped from 50% to 35%. And, most likely, this same demographic also saw themselves pushed into a much lower starting bracket.

procon

(15,805 posts)people when they are down and out and at their most vulnerable, when rich people get away with paying little or no taxes? How do wealthy people get to write off their yachts and private planes, but the working class can't even get a break on their homes?

Economic justice is long overdue.

Celerity

(54,005 posts)thus allowing divisions of all stripes to be exploited, especially along racial and xenophobic lines. As a bonus for Rethugs and their legions, it impacts and hurts PoC at a far higher rate, so further feeds and enables the white nationalist schemes of group hatred.

The poor are often too busy simply trying to feed themselves and their families to take time out to learn the big picture, or at least (in terms of percentages compared to the highest econmical levels) send their children to institutions of higher learning where those children/young adults can be exposed to the critical thinking and economic earning potential that comes from tertiary degrees. The cycle of low wage debt slavery for the poor is thus kept intact to a large degree. The only other OECD nation with a lower upward socio-economic rate than the US is the UK. The rags to riches American myth is just that, a myth for the vast majority. You are very likely to remain poor if you are born porn, all the wonder stories of exceptions aside.

It also lowers overall health and lifespans, thus increasing wealth extracted real time (whilst they are alive and of workforce age) by the for-profit US healthcare system, and also prematurely killing off millions who would otherwise get back far larger percentages of their elderly-age denominated transfer payments, ie. pensions (in some cases), Social Security, and Medicare, etc.

KPN

(17,201 posts)think everyone should pay their fair share and define that as the same amount regardless of income. They believe everyone has the same opportunity to better themselves financially. They make no distinction between the value of services and infrastructure to poor people vs wealthy people because in their minds they all have equal access to those services and that infrastructure. So they are ideologically opposed to any special benefits (as they see them) for poor and lower income or even middle class people. They also believe that if they don’t need the services, they shouldn’t be required to pay for them; that only those people who need them should pay for them, ie, public education, social security, Medicare/Medicaid. And they believe that all wealth derived from private individual or corporate effort and innovation so those sources of wealth should be freed from requirements that hinder the creation of wealth because wealth is good.

That’s what I think. They actually believe this bullshit which lacks any consideration, regard, appreciation of or empathy for the full myriad of innate inequalities, as well as for the long-term societal consequences which ultimately affect all of us including them. Lacks any ability to see and understand the hypocrisy.

Boiled down it comes to egregiously shallow thinking and consequent lack of empathy; in effect, near total self-centeredness.

ancianita

(43,162 posts)their intertwined history of class and the other usual hierarchies.

Much of US history has been about keeping/losing the UK baggage through constant constitutional struggle. After being punched hierarchically downward, and then horizontally on money and tax fronts, it's past time to punch up.

Permanently upping tax rates on the rich stops the trickle down and starts debt challenge.

AllaN01Bear

(28,906 posts)vain attempts to privatize ss.

gulliver

(13,810 posts)Our current strategy sometimes seems to be: 1) Add policies that win 60% of the votes, 2) Protest until we reduce that to 50%.

Everything has to be win-win for the bulk of the population, economically and emotionally. Social Security and economic security in general should be a crushing strong suit for us. It's not but only because of bad sales representation. I have high hopes for Biden/Harris tho.

Reagan and Trump are both media creations, both salesmen.

beachbumbob

(9,263 posts)this income/

Why is it that?

WyattKansas

(1,648 posts)Multiple decades of Republican fucking over working people, while they play big businessman (frauds) and ACT like they have some genius skill (fraud) at handling money. Unless the word 'business' is held in check with solid morals and regulations, then it is just a dirty word... Fact!

And the American People remain spoon fed bait & switch gimmicks (financial portfolios) that are pissed away on #7 at the stock market, while the Wealthy Elite slip out the back doors with any of those gains... Unless the American People can liquidate their imaginary financial portfolio at any time and walk away with that much actual cash, then it is not worth the paper it is written on. When people wake up to the fact that they have been gamed for decades, then widespread outrage will target all culprits and change the status quo gimmick this country has operated by for decades.

Kaleva

(40,283 posts)David__77

(24,511 posts)Don’t pair it with an increase in taxes. Just say it will spur growth and provide relief for our cherished people.

onenote

(46,065 posts)Unemployment benefits first were subjected to federal income tax on a limited basis in 1978, while Jimmy Carter was president. They became fully taxable in 1986 pursuant to a bill introduced by Dan Rostenkowski (D-IL) and supported by a majority of members from both parties. The taxation of social security benefits was enacted in 1983, again pursuant to a bill enacted by Rostenkowski and again with support from a majority of members from both parties.

