General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forums'Black Swan' author Nassim Taleb says bitcoin is an open Ponzi scheme and a failed currency

The "Black Swan" author Nassim Taleb doubled down on his view that bitcoin is an open Ponzi scheme and a failed currency in a CNBC interview on Friday.

"There's no connection between inflation and bitcoin," Taleb told CNBC, adding that everyone knows bitcoin is "a Ponzi."

Some analysts view the cryptocurrency, often referred to as digital gold, as a hedge against inflation, highlighting its similarities with the precious metal.

"If you want to hedge against inflation, buy a piece of land," Taleb said. "The best strategy for investors is to own things that produce yields in the future. In other words, you can fall back on real dollars coming out of the company."

https://www.msn.com/en-us/money/markets/black-swan-author-nassim-taleb-says-bitcoin-is-an-open-ponzi-scheme-and-a-failed-currency/ar-BB1fYMY2

kimbutgar

(27,119 posts)I tried to understand it and never could understand its legitimacy. I felt it was scammy then and this was back in 2014.

Fools and their fake money!

PoliticAverse

(26,366 posts)Hugh_Lebowski

(33,643 posts)Can never go wrong with that ![]()

Hugin

(37,757 posts)Stored in a cool dry place for a rainy day. Don't cha know it. ![]()

ret5hd

(22,418 posts)NoRethugFriends

(3,718 posts)Bettie

(19,566 posts)money laundering for various criminal enterprises and the rubes they hook to wash it for them.

obamanut2012

(29,307 posts)speak easy

(12,595 posts)There are bitcoin bugs like there are gold bugs.

zipplewrath

(16,698 posts)A whole bunch of people assigning value to a random item, in hopes other people will add more value to it. What happens when someone creates a new random item that people like better?

Celerity

(54,102 posts)Last edited Sat Apr 24, 2021, 11:24 AM - Edit history (1)

Also, tulips are not durable, bitcoins are, and tulips relied on a an extremely laborious, time intensive, and expensive supply chain to produce a fiduciary transfer of wealth, bitcoins can been used/redeemed with a few keystrokes anywhere on the globe.

hedda_foil

(16,977 posts)Although in their buyers' defense, when the price of tulips went to zero, the guys left holding the bulbs could either plant them or eat them. With bitcoin, there's not even that.

efhmc

(16,455 posts)Tulips contain alkaloid and glycoside compounds that are toxic and are concentrated in the bulb. Eating tulip bulbs can cause dizziness, nausea, abdominal pain and, rarely, convulsions and death.

hedda_foil

(16,977 posts)efhmc

(16,455 posts)OhZone

(3,216 posts)Doggie Coin?

PufPuf23

(9,776 posts)Taleb is an extremely intelligent and insightful man.

