General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsInflation Continued to Run Hot and Consumer Spending Fell in December

Prices are rising rapidly, wages are growing and consumers are glum as a fraught economic moment poses big challenges for policymakers.https://www.nytimes.com/2022/01/28/business/pce-inflation-federal-reserve.html

Inflation came in strong and wage growth remained elevated at the end of 2021. At the same time, consumer spending fell in December as spiraling coronavirus caseloads kept many Americans at home and persistent supply chain bottlenecks disrupted holiday shopping.

Those indicators, released on Friday, underline that despite plummeting unemployment and a strong rebound in growth, the economy — like the country itself — has yet to break free of the pandemic’s grip. That is making for a confusing and contradictory moment headed into 2022.

Rising prices and an unflagging pandemic are slowing spending, denting consumer optimism and detracting from quickly climbing pay and unusually rapid overall growth. People are predicting worse financial outcomes for themselves and higher inflation as the virus lingers and uncertainty deepens, bad news for policymakers who are just beginning to try to tame price increases.

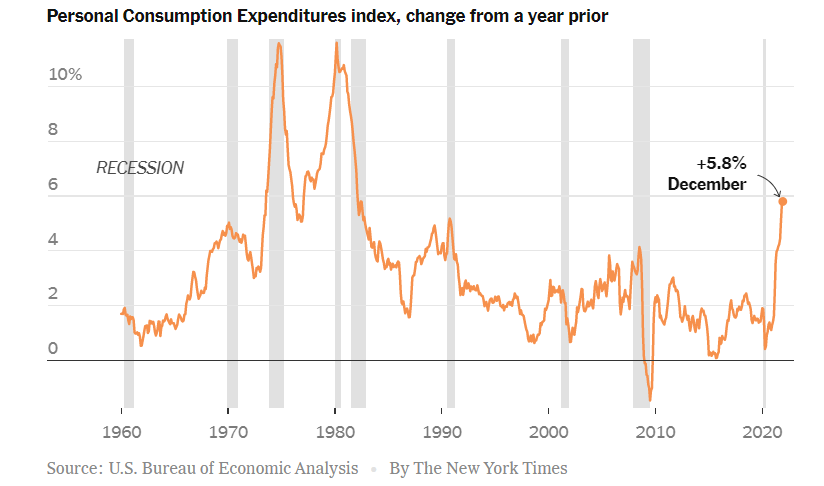

The Personal Consumption Expenditures index, the Fed’s preferred inflation gauge, rose 5.8 percent in the year ending in December, up from 5.7 percent the prior month. Prices are climbing at the fastest pace since 1982.

snip

LENNY0229

(185 posts)Celerity

(54,005 posts)Consumer spending fell in December as Omicron spread.

Overall spending fell for the first time since February as the virus and supply chain issues impacted purchases.

https://www.nytimes.com/2022/01/28/business/consumer-spending-december-omicron.html

LENNY0229

(185 posts)supply shortfalls. No question that was also part of it. Omicron is also a factor, but not the only one as has been reported in other articles. Heavy holiday spending in October and November rather than December was also certainly a factor.

Celerity

(54,005 posts)that is not (the reasons behind the dip) what you were trying to slate and call 'clickbait.

Holiday sales on track to blow past record for spending, topping retail trade group’s biggest forecast

https://www.cnbc.com/2021/12/03/holiday-shopping-2021-spending-set-to-blow-past-records-nrf-says.html

Holiday sales could exceed even the rosiest expectations for the major shopping season, according to the National Retail Federation.

The major trade group’s economist, Jack Kleinhenz, said Friday that spending in November and December could grow as much as 11.5% compared with the same period a year ago — higher than many retail analysts and NRF itself had predicted.

The NRF had already called for a record holiday season, projecting in late October that sales would rise between 8.5% and 10.5% from last year. The group said it expected sales in November and December would hit an all-time high of between $834.4 billion and $859 billion. The sales forecast excludes spending at automobile dealers, gas stations and restaurants.

Last year, holiday sales rose 8.2% from 2019 to a record $777.3 billion, according to the NRF.

“People have the ability to spend and I think they are in the mood to spend,” Kleinhenz said in an interview. He pointed to strong balance sheets coming out of the pandemic, the low unemployment rate and the desire to reunite for holiday gatherings.

snip

and from earlier:

Retail trade group expects holiday sales to rise by all-time record, despite congested ports

https://www.cnbc.com/2021/10/27/holiday-sales-2021-to-rise-by-8point5percent-to-10point5percent-national-retail-federation-says.html

Retailers will see eager holiday shoppers flock to stores and websites even as some toys, clothes and other gift-giving items remain stuck at congested ports, according to a new forecast that cited rising household incomes and high savings rates for its upbeat outlook.

The National Retail Federation said Wednesday that it expects holiday sales during November and December to rise between 8.5% and 10.5%, for a total of between $843.4 billion and $859 billion of sales. The sales forecast excludes spending at automobile dealers, gasoline stations and restaurants.

That would mark an all-time high for holiday sales growth and top last year’s record. Last year, holiday sales rose 8.2% from 2019 to $777.3 billion, according to the NRF, as consumers cheered themselves up with gift-giving during the pandemic. Holiday retail sales have increased by 4.4% on average over the past five years.