SCantiGOP

(14,681 posts)But a lot of Social Security recipients are in the top 5 or 10% even when retired because they have pensions and other saved assets. Those should be subject to tax just like income.

pnwmom

(110,217 posts)a progressive tax.

Hoyt

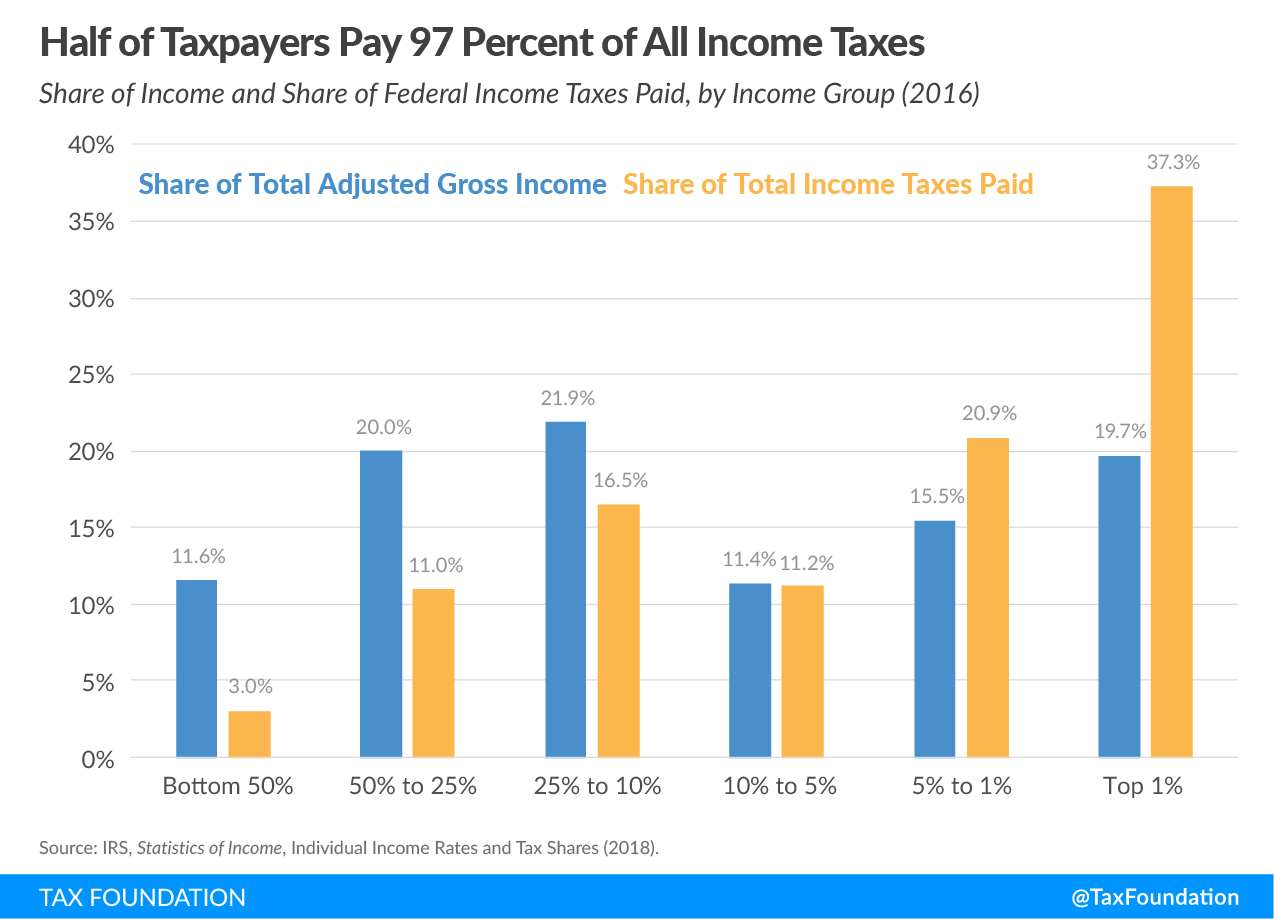

(54,770 posts)For example, people think the wealthy don't pay taxes. But fact is, the top 10% of earners pay 69% of total income taxes. And the top 25% paid 86% of total income taxes.

