General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsAccording to CNN the economy is tanking

[url=https://ibb.co/zSFhdL1][img]

[/img][/url]

[/img][/url]

Based on one day in the stock market casino.

Faux news lite.

bucolic_frolic

(54,791 posts)7 ... 8 ... 9 % Bonds yielding 14-15-16%

Walleye

(44,381 posts)That’s what boomers lived with. When I was in high school candy bars for a dime gas for $.30 a gallon. I’m tired of hearing these kids complain about a little bit of inflation. As long as people keep spending, inflation will go up

They were high in the late 70’s and eighties when I wanted to buy a house. Eventually we built a house, and interest was around six percent.

Mme. Defarge

(8,972 posts)the mortgage rate on the home we bought was 10%.

LiberalFighter

(53,544 posts)I was single and paid it off in 2007 I think. I was paying more than I needed to each month too. I didn't have a credit card until a few years after.

Mme. Defarge

(8,972 posts)All Mixed Up

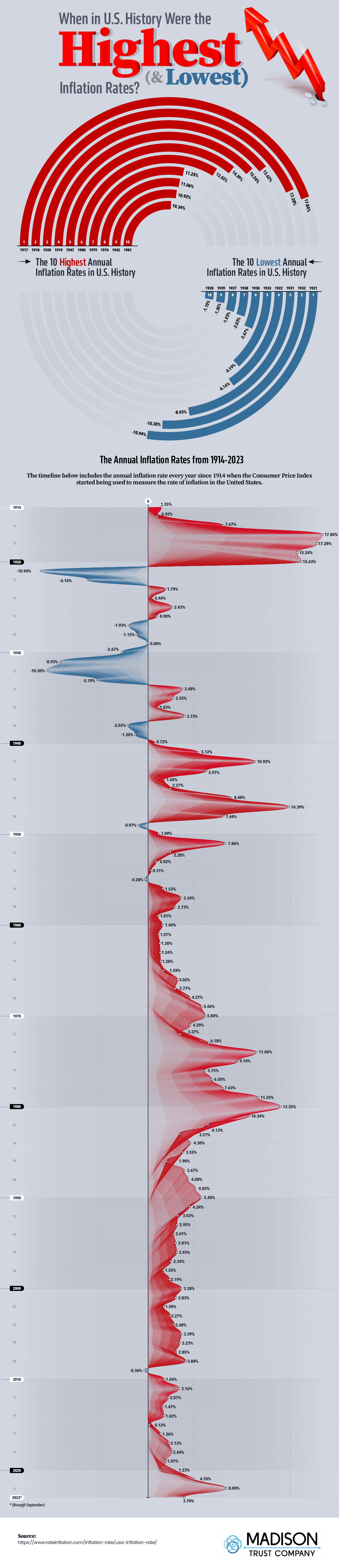

(597 posts)That 3.5% is on top of the 5% inflation seen in March, 2023, which is on top of the 8.5% inflation seen in March, 2022, which is on top of the 2.6% inflation seen in March, 2021.

That means inflation is up nearly 20% since March, 2020.

In a healthy economy, that stretch would have yielded, on average, only an 8% increase.

We're more than double that.

Remember: inflation doesn't just reset to 0 every year. Costs are still dramatically higher than they were in 2021.

If inflation had only grown at 3.5% the last three years, it wouldn't be as big of an issue but it didn't.

bucolic_frolic

(54,791 posts)The financial press does not report inflation numbers by adding them together. Maybe you got that from Bartiromo World?

All Mixed Up

(597 posts)Are you under the assumption inflation just resets every year?

Every number is on top of previous rising cost.

That's why it's so important to get these numbers as low as possible because costs are already high due to a huge spike in Inflation early in Biden's presidency.

Things are still way more expensive than they were in March, 2021.

So, Inflation just being up 3.5% over last March wouldn't be so bad if it wasn't up 20% over the last three years.

bluesbassman

(20,378 posts)That means a significant increase in unemployment. Yeah, that’ll be good for the economy.

DBoon

(24,874 posts)It was an attempt to roll back price increases from WWI.

It resulted in some miserable economic times for British workers:https://www.economicshelp.org/blog/5948/economics/uk-economy-in-the-1920s/

There are worse things than 5% inflation, much much worse things

All Mixed Up

(597 posts)There's always going to be inflation. Even out of the Great Recession, we only had one year (2009) where we actually saw deflation on average for the year.

