General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsRECESSION PRECEDED PANDEMIC

I had previously posted that Donnie and his criminal minions had driven the national economy into the ground BEFORE the pandemic, quite to the contrary of the mantra of his supporters and Congressional Repubs, that the economy was ROARING until poor Donnie was blind-sided by the pandemic. After inheriting an expanding economy from Obama, the economy kept slowing, and slowing, until finally contracting.

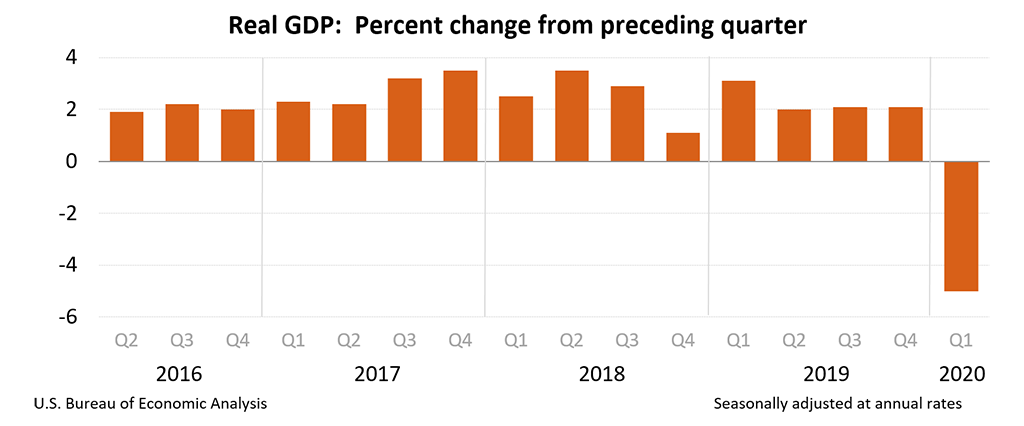

Welp, the NBER (the official private-sector documenter of economic cycles) has officially confirmed the national economy crashed into recession in February 2020, prior to the pandemic. The first death from Covid-19 was on February 29th, which if not a leap year, would have been March 1st, and Donnie said don't worry, it's just one Chinese guy, we have it contained.

According to the National Bureau of Economic Research, the contraction lasted just two months, from February 2020 to the following April.

Though the drop featured a staggering 31.4% GDP plunge in the second quarter of the pandemic-scarred year, it also saw a massive snapback the following period, with previously unheard of policy stimulus boosting output by 33.4%.

https://www.cnbc.com/2021/07/19/its-official-the-covid-recession-lasted-just-two-months-the-shortest-in-us-history.html

Walleye

(44,062 posts)Now it turns out we have shrunk life expectancy by a year and a half. Still he will not go away, after losing the national vote twice and being impeached twice, he should realize the majority of American people hate his guts. Yet the Republicans can’t wait to put him on top of their ticket again. They are a death cult as they’re intent on killing their own party

Response to Walleye (Reply #1)

Chin music This message was self-deleted by its author.

Walleye

(44,062 posts)OAITW r.2.0

(31,731 posts)foundation. Covid simply accelerated the problematic results. Turns out Trump made America Weaker Again. It's what Republicans always do. It ain't Government that makes things worse, it's Republican policies that have done this since Reagan was in office.

WarGamer

(18,328 posts)The OP isn't quite... clear on what the NBER said

https://www.nber.org/news/business-cycle-dating-committee-announcement-july-19-2021

The NBER goes by months, not dates. It doesn't say the "crash" was in February. It says:

"The previous peak in economic activity occurred in February 2020."

So there's THREE data points.

Feb (peak)

March (crash)

April (trough, end of recession)

February was the PEAK of the economic expansion.

March was the crash, specifically approx 3/20

And April formed the "trough" which NBER called the end of the recession, stating

"In determining that a trough occurred in April 2020, the committee did not conclude that the economy has returned to operating at normal capacity. An expansion is a period of rising economic activity spread across the economy, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. Economic activity is typically below normal in the early stages of an expansion, and it sometimes remains so well into the expansion.

The committee decided that any future downturn of the economy would be a new recession and not a continuation of the recession associated with the February 2020 peak. The basis for this decision was the length and strength of the recovery to date.

In determining the date of a monthly peak or trough, the committee considers a number of indicators of employment and production. In the current case, all of those indicators point clearly to April 2020 as the month of the trough."