Celerity

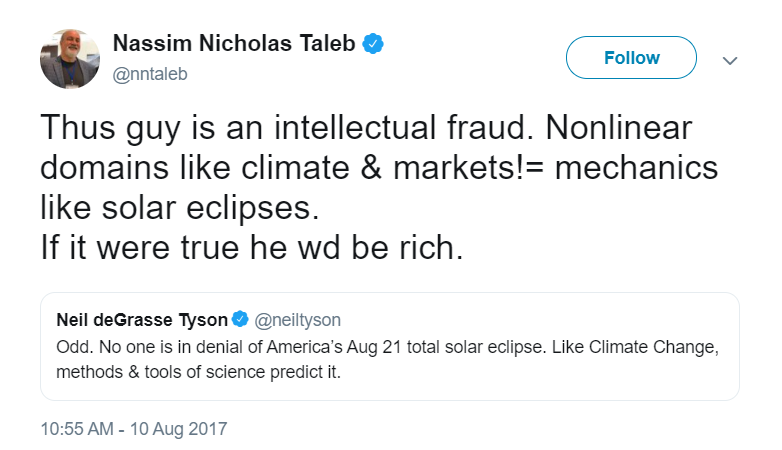

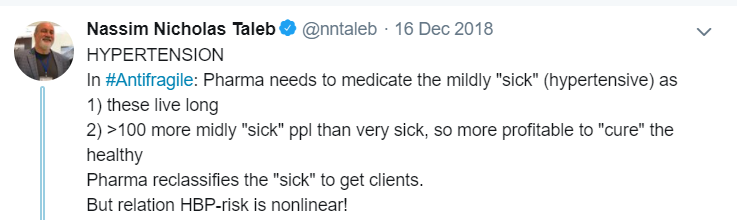

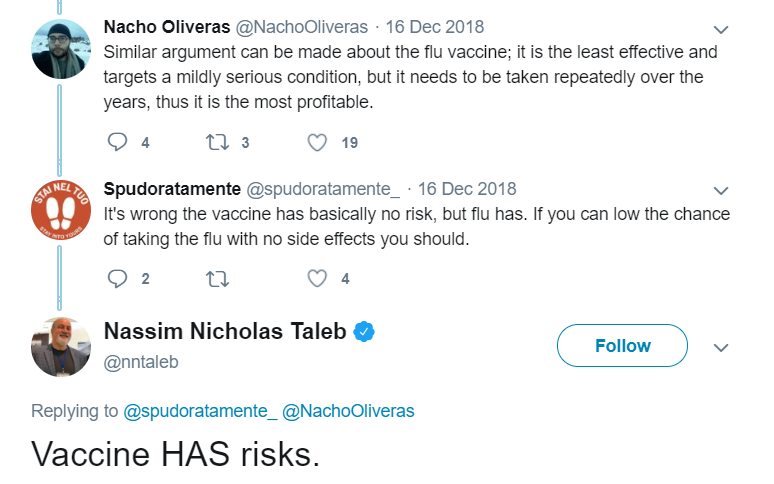

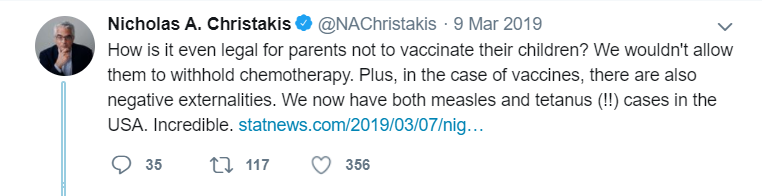

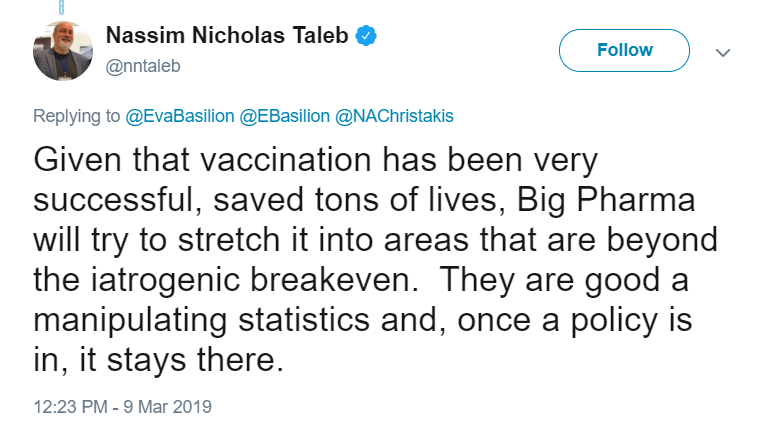

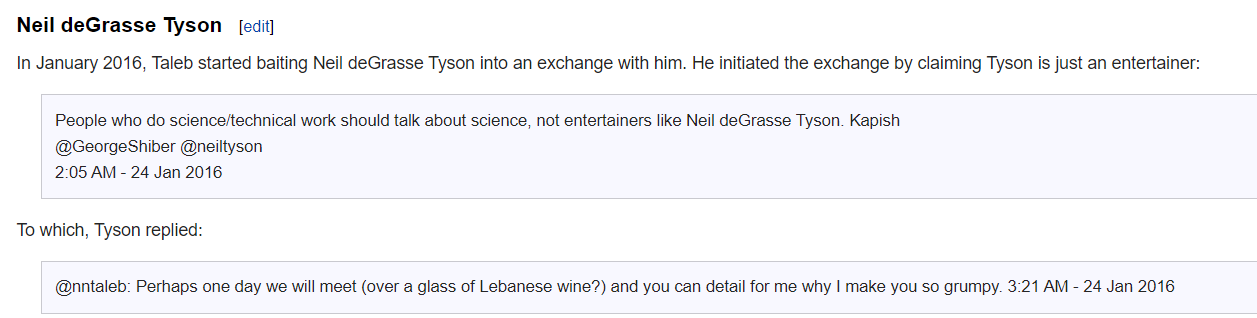

(54,102 posts)past to being fairly hostile to some vaccines (saying that Big Pharma will push them too much just to profit off them) due to selective use of his pet theory of iatrogenics, and has a long history of attacking/mocking atheists, plus smears and libels people like Neil deGrasse Tyson (whom he, ironically, accuses of being a showman, not a scientist, and calls him a fraud), etc.

Link to tweet

Lots more info here: https://rationalwiki.org/wiki/Nassim_Nicholas_Taleb

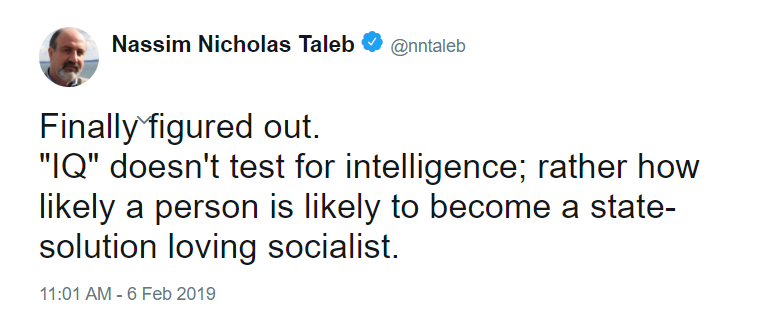

Taleb also calls IQ a complete pseudoscientific swindle and uses (as he so often does) multiple strawmen and no sequiturs in his attacks (quote 'Finally figured out. "IQ" doesn't test for intelligence; rather how likely a person is likely to become a state-solution loving socialist.' end quote):

http://archive.is/nhGxk

Vani Hari aka Food Babe (a crackpot pseudoscience pusher) has praised Nassim Taleb on her Facebook page, quoting his quack conspiracy beliefs:

https://www.facebook.com/thefoodbabe/photos/1089566281078082/

