General Discussion

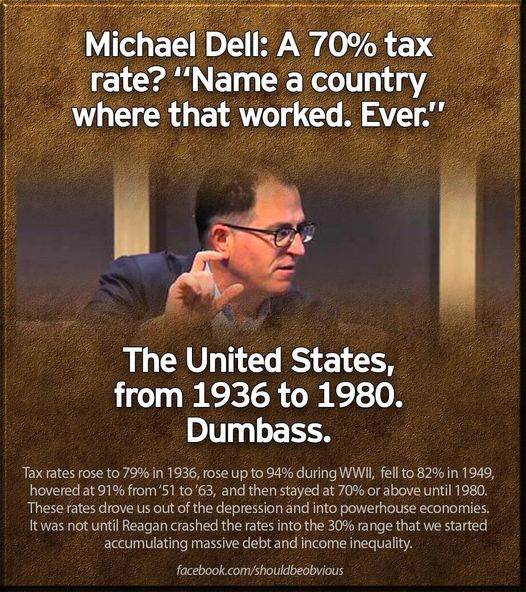

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forums"Name a Country Where 70% Tax Worked"

rickyhall

(5,509 posts)dhol82

(9,648 posts)sandensea

(23,255 posts)

calimary

(89,758 posts)sandensea

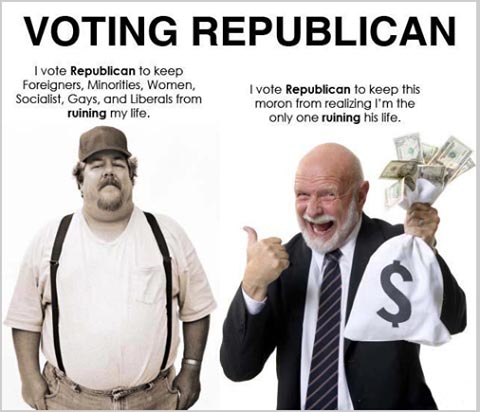

(23,255 posts)I guess it shows (for anyone who wasn't already clear on that) who runs the GOPee.

calimary

(89,758 posts)nattyice

(341 posts)CaptainTruth

(8,164 posts)moose65

(3,449 posts)No one ever paid 70% of their entire income in taxes. The 70% was the marginal rate on the top level of income.

Whenever Republicans rail against “Democrat tax increases,” they deliberately conflate the marginal rate with the effective rate and make it seem like people will be paying the top rate on ALL their income. They use that to scare people and it drives me bananas.

FoxNewsSucks

(11,649 posts)from the explanation, but the point is still made. A lot of people don't know that, and it's a good reminder that billionaires and corporations pay nowhere near their fair share, if they even pay at all.

wryter2000

(47,940 posts)"Marginal" doesn't tell you immediately what we're talking about. There needs to be an easier way to describe it.

muriel_volestrangler

(106,037 posts)Link to tweet

Erik Brynjoffson immediately replies to Dell, giving the 1930s to 1970s example of the USA, and that it "worked" then.

Johnny2X2X

(24,046 posts)"I don't think it will grow the economy..."

Why are we asking fucking Michael Dell what he thinks will grow the economy? How would he know the first thing about that? He's a rich guy who started a computer company, I would expect him to know about computer companies and that market. I wouldn't expect he would know the first thing about what tax rates will do to economic growth in America, he has zero qualifications to talk about that.

We hold the rich in too high regard, they are usually just as clueless as everyone else on 99% of the issues they get asked about.

Mariana

(15,621 posts)It never occurs to them to perform the calculations to figure out what their effective tax rate actually is.

Grins

(9,402 posts)As said at the time this was learned:

“Less than the gratuity a restaurant would charge for a party of six.”

Mariana

(15,621 posts)to try to fool people into thinking he pays more tax than he actually does. He donated a bunch of money to charity, and then he didn't claim it all so he could manipulate his effective tax rate to be what he thought would be politically acceptable.

https://www.nbcnews.com/news/world/romney-overpaid-his-taxes-because-hes-running-office-petes-sake-flna1B6038308

That means the Romneys voluntarily paid a higher tax rate than they were legally required. The full documents, which only cover the 2011 tax returns, will be posted online at 3 p.m. today.

This can get a little complicated, so let's be clear about the details. If Romney had simply filed normally, taking all of the deductions to which he's legally entitled, he would have paid an effective tax rate of about 9 percent.

But that would have proven politically problematic, so purely for show, he deliberately overpaid the IRS, in order to increase his tax rate, on purpose. Romney was in the rather extraordinary position of selecting his own preferred tax rate, and then working backwards from there.

Caliman73

(11,767 posts)Then again, I don't have scores of accountants and lawyers I can pay to fudge my numbers.

