General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsNearly half of Americans do not earn enough to afford to rent a one bedroom apartment.

Link to tweet

Link to tweet

Link to tweet

iemanja

(57,631 posts)I don't think Bernie's statement is true. The median income in the US is $68,703. Half are above that number and half are below.

Uncle Joe

(64,577 posts)Nearly half of American workers do not earn enough to rent a one-bedroom apartment, according to new data.

Rents in the US continued to increase through the pandemic, and a worker now needs to earn about $20.40 an hour to afford a modest one-bedroom rental. The median wage in the US is about $21 an hour.

The data, from the National Low Income Housing Coalition, shows that millions of Americans – from Amazon warehouse workers to cab drivers to public school teachers – are struggling to pay rent. For the poorest Americans, market-rate housing is out of reach in virtually all of the country.

About 14% of Americans fell behind on rent payments during the pandemic – roughly double the figure before the pandemic. A federal moratorium on evictions has kept renters from being kicked out of their homes, but the moratorium lapsed last month, only to be extended into early October for those in regions hardest hit by the pandemic.

(snip)

https://www.theguardian.com/society/2021/aug/12/housing-renter-affordable-data-map

iemanja

(57,631 posts)Shocking.

NoMoreRepugs

(11,880 posts)iemanja

(57,631 posts)It was a 2021 number that google compiled from the US census and two other sources. Here is what the US census says for 2020:

https://www.census.gov/library/publications/2021/demo/p60-273.html

Slammer

(714 posts)Your number is a median of combined household incomes rather than a median of individuals.

Babies and children earn zero income (even government tax rebates are tallied to the adults in the house rather than directly to the children's income).

Teens most often don't earn enough to pay rent.

People who are retired or disabled can earn zero or some fraction of their previous income, depending on whether they paid into Social Security or have private retirement plans. Additionally, many of them have medical expenses necessary to keep them alive which would prevent them from paying rent as well (I personally fall into that category.)

People who are in college most often don't earn enough to pay rent. They live at home, find roommates, and/or take out government loans to cover their expenses.

Housewives aren't counted in official stats as "earning an income" even if their work allows someone else to leave the house and earn a handsome income. President Trump's wife falls into that category as do the spouses of many multimillionaires.

Illegal aliens often don't earn enough to live and pay rent. They're either working off the debt for their passage to whichever criminal organization got them here and are living in communal housing of some sort (have experience from my years of working on how they make that work), have roommates, or their employer provides them with some sort of minimal group housing.

Then there's people who work for somewhere close to minimum wage who just don't have enough to pay median rent.

And median rent itself a deceptive number. Rents in New York, Boston, and San Francisco which are absurdly high are averaged in with the rents from other places which are more reasonable or very low.

But no one at all pays a hypothetical median national rent.

So Bernie can post up something which is both absolutely true but which doesn't contain information which is useful apart from being propaganda to promote our agenda.

iemanja

(57,631 posts)According to this post: https://www.democraticunderground.com/?com=view_post&forum=1002&pid=16037919

Withywindle

(9,989 posts)You can't compare a "household" with two incomes combined against that of only one.

Where I live (Chicago), it's very common for single people to have roommates well into their 30s, 40s, 50s and up (I have two!). But you can't really do that with a one-bedroom if that person isn't your spouse or partner. You need at least a 2BR.

BeerBarrelPolka

(2,173 posts)Soon I will be moving back to Chicago and simply cannot afford the rents. I am single, in my 50s, and as you know, landlords demand you earn 3 to 3.5x the monthly rent. I've been looking online. Just renting a bedroom in a shared apartment is going for $850 and up depending on the location. That's around Jefferson Park and that general area. I'm going to be in trouble.

iemanja

(57,631 posts)According to this post: https://www.democraticunderground.com/?com=view_post&forum=1002&pid=16037919

NoMoreRepugs

(11,880 posts)George II

(67,782 posts)Just about where it's been for decades.

Unfortunately the average person takes these numbers as fact.

Many of those percentages in those other tweets aren't truly accurate, either.

Hoyt

(54,770 posts)Musk is not $293 Billion richer since pandemic started, as Sanders says. That’s his total wealth.

Fortunately, Musk will be paying some big bucks in taxes during next 12 months. Could be more if we raise tax rate.