Fughedabout the "victim" business. And it is not about enemies building you up, that's not the point. There a *real thrill* feeling that you are risking something for your ideas. The more risk, the more skin-in-the-game, the more thrill. The more they attack you, the more skin-in-the-game, the more you feel honorable. I cannot describe the sentiment: all I can say is that it is the exact opposite of shame.

He is always pushing CT that Big Pharma and Big healthcare mainly want to just profit off the mildly ill as they live longer and are thus more viable profit centres than extreme ill people

Link to tweet

Nassim Nicholas Taleb now pro-homeopathy as well as anti-GMO

https://geneticliteracyproject.org/2016/01/05/nassim-nicholas-taleb-now-pro-homeopathy-as-well-as-anti-gmo/

Link to tweet

You Are All Soft! Embrace Chaos!

A reader could easily run out of adjectives to describe Nassim Nicholas Taleb’s new book “Antifragile: Things That Gain From Disorder.” The first ones that come to mind are: maddening, bold, repetitious, judgmental, intemperate, erudite, reductive, shrewd, self-indulgent, self-congratulatory, provocative, pompous, penetrating, perspicacious and pretentious.

https://www.nytimes.com/2012/12/17/books/antifragile-by-nassim-nicholas-taleb.html

snip

And some of his observations are just wilfully perverse. He suggests, for instance, that administering mammograms to “women over 40 on an annual basis does not lead to an increase in life expectancy,” because a doctor, seeing a tumour, “cannot avoid doing something harmful, like surgery followed by radiation, chemotherapy, or both — that is more harmful than the tumour.”

