General Discussion

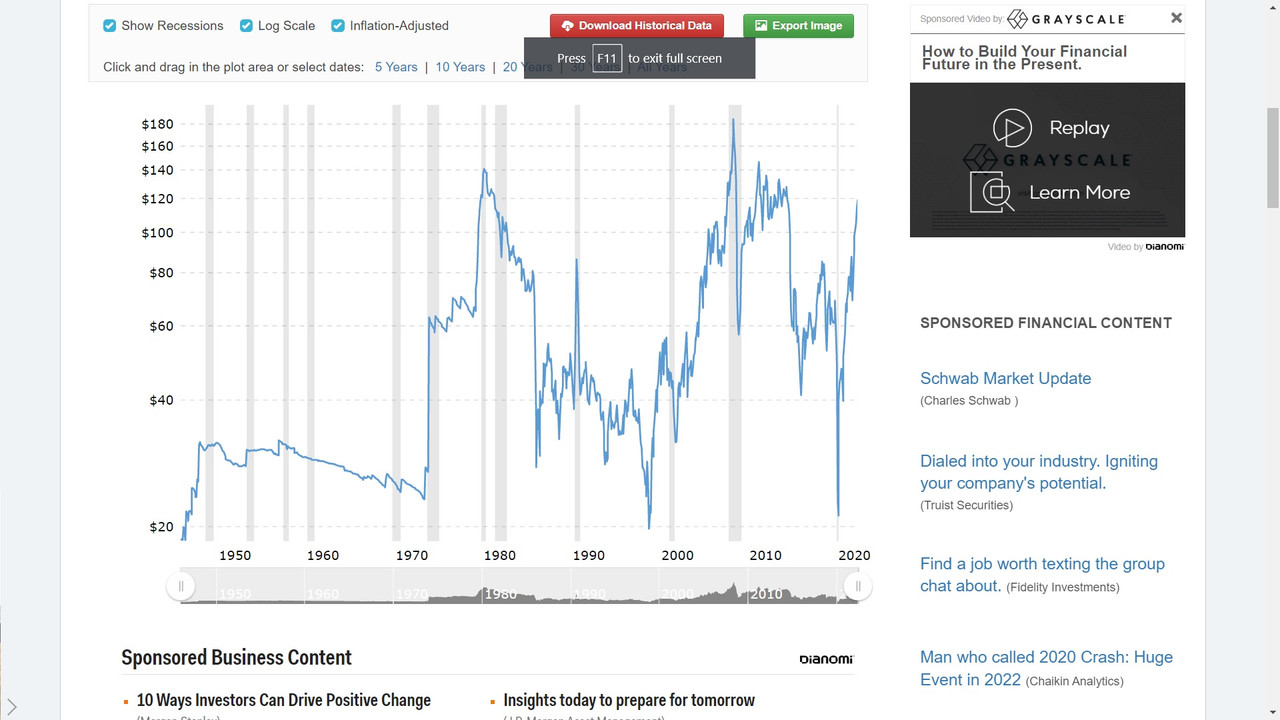

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forums2011-14 crude oil prices were similar to NOW !!!

DO NOT get fooled by the "production cost" or "traders" argument that's being passed around on social media

What we have now is naked f**kin greed, its not just the oil prices its gas prices Big Oil is gouging on!!!

Big oil is making tons off the gas which they have more control of prices too.

https://www.macrotrends.net/1369/crude-oil-price-history-chart

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=emm_epm0_pte_nus_dpg&f=m

This is why looking at the UK is thinking about doing should be taken into consideration.

U.K. imposes windfall tax on oil and gas company profits as inflation bites

https://archive.ph/8uYIs

Britain’s Conservative government announced Thursday a 25 percent windfall tax on the profits of oil and gas firms that would be used to support $19 billion in assistance for low-income households struggling with a sharp spike in the cost of living.

Big Oil is **NOT** going to return the value of currency they are sucking up back to populaces around them.

mucifer

(25,602 posts)control the oil prices which might lose us the congress.

progree

(12,808 posts)panader0

(25,816 posts)I looked this up about a week ago, so I'm not exact on the numbers, but it's very close to being

accurate. Greed of oil execs is the cause, not the Ukraine invasion or any of the many excuses

big oil makes for the prices.

NoMoreRepugs

(11,879 posts)control a huge portion of the supply is it hard to imagine they are HEAVILY involved in the oil futures market??? If it was me I sure would be.

TigressDem

(5,126 posts)BP using the situation in Ukraine to price gouge and pay off their own debt, and buy back shares

20,384 Million loss in 2022 First Quarter vs 2,326 Million profit in 2021 Fourth Quarter is due to HUGE debt reduction

https://www.bp.com/en/global/corporate/news-and-insights/press-releases/first-quarter-2022-results.html

Reported loss primarily due to decision to exit Rosneft shareholding

Net debt reduced to $27.5bn; further share buyback announced

Delivering resilient hydrocarbons: major project start-up in the Gulf of Mexico; deal to create Azule Energy in Angola

Continued progress in transformation to an IEC - momentum in each of the five transition growth engines

Stock exchange announcement

Financial summary $ million

First quarter 2022 Fourth quarter 2021 First quarter 2021

Profit (loss) for the period attributable to bp shareholders (20,384) 2,326 4,667

uponit7771

(93,504 posts)TigressDem

(5,126 posts)Instead of using this cash to make the investments needed to help lower the price of oil or to fulfill their climate pledges, companies are giving most of it back to their already extremely wealthy shareholders in the form of stock buybacks or giving it back to themselves in the form of executive bonuses. Last year, 28 of the top oil and gas CEOs raked in $394 million in compensation—a nearly $45 million increase since 2020.