Uncle Joe

(64,577 posts)Musk only made 6.7 billion in compensation for 2020.

tblue37

(68,344 posts)Hoyt

(54,770 posts)more misinformation, no matter how well intentioned.

George II

(67,782 posts)But in fact the same vial is now $26, up only $5 over several years ago. It's actually an entirely different formulation/grade/dose of insulin that costs $320.

Hoyt

(54,770 posts)cannabis_flower

(3,921 posts)I have been living in the same place for 10 years. Rent doesn’t usually go up as fast when you stay in one place it doesn’t go up as fast. I have a 2 bedroom, 2 bath for less than what a lot of people pay for a one bedroom. I pay $950 here in Houston but I probably couldn’t afford it by myself.

BeerBarrelPolka

(2,173 posts)In these parts of Illinois, you must earn 3 to 3.5x your monthly rent in wages per month. It's difficult for many people to even qualify to rent.

WhiskeyGrinder

(26,695 posts)JoeOtterbein

(7,866 posts)Jose Garcia

(3,450 posts)meadowlander

(5,109 posts)or forgo other necessities (medicine, food, retirement savings) so that they can pay rent.

You don't have to be homeless to experience housing insecurity.

Uncle Joe

(64,577 posts)Also I believe the homeless population is greatly undercounted.

George II

(67,782 posts)RussBLib

(10,465 posts)doesn't that depend on where you live? Or, what is the national average?

I wonder about DU'ers ... maybe do a poll.

Torchlight

(6,521 posts)I cited rent.com which also provides 2021 averages per state, averages per pop. density, etc.

George II

(67,782 posts)....as high as $4000-5000. I would guess that very few if any are as low as $1600.

There are thousands of one-bedroom apartments in Manhattan, that's going to skew the "average" quite a bit.

ancianita

(43,162 posts)The average rent in Hyde Park, Chicago is $2,000 (University of Chicago neighborhood);

citywide it's $1600.00 per month; so the city area prices differ from the IL state average.

https://vividmaps.com/how-much-cheaper-it-is-to-rent-than-buy-a-home-in-every-u-s-state/

Kaleva

(40,285 posts)ancianita

(43,162 posts)Kaleva

(40,285 posts)JanMichael

(25,725 posts)Or that there are plenty of affordable units everywhere? Or that people are lying about housing issues?

Kaleva

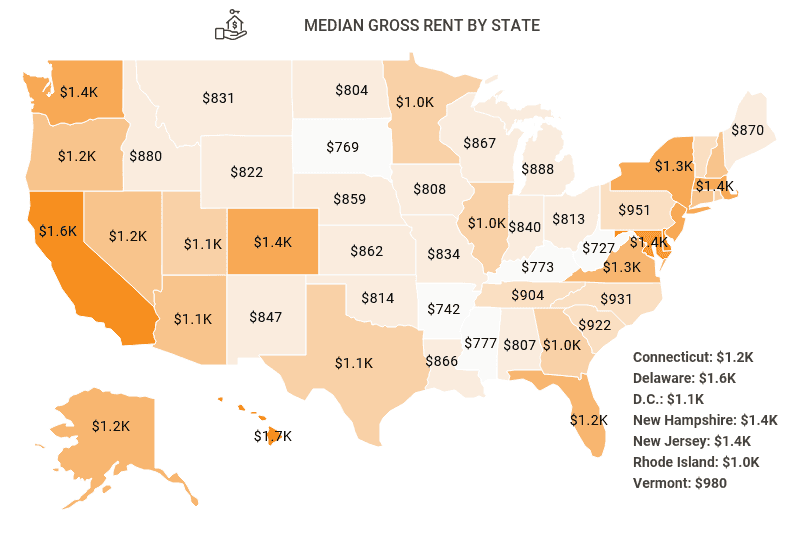

(40,285 posts)If the median rent is $888 a month, then half of the apartments are less then that. Some could be much higher then $888 a month and some could be much lower then $888 a month.

Basic math.

Beastly Boy

(13,283 posts)Median monthly rent in the US: $1098, or $13,176 annually (https://worldpopulationreview.com/state-rankings/average-rent-by-state)

Median annual income in the US: $$67,521 (https://www.census.gov/library/publications/2021/demo/p60-273.html)

Breakdown on household spending here: https://www.thebalance.com/breakdown-of-average-monthly-household-expenses-4687519

Average household personal taxes come to $10,481 (https://www.fool.com/taxes/2018/04/22/how-much-does-the-average-american-pay-in-taxes.aspx)

Half of American households would pay about 23% of their post-tax income in rent, well within the recommended 30% total income.