Mr. Taleb seems to revel in being contentious and controversial, perhaps betting that such notoriety will win him and his book some added buzz. He consigns television, air-conditioning, newspapers and economic forecasts to the category of “offensive irritants.” And he talks about rationing the supply of information because, he insists, “the more data you get, the less you know what’s going on.”

“Antifragile” is also riddled with contradictions. Mr. Taleb offers predictions about the future, though he keeps talking about the unreliability of predictions. He repeatedly attacks theorists and academics as the sorts of people who would presume to “lecture birds on how to fly.” And yet he’s an academic himself (whose main subject matter, his book jacket tells us, is “decision making under opacity”), and the book he’s written is nothing if not one big, hyperextended, overarching theory about how to live in a random and uncertain world.

IS MEDICINE A THREAT TO YOUR ANTIFRAGILITY?

https://drug-dev.com/management-insight-antifragile-nassim-taleb-on-the-evils-of-modern-medicine/

Taleb argues that the side effects of medication are unpredictable. We simply don’t have enough history to truly predict outcomes. Medicine is like tobacco, which when it first was introduced was purportedly good for you. There was no “proof ” to the contrary as it took decades for the evidence to accumulate. Thalidomide was prescribed as an antinausea medicine but its side effects on the unborn fetus weren’t clear for a few years. He takes these anecdotal stories as fodder for his theory that medicine is only justified if it’s efficacy has been proven for thousands of years, or if the benefit is so great that any possible side effect is justified (ie, an oncology product that might save your life). Taleb started in the financial world, and he seems to view medication through the same lens as one might view a financial option. Does the upside outweigh the downside? Then he generalizes based on a few anecdotes that for every known side effect there are potentially countless horrific and quite possibly deadly unknown side effects that simply haven’t come to light yet. When he puts this huge potential negative on the scale beside the known side effects, giving it in effect more weight and value than the known side effects, it is a small wonder that his scale never balances. The result from this logic is that you would never take a pill unless you are certain it will save your life.

Somewhere between a minor blood pressure anomaly and a potentially terminal cancer lies the true balance. His accusation that physicians overprescribe may be true in some fields, particularly the use of psychotropic drugs in children, but most of his discussion of iatrogenics is anecdotal and relies heavily on outdated practices, including the practice of bleeding out patients – the death of George Washington in 1799, and a study of children in 1930. Apparently, because of these mistakes, we should throw out the vast majority of modern medical science. Given Taleb’s very biased approach to medical research, it comes as no surprise that he completely bypasses any discussion of the benefits of modern medicine. The Green Agricultural Revolution, for example, fed billions of people who would have starved if only natural agricultural techniques were used.

But the most glaring of all omissions is the complete or near eradication of smallpox, polio, TB, cholera, and the bubonic plague from our lives. These vaccines do not meet his criteria. Because it cannot be shown that a single vaccine will save your life, and because we cannot predict whether or not it will save you (not until we have a thousand years of evidence), vaccines should, by his logic, be avoided. It’s precisely this type of thinking that spurs anti-vaccination campaigns and has now caused the reintroduction of some of these midcentury diseases. Epidemics themselves are in fact nonlinear, and it is this fact that has taught us how to eradicate them. Take malaria, for example. It is ridiculous to think that we could get rid of this disease by eliminating all mosquitoes. There are simply too many. But because epidemics are non-linear, they have thresholds. We don’t need to get rid of all mosquitoes to stop the disease; we only need to reduce their population to below the epidemic threshold. This logic has led to the elimination of many diseases, and it is this logic that will save millions of lives going forward.

AN EDGY ARGUMENT GOES OVER THE EDGE

Somewhere along the way, Taleb takes a well-reasoned argument and pushes it off a cliff. Nothing can be trusted if it hasn’t been tried through the millennia. Not even papayas. Taleb avoids all fruits without a Greek or Hebrew name because his ancestors would not have eaten them. Not even fruits that other cultures have eaten for thousands of years pass his threshold for reliability. He drinks only beverages that are at least a thousand years old. By his logic, most of our industry might just as well close up shop right now, because unless your molecule will save a life from a very imminent death, it’s just not worth the risk.

