General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWhy is discussion of taxing the middle class taboo?

The gap between a family earning six figures with a $350,000 house and someone below the poverty line is daunting. If we are serious about addressing income and wealth inequality, fixing systemic racism, fighting climate change, and all the other challenges facing us, everyone is going to have to pay their fair share, not just the rich, because frankly there aren't that many of them. This is a conversation we're going to have eventually, and we had better start laying the groundwork now.

Fullduplexxx

(8,624 posts)I think that's about all the talk this discussion needs

SheltieLover

(79,666 posts)Lochloosa

(16,717 posts)MichMan

(17,061 posts)With inflation that equals $118,000 now.

I agree, anyone making over $118,000 should pay 50% federal income tax, plus whatever the state and local taxes are. Those that are that fortunate need to pay their fair share.

Wonder who in congress will support something like that, and would Pres. Biden sign it if it passed congress?

Happy Hoosier

(9,507 posts)Hey, why not destroy what‘s left of the middle cöass, right?

I‘d consider something like that once we address the ridiculous undertaxing of the very rich.

Celerity

(54,198 posts)50% on all 118K?

If so, that is madness.

Even if you mean only income over 118K (and I am not talking about mega millionaires or billionaires here), you are advocating political suicide for our Party.

Let's say you have a professional couple in NJ. Wife makes 150K and husband makes 120K in AGI.

Under your plan, if they file jointly, they would likely (barring some tax sheltering) pay over 100K usd JUST in federal income tax. Add in mortgage, property taxes (insane in NJ), transportation costs (plus perhaps 2 auto loans/leases), food, healthcare/insurance/pharma costs, state and local income taxes/other taxes, student loan payments, utilities (and NO children, so this doesn't even count childcare costs which can be crazy) and you have left them (perhaps) with so little to save for retirement their heads will spin.

IF you mean 50% on the entire amount, they are quite possibly well in the bin.

The USA is not Sweden where at least you get HUGE returns for your taxes (near free healthcare/pharma, free tertiary education up to PhD level, (and then if a PhD student or beyond, you GET PAID, in some cases A LOT), massive childcare subsidises (sometimes free), around 2 months a year paid holidays (combined public/private), extended (a year or so per parent, it can be more or slightly less, in some cases) post birth time off that is paid, and goes to both parents (just not at same time), world class national infrastructure, government mandated extremely low interest rates on many types of loans (how does a 1.4, 1.7% or so APR mortgage sound?) etc etc etc etc.)

MichMan

(17,061 posts)The example I gave was what one of those tax brackets was in 1981 right after he was elected. FYI, in 1981 I made a little over $9000

I take it that you do not think we should return to those tax rates (as many favor) and to do so would be political suicide.

Celerity

(54,198 posts)it is going down an unfruitful path.

cheers

MichMan

(17,061 posts)In reply I posted what the tax rate was in 1981 on someone making over $41, 500. One can argue what the current tax rates should be, but to return carte blanche to the pre Reagan tax rates (as others proposed) has a pretty severe implication for the middle class.

You said "Even if you mean only income over 118K (and I am not talking about mega millionaires or billionaires here), you are advocating political suicide for our Party."

That was why I pointed out that would be what we got if post #1 was implemented

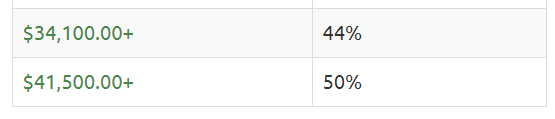

https://www.tax-brackets.org/federaltaxtable/1982#:~:text=Federal%20Income%20Tax%20Brackets%20%28Tax%20Year%201981%29%20ARCHIVES,%20%2016%25%20%2010%20more%20rows%20

Celerity

(54,198 posts)using the 1981 numbers

make me a single filer

make my income 43K (43K in regards to the number the chart refers to)

If this was 1981, I would thus owe 21,500 usd in federal income tax?

MichMan

(17,061 posts)in 1981, you paid 0 % on the first $2300, 12% on the next $1100, 14% on the next $1000 after that and so on... until you get to 50% on anything above $41,500.

For your example of $43,000 you would be paying 29.6% or $12,709 usd

Using an inflation calculator, the current value of $43,000 in 1981 is $118,000. According to the current 2020 tax tables, your effective rate on that income would be 19%.