But we're averaging a 3.3% increase so far this year (and it's gone up each of the last three months). If it stays at that 3.3%, that would be the largest yearly average since 2008 when you exclude 2021, 2022 and 2023.

Not counting 2021, 2022 and 2023, even March's 3.5% is higher than we're used to seeing. The last time we hit that total (again, not counting 2021, 2022 and 2023) for a monthly gain was October, 2011.

So, in the context of the last 13 years, even this month is generally high.

We don't need to break even but yes, inflation probably needs to get below 2%, where it was for 108 months before 2021 and so far there's no evidence of that happening.

So, expect the Fed to not lower interest rates.

Voltaire2

(15,377 posts)So we are back within normal levels after the post pandemic spike. The point being that there isn't an inflation crisis. Moderate inflation has been normal for a very long time. Inflation right now is on the high end of moderate. It is not a crisis.

All Mixed Up

(597 posts)We're still well above that.

To put that into context, the average for 2023 was 4.1%. Not counting the proceeding two years of Biden's term, that alone would be the highest average yearly inflation the US has seen since 1991, where it was 4.2%.

Right now, we're at an average of of about 3.3% the first three months of 2024 (and it's increased each month so far this year - from 3.1 in January, to 3.2 in February to 3.5 in March).

Excluding 2021, 2022 and 2023, that 3.3% average would be the highest yearly inflation average since 2008 (3.8).

Now I'm not even getting into the 8.0 average we saw in 2022, which was the highest yearly average since 1981.

The problem is that the US saw an incredible run of low inflation. From 2009 to 2020, the highest yearly average was in 2011 at 3.2. But that was just a blip.

2009: -0.4 (we actually saw deflation after the recession)

2010: 1.6

2011: 3.2

2012: 2.1

2013: 1.5

2014: 1.6

2015: .1

2016: 1.3

2017: 2.1

2018: 2.4

2019: 1.8

2020: 1.2

In just three years, from 2021 through 2023, the average inflation rate jumped by 16.8 points.

From 2011 to 2020, nine years, that rate only jumped by a total of 17.3 points.

In just three years, inflation jumped by nearly the same amount as the previous nine years combined on average.

That's why these numbers are not good. Because costs are already extremely high, especially compared to where they were in the 2010s.

If we were looking at a situation where 2021, 2022 and 2023 were, on average, 3.5 points - you'd have a point. It wouldn't be as big of a deal. Maybe some concern that the market was a bit too hot but nothing to be terribly concerned about.

Now, though? They're still well above normal when you factor in the last 30 years.

And the trend is ticking up, which should be the bigger concern here.

But the truth is that people are feeling it and high inflation persists because we're still seeing a decent-ish increase each month. At least compared to the last 30 years.

WarGamer

(18,429 posts)ProfessorGAC

(76,432 posts)...average rate of inflation of 3.8% over that same 3.25 years, we get 12.88%

Now, that 5.12% is significant, but it's a bit misleading to announce 18% as a problem, without defining the magnitude.

In reality, it only cost $51 pet thousand of expenses more than it would have without the COVID triggered spike.

People too often, see a number like 18% and think that everything simply went up 18% higher than it was supposed to cost.

WarGamer

(18,429 posts)Celerity

(54,069 posts)

jmbar2

(7,901 posts)Those of us who took severe financial hits during the Great Recession of 2009 can remember how gut-wrenching that era was. This is the first rodeo for younger workers.

I sympathize with their angst.

https://www.cnbc.com/2024/03/07/layoffs-rise-to-the-highest-for-any-february-since-2009-challenger-says.html

SWBTATTReg

(26,213 posts)other tech-related, often times, better tech to employ in their businesses.

Fortunately, the tech changes don't make it into the Business World 100%, since some businesses continue to use old platforms (don't want to spend the money, want to continue to use the older tech), so they'll be jobs out there, it's just that the raises and such won't be coming as much as before. Some of my friends/acquaintances are making insane amounts of money on these jobs that employ the new software languages out there. I still can't believe the money amounts.

And yes, I do remember the shake down in early 2008, 2009, etc. I was planning for my retirement then at that time, and then WHAM, the whole thing collapsed, the markets, real estate, everything. I had to put my plans to retire onto the back burner until things 'calmed down' a bit.

jmbar2

(7,901 posts)I was working on the training side - always the first to go, and the last to get hired again when business picked up. Those were some very lean times.

At least then, housing was somewhat affordable. I cannot imagine getting laid off with today's high housing costs.