Neil deGrasse Tyson's Epic Reply to Nicholas Taleb's Condescending Tweet.

https://ginosblog.home.blog/2016/01/25/neil-degrasse-tysons-epic-reply-to-nicholas-talebs-condescending-tweet/

greenjar_01

(6,477 posts)week was...well...interesting.

Fool and his money, etc.

RandiFan1290

(6,701 posts)Celerity

(54,102 posts)unless I could find a worse forum to discuss blockchain, crypto, etc. than DU, I would be assuming room temperature posthaste.

FrankChurchDem

(12,692 posts)Lost cause.

JCMach1

(29,167 posts)Pluvious

(5,364 posts)Adoption of DLT, Blockchains, DeFi, smart contracts, and the World's inevitable migration to the Internet of value will surprise many.

But it's gonna be disruptive as well.

Few...

Celerity

(54,102 posts)President Biden

Pluvious

(5,364 posts)Where every decision is based on the answer to "what's in it for me?"

StatWoman

(519 posts). . . like all those "innovative" financial instruments in the mid-2000s.

Hugin

(37,757 posts)I really believe much of the market instabilities we are experiencing now rippled out of that episode of shame.

Fortunately, most of the drivers of that fiasco are gone from positions where they can keep it going. The seven have succumbed to the attrition of time.

But, as we're seeing Nature abhors a vacuum, so another new day will yield it's own scam.

NQAS

(10,749 posts)But around 20 years ago I heard about Enron and wondered how they made money. It just didn’t make sense. Turns out I was right. I also can’t figure out cryptocurrency.

GumboYaYa

(6,001 posts)I could not understand their business and kept asking questions. Eventually it became clear to all of them that I just was too unsophisticated and not smart enough to understand how they were building the new economy. Cryptocurrency and its proponents certainly does feel the same way.

Emrys

(9,033 posts)Cryptocurrency mining uses huge amounts of power—and can be as destructive as the real thing.

Money, it’s often said, is a shared fiction. I give you a slip of paper or, more likely these days, a piece of plastic. You hand me eggs or butter or a White Chocolate Mocha Frappuccino, and we both walk away satisfied. With cryptocurrency, the arrangement is more like a shared metafiction, and the instability of the genre is, presumably, part of the thrill. Dogecoin, a cryptocurrency that was created as a spoof, has risen in value by eight thousand per cent since January, owing to a combination of GameStop-style pumping and boosterish tweets from Elon Musk. On Tuesday, which backers proclaimed DogeDay, the cryptocurrency was valued at more than fifty billion dollars, which is more than the market cap of Ford. Coinbase, a cryptocurrency exchange, went public last Wednesday; almost immediately, it became worth more than G.M.

The mainstreaming of cryptocurrency, as it’s been called, is obviously a big deal for the world of finance. It’s also a big deal for the world of, well, the world. This is particularly true in the case of the ur-cryptocurrency, Bitcoin. Like Dogecoin, bitcoin has recently surged in value. In April, 2020, a coin was worth about seven thousand dollars; today, it’s worth more than fifty-five thousand. (It hit a record high of $64,895.22 on April 14th, but has since fallen off.) As the cost of investing in bitcoin has soared, so, too, has the potential profit in “mining” it. Bitcoin mining is, of course, purely metaphorical, but the results can be every bit as destructive as with the real thing.