Obviously it is true that the wealthy have more money, but it's not like the bottom 50% are paying all the taxes.

Personally, I think capital gains and estate taxes are where we need to focus. I'm kind of neutral on a small wealth tax, depending on what happens with capital gains and estate taxes. Maybe even some kind of forced wealth tax that works something like the minimum annual withdrawal amount from IRA/401Ks.

Voltaire2

(15,377 posts)Last edited Thu Dec 31, 2020, 10:07 PM - Edit history (1)

I don't. It is a horseshit tax that slams people who saved for retirement in tax deferred ira's and 401ks. Wealthy people don't give a flying fuck about ss income to begin with.

OMGWTF

(5,043 posts)that is until he was tapped as VP, then it was hunky-dory. I remember hearing St. Ronnie Raygun talking about building up the military, etc. but cutting taxes and thinking to myself, "This makes zero sense. How does that even work?" Turns out it doesn't.

blue-wave

(4,835 posts)to do a forensic financial analysis of all tax cuts and increases since the days of Ronnie. Repeal and change all tax policy to benefit the middle class and poor.

JoeOtterbein

(7,866 posts)Cozmo

(1,402 posts)Traildogbob

(12,733 posts)This needs to be screamed loudly. If billionaires get tax breaks at their levels, seniors damn sure deserve to go back pre Ronney. My dad was just bitching about the taxes taken out of a SS raise he just got. Tried to tell him Ronney did that to cover his loss from rich asses gifts of cuts. My dad, Trump voting proud republican who blames everything on Pelosi, and when trying to get him, a Georgia resident, to end McConnells reign of terror, he does not know who Mitch is. 🤬

His response, Osoff looks gay and he saw the preacher on Fox saying he hates America.

Voter eligibility should require at least a test of basic civics and how a bill is written and passed. If GOP can create absurd requirements to vote, or be counted, damnit, this is not a outrageous requirement.

That would eliminate that 35 percent red hat shit brained cultist.

ancianita

(43,162 posts)Gingrich and other strategists knew then that the contract ON America would include harassing and bullying the Dems of every administration to hurry up and clean up that debt!

I'll bet most Republican voters don't even know that, and the ones who do know this history think it was clever af.

roamer65

(37,852 posts)Anyone income past $1M should be taxed at that rate.

That would more than pay for any tax cuts for SS and UI folks.

RocRizzo55

(980 posts)turbinetree

(27,208 posts)BootinUp

(51,035 posts)For the whole Reaganomics thing to die. Seems to me there’s never been a better time.

wryter2000

(47,940 posts)That taxing unemployment would make it less attractive to be on unemployment...as if people WANT to lose their jobs so they can collect free money. My husband's job was eliminated during one of Reagan's recessions. We didn't regain financial solvency until my husband started getting Social Security.

dlk

(13,188 posts)It makes no sense the richest Americans pay the least.

quaker bill

(8,262 posts)is whether the benefits you get should be taxed. I think they should not be taxed. Taxing benefits, is the functional equivalent of reducing benefits, just with extra paperwork. The Government "gives" you a benefit but withholds some of it in taxes. This is exactly the same as simply paying a smaller benefit, but it is more politically palatable to tax benefits than simply reducing the benefits by the same amount.

In so far as Reagan was concerned, at that time in my life most of the taxes I paid were Social Security and Medicare withholding because my income was low. Reagan doubled SSI withholding and substantially increased my taxes.

smirkymonkey

(63,221 posts)pay them off in full due to the massive interest payments, then when you retire, they should not be able to garnish your SS payments.

My principal would be payed off in a few more years, but because of the compounded interest, I will never be able to pay it down completely and I have not been able to save much for retirement at all. Stop adding insult to injury by squeezing money out of people who are least able to afford it. Very few seniors (not there just yet, but will be eventually) are able to get decent paying jobs to keep up with payments and can barely survive on SS payments. There are other sources of wealth they can go after to make up for that shortfall.

Hermit-The-Prog

(36,631 posts)DU actblue link for Warnock, Ossoff, Stacey Abrams' Fair Fight:

https://secure.actblue.com/donate/dufor2020runoff

A few questions: https://www.democraticunderground.com/?com=view_post&forum=1002&pid=14520874

and answers: https://www.democraticunderground.com/?com=view_post&forum=1002&pid=14520972