SWBTATTReg

(26,213 posts)that long, so I wasn't loaded up w/ experience, just a new hire out of school. But, as the years went on, I did get into a lot of related fields, got into negotiating w/ agreements between companies in the exchange of data, starting up w/ EDI (still brand new to the industry at that time), so it was overall good.

And you're right, training is usually the first to go, but I would have thought that you would taken you, w/ the knowledge you had, and used you in a production mode, that is, support live environment vs. a training mode. Hopefully by now, you're more in a stable environment/job, and you have no worries.

Take care!

werdna

(1,223 posts)"How dare Joe Biden threaten to make us billionaires pay our fair share of taxes! We'll show him!!"

Expect more of this as the election draws near.

Nailed it

doc03

(39,000 posts)voters that voted for Biden in 2020. When asked about the economy 8 out the 9 said Trumps economy was better. One of them said Biden's economy is a disaster.

Marcus IM

(3,001 posts)Corporate media are not on our side.

End of story.

Bookmark and watch ...

Mad_Machine76

(24,941 posts)How was Trump's economy a success? What made it a "success"? What makes Biden's a disaster (aside from recovering from COVID, which was exacerbated by Trump's negligence/incompetence)? I would love somebody to dig a bit deeper with some of these focus groups.

doc03

(39,000 posts)NickB79

(20,298 posts)Gas prices were $1.50 because half the country was at home, and that's all a lot of people remember, it seems

patphil

(8,927 posts)7% in 2021, and 6.5% in 2022.

People should remember that the first 2 years of a president's term the economy is still reacting to what happened in the previous president's term. And that was all Covid.

Given the disaster of the Covid pandemic, we've actually rebounded pretty well. However, it's still very important for the Biden administration to pull the number down to 3% or less over the next few months.

There's a whole lot of people out there who aren't ready to accept what happened, given the struggle they have paying their bills.

All they remember is that inflation used to be low, and they want to go back to that time.

To tell you the truth, it was lower when Obama was president than when Trump was.

https://www.usinflationcalculator.com/inflation/current-inflation-rates/

gab13by13

(31,885 posts)and was roundly criticized for using the phrase, "negative Fed speak."

What is so magical about a number? What is so magical about keeping inflation at 2.0? Just maybe the country's economy will do just fine at 3.0 - 3.5?

What terrible event will happen if the Fed cuts interest rates 2 or 3 times this year?

I know this that when economists cry about not cutting rates or even talk of raising them, the stock market tanks.

Cut the fucking interest rates like you promised, stop with the "negative Fed speak." It's almost like someone wants the economy to tank. I know, the stock market isn't the economy.

If we are truly concerned about inflation then have the government take over Big Oil. We are now a net exporter of petroleum products. When someone says Israel and Iran may go to war and the price of gas jumps, we won't have that scenario when government owns the fossil fuel industry, inflation problem solved.

triron

(22,240 posts)Silent3

(15,909 posts)I'm not fond of group punishment like that.

Flatrat

(176 posts)CNN is tanking

ScratchCat

(2,727 posts)As if it is some magical or existential force, maybe even like climate, that exists in and of itself. Never before in the history of this country did the corporate media treat "inflation" this way. But its not "inflation" now; its little more than "spiteflation" where wealthy corporations are raising prices to spite working Americans hoping they wont vote Democrat this time around.

gab13by13

(31,885 posts)I understand during Covid we had a supply problem, there were no hand towels, Kleenex, toilet paper, on the shelves, supply and demand, prices rose.

The supply issue is over but prices didn't react to increased supply.

Let me take a stab at the cause of inflation, it's pretty technical, I took Econ 101;

I take 4 prescription drugs, 3 from a mail order company but one I do not. I got a text from the mail order company informing me that I can save money if I get my blood thinner from them, only $399.00 for a 3 month supply. I get my blood thinner from my local drug store, same popular brand, for $10.00 a month and that deal is from the company that makes the blood thinner.

I don't have to spell out what the inflation problem is.

ScratchCat

(2,727 posts)The supply issue is over but prices didn't react to increased supply.

That everyone from big corporations to the local home builder would be inventing excuse after excuse for eternity as to why a)prices can't come down and b)why they have to keep going up. And here we are...

Silent Type

(12,412 posts)womanofthehills

(10,883 posts)I feed them organically & their feed went up $10 a bag.

Silent Type

(12,412 posts)0rganism

(25,559 posts)During Democratic administrations, it's completely controllable if only the politicians cared about the people.

