General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe “Fiscal Cliff” Hoax

The scare of a so-called “Fiscal Cliff” is basically a trick created by right wing elites to get us to accept cuts to social safety net programs like Social Security, Medicaid and Medicare – as well as to extend the Bush tax cuts for the rich. If extending tax cuts for the rich doesn’t sound to you like a good way to reduce the federal deficit, you’re not alone. Yet despite the massive evidence to the contrary, and against the opinions of any decent economist not in the pockets of Wall Street, the right wing elite want us to believe that decreasing their taxes will create jobs, reduce the federal deficit and stimulate our economy.

The so-called “Fiscal Cliff”

So what exactly is the “fiscal cliff”? At the end of December 31, 2012, two things will happen if some sort of deal isn’t cut to prevent it. One is that the Bush tax cuts for the rich will expire, and the top marginal tax rate will go back to the 39.6% that it was during the Clinton administration. That in itself would go a long way towards reducing our federal deficit. And it would not reduce jobs or slow down job growth. During the Clinton Presidency our economy was much better, unemployment was much lower, and small businesses grew twice as fast as after the Bush tax cuts for the rich. And we then had a budget surplus.

Along with taxes on the rich going back up to Clinton era levels, there would also be a modest rise in taxes on the middle class. So how could that be rectified? Legislation has already been passed by the U.S. Senate to restore the middle class tax cuts in 2013, and President Obama has vowed to sign that into law if the House goes along with it. Would the House dare to refuse to do that? What would that do to their re-election chances?

The other thing that will happen after the end of this year if a deal isn’t cut first is that there will be various automatic cuts to domestic and military spending. Those consequences are not cut in stone, but rather are a Tea Party/GOP manufactured crisis. They demanded those future automatic cuts in the summer of 2011 in return for their agreeing to raise the debt ceiling so that our country could pay its debts and avoid crashing the economy. It was blackmail. Right wing zealots in Congress created this “crisis”, and they could just as easily un-create it by acquiescing to a reversal of the spending cuts they voted for in 2011.

This is what Nobel Prize-winning economist Paul Krugman had to say about the so-called “fiscal cliff”:

And as for their motives:

The real crisis

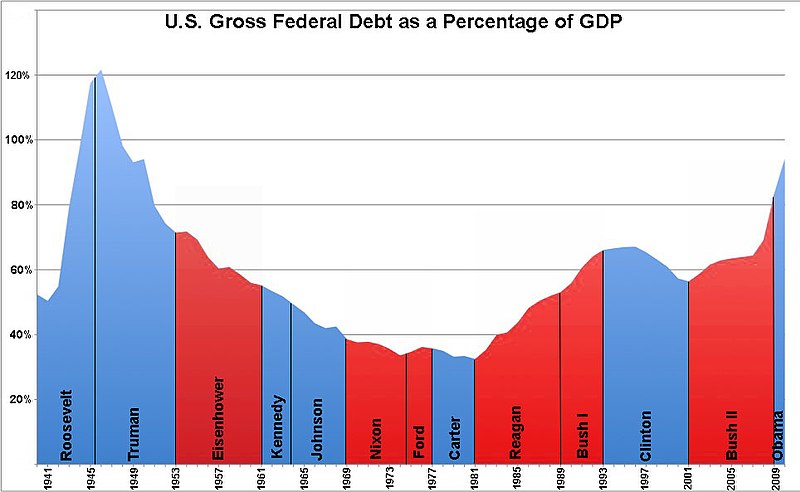

So why did Krugman say that the danger “is not that the deficit will be too large but that it will be too small”? Our federal deficit at this time is not all that much larger as a percentage of our GDP than it has been in the past, as you can see from this chart:

Our major problem at this time is our very weak economy and the joblessness that goes along with it. Economists have long known that this kind of problem is not solved by decreasing spending, but by increasing it on things that put people to work. It is exacerbated by the kind of severe income and wealth inequality that our country is now experiencing and that our right wing elites want to make even more severe. It is exacerbated by cuts to social safety net programs that our right wing elites want to privatize and destroy. Robert Borosage explains:

Austerity is, paradoxically, likely to undermine the stated goal of deficit reduction. Cutting spending… in a weak economy destroys jobs and slows growth. The increased unemployment leads to declining tax revenue as well as increased demands on government services, all of which adds to the deficit. This is the famous “debt trap” recently experienced in much of Europe, where premature and harsh austerity drove many EU countries into recession…

Putting people back to work does more to reduce deficits than any other factor. That requires more federal spending now, preferably in areas vital to the economy, like modernizing our infrastructure and keeping teachers on the job. Once the economy is growing and people are working, the deficit will come down. Additional steps can be taken, if necessary…

What Americans do not want

Most Americans are against what the right wing elites are trying to force upon on with their “fiscal cliff” scare. They are against “requiring deep cuts in domestic programs without protecting programs for infants, poor children, schools and college aid” (75%); they are against “cutting discretionary spending, like education, child nutrition, worker training and disease control (72%); they are against cutting taxes for the rich and corporations (67%), and; they are against “reducing Social Security benefits by having them rise more slowly than the cost of living” (62%). And all this is despite the massive propaganda efforts of our right wing elites.