Brenie may have a point here, but he is not doing himself any favors when he fails to make it.

Uncle Joe

(64,577 posts)Nearly half of American workers do not earn enough to rent a one-bedroom apartment, according to new data.

Rents in the US continued to increase through the pandemic, and a worker now needs to earn about $20.40 an hour to afford a modest one-bedroom rental. The median wage in the US is about $21 an hour.

The data, from the National Low Income Housing Coalition, shows that millions of Americans – from Amazon warehouse workers to cab drivers to public school teachers – are struggling to pay rent. For the poorest Americans, market-rate housing is out of reach in virtually all of the country.

About 14% of Americans fell behind on rent payments during the pandemic – roughly double the figure before the pandemic. A federal moratorium on evictions has kept renters from being kicked out of their homes, but the moratorium lapsed last month, only to be extended into early October for those in regions hardest hit by the pandemic.

(snip)

https://www.theguardian.com/society/2021/aug/12/housing-renter-affordable-data-map

It looks to me like U.S. non-household debt has nearly doubled from 2.2 trillion in 2004 to 4.25 trillion in 2021, I believe that's a large part of the reason as to why nearly half of the American People can't afford a 1 bedroom rental.

There is a helpful graph on the link below.

https://www.newyorkfed.org/microeconomics/hhdc

George II

(67,782 posts)....vary greatly depending upon the particular area.

The average rent in Oklahoma City is $874 for an 804 square foot apartment.

The average rent in Manhattan is 4072 for a 702 square foot apartment.

Manhattan rent is more than FIVE times that in Oklahoma City.

All of those apartments, in both cities and thousands of others are among those used to stride an "average". One simply can't speak so generally about rents, income, and many other factors.

More, the cost of living index in Paducah, Kentucky is 71.6 compared to a national index of 100. The cost of living index is 258.3 in Manhattan.

Coming up with "averages" as we've seen here proves nothing.

Uncle Joe

(64,577 posts)(snip)

And it’s not just big cities skewing the data. A two-bedroom rental – a reasonable size for a family – would stretch the budgets of renters in most US counties:

(snip)

https://www.theguardian.com/society/2021/aug/12/housing-renter-affordable-data-map

George II

(67,782 posts)....draw conclusions across the United States, which has 330 million people and 157 million workers.

What blows holes in that article's conclusions is that

There is no minimum wage in Mississippi!!

Uncle Joe

(64,577 posts)If a state doesn't have a minimum wage then the federal minimum applies.

George II

(67,782 posts)It's a sloppy article and the claims being made here are inaccurate.

Uncle Joe

(64,577 posts)from the central argument that nearly half can't qualify for a one bedroom rental.

So there is nothing inaccurate about that in the article, they even knew the minimum in Mississippi.

I already showed you a link to a separate article as to how U.S. Non-household debt has nearly doubled as well from 2004 to 2021 but here it is again, perhaps you believe this is just a coincidence?

Just slide the little bar on the graph.

https://www.newyorkfed.org/microeconomics/hhdc

George II

(67,782 posts)And "Non-household" debt includes all aspects of the economy, including billions in business debt, which is only owed on paper.

Kaleva

(40,285 posts)Here is a link to a section 8 apartment not far from where I live. A 2 bdr apt goes for a $1 a month and there are units available.

https://www.realrentals.com/houses_for_rent/?city=Ontonagon&state=Michigan+MI

George II

(67,782 posts)....of miles in rural, urban, and farm areas it's impossible to draw any sweeping conclusions that are being presented in tweets in the OP.

Kaleva

(40,285 posts)Beastly Boy

(13,283 posts)make a compelling case for nearly half of American workers being unable to afford a one-bedroom apartment.

This is not to say that 25% may be unable to do so, which is bad enough. But it would be more responsible of Bernie to choose accuracy over catchy talking points.

Uncle Joe

(64,577 posts)I'm of the mind if one believes the house is on fire, don't whisper about it.