I posted:

"the national economy crashed into recession in February 2020"

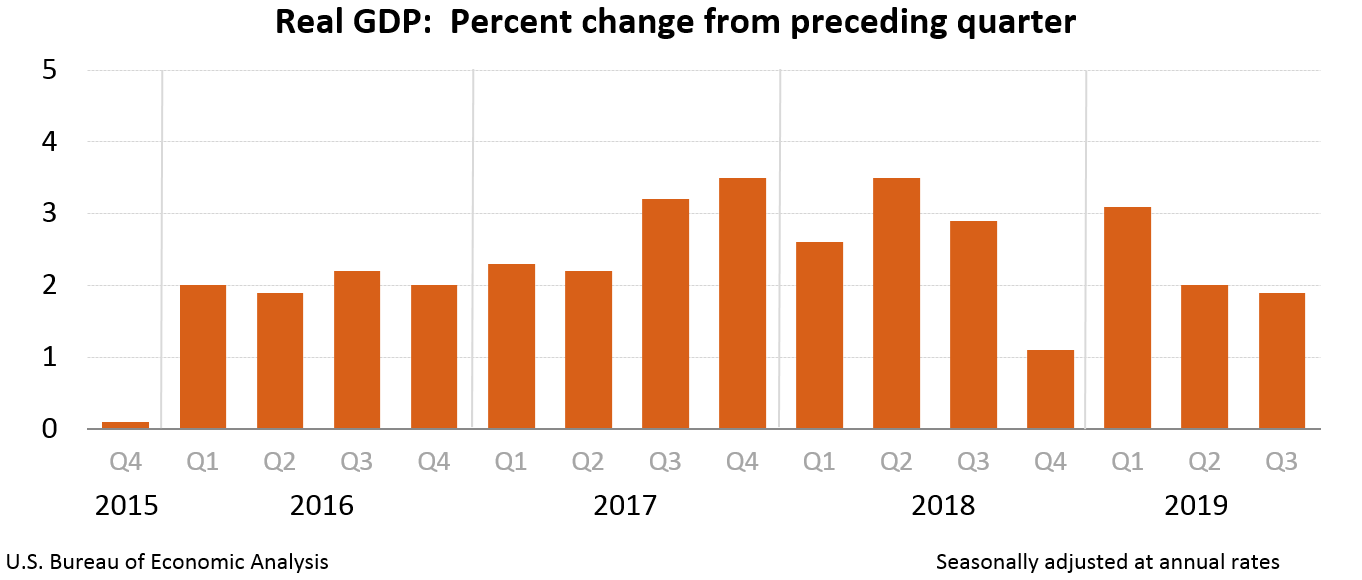

That's silly, as GDP had been declining in 2019:

The third week of March was the lockdown. The economy was already in recession for a month and a half.

WarGamer

(18,328 posts)I'm just clarifying the link to your OP.

According to them the Obama expansion ran through Feb 2020 (the peak)

Your 2015-2019 partial graph is irrelevant.

No big deal, this is complex stuff...

But according to the NEBR the recession lasted 2 months, March and April.

To help you understand the NEBR terminology...

https://www.investopedia.com/terms/b/businesscycle.asp

"Recessions start at the peak of the business cycle—when an expansion ends—and end at the trough of the business cycle, when the next expansion begins."

So "peak" doesn't mean the highest point since the Obama expansion began, it means the end of the expansion

February was the "final month" of the Obama 10+ year expansion...

That's funny.

I'd say the BEA (the U.S. Bureau of Economic Analysis) would beg to differ.

I don't find it to be.

On Edit:

I'm not in need of any "help" with the terminology.

Recessions start at the peak of the business cycle—when an expansion ends

Exactly, when it enters contraction. The economy entered contraction in the first week to 10 days of February.

Your graph was irrelevant to the matter under discussion.

Where the graph came from is again... irrelevant.

You're trying to expand the argument when I was just clarifying your OP and the CNBC article (who should know better)

One more time.

3 data points. Feb, March and April.

Feb was "normal" and March + April were recession. They don't flag what date, they use the whole month.

I mean seriously, just read the NEBR web page.

If you think that CNBC knows more than the the 'U.S. Bureau of Economic Analysis', there's your problem right there.

Hoo Boy.

WarGamer

(18,328 posts)WarGamer

(18,328 posts)"Exactly, when it enters contraction. The economy entered contraction in the first week to 10 days of February."

So where'd you pull that out from?

Hehehehe...

(P.S. the NEBR doesn't agree with you)

WHITT

(2,868 posts)with itself. You apparently didn't notice they had to throw their original definition of "recession" out the window to issue their recent report.

WarGamer

(18,328 posts)WHITT

(2,868 posts)Kingofalldems

(40,091 posts)WarGamer

(18,328 posts)unblock

(56,081 posts)February being the "peak month" means February was better overall than January. Negative growth for most of February means the first week or so of February would have had to have been spectacular for February overall to beat January, which had positive growth the entire month.