What we should do

Robert Borosage sums up the situation that we now face, and how we should address it:

The debate we should be having is about how to make the economy work for working people again, how to revive a broad middle class and make the American Dream more than a nostalgic fantasy….

A serious long-term commitment to rebuild America would renovate our infrastructure to withstand the extreme weather that is already upon us. It would break up the big banks and shackle finance so that it serves, rather than threatens, the real economy. Measures to transform corporate governance, curb excessive executive compensation, and empower

workers to organize and bargain collectively would help counter extreme inequality…

It would feature progressive tax reform, compelling the wealthy and corporations to pay their fair share. It would continue healthcare reform and guarantee affordable care as a right for every citizen, not a privilege allowed only to those who can afford it…

Reaching no deal is preferable to a bad one that cuts entitlements. Going over the so-called fiscal cliff is perilous, but probably preferable to a bargain under the terms currently in play. With no agreement, the Bush tax cuts would expire. In January the Senate would immediately push to revive the lower rates for everyone but the top 2 percent….

msongs

(73,459 posts)Time for change

(13,737 posts)Try to push through legislation to create jobs and stimulate our economy.

Put the pressure on Republicans to obstruct that if they dare to risk their reelection.

grahamhgreen

(15,741 posts)Fantastic Anarchist

(7,309 posts)riderinthestorm

(23,272 posts)Time for change

(13,737 posts)If Congress took his advice rather than that of the Wall Street elite who support their campaigns our country would be a lot better o

rtassi

(629 posts)Time for change

(13,737 posts)Fire Walk With Me

(38,893 posts)

Scuba

(53,475 posts)"...the deficit-scold movement was never really about the deficit. Instead, it was about using deficit fears to shred the social safety net..."

Spot on.

chervilant

(8,267 posts)The Corporate Megalomaniacs--who intend to secure their obscene wealth and their continued access to even MORE wealth--believe that their pitiable Tea Party sycophants are representative of the REST of us poor working saps, most of whom are NOT willing to swallow this 'fiscal cliff' brouhaha. They should know that we are not that gullible, but their greed blinds them...it truly does.

rudycantfail

(300 posts)What a shame that so many Democratic Party leaders legitimize this bipartisan fraud.

Morganfleeman

(117 posts)child tax credits, AMT relief, earned income tax credit, dependents tax credit, community development tax breaks and green energy tax breaks. NEITHER party has an interest in going over the fiscal cliff. Let's not forget the Doc Fix for Medicare and long term unemployment benefits expiring. This doesn't just affect the top 2%.

Time for change

(13,737 posts)The good majority of those things are separate from the expiration of the Bush tax cuts. There is no good reason why Congress has to let them expire. Most of them were forced upon us by the Tea Party inspired "Sequester", which was insisted upon by radical right wing Republicans as part of a deal to lift the debt ceiling so that our country wouldn't default on its debts, which probably would have resulted in economic catastrophe. There is no good reason why Congress couldn't reinstate those things while allowing the Bush tax cuts to expire. It is an artificial "fiscal cliff" of their own making, and there is no reason that they can't undo it.

customerserviceguy

(25,406 posts)I've been saying the same thing, and anybody who thinks the Rethugs will just let the Bush tax cuts expire and the sequester take place, then be good little boys and girls and sign on to legislation to take care of those other things is fooling themselves.

Now, I believe refundable tax credits are really easy to abuse, and I wouldn't mind seeing them expire. Also, maybe we ought to phase out dependent exemptions after two per family, with an exception made for adopted and foster children.

In any case, for many people, the cliff is indeed real.

John2

(2,730 posts)you no good to make this defense, when those are some of the loop holes, the Republicans are talking about. Think about it. They cannot come up with enough loopholes to cut unless they go there. We were not just blowing smoke when we told them to come up with the math. Never trust a pit of snakes. This is all about protecting the wealthy and not the so called moochers. If they really cared about the middleclass, then they would raise taxes on the group they seek to protect. And they did vote against unemployment benefits the last I saw.

grahamhgreen

(15,741 posts)Than to give away too much in a Grand Sell Out!

myrna minx

(22,772 posts)99Forever

(14,524 posts)Austerity will bring Revolution.