So just how rich have these companies gotten during the first three months of 2022?*

Shell’s profits were 280 percent higher than in the first quarter of 2021.

Shell made $19.3 billion in total profits in 2021.

Shell bought back $8.5 billion in stocks for wealthy shareholders.

Shell cut 5,000 jobs from its workforce in 2021.

Shell’s CEO has not been shy about admitting that Russia’s war on Ukraine helped the company’s profits, saying on a recent shareholder call that “well, you know, can I also say that the performance we are seeing this quarter, of course, has been helped by the macro, and the macro has been impacted by the war in Ukraine.”

ExxonMobil’s profits were 320 percent higher than in the first quarter of 2021.

ExxonMobil made $23 billion in total profits in 2021.

ExxonMobil pledged to buy back $30 billion in stocks for wealthy shareholders through 2023.

ExxonMobil cut 9,000 jobs from its workforce in 2021 to “cut costs.”

Despite being one of the most profitable corporations in the United States, ExxonMobil paid an effective federal income tax rate of just more than 2 percent in 2021, and that is not for a lack of funds. ExxonMobil’s Chief Financial Officer Kathy Mikells underscored just how much the company expected to profit in the first quarter of 2022 and how that would benefit shareholders, saying in early March that “we expect to generate over $100 billion in excess cash flow beyond meeting our capital program and current dividend, and so I would say we have a very robust forward plan and we expect to have sustained excess cash flow and increasing shareholder distributions.”

Chevron’s profits were 380 percent higher than in the first quarter of 2021.

Chevron made $15.6 billion in total profits in 2021.

Chevron plans to buy back $10 billion in stocks for wealthy shareholders by the end of 2022.

Chevron cut its workforce by 5,000 jobs in 2021.

Despite being one of the most profitable corporations in the United States, Chevron paid an effective federal income tax rate of less than 2 percent in 2021. Moreover, Chevron’s CEO has been upfront about the profits they are raking in, saying amidst rising gas prices in January that “the last two quarters have been the best two quarters the company has ever seen.”

BP’s profits were 240 percent higher than in the first quarter of 2021.

BP made $12.8 billion in total profits in 2021.

BP expanded its stock buyback plan to $2.5 billion for wealthy shareholders in 2022.

BP cut its workforce by 2,000 jobs in 2021.

BP executives attributed their record profits to “exceptional oil and gas trading” conditions—conditions that included Russia’s invasion of Ukraine and Americans suffering record-high gas prices.

ConocoPhillips’ profits were 480 percent higher than in the first quarter of 2021.

ConocoPhillips made $8 billion in total profits in 2021.

ConocoPhillips plans to buy back $10 billion in stocks for wealthy shareholders in 2022.

ConocoPhillips’ workforce numbers stayed essentially flat in 2021.

ConocoPhillips’ has tripled its lobbying expenditures to lock in oil and gas development for decades to come at its proposed Willow project in the Western Arctic. The proposed project threatens to erase the climate benefits of renewables on public lands and waters and would require the installation of artificial “chillers” to refreeze the Arctic’s melting permafrost in order to build the infrastructure needed to drill for oil. The company has also been under fire for a recent gas leak that “led to the temporary removal of 300 personnel [and] alarmed residents in the nearby village of Nuiqsut.”

roamer65

(37,852 posts)The idea that gas prices now have to be over $5/gal is pure oil company greed.

Only difference between 2008 and now is the party of the President.

Emile

(41,429 posts)Sad

uponit7771

(93,504 posts)maxsolomon

(38,401 posts)It was $4.04/gallon yesterday.

mathematic

(1,605 posts)uponit7771

(93,504 posts)... surplus tax to BP for sucking capital out of circulation into their own pockets.

B.O. can make money and not hurt the working person

ProfessorGAC

(76,163 posts)There is, however, something up with the markets.

Historically the RBOB price of a gallon of unleaded has been 2.7-2.8% of the barrel price of crude.

Yesterday, it was almost 3.4%, and has been well over 3% for weeks.

Yet, no significant disruptions in supply are reported in the US.

The OP derides the "Trader" (not my quotation marks) argument, but market behavior causing unwarranted commodity prices are where I'd look first, not at the greed of refiners.

Are they happy with these prices? Of course!

But, if we're looking for answers & causes, I wouldn't go after the people who don't set prices.

Amishman

(5,918 posts)I really think Joe should suspend the Federal gas tax, and encourage states to do so as well.

Incentives to reopen refineries.

Investigation into profiteering/ price gauging