Ferrets are Cool

(22,816 posts)A point that needs to be made repeatedly.

louis-t

(24,599 posts)WarGamer

(18,495 posts)NOBODY paid 70%

PSPS

(15,300 posts)Plus, your "paid 70%" is misleading. True, nobody paid 70% effective tax rate on all of their income because that's not how taxes work. It's bracketed so that the top rate is levied only on any income within that bracket. Lots of people paid 70% on any dollars they earned in that bracket and were more than happy to do so.

WarGamer

(18,495 posts)But make no mistake: Many top earners during the high-rate era, such as politicians Dwight Eisenhower and Ronald Reagan, entertainer Jack Benny and librettist Alan Jay Lerner, didn’t pay the top rates. In 1952, for example, when the top rate was 92%, the highest-earning 1% of taxpayers had an average rate of 32%, according to Elliot Brownlee, a tax historian and emeritus professor at the University of California, Santa Barbara.

But if you disagree, lol... Professor Brownlee has written a lot about it and Google-Fu is strong...

SunSeeker

(58,176 posts)You can fall into the 92% marginal tax rate on some of your income and still end up with a 32% average tax rate if very little of your income falls into the 92% tax rate and/or you have lots of deductions/tax credits.

If we could go back to the rich paying an average tax rate of 32%, instead of the 15-23% they pay now, it would create enough revenue to pay for a lot of transformative social programs and lower the national debt. Right now, the top 400 richest families pay a lower average effective tax rate than the middle class. https://www.cbsnews.com/news/americas-richest-400-families-pay-a-lower-tax-rate-than-the-middle-class/ That is obscene.

WarGamer

(18,495 posts)In 2018, the top 1% paid 26.87% in Federal Income Taxes.

https://taxfoundation.org/summary-latest-federal-income-tax-data-2018-update/

SunSeeker

(58,176 posts)Those are not 2018 stats you're citing. Those are 2018 updates to 2016 states, as the article you cite makes clear:

As you know, Trump signed a massive tax cut for the rich in 2017. So, the stats for 2016 are no longer reflective of current reality. And when you say "the top 1% paid 26.87% in Federal Income Taxes," that is not marginal tax rate, but the "Average Tax Rate" (for 2016) as the table you plucked that number from explicitly states.

WarGamer

(18,495 posts)Your link is referring to the "Top 400 families" and is not representative of the "top 1%"

Your link doesn't even back up it's own numbers. It's basically an op-ed by 2 economists.

I never claimed 26.87% was a marginal rate. Stop putting moronic words in my mouth.

It's the average over an entire level of income earners and is comparable to the data I plucked from the 70% marginal tax era.

Seems to me you're just trying to argue facts that aren't relevant to what I've been claiming.

My claims stand.

Your claims may or may not be accurate, but they certainly don't change the accuracy of mine.

Response to WarGamer (Reply #33)

SunSeeker This message was self-deleted by its author.

SunSeeker

(58,176 posts)...

But the tipping point came in 2017, with the passage of the Tax Cuts and Jobs Act. The legislation, championed by President Trump and then-House Speaker Paul D. Ryan (R-Wis.), was a windfall for the wealthy: It lowered the top income tax bracket and slashed the corporate tax rate.

By 2018, according to Saez and Zucman, the rich were already enjoying the fruits of that legislation: The average effective tax rate paid by the top 0.1 percent of households dropped by 2.5 percentage points. The benefits promised by the bill’s supporters — higher rates of growth and business investment and a shrinking deficit — have largely failed to materialize.

https://www.washingtonpost.com/business/2019/10/08/first-time-history-us-billionaires-paid-lower-tax-rate-than-working-class-last-year/?outputType=amp

Plus, as others have stated in this thread, it's misleading to just talk about federal income taxes. We should be talking about effective total tax rate. Current law results in a smaller share paid by the richest 1 percent and the next richest 4 percent. All other groups pay a larger share of total taxes under current law compared to what they would pay under pre-TCJA law. https://itep.org/who-pays-taxes-in-america-in-2019/

PETRUS

(3,678 posts)I'm more or less agreeing with the general thrust of your argument here, and thought you might be interested in some further thoughts.

The Federal government collects taxes other than the personal income tax, as do states and localities. The actual effective tax rates (not just the statutory rates) were much higher mid-century. From Saez and Zucman (in their book, The Triumph of Injustice):

"The average tax rate of the top 0.1% income earners neared 60% in the 1950s and reached close to 70% for the top 0.01% in 1950, when higher corporate taxation generated massive revenue and equity ownership was still highly concentrated."