Fantastic Anarchist

(7,309 posts)DirkGently

(12,151 posts)hexola

(4,835 posts)Faryn Balyncd

(5,125 posts)Overseas

(12,121 posts)war profiteering that privatization of our military services has wrought,

or raise the taxes of the Top 2% even more,

we do not need to slash any more billions from the poor, disabled, elderly or middle class.

Time for change

(13,737 posts)Overseas

(12,121 posts)For which they are to be rewarded with Austerity for the 98% !!

Hey listen GOP, taxing the top 2% is a concession for Democrats too-- they depend on campaign contributions from the ultra-wealthy too.

Fantastic Anarchist

(7,309 posts)RC

(25,592 posts)

The picture is of a homeless man sleeping in J.C. Nichols Park, in Kansas City, Missouri.

BlancheSplanchnik

(20,219 posts)Good to see you TfC!! I was wondering where you were.

Remember when people used to look to actual experts to help them understand the world? We here at DU have access to that expertise thanks to you and others here.

Wishing you and yours a loving Thanksgiving. ![]()

Time for change

(13,737 posts)I've been around, though I haven't posted as much this year as I usually do because I was busy writing my book.

Hope your having a great Thanksgiving.

BlancheSplanchnik

(20,219 posts)when your book comes out! Have you posted about it? If so, I'd love to see the post.

Cooked some good food with a friend for Thanksgiving....very nice, thank you! ![]()

Time for change

(13,737 posts)Here's the post:

http://www.democraticunderground.com/10021536646

Information is also in my sig line.

![]()

Ghost Dog

(16,881 posts)Poiuyt

(18,272 posts)Why don't more people look at what has worked in the past?

nightscanner59

(802 posts)Democrats have been pounding this in since Bush broke the system. Fox news keeps the that truth hidden in the fantasy that trickle-down "works".... like... this time... it really, really will work... although it never, ever has, and never, ever will.

mckara

(1,708 posts)The threats were the same when Clinton raised taxes in his first term.

Faryn Balyncd

(5,125 posts)AdHocSolver

(2,561 posts)The Federal deficit is not the problem. The problem is a revenue deficit. Cutting taxes for the rich and the corporations will exacerbate the revenue deficit.

Cutting spending will NOT reduce the deficit. In fact, cutting spending will increase the deficit because jobs will be lost reducing tax revenue still further.

All economies are demand driven. Reducing money for the middle class, the working poor, and those who depend on the social safety nets such as Social Security, Medicare, and Medicaid, whose spending helps drive the economy, will further shrink the economy and increase the deficit. At the same time, the wealthy are just "money hoarders" extracting wealth from the economy, just as leeches suck blood from their victims.

The major problem with the U.S. economy is not the Federal deficit, but the trade deficit. Bring jobs that have been offshored back to the U.S. (by rewriting the tax code and renegotiating trade agreements to reduce the unfair competitive advantage given to outsourcers) and many of our economic problems will be corrected.

Time for change

(13,737 posts)improving our economy at this time is far more important than cutting the deficit. We need to get people back to work and do what we can to ensure that all of us have the opportunity for decent lives.

We can afford to increase the deficit somewhat, if we need to do that to make our economy work and provide necessary help to people who need it. If by doing that the deficit comes down because of the reasons you give, then great. If it goes up a little, that doesn't mean that we've done the wrong thing. Improving the economy and peoples' lives should be our # 1 priority.

The austerity hawks talk about "shared sacrifice", and what they really mean is sacrifice for everyone but the wealthy, who have sacrificed nothing over the past several years, while most Americans have sacrificed a lot.

Ghost Dog

(16,881 posts)· Create Jobs - Putting people back to work does more to reduce deficits than any other factor. That requires more federal spending now, preferably in areas vital to the economy, like modernizing our infrastructure and keeping teachers on the job. Once the economy is growing and people are working, the deficit will come down.

· Continue Healthcare Reform - The projected increase in healthcare costs—through Medicare, Medicaid, children’s and veterans’ healthcare—drive long-term deficits. The costs of Medicare and other public healthcare programs are rising more slowly than private healthcare, but even so, in the long term they are unaffordable. As economist Dean Baker of the Center for Economic and Policy Research has pointed out, if per capita US healthcare spending were comparable to what other industrialized countries spend (with better results), we would be projecting budget surpluses as far as the eye could see. The solution requires challenging the predatory oligopolies—the insurance companies, drug companies and hospital complexes—that profit from high costs. Obamacare began that process; Medicare costs have begun to rise more slowly. The sensible solution to our long-term debt problem is continued healthcare reform, not cuts in basic security for Americans.