According to the Cambridge Bitcoin Electricity Consumption Index, bitcoin-mining operations worldwide now use energy at the rate of nearly a hundred and twenty terawatt-hours per year. This is about the annual domestic electricity consumption of the entire nation of Sweden. According to the Web site Digiconomist, a single bitcoin transaction uses the same amount of power that the average American household consumes in a month, and is responsible for roughly a million times more carbon emissions than a single Visa transaction. At a time when the world desperately needs to cut carbon emissions, does it make sense to be devoting a Sweden’s worth of electricity to a virtual currency? The answer would seem, pretty clearly, to be no. And, yet, here we are.

https://www.newyorker.com/news/daily-comment/why-bitcoin-is-bad-for-the-environment

OneGrassRoot

(23,943 posts)and the fact that terrorists love cryptocurrency, I don't get why a certain segment of the left adores cryptocurrency.

JCMach1

(29,167 posts)So, honestly the electricity arguments are ultimately pearl clutching of the first order...

NickB79

(20,299 posts)It's clear that BT consumes massive quantities of electricity in it's creation.

JCMach1

(29,167 posts)To Proof of Stake...

Also note, a lot (not all for sure) of the mining going on currently is with electrical wastage. In TX, it's done with NG blowoff.

HariSeldon

(540 posts)Blockchain is a legitimate technology with many interesting and viable uses. Personally, I'd love the level of security a real Bitcoin transaction has when I use a credit card for payment. I've been in the payment card industry for years and, comparatively, their security is a joke.

But insofar as the value of Bitcoin (Etherium, Dogecoin, and all the others), I agree: total Ponzi scheme.

Sgent

(5,858 posts)The technology almost doesn't matter -- its the bank that stands behind that technology. As long as I'm confident that the bank will reverse any fraudulent charges, I don't care about the implementation.

If your wallet / account gets stolen because you installed software with a backdoor (like most of the S&P500 and Solarwinds), you have lost your entire bank account with no recourse.

Moostache

(11,133 posts)Yavin4

(37,182 posts)Best guess is that some version of it will survive and create the next class of mega billionaires. See Amazon's survival of the dot com boom/bust.

hunter

(40,599 posts)When the Beanie Babies market collapsed people still had the beanie babies.

https://en.wikipedia.org/wiki/Beanie_Babies

When Bitcoin market collapses all that's left is bits.

nuxvomica

(14,017 posts)Apparently "miners" have been able to restart abandoned fossil-fuel power generation plants for the sole use of the mining, plants that couldn't be restarted under current rules if they supplied retail power to customers so they are taking advantage of a loophole in regulation, allowing them to pump more carbon into the atmosphere. And someone said that bitcoin generation worldwide uses more energy than all of Argentina. As the discussion went on, I kept trying to think of what benefit bitcoin offers society, considering it's a currency that doesn't create jobs (except at the dirty power plants) or produce anything of practical value but it does seem to be one part of a multifarious assault on democratic governance, specifically government's control of currency, which is an assault on the people generally.

hunter

(40,599 posts)A single bitcoin transaction requires as much energy as several thousand ordinary bank card transactions.

Metaphorical

(2,620 posts)I've watched the Bitcoin "industry" rise and fall pretty much from its inception, and somewhere in the ether I have a few thousand ecoins that were given to me for some consulting as a gratuity (I might actually be able to buy a cup of Starbucks with it if I can ever figure out where they went). The underlying tech for bitcoin, blockchain, similarly seemed like a fairly silly idea, because it assumed that you can build trust networks without human trust. The problem with trustless networks is that at the end of the day, there is no one to sue if something goes wrong, and no amount of prime factoring or similar NP tasks will solve that particular problem.

Beware of NFTs, which are basically ICOs (link Bitcoin) dressed up as certificates of authenticity.

empedocles

(15,751 posts)A Gold Mine Is a Hole in the Ground ... - Quote Investigator

https://quoteinvestigator.com/2015/07/19/gold-mine

Jul 19, 2015 · The columnist began with a very funny and facetious remark attributed to Mark Twain:

1 ''A gold mine is a hole in the ground with a liar standing on top of it.''

Tomconroy

(7,611 posts)by the full faith and credit of a government. Crypto currencies are backed by the full faith and credit of six guys in Green Bay, Wisconsin.

Binkie The Clown

(7,911 posts)as computer memories around the globe are wiped clean.

