General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsKrugman: This Is The Chart That Debunks What Everyone Says About The National Debt

KRUGMAN: This Is The Chart That Debunks What Everyone Says About The National DebtJoe Weisenthal | Nov. 25, 2012, 11:05 AM | 18,672 | 64

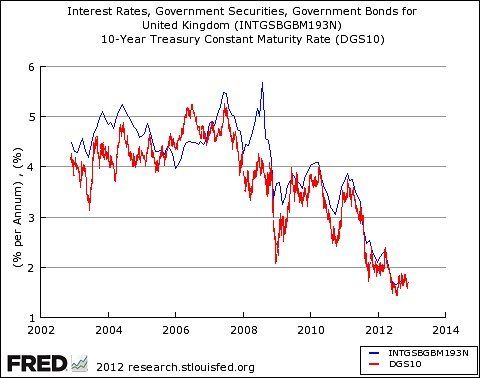

Paul Krugman posts a simple chart that makes a profound point.

It compares the yield on UK debt vs. US debt.

What should stand out for you, instantly, is that the two countries borrow at virtually identical rates, and have for years.

What this should show to people is that much of the popular stories that people tell about sovereign debt is a myth.

Countries that borrow in their own currencies and can "print" at will don't have default risk, so their borrowing costs are an expression of expectations of future interest rates and growth. The US has been notably profligate since the crisis. The UK (under Cameron) has been prematurely austere. The upshot: it hasn't mattered much on the yield front.

MORE[p]

Krugman Blog LINK: http://krugman.blogs.nytimes.com/2012/11/25/incredible-credibility

But won’t that money printing cause inflation? Not as long as the economy remains depressed. Budget deficits could lead people to expect higher inflation down the road, once the slump finally ends — but that would be a good thing for the economy in the short run, discouraging people from sitting on cash and weakening the exchange rate, thereby making exports more competitive.

The point, then, is that the whole “credibility” argument is incoherent.

1StrongBlackMan

(31,849 posts)too many people (including many Democrats) attempt apply Household Economics to the Economics of Nations with a Sovereign Currency. While the former is easier to undersatnd because we deal with it on a daily basis; it has nothing to do with the latter.

nadinbrzezinski

(154,021 posts)Do you have a credit card?

Well, yes.

Do you float debt on it?

Yes.

So you mean you don't run a balanced budget?

I know it is simple, but it works.

ronnie624

(5,764 posts)but infinitely accelerating debt is not logical. At some point, such a system would have to be come unstable.

1StrongBlackMan

(31,849 posts)and see why your explanation (while completely accurate) doesn't work with most in the public ...

The poster say:

and,

In the same post.

Where an understanding of National Debt/Sovereign Currency would reveal that national borrowing is never "unstable", household economics can never fathom it because "eventually we have to pay our credit card bill."

The difference being, we can borrow until the global community is unwilling to buy our debt; at which point we purchase back (by "printing more money"

nadinbrzezinski

(154,021 posts)and the propaganda that we cannot deal with this debt in a rational manner, except austerity, is strong all over the place.

But I have used this explanation in the flesh and blood, and it usually works. It puts it in a context people understand. I usually throw into it the mortgage as well.