· Demand that Wall Street pay for the damage it caused - For example: our debt burden nearly doubled because Wall Street’s excesses blew up the economy and drove us into the deepest recession in seventy-five years.

· Impose higher tax rates on millionaires and billionaires - We are witnessing the worst inequality since the Gilded Age. The top 1 percent of taxpayers pocket more income each year than the bottom 40 percent, and they own more wealth than 90 percent of Americans. Yet their tax rates are near the lowest in post–World War II history.

· Enforce higher taxes on corporations and a clampdown on overseas tax havens - Lower rates, corporate loopholes, offshore tax havens and transfer pricing have reduced the corporate share of federal tax revenues consistently since the 1950s.

· Cut Military Spending - The military budget has doubled over the past decade, now exceeding what it was, in comparable dollars, at the height of the cold war.

· Establish a Different Basis for Growth - Investments now in areas vital to our future and a fundamental change of course. - ···

··· Revive Domestic Manufacturing - and thus reduce the destabilizing trade deficits that have contributed to the global crisis.

··· Implement an Industrial Policy - designed to help the United States lead the new global green revolution.

··· Renovate Infrastructure- to withstand the extreme weather that is already upon us .

··· Reform Public Education - Universal preschool, small classes in the early years, greater rewards and respect for teachers, after-school programs, affordable college and advanced training.

____________

Based on the following article: http://www.thenation.com/article/171266/grand-bargain-fiscal-cliff-could-be-grand-betrayal#

[center]

[/center]

[/center]

GD

Many thanks for the OP, as always, Time for change.

underoath

(269 posts)kentuck

(115,348 posts)Otherwise, they are digging their own grave. How about this for a starter? How about we close all the loopholes so people like Mitt Romney do not hide all their money overseas and only pay 14% on the years they choose to make public? How about we ask these people to pay back some of the booty they acquired in the last 20-30 years? How about a tax rate of about 49% on those incomes in the 1% that do not create jobs. That is almost 97% of all millionaires and billionaires. How about that for a starter?

Also, since we ask working people to pay for their SS and Medicare thru payroll taxes, how about we ask the wealthy to pay for the tax breaks and big defense contracts in a similar manner? Why should SS be asked to pay for their goodies also??

AllyCat

(18,720 posts)Bookmarking for future discussion with people who keep asking me "What do you think of this fiscal cliff?" And I don't work in finance...people ARE talking about this.

chervilant

(8,267 posts)so many poor delusional saps listen to the propaganda spewing forth daily (hourly...) on virtually all the media, including the internet.

Yet again, we've allowed the Rovian corporate megalomaniacs to frame the rhetoric. I sincerely hope that this administration stands against these obscenely wealthy criminals.

freshwest

(53,661 posts)chervilant

(8,267 posts)are playing their game on a grand scale with this 'fiscal cliff' brouhaha. It is PAST time for all of us to stand our ground and assert, "we're not playing in your stinkin' sandbox anymore!"

John2

(2,730 posts)have to say is I agree with this economist. He is very smart and I do have some education enough to understand his logic. The fiscal cliff is smoke and mirrors just like the WMD scare which got us into Iraq. The same people that led this country into Iraq, are the same people in Congress that put us into this situation.

To be specific, they are the ones agreed to go to Wars without paying for it. They also gave us taxcuts on top of taxcuts by yielding to corporate interests and Wall street. Those interests have been essentially writing the laws, once people get in Congress. It has not been all the Congress people like Senator Sanders.

If we go off this fiscal cliff, it is the Republicans and their allies will take the most pain. Much of the spending cuts are on the Military Industrial complex side within red districts. In my own state of North Carolina, we have a number of military bases. That would hurt Burr and Hagan tremendously, if they are seen protecting the wealthy and leaving their military constiuents out to dry. If the President campaign in those districts and explain what the consequences are, then pressure can be placed where it belongs, and that is on those North Carolina representatives. It should be the Republicans move. If they don't move off their stances, then show them we are willing to go the distance, just like with Iran. That is our most potent weapon and why we now have the upperhand. Don't let them off the hook.

NoMoreWarNow

(1,259 posts)I wish Obama gave some hint that he understood this!

Fantastic Anarchist

(7,309 posts)... but when I do, I rec posts such as yours.

davidn3600

(6,342 posts)Killing the Bush tax cuts for those making over $250,000 only raises revenue by roughly $60 billion a year. That's a drop in the bucket and really insignificant. To make any difference, the taxes need to be much, much higher than that.