Calculating

(3,000 posts)That's basically a end of the world as we know it event

NickB79

(20,299 posts)It would be a global natural disaster. Wiped computer memories? Pfff, how about fried transformers that would take years to replace.

Binkie The Clown

(7,911 posts)You think China is going to supply us transformers when they will need them to repair their own grid?

cinematicdiversions

(1,969 posts)

lame54

(39,497 posts)Johonny

(25,965 posts)would appear to be their problem. While each coin has a different scheme to their creation, the fact is; it doesn't appear to take all that much for someone to create a new one. I assume the market will continue to be flushed with new fade coins. In the end, buying gold or silver is likely a better long term bet if you want an asset such as this. Gold and silver have a history of desire in mankind that predates actual written history whereas these virtual coins have the feel of ancient Chinese paper currency...

Celerity

(54,102 posts)Also the rewards for bitcoin mining are reduced by half every four years, and the complexity of the equations constantly increases. Bitcoin is designed to evaluate and adjust the difficulty of mining every 2,016 blocks, or roughly every two weeks.

There are 18.7 million or so BTC in existence, with only 2.3 million or so left to be mined. 21 million was the cap from the beginning. Depending on which estimates you buy into, 4 to 6 million have been permentty lost/or are irretrievably locked up.

There are thousands of explanatory resources out there about blockchain and crypto.

ETA

Perhaps you meant new coin systems.

rgbecker

(4,890 posts)Thousands in fact.

https://www.google.com/search?safe=active&client=firefox-b-1-d&sxsrf=ALeKk00CB8TbE4vkCDYjMtyP960XDvw2DQ%3A1619271364563&lei=xB6EYK7iIb-v5NoPormkuAc&q=cryptocurrencies%20list&ved=2ahUKEwiu1Orz_5bwAhW_F1kFHaIcCXcQsKwBKAF6BAgxEAI&biw=1366&bih=626

I think Johonny is on to something here.

Celerity

(54,102 posts)rgbecker

(4,890 posts)Or will it reach a point and finally stabilize in price in relation to say a bushel of corn? At that point, will people continue to hold or will they move to another cryptocurrency or other investment that has potential to increase in value? If that occurs, and more and more people move out of Bitcoin, and the value of a Bitcoin falls, at what point will the price then stabilize on the low end? Most investors, in my experience, are looking for some return on their investment rather than just a stabilized value. If another investment returns anything at all compared to the Bitcoin, whose only value is the possibility of increase in market price based on speculation, I don't see any future for it.

Celerity

(54,102 posts)I am not concerned with migration atm

I keep my private keys on discrete and redundant IronKey-stored wallets, offline, on hardware, no online presence, so no chance of an online wallet being hacked

my cost basis (from Q2 of 2012) per BTC is over 7,500 times less than the current price

so my returns are not an issue

I have redeemed no BTC in the past 9 years, no transactions since I was gifted them for my 16th birthday by my father

I do not trade crypto, the delta is far too much for my tolerance, but I am quite patient in terms of a longer term even horizon in regards to my holdings

muriel_volestrangler

(106,006 posts)It produces nothing. You are predicting that other people will want to pay more for it in the future, because they think other people will want to pay even more after that, and so on. Unlike frozen concentrated orange juice, whisky, or gold, it has no intrinsic use. Even a painting is decorative.

Celerity

(54,102 posts)A satoshi is currently the smallest unit of the bitcoin currency recorded on the block chain. It is a one hundred millionth of a single bitcoin (0.00000001 BTC)

A person doesn't have to buy or redeem a whole BTC at all.

I invested nothing, I was given bitcoins for my 16th birthday by my father after a he bought them whilst in NYC on a business trip, and one of his co-workers in the NYC main trading desk of his bank talked him into buying some on spec in 2012. I have sat on them for almost 9 years, including the massive plunge from December 2017 (almost 20K usd per BTC at peak) down to its toughing out in Q1 2019 at well under 4K usd per BTC.

Initech

(108,416 posts)And the people who are getting rich off it are people who you who you wouldn't trust with 15 cents, let alone $15 million. ![]()