On top of that data, the link below reflects how non-household debt coincidently also nearly doubled from 2004-2021, wages of course never came close to doubling, that to me seems like an elephant in the room in regards to the economic situation of nearly half the Americans workers not being able to afford a 1 bedroom rental.

https://www.newyorkfed.org/microeconomics/hhdc

Beastly Boy

(13,283 posts)Yes, I looked at the PDF. The problem with squaring its content with Bernie's claim is that the data given in it is for a subset of Americans who are renters. By definition, this subset can afford their rent one way or another, otherwise they wouldn't be renters. The point being made in this document is that they are falling behind, not that they have been priced out of the rental market. This alone makes it impossible to square the data with Bernie's claim, since Bernie is talking about a much bigger sample (all Americans) and a much smaller subset of rental units (one-bedroom apartments). Two completely different data sets, and Bernie's set is not included in, is impossible to derive from the data examined by the NLIHC analysis, and thus remains purely hypothetical.

The second link does not tie with Bernie's statement at all, and thus neither confirms nor denies its accuracy.

Initech

(108,010 posts)It fucking sucks. ![]()

JT45242

(3,930 posts)Not sure where he came up with those statistics, but I can tell you that it is a major problem. In the Iowa City-Cedar Rapids corridor finding affordable housing can be a nightmare -- clearly not a major metroplitan area.

Seattle, San Fran, NYC, Houston, all dominate the talks because of the high population densities but the problem is real.

In far too many places, developers are allowed to build only high end homes and apartments. Where their once were apartments that poor folks could afford, cities allow gentrification and they no longer can live their. In Cincinnati, there were lots of areas that became gentrified and priced people right out of the neighborhood.

Zoning boards need to require builders to build a mix of housing at different price points. Employers need to pay a living wage.

There are many levers that move thi sproblem and using misleading statistics does not help the cause. Bernie's heart is in the right place but if you use faulty statistics then people will discount all that you say.

Uncle Joe

(64,577 posts)Nearly half of American workers do not earn enough to rent a one-bedroom apartment, according to new data.

Rents in the US continued to increase through the pandemic, and a worker now needs to earn about $20.40 an hour to afford a modest one-bedroom rental. The median wage in the US is about $21 an hour.

The data, from the National Low Income Housing Coalition, shows that millions of Americans – from Amazon warehouse workers to cab drivers to public school teachers – are struggling to pay rent. For the poorest Americans, market-rate housing is out of reach in virtually all of the country.

About 14% of Americans fell behind on rent payments during the pandemic – roughly double the figure before the pandemic. A federal moratorium on evictions has kept renters from being kicked out of their homes, but the moratorium lapsed last month, only to be extended into early October for those in regions hardest hit by the pandemic.

(snip)

https://www.theguardian.com/society/2021/aug/12/housing-renter-affordable-data-map

To me this isn't surprising, aside from that article, check out the link below for U.S. non-house debt increase from 2004-2021 (it has one of those nice graphs that you can slide the bar around) it nearly doubled as well, going from 2.2 trillion to 4.25 trillion, I'm pretty certain wages did not keep pace.

Mortgage balances shown on consumer credit reports increased by $230 billion in the third quarter of 2021 and stood at $10.67 trillion at the end of September. Balances on home equity lines of credit (HELOC) saw a $5 billion decline, continuing a declining trend in place since 2016Q4, bringing the outstanding balance to $317 billion. Credit card balances increased slightly in the third quarter, by $17 billion, after an increase of the same size in the second quarter. Still, credit card balances remain $123 billion lower than they had been at the end of 2019. Auto loan balances increased by $28 billion in the third quarter. Student loan balances grew by $14 billion, coinciding with the start of an academic year.

https://www.newyorkfed.org/microeconomics/hhdc

On the zoning issues and NIMBY, I agree they do pose challenges but that doesn't void Bernie's statistics.

BobTheSubgenius

(12,182 posts)...reach a trillion dollar personal net worth. Wouldn't you?

fescuerescue

(4,475 posts)Most people live with others.

Even if everyone just paired up, then by extension EVERY pair could afford an apartment.

In fact, since the average household size is 2.53 people, we are doing pretty damn good if we just go by statistics.

Now those statistics don't tell the whole story. But they do a better job than Bernie number.

BannonsLiver

(20,316 posts)That detail is important.