Notice on that graph, how fast the debt after WWII was repaid during the Truman and Eisenhower period. Tax rates were in the 70% range for the top earners. People had jobs and were paid a livable wage. Unions were strong. And America was a creditor nation. We were building infrastructure and progressing quickly.

We don't have any of that today. The tax rates are at the bottom and we are spending money on stupid crap. And the trade deficit didn't exist back then. We were making things IN America that other countries wanted to buy.

That's the difference between the 1940s and now. And it's why our debt situation today is much more toxic than it was back then.

Today the biggest problem is inflation. The wealth disparity will continue to increase when we continue to flood the money supply without there being any real economic growth or revenue coming in. These new low-wage jobs that we keep celebrating with each job report is completely worthless to our economy. Minimum wage jobs do not help us, they hurt. Because people no longer can work a job and bring home enough money to live on.

... inflation is NEGLIGIBLE and will remain so until the economy heats again, if ever.

Like all huge arguments with polarized sides, the truth is somewhere in the middle. Truth ONE, the Bush tax cuts have to go, period, no matter what the cost. The fiction that these cuts would create jobs is revealed clearly by the jobs situation of the last 4 years.

Secondly, the sequestration cuts would almost certainly tip the economy back into recession. But they would ALMOST be worth it to FINALLY have our pretty much useless military's budget cut. When I say useless I'm not talking about soldiers. I'm talking about lying political military leaders who tell the politicians what they want to hear and squander lives and resources in the vain hope of fixing the unfixable. Iraq, Afghanistan, just like Vietnam. Nothing has changed and we learned nothing. I'd like to drown THAT whole system in a bathtub and get back to a military who's mission is to defend our shores and leave global cop to someone else.

Letting even the below $250K earners get a tax increase would be preferable to giving in to ONE MORE DAY OF BLACKMAIL from the minority Repugs. It's time to clip their wings, period. And I am hoping against hope that Obama stands his ground and tells them to PACK SAND.

Time for change

(13,737 posts)But there are some very harmful items in the sequestration cuts. These can be reversed, and it is up to Congress and our President to reverse them. The blackmail has to stop because up to this point is has resulted in far more benefits to the 1%, with consequent continously rising income and wealth inequality and great damage to our economy and our people.

RC

(25,592 posts)This will do it:

http://www.steelinterstate.org/concept

The Steel Interstate System (SIS) is a core national network of high capacity, grade separated, electrified railroad mainlines. It would realize for railroads what the Eisenhower Interstate Highway System achieved for roads, and would become the backbone for movement of both goods and people in the 21st Century. Many more trains of all kinds could be accommodated and they could move much faster, providing truck-competitive speeds for movement of freight, and auto-competitive speeds for movement of passengers. This section describes what such a rail system would look like, how the SIS would transport all kinds of goods as well as people, and how the concept fits into the evolution of rail transportation in America.

Think of the jobs this would generate. And the spin-off jobs. And the spin-offs of the spin-offs...

Courtesy of kooljerk666

http://www.democraticunderground.com/1061515#post1

socialist_n_TN

(11,481 posts)At all times, a bad "compromise" that leads to bad law is WORSE than doing nothing. Just say NO! to disaster capitalism.

Uncle Joe

(64,788 posts)Thanks for the thread, Time for change.

Doctor_J

(36,392 posts)and is thus "negotiating" from an extremely weak stance. Hopefully it's just incompetence and not complicity.

judesedit

(4,588 posts)Big time lost. Gone bye-bye. Left the country. If you still believe their bullshit, you must be snorting peanut butter. Put the taxes back to the rate they were under Clinton so we can get back to normal.

woo me with science

(32,139 posts)blackspade

(10,056 posts)The 'fiscal cliff' is bullshit

Savannahmann

(3,891 posts)The White House issued a new warning on the fiscal cliff. Link

http://www.latimes.com/business/money/la-fi-mo-economy-fiscal-cliff-20121126,0,7839105.story

The report released Monday projects that if Congress fails to act and middle-income taxes rise, consumer spending growth could be sliced by 1.7 percentage points and economic growth overall would probably be cut by 1.4 percentage points in 2013. Those are not small numbers given that consumer spending drives about two-thirds of U.S. economic activity and that the American economy has been growing by just a little more than 2% since the recovery began in mid-2009.

Does anyone really think those numbers are real? I for one don't, and I encourage Democrats to take the fight to the Repugs. Tell them it's our way, or no deal. If they say no deal, then we win, and taxes go up on the rich. If we cave and screw the base again, we can't very well beg them to go out in force and get all energized for the midterms because they just won't do it.

grahamhgreen

(15,741 posts)Great post!