If we had the same tax rates we had in 1981, someone making that amount of income would pay $11,820 more than they do now. That is > a 50% increase in taxes owed compared to the current rates.

Celerity

(54,198 posts)later)

so, as promised, my answer:

Even with that progressive nature and with inflation factored in, that is too low a threshold for a 50% rate, due to the lack of transfer value back in the US.

make that value-back level similar to here in Sweden, and I am all on board, (and perhaps adjust the threshold a bit higher)

thank you for you replies

![]()

NutmegYankee

(16,477 posts)Because right now, we pay the highest actual tax rates and get virtually nothing for it. We are cut out of any stimulus, and almost any program because of income limits, but we don't have the investment shelters of the wealthy elite and so we pay a substantial portion in federal/state/local taxes compared to them.

MichMan

(17,061 posts)They just didn't pertain to the super rich. The poster I replied to wanted to return to those tax rates

NutmegYankee

(16,477 posts)Without the housing crunches, I think wages would be a lot lower in many places than what they are at today. The professional wages really grew while others stagnated. It would be unpopular, but taxes really should take into account local price variations. $118k is a helluva lot different in Connecticut than it is in Nebraska.

MichMan

(17,061 posts)NutmegYankee

(16,477 posts)MichMan

(17,061 posts)onecaliberal

(36,594 posts)dsc

(53,373 posts)those people are taxed pretty high already. We very much under tax the rich and even more so under tax corporations. If we bring those more in line with what other countries do and provide the higher level of government services that other countries do, then we can talk about taxing them more.

MichMan

(17,061 posts)Ex Lurker

(3,966 posts)"Don't tax you, don't tax me, tax that fellow behind the tree!"

kysrsoze

(6,436 posts)Case in point - Repuke tax scam’s SALT tax limitation, and our new brackets being temporarily reduced (despite permanently losing things see can itemize), while the wealthy have permanent tax cuts.

We get hosed every time.

NutmegYankee

(16,477 posts)It also sunsets along with the old brackets.

LakeArenal

(29,949 posts)I have heard tales of a time of high wages, five day work weeks, overtime, benefits, and vacation. Unicorns were the building blocks of this middle class. Oh, wait, unions not unicorns. Same thing now I guess.

Happy Hoosier

(9,507 posts)Restricted to the professional class. Blue collar middle has nearly disappeared.

FlyingPiggy

(3,748 posts)We give TOO MUCH in terms of corporate welfare. The middle class has done enough. And I guarantee you those making millions are NOT paying their fair share due to tax havens and loopholes.

harumph

(3,204 posts)doc03

(39,032 posts)forget about the House in 2020. Same goes for guns even more so.

TheFarseer

(9,768 posts)The mega rich I mean. Why get mad at doctors and engineers that went to school for 6 -8 years or whatever and pay on the same progressive tax schedule you do? Get mad at parasites that do little to no work and collect dividends for a living and pay a special lower tax rate! Get mad at people who buy and break up companies and lay people off and rig the system so they don’t pay any taxes. I’m OK with paying more taxes and I’m definitely not in the lawyer and engineer bracket but can we please go after the hedge fund managers, real estate moguls and private equity vultures first?

KentuckyWoman

(7,392 posts)The vast majority of 6 figure paycheck earners pay plenty of taxes. Low 6 figures isn't enough to buy into all the tax breaks millionaires and billionaires can legally take. High 6 or 7 figures is another conversation.

Don't put it on working people. Whether they make min wage or 6 figures. Work is work.

The inequity is on investment income, and salaries paid out in investments. That needs to be addressed. Once there is some equity on that score. If there are still serious needs, then we discuss how it all gets paid for.

JI7

(93,493 posts)about wanting those things that Europe has.

Personally I would be ok with a lot of it but I know the reality . Even California is resistant to raising taxes for many good things.

andym

(6,063 posts)The middle class has the largest group of voters and they decide elections. Although you might hope for complete altruism, most voters consider their own interests first and foremost. Therefore, there won't be any middle-class tax hikes in the foreseeable future.

radius777

(3,921 posts)Reagan killed us because he played the suburbs vs the inner cities etc - portraying Dems as the party that taxes the middle class to subsidize the poor... all while the 1 percent and big corps made out like bandits.

Forget about what the soccer moms are making - look at what the bankers and hedge fund guys are doing.