General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe CBO Says BBB Will Pay For Itself

or so they said on CNN. And I believe WaPo is saying the Dems got good news.

TwilightZone

(28,836 posts)Me.

(35,454 posts)I noticed that Bloomberg is not happy but with all the nay saying over the last month and days I think this is relatively good news and won't kill the bill.

elleng

(141,926 posts)would increase outlays by $80 billion and revenues by $207 billion, thus decreasing the deficit by $127 billion, through 2031.

TwilightZone

(28,836 posts)The CBO estimated that the overall bill would slightly increase the deficit.

https://www.democraticunderground.com/100216065069

Me.

(35,454 posts)MichMan

(16,888 posts)The CBO scored the entire bill as adding approx. $240 billion a year to the deficit, meaning it no longer pays for itself

Hoyt

(54,770 posts)ment. I think entire bill had a $20 Billion per year deficit (assuming folks accept the CBO scoring).

https://www.cnbc.com/2021/11/18/build-back-better-act-vote-cbo-releases-score-of-biden-plan.html

But, could be definitely wrong. This stuff changes too much, which I'm sure is frustrating citizens.

Celerity

(54,006 posts)

Summary

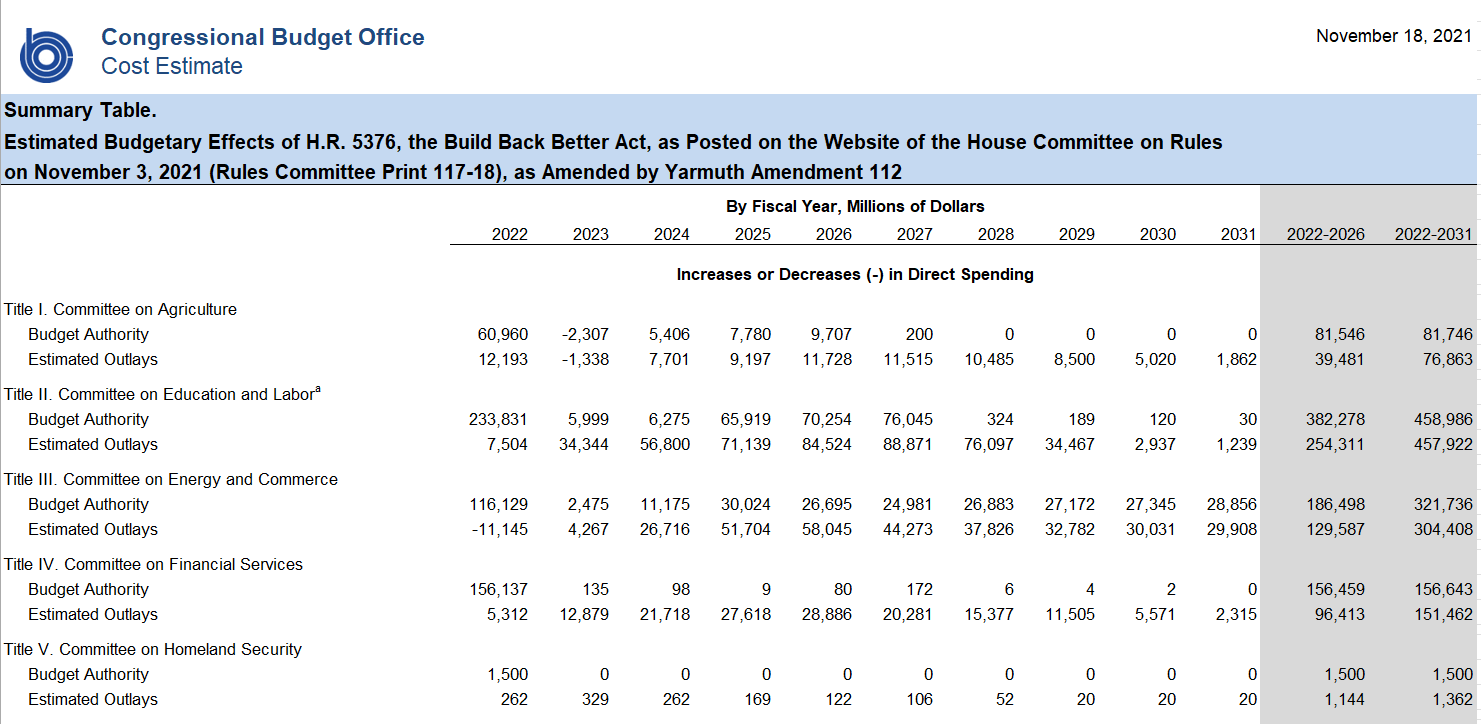