For comparison, the actual effective tax rate (when taking everything into consideration exactly as the above quote does) for the top 0.1% in recent years is around 30%, and is even lower for the top 0.01%.

SunSeeker

(58,176 posts)So when the GOP says the poor don't pay taxes, that is total bullshit.

twodogsbarking

(18,394 posts)and if you were any kind of accountant your clients didn't pay 70%. So many legal ins and outs.

tblue37

(68,408 posts)WarGamer

(18,495 posts)Bonn1997

(1,675 posts)It is part of our country’s statistical illiteracy. I’ve heard many people, including commentators, talk about the idea that you can keep more money sometimes if you earn less because it keeps your tax rate lower. That of course is not possible.

Calista241

(5,633 posts)Nobody gets really, really rich through taking a regular salary that's subject to regular tax rates.

Extremely rich people are typically compensated in stock / options, granted at certain times and under certain conditions in thei r employment. And those stocks / options are is not worth anything until it is sold. When it is sold, it's usually treated as capital gains and taxed at that rate. This is how Steve Jobs, Michael Dell, Donald Trump, and other very rich people always took a salary of $1.

And it's not as simple as just increasing capital gains tax rates either. Unions, retirees, and others have come to rely on the market for their income. Increasing their capital gains taxes would have a severely detrimental effect.

Increase capital gains taxes too much, and people may choose to invest in the market less, which means companies are worth less, and have less capital to invest in employees, facilities, growth, R&D, and other projects. Companies, with a handful of exceptions, do not just sit on money. They may keep some savings as a backup for hard times, but for the most part, this money is invested in the company.

The current 15% capital gains rate can surely be increased, but the trick is to do it without going too far.

jmowreader

(53,090 posts)Have one for retirees living on income from investments.

Another for people who buy and hold stock.

And a higher rate for people buying stock with incentive stock options, which is how rich people get paid.

WarGamer

(18,495 posts)Calista241

(5,633 posts)And lots of options are exercised by an estate for people that are in that age range. There's always going to be ways to game the system. It's a hard question, with no easy answers.

It just irks me that people are like "tax them at 70% or 90%" as if that solves all our problems.

JI7

(93,491 posts)but for the things that some people call for it would mean taxing just about everyone a lot more.

Those countries in Europe they point to have all people paying a lot more taxes than we do here.

OnlinePoker

(6,119 posts)According to the link upthread, the top 10% paid 69.5% of all income tax in 2016.

Moostache

(11,134 posts)Yeah, they paid a majority of total dollars, but the percentage of their income that was taxed was significantly less than most I believe...if I am wrong I am sure someone can set me straight,...

OnlinePoker

(6,119 posts)As someone else has pointed out, though, these figures were before Trump gave them a massive tax cut so it will be interesting to see how much of a difference that cut made to how much they pay.

OnlinePoker

(6,119 posts)No capital gains taxes at all. It would sure make the tax code a lot easier.

jmowreader

(53,090 posts)In the OLD days, the capital gains tax encouraged people to leave their money in an investment long-term.

But since that's an increasingly rare style of investing, it's pretty much become a preferential tax rate for people who can afford to wait two years to cash their paychecks.

muriel_volestrangler

(106,037 posts)The "people may choose to invest less" argument can equally be made for work; the difference is that if you don't invest your excess money, you have little choice other than to spend it (which still helps the economy). If you decide that you're taxed too heavily for it to be worth working more, then you may just do nothing instead. So high taxation of capital gains matters less than of true earnings from work.

BobTheSubgenius

(12,203 posts)Especially someone who, I'm sure, wants to be known for his intelligence and acumen.

roamer65

(37,896 posts)Suck on that, Dell.

ZonkerHarris

(25,577 posts)ChoppinBroccoli

(3,900 posts)Probably for a different reason, though. You know what I'm talking about.

Warpy

(114,547 posts)Never mind there was such a sustained boom that they were raking in the dividends.

IOW, check out those historic P/E ratios, dumbass.

JHB

(38,136 posts)Let's use a snapshot of good ol'1955, right smack in the middle of "I want my country back" territory.

There were 24 tax brackets. Converted to 2013 dollars (because those are the numbers I have) 16 of them kicked in at incomes above the $250K mark. Back in the Obama years the debate was "Is $250K 'rich'?" but, as if by magic, nobody mentioned that during WW2/Cold War capitalism, 2/3rds of the tax brackets affected incomes above that mark.

11 of those 1955 brackets affected incomes above the equivalent of $500K. 45%.

The top rate of 91% kicked in on taxable income above about $3.5 million.