The idea that the first portion of February was so much better than January the it was enough to overcome a contraction later in February enough so it was still the peak month is rather far-fetched.

The far most likely scenario is that the contraction starting around the second week of *march*.

That makes it real easy for February to be better than both January and March. Hence, the peak month.

WHITT

(2,868 posts)You can't have a 'peak' in Feb if GDP has been declining for the previous year.

Now expansion stopping, positive GDP, is a different matter.

Negative GDP began in early Feb, not March.

unblock

(56,081 posts)It is possible for an economy to start contracting late in a month (February) and for that month to still be a peak of it grew more in the first part than it contracted in the second part.

Alternatively, the economy started contracting in the first part of the following month, so that March in this case was the first month to show negative growth.

So theoretically the recession started sometime between the 3rd week of February and the 2nd week of March.

In this particular recession, the initial cratering was so severe that it's possible that it started later in March but the negative growth in a small number of days at the end of March was more than enough to wipe out the meager gains from the early bulk of March.

In practice, it's very likely the contraction began thr 2nd week in March. I have access to proprietary data that strongly points to this as the beginning, though never certainly has more data than I do.

The contraction starting in early February just doesn't make sense, and there's really no data to support the idea that it began in February at all even if nber's designation of February as the peak month doesn't specifically exclude that theoretical possibility.

Make7

(8,550 posts)

Actually, that chart says the GDP was growing at an annual rate of about 2% in the 2nd and 3rd quarter of 2019. If GDP had been declining, the chart would have data below the zero point of the y-axis.

According to data from the BLS, nonfarm payroll employment increased by 289,000 in February 2020.

According to data from the BEA, real personal income was higher in February 2020 than in January or March.

The determination of the months of peaks and troughs is based on a range of monthly measures of aggregate real economic activity published by the federal statistical agencies. These include real personal income less transfers, nonfarm payroll employment, employment as measured by the household survey, real personal consumption expenditures, wholesale-retail sales adjusted for price changes, and industrial production. There is no fixed rule about what measures contribute information to the process or how they are weighted in our decisions. In recent decades, the two measures we have put the most weight on are real personal income less transfers and nonfarm payroll employment.

https://www.nber.org/research/business-cycle-dating

WHITT

(2,868 posts)The chart shows it declining. Q2 is lower than Q1, Q3 is lower than Q2. By definition it declined.

Employment/Unemployment is a lagging indicator. As someone pointed out, it's actually the laggiest of the primary lagging indicators.

And?

WarGamer

(18,328 posts)The chart shows GDP GROWTH over previous quarter.

So YES... the GDP was growing in Q2 and Q3.

lol... GDP is quarter over quarter growth!!

Negative GDP is a decline.

The previous poster is indeed, correct.

Let me know if I can help you further.

WHITT

(2,868 posts)Perhaps a new vision prescription?

Q3 GDP was lower than Q2 GDP.

Q2 GDP was lower than Q1 GDP.

By definition, declining.

WarGamer

(18,328 posts)A decline is a negative growth rate.

That's why the definition of TWO consecutive negative GDP quarters = Recession.

Words have definitions.

Seriously, this isn't a classroom. I can't teach you economics all night.

https://www.investopedia.com/terms/n/negative-growth.asp

Economists also use growth to describe the state and performance of the economy by measuring GDP. GDP takes into account a multitude of factors to determine how the overall economy is doing. These factors include private consumption, gross investment, government spending, and net exports. When an economy is growing, it is a sign of prosperity and expansion. Positive economic growth means an increase in money supply, economic output, and productivity. An economy with negative growth rates has declining wage growth and an overall contraction of the money supply. Economists view negative growth as a harbinger of a recession or depression.

Nope.

I'm afraid you're the one who needs "help" with terminology. You're conflating negative GDP with declining quarters of GDP. GDP itself does not ascend or decline. GDP is only either positive or negative.

Absolutely Laughable.

WHITT

(2,868 posts)The national economy was crumbling by late 2019:

* U.S. Durable-Goods orders sank in November by the sharpest decline in six months.

* The manufacturing sector was already in recession for six months, but the slump worsened in December as the 'Institute for Supply Management Index' fell to a 10-year low.

* According to 'BankRate', the number of auto loans that were 90-days or more 'Past Due' was at an almost 20-year high level, which was worse than at the peak of the 'Great Recession' of almost a dozen years earlier.

* Productivity, Capital Spending, Commercial Construction, and Corporate Profits were all contracting.