Inflation is so amazing! Callous yet sensitive, impervious yet vulnerable, cruel yet empathetic -- truly a breeding ground of contradictions and paradoxes, rather like the media which reports on it.

TheRealNorth

(9,647 posts)Gas and housing are the leading causes of the inflation increase. So this should have been expected - that the bastard oil companies and private equity firms would raise prices to increase profits and hurt the Democrats in an election year.

gab13by13

(31,885 posts)that just the speculation of a war between Israel and Iran caused gasoline to go up?

Maybe our government needs to take over Big Oil and shit like that won't happen. We are now a net exporter of petroleum products.

Silent Type

(12,412 posts)WarGamer

(18,429 posts)NickB79

(20,298 posts)JuJuChen

(2,253 posts)Avalon Sparks

(2,747 posts)Last month I paid slightly less than 18 dollars for 6 Orange Bell Peppers and 4 Honey crisp apples at Kroger.

People are definitely hurting.

videohead5

(2,925 posts)For $2.99 yesterday at Kroger.

TheRealNorth

(9,647 posts)Checked the prices at my nearest Kroger and it's 6.79 for a 3 lb bag or $2.29/lb for individual apples

videohead5

(2,925 posts)The weekly sale ended yesterday.

Avalon Sparks

(2,747 posts)6 yellow bell peppers and a 3lb bag of honey crisp is $15.43. There’s 7-8 smaller apples in the 3lb bag then the 4 bigger single ones I got last month.

videohead5

(2,925 posts)I will buy Gala's if the Honey Crisp are not on sale.

senseandsensibility

(24,744 posts)answer to supporting a federal abortion ban according to their webpage. ![]()

Blue Owl

(58,836 posts)malaise

(295,024 posts)Eff them

Calculating

(3,000 posts)My car insurance just went up $100 randomly because of inflation, my health insurance went up $50 a month, medical bills are out of control even for simple stuff, etc.

brooklynite

(96,882 posts)I assume you feel that’s not a news story?

TheProle

(3,962 posts)We all know they just made up that number because they want fascism...

ificandream

(11,828 posts)And they didn't say "the economy was tanking." They reported the one-day drop in the Dow. Kind of a big difference there.

orangecrush

(29,803 posts)Their top headline and added 10 articles all supporting the same conclusion with no opposite point of view, like when we had, what was that called, "The Fairness Doctrine"?

ificandream

(11,828 posts)They headlined the main story about the Dow Jones drop and grouped related stories around it. Not sure what you're looking for. A 500 point Dow drop is what it is. It doesn't mean, however, we're on the verge of a depression.

All Mixed Up

(597 posts)A 500 drop is significant any way you cut it.

But it's already fallen off their top page.

People just want perfect coverage and for every news source to pretend everything is fine.

ificandream

(11,828 posts)And it’s not right unless it’s their way.

brooklynite

(96,882 posts)It didn't require objective reporting. It didn't require TV stations to provide alternative reporting. It required time be given to alternative opinions if the station expressed an opinion. And that time could be at 2 in the morning.

Add to which, it never applied to news outlets that didn't utilized over the air broadcasting.

angrychair

(12,086 posts)In theory, at it most simple explanation, its corporations raising prices because of increase costs related to labor and/or raw materials. Either due to demand exceeding supply or increase costs because of the availability of raw materials.

That is not what is happening. Not to any significant extent that prices should be increasing across all business sectors.

Also if prices have gone up to offset increases in supply demands of other expenses, profits would remain largely flat or companies financials would be a little worse than previous quarters because inflation is a lagging indicator. That is not happening.

Corporations are reporting record profits, repeatedly, quarter after quarter. Some have reported the largest quarterly profits in their history. Corporate stock buybacks are being done at a record pace. Corporations, collectively, have built up the largest cash reserves in US history.

None of this is the sign of an inflationary economy. Its is a sign that corporations are screwing the consumer and price gouging for profit. This is not just my opinion but the opinion of noted economists like Robert Reich.

We are being played.

LenaBaby61

(6,991 posts)😴

![]()

codfisherman

(89 posts)Whatever the economic situation, CNN succeeded in getting 59 more people (myself included) in looking at that ad by clicking on this. Yay team!

Emile

(41,803 posts)TBF

(36,286 posts)there is also the problem that multi-national corporations are making billions. They have no problem with raising their prices & over-compensating their executives. The Fed does need to hear about the rates, but they can't do much (at least in short term) about the companies and their shenanigans. What we need is these companies held to account, and that's going to be difficult in an election year because the strongest lever on that is tax hikes.