General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsHouse Republicans vote to strip IRS funding, following pledge to repeal nearly $80 billion approved

by CongressHouse Republicans on Monday night voted to slash funding for the IRS, following a pledge from newly-elected Speaker Kevin McCarthy to repeal the money approved by Congress last year.

Passing along party lines, the bill would rescind tens of billions allocated to the agency over the next decade through the Inflation Reduction Act passed in August.

The measure doesn't have the support to pass in the Democratic-controlled Senate, and the White House opposed the bill in a statement released Monday.

"It's not going to become law, but it makes a very strong political statement," said Mark Everson, a former IRS commissioner and current vice chairman at Alliantgroup, noting that the partisan IRS divide isn't good for the agency's "long-term stability."

https://www.msn.com/en-us/news/politics/house-republicans-vote-to-strip-irs-funding-following-pledge-to-repeal-nearly-80-billion-approved-by-congress/ar-AA16b9Lt

Welcome to two years of Kabuki theatre and very little else getting done.

Beachnutt

(8,873 posts)underpants

(195,907 posts)

TigressDem

(5,126 posts)A well-functioning tax system requires that everyone pays the taxes they owe. Today, the “tax gap”—the difference between taxes that are owed and collected—totals around $600 billion annually and will mean approximately $7 trillion of lost tax revenue over the next decade. The sheer magnitude of lost revenue is striking: it is equal to 3 percent of GDP, or all the income taxes paid by the lowest earning 90 percent of taxpayers.

The tax gap can be a major source of inequity. Today’s tax code contains two sets of rules: one for regular wage and salary workers who report virtually all the income they earn; and another for wealthy taxpayers, who are often able to avoid a large share of the taxes they owe. As Table 1 demonstrates, estimates from academic researchers suggest that more than $160 billion lost annually is from taxes that top 1 percent choose not to pay.

Johnny2X2X

(23,968 posts)I figured for sure they'd have voted to repeal that 3 or 4 times by now.

MineralMan

(151,050 posts)will get through the Senate, and if it did, Biden would veto it. So, they'll introduce all kinds of right-wing bullshit that will never take effect for two years. Then, the voters will boot out enough of the House members to create a Democratic majority.

Think beyond next week and beyond the House. Those House GQPers aren't going to get shit done.

PortTack

(35,819 posts)Elessar Zappa

(16,385 posts)Some people here seem to believe that the House can meaningfully affect policy right now. They can’t. They don’t have the Senate or the Presidency. The most damage they can do is in regards to the debt ceiling but I trust Biden to navigate through that. This House is basically toothless.

walkingman

(10,662 posts)class pays the bills. I wouldn't have a problem with them changing our tax structure but not in a way that rewards tax cheats. I have to write a check every years as a retired person and it's time everyone paid their fair share and we would not have the huge deficits.

It is so bogus that the GOP claims that they support fiscal responsibility when in reality it is just the opposite. They depend on uninformed voters to not only get elected but also to support their BS.

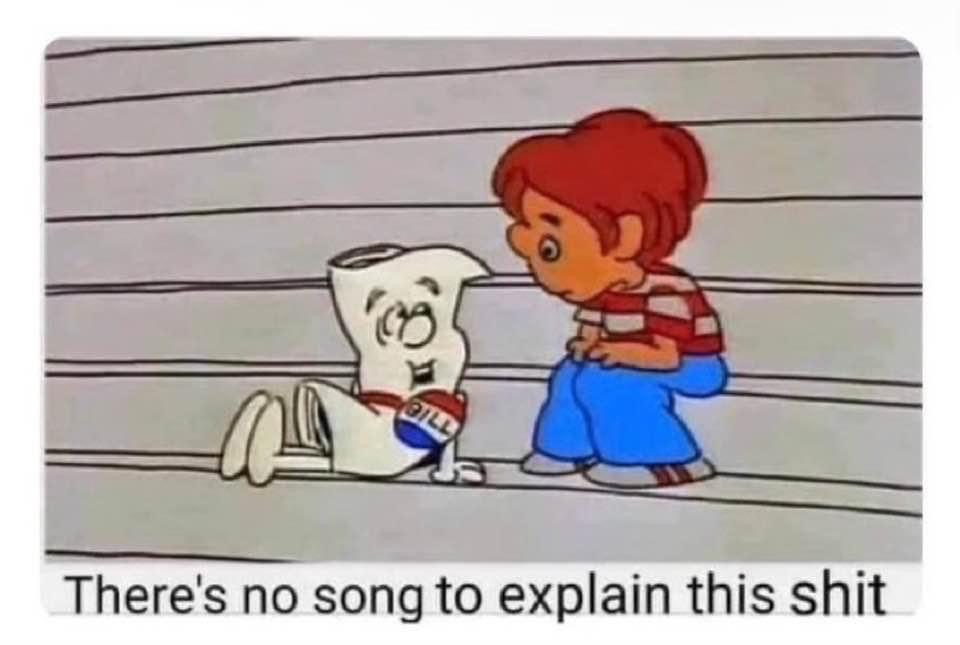

Mr.Bill

(24,906 posts)of the damage that would happen if these things became law. Make it plain and simple what it would cost and paint them as the party that will destroy the economy.