General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsCould inflation be because there is too much wealth in the world. We all know the

stock market is overpriced. Interest rates are low so bonds are not a place to invest. Hedge funds are competing to see who can be a monopoly in their business field. Houses are being speculated on so much laws are being put in place to stop foreign buyers. People are investing in bitcoin. There is lots of stock buybacks so even more money in the pockets of the people in the stock market. We always hear of too much money chasing too few goods results in inflation. Just a guess.

jmbar2

(7,785 posts)I wish more of the rich would quit chasing more wealth, and distribute it more widely. Too many have more than they, or their subsequent generations could ever spend.

Hoyt

(54,770 posts)childcare, healthcare, housing, etc., that the 329 million purchase. Of course, the prices of yachts seemed to have spiked in recent years.

We could take their wealth and distribute it to everyone, and live high for awhile.

applegrove

(131,103 posts)Last edited Sun Apr 10, 2022, 11:11 PM - Edit history (1)

there is something structural in inflation beyond open monopoly power and not enough competition, tight employment market, logistics, etc.. If it is structural, I'm sure they would want to know as inflation will eat into wealth and the wealthy don't like that. It can also destroy an economy which the rich don't like either.

doc03

(38,941 posts)Rate for Purchases and Transfers 26.99%". For a cash advance they charge either $10 or 3% of the amount of

each cash advance, that is in addition to a 26.99% APR on the balance. Late payment fee $40.

I checked with Capitol One and they are paying an "Annual Percentage Rate of .40%" on their savings accounts.

EarnestPutz

(2,843 posts)PoliticAverse

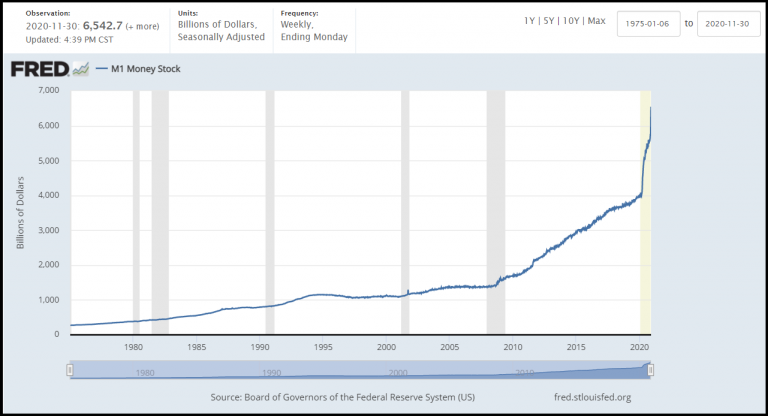

(26,366 posts)A large increase in the money supply is the basic definition of inflation.

For the US for example:

applegrove

(131,103 posts)Septua

(2,957 posts)..in this case, with most of the high prices. Gas prices are due to 'wealth' sort of. The oil companies lost money in 2020 due to everybody staying home rather than riding the roads. Oil companies didn't adjust their production soon enough and got stuck with a bunch of reserve they couldn't sell. Now they're taking their sweet time cranking up production and making back some or all of their losses with high crude prices.

Most of the other stuff is just the result of so many businesses that had to shut down or cut back due to the pandemic and can't seem to catch up with demand for whatever reasons. The aftermath of the pandemic screwed up the global economy.

I'm no economist and the details are far more than the way I described but the wealthy were wealthy before the pandemic and some got wealthier as a result of it but they didn't cause inflation...just an opinion.

TreasonousBastard

(43,049 posts)the money comes from for houses to be auctioned off snd sell for way above asking. The east end of Long Island has become unlivable for most people living on a paycheck. Even a good paycheck. And gas prices have little to do with it.

I suspect the real problem is that there's little keft to buy. We have pretty much all the things we need, even toys. Buying a 100 grand truck isn't going to suck up extra money like the revolutionary situations that the automobile or air travel did.

We need a new revolution, like personal electric generation or something else that gets everyone out buying stuff. Not simply the throway stuff we're buying now, but a new idea.

And yes, some people simply have too much money. Money should be seen as national resource not to be hoarded by individuals. We really can't affordthat any more. If we ever could.

Xolodno

(7,319 posts)Consumption was reduced due the pandemic and the the supply chains reacted in turn. And there has been no hurry to ramp it back up. Why? Don't know.

Price gouging? Yeah that is going on, but it can't last.

Housing crisis is a leftover from 2008 crisis, we bailed out the banks, but didn't fix the problem. In some states, doubled down. How it plays out, I don't know. But I will know when a correction occurs, once I stop seeing assholes on TV telling me they will buy your house in any condition without the hassle, etc. Then I know its happening.

At a corporate meeting, someone asked the question, despite getting a larger merit raise, it was still below inflation. Our CEO stated that was absolutely the case. But in our industry, we are always playing catch up and said if another company could keep up, by all means, go work for them.

PoindexterOglethorpe

(28,485 posts)Looking at this chart https://www.currentmarketvaluation.com/models/price-earnings.php there was a very long time when PE ratios were far below average, and it seems to me that a lot of people assume those low ratios are the norm.

Meanwhile, a lot of companies are making money, which is probably the more important issue.

People here have been saying for a decade or more that the market is vastly overpriced. Really? More to the point, trying to time the market is a true fool's game. You cannot possibly know when the highs or the lows are, and staying invested is far and away the better strategy. The market goes up two out of every three years. The long term trend, even the medium term trend, is up.

I've been investing since about 1978. I currently have a wonderful financial advisor, since about 1998. He has done very well for me, including a couple of annuities, which are largely scorned here. Mine have done very well, and are currently giving me a stable income.

roamer65

(37,852 posts)Reduce demand and inflation will cool down.

Cars are a prime example right now.

rownesheck

(2,343 posts)to allow millionaires and billionaires any say in governmental policy. They're millionaires and billionaires. Everything has obviously worked out for them. They need to shut up and go away. Let normal people run shit.