It's not as if that did anything for us, unless you count getting out of the Depression, beating the Nazis and Imperial Japan, widespread postwar prosperity, and winning the Cold War. But if those thing were important surely we'd hear about them from TV talking heads with multi-million dollar incomes that would be directly affected by rates like that, wouldn't we?

colsohlibgal

(5,276 posts)Yep it all worked well from FDR to the B Hollywood Actor.

Reagan did a ton of Damage....BTW the two Presidents that cases the most damage in my lifetime were both non Politicians and both Republicans.

Think we are in for a turbulent times going forward, there are millions of people who have taken leave of their senses and lots of them are armed to the teeth.

UpInArms

(54,768 posts)Nearly 100 Fortune 500 companies effectively paid no federal taxes in 2018, according to a new report.

The study by the Institute on Taxation and Economic Policy, a left-leaning think tank, covers the first year following passage of the Tax Cuts and Jobs Act championed by President Donald Trump, which was signed into law in December 2017.

Gannett

INTL FCStone

Murphy Oil

AECOM Technology

International Business Machines

CenturyLink

DowDuPont

Activision Blizzard

Avis Budget Group

Celanese

JetBlue Airways

Deere

First Data

Duke Energy

Pitney Bowes

Freeport-McMoRan Copper & Gold

WEC Energy Group

Levi Strauss

Brighthouse Financial

Aramark

Whirlpool

Prudential Financial

Trinity Industries

Ryder System

United States Steel

Eli Lilly

CMS Energy

Tapestry

EOG Resources

Beacon Roofing Supply

SPX

Realogy

Public Service Enterprise Group

Rockwell Collins

Goodyear Tire & Rubber

MDU Resources

FedEx

Williams

SpartanNash

Chevron

Delta Air Lines

Edison International

Penske Automotive Group

Principal Financial

PulteGroup

Air Products & Chemicals

Honeywell International

Netflix

General Motors

Tenet Healthcare

Xcel Energy

Halliburton

MGM Resorts International

Atmos Energy

Molson Coors

Nvidia

PPL

American Electric Power

Starbucks

Dominion Resources

Mohawk Industries

DTE Energy

Amazon

Andersons

Kinder Morgan

Owens Corning

Devon Energy

DXC Technology

FirstEnergy

Ameren

Hartford Financial Services

Alaska Air Group

Darden Restaurants

Ally Financial

Sanmina-SCI

Builders FirstSource

McKesson

Occidental Petroleum

UGI

Westrock

AK Steel Holding

ABM Industries

Cliffs Natural Resources

AMR

Chesapeake Energy

HD Supply

Navistar International

Pioneer Natural Resources

Salesforce.com

Visteon

https://www.cnbc.com/2019/12/16/these-91-fortune-500-companies-didnt-pay-federal-taxes-in-2018.html

Amishman

(5,927 posts)exceptions, loopholes, and credits made sure no one actually paid anything near those top line rates.

https://www.taxpolicycenter.org/taxvox/effective-income-tax-rates-have-fallen-top-one-percent-world-war-ii

In 1945, when the top statutory income tax rate was 94 percent, the effective tax rate on the top 1 percent was about 40 percent. Taxpayers with even larger incomes faced even higher effective tax rates, peaking at about 65 percent of income for those in the top 0.001 percent. In other words, those taxpayers paid about 65 percent of their AGI in federal income taxes.

Picaro

(2,376 posts)Michael Dell apparently spent more time in his dorm room building PCs than attending class at UT.

Both the US and the UK are classic cases of government being starved for tax revenue and harming the greater percentage of the population.

Only the upper 10% of the country do well as their wealth has shot up while the economically disadvantaged refuse to vanish in spite of all that incentive provided to them.

The argument goes like this… If you tax the well off they will suddenly stop working and stop creating all that wealth that they create. But if you start the poor they will suddenly discover those bootstraps that they’ve been failing to utilize all these years and with a mighty groan and a massive shove they will pull themselves up into the lower middle class.

The truth is that high tax rates on the economically advantaged create a world that is much much better than the world we live in today. Life is better for not only the less well-off but also that are for those that are well off.

bucolic_frolic

(54,812 posts)Aussie105

(7,818 posts)I bought 2 Dell laptops at the end of last year.

Based on price and technology inside them.

If I'd known Mr Dell was such a creep, I'd shopped elsewhere.

JCMach1

(29,177 posts)Rather than gamifying their capital

KY_EnviroGuy

(14,774 posts)Typical Texas bidnessman, wanting cheap labor and no gubmint.

All hat, no cattle.........![]()

Beartracks

(14,540 posts)If something provides for the health, safety, welfare, and economic wellbeing of the majority of Americans, especially the low- and middle-class, then it is not, according to Republicans, "working," because it is not maximizing profits for the rich. Only policies and priorities that maximize profits for the rich are what "works," according to Republicans.

===============