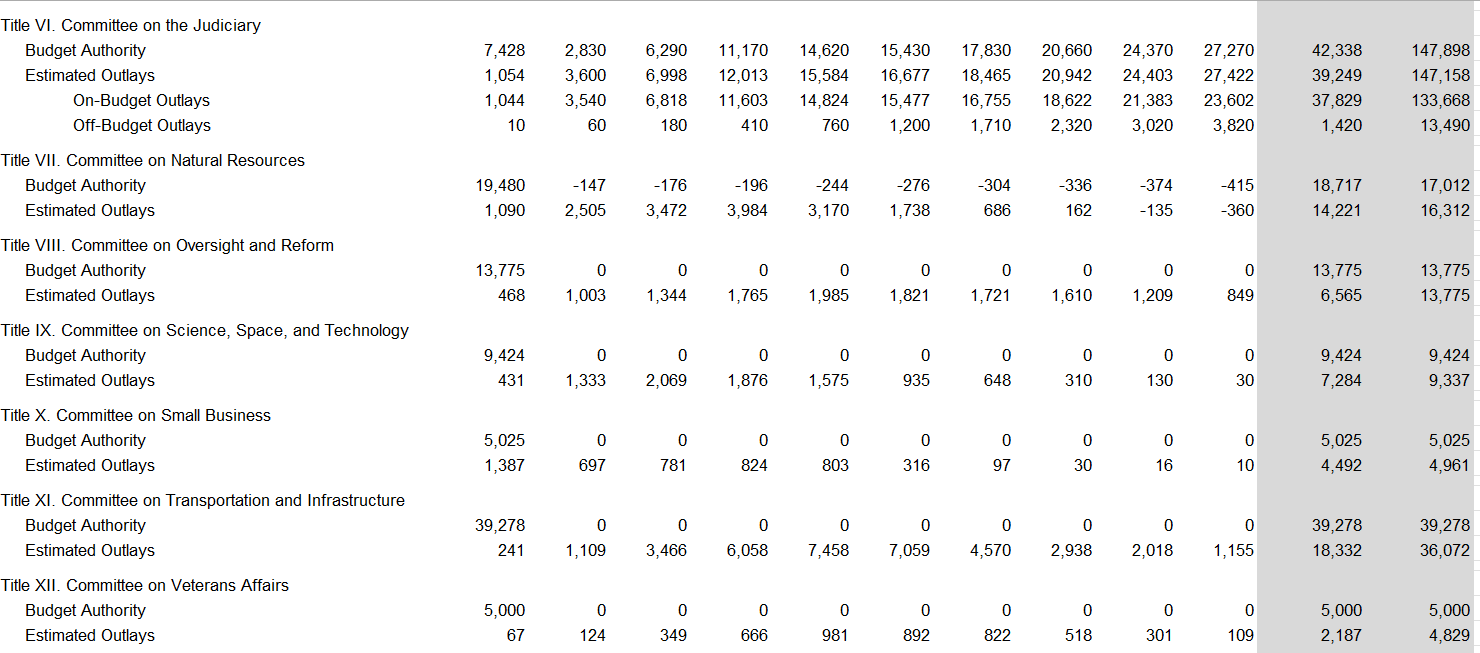

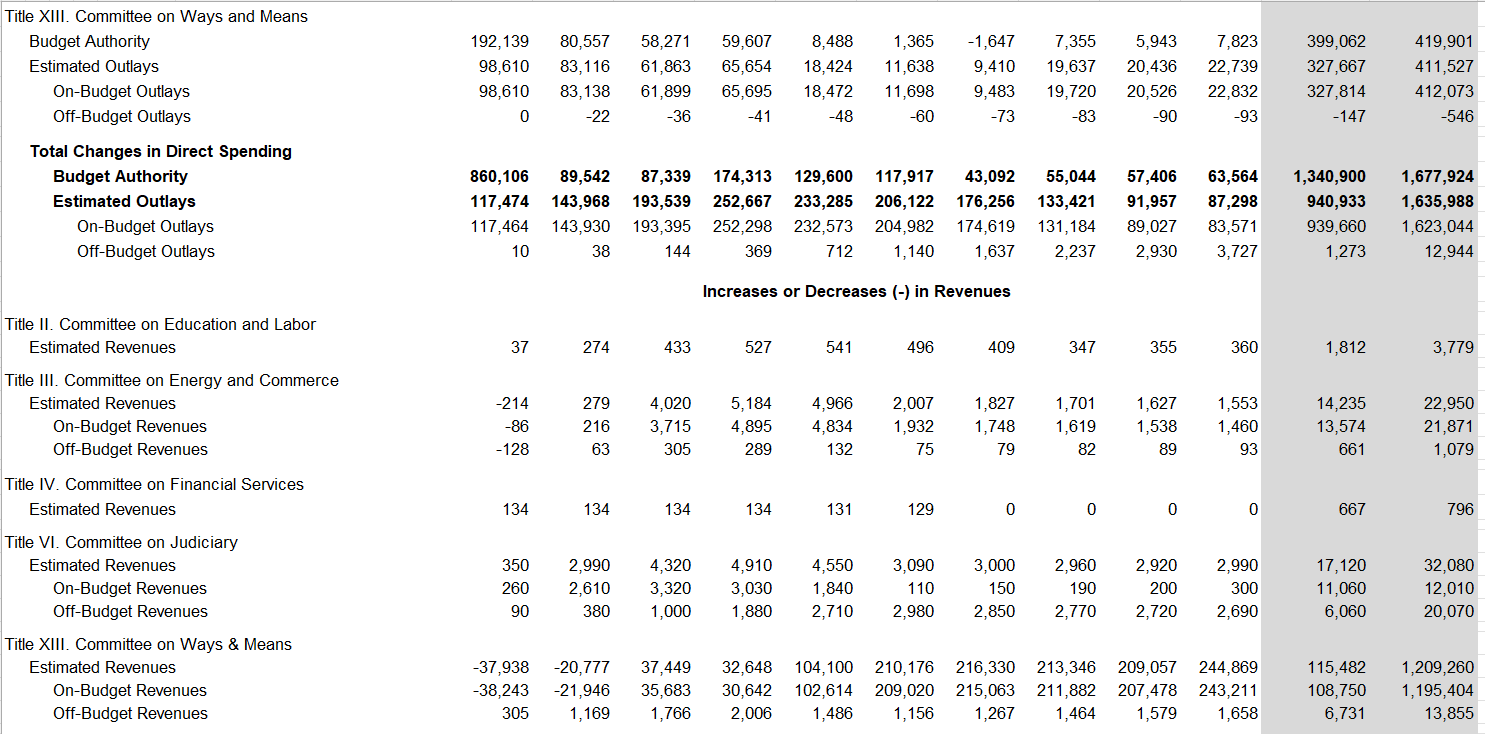

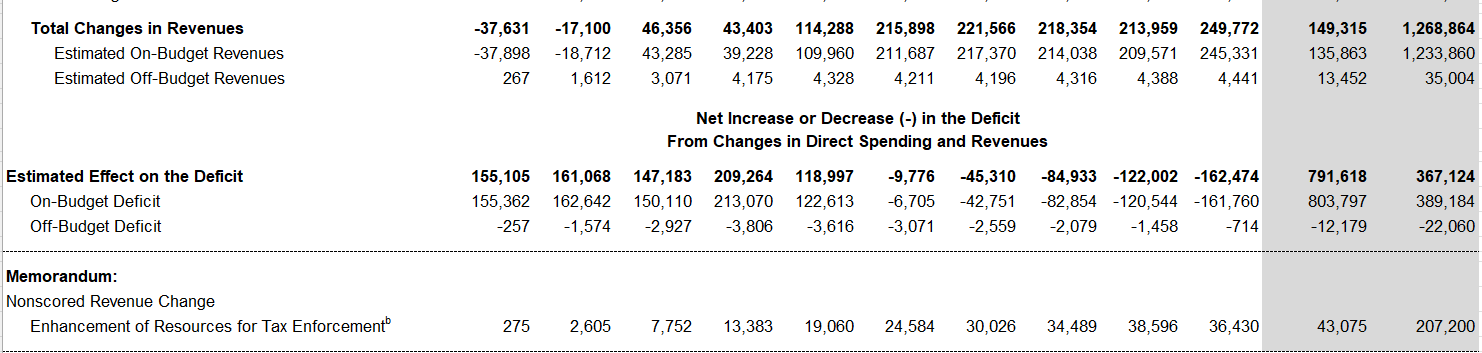

CBO estimates that enacting this legislation would result in a net increase in the deficit totaling $367 billion over the 2022-2031 period, not counting any additional revenue that may be generated by additional funding for tax enforcement.

This estimate is based on language in two documents, which are available from the House Committee on Rules:

Rules Committee Print 117-18, Text of H.R. 5376, Build Back Better Act

Rules Committee Print 117-18, Yarmuth Amendment 112