General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsIs'nt this just a classic pump and dump

on a monumental corrupt scale?

Trump threatens massive tariffs on some country,

Markets tank, Trump and his surrogates buy buy buy,

Then trump says, just kidding, markets sky rocket,

and trump and his buddies make off with shitloads of money.

Thoughts? It's the elephant in the room that the media is crickets about.

raccoon

(32,287 posts)calguy

(6,104 posts)erronis

(23,151 posts)dchill

(42,660 posts)PatSeg

(52,599 posts)Some are making a fortune off his ridiculous antics.

groundloop

(13,646 posts)I keep having this dream that he'll be prosecuted and held accountable for all of his many crimes, but that's never going to happen.

We're screwed.

dchill

(42,660 posts)PatSeg

(52,599 posts)but what we've learned about the very wealthy is for them, there is never enough. They are like a different species than the rest of us.

PatSeg

(52,599 posts)held accountable, but it has been one damn disappointment after another. How can someone so blatantly and publicly corrupt keep getting away with it? What it says about our society is far worse than what it says about a crook like him.

I think the only thing we have going for us is his age. Most dictators start much younger.

Response to Be The Light (Original post)

iluvtennis This message was self-deleted by its author.

Response to iluvtennis (Reply #5)

Bernardo de La Paz This message was self-deleted by its author.

Response to Bernardo de La Paz (Reply #6)

iluvtennis This message was self-deleted by its author.

iluvtennis

(21,480 posts)Bernardo de La Paz

(60,320 posts)To accomplish this, some shareholders have to allow their shares to be borrowed. A small fee is charged for borrowing but I think the broker holding the account on behalf of the shareholder accrues the fee, but I'm don't know on that point. tRump tried to limit the number of shares available for shorting on his DJT stock.

If there occurs a large position of shorts on a stock or commodity and the stock rises instead of falling the way the "shorts" hoped it would, then there might be a rush by them to buy back the stock, leading to a "short squeeze" that temporarily boosts the price of the shares even more.

Shorting is a useful part of market action to get views of participants reflected in market prices, but it needs to be (and is) carefully regulated to limit its effect and to protect retail investors from suffering from a run of shorts or being tricked into making short sales. Short sales can be risky because there is unlimited loss potential (if the price goes to the moon) and limited gain potential (max is the price of the stock at the time of sale).

iluvtennis

(21,480 posts)new today. Thanks again.

Bernardo de La Paz

(60,320 posts)iluvtennis

(21,480 posts)Fla Dem

(27,493 posts)Yet he's allow to influence our financial markets to enrich himself, his family and billionaire supporters.

It's a financial conspiracy scheme. However it can be done, charges should be brought against him.

Bernardo de La Paz

(60,320 posts)If the OP is based on the last two months of announcements and market action, then it may have some merit, but is lacking in hard evidence.

There is zero evidence yesterday's administrative court decision has anything to do with insider trading.

CaptainTruth

(8,092 posts)More Than a Dozen U.S. Officials Sold Stocks Before Trump’s Tariffs Sent the Market Plunging

https://www.mprnews.org/story/2025/05/28/propublica-over-a-dozen-us-officials-sold-stocks-before-trumps-tariffs-sent-market-plunging

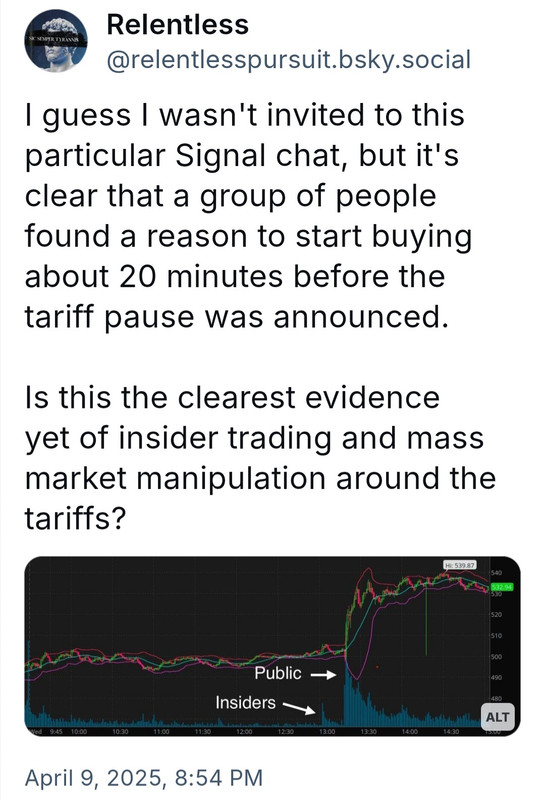

I also saw a graph a couple weeks ago, which I can't find right now, which showed a spike in trading (insider presumably) about 20 minutes before one of the major tariff announcements.

But as you say, without knowing who was trading & what they knew, it's not really proof.

Bernardo de La Paz

(60,320 posts)ProfessorGAC

(76,179 posts)...I don't see this as evidence of either "pump & dump" or insider trading.

It did not require non-public information to realize the markets would react negatively to tariffs.

I have issues with congress people doing this then voting to support his agenda, but that's an ethics thing, not a legal one.

As to "pump & dump", the market reactions have not caused a full recovery. So, if it is pump & dump scheme, it's a bad one.

Be The Light

(141 posts)not the proper Nomenclature ,

but definitely manipulating the market for personal gains.

Be The Light

(141 posts)ass fuckery would also work in the description of whats going down.![]()

ProfessorGAC

(76,179 posts)I find such suspicions dubious at best.

Bernardo de La Paz

(60,320 posts)It's a big spike in volume 18 minutes before the announcement. That's caused by a big move by a few big trading houses or a big move by multiple high worth individuals or some combination. Note that there is a tail to the spike volume, which would be smaller traders noticing the volume spike and making some trades, perhaps to hedge without knowledge of what was about to happen.

The spike was accompanied by a rise in price which was not relatively large and also tailed off as the follow-on / hedging trading ebbed away. This means the spike was due to buying. Notice the green open candle at that point where the prices made the little jump at that point. That is also indication of counter-trend buying.

So it is strong evidence that some entities had advance knowledge of "impending news". They may not have known any specifics, but they got advance notice that something was up.

But whether or not the participants knew it was about to be a positive for stocks we don't know at this point. It could have been as "innocent" as that perhaps the media got alerted by Press Office staff that there would be an announcement in, say, 10 or 15 minutes and it was a few minutes late. Or it could have been insider trading.

But insider trading is not pump-and-dump, which is what the OP refers to.

CaptainTruth

(8,092 posts)Bernardo de La Paz

(60,320 posts)See my post #29 for discussion of the insider trading issue.

Pump-and-dump takes days to operate because it depends on diffusion of the "pump" through the media, reaching a large enough number of institutional and retail investors / traders and for them to react by buying stocks.

Of course, most of the scenarios talked about are sort of the reverse, but I don't know an appropriate mellifluous term to use. It is like the origin (orange origin) pushes prices down with a tariff announcement. The market declines on the news, either suddenly or over a few days. Then a few days or a week later the schemers buy stocks. After they've made their buys, the Oval anus makes his third-grade level announcement that he is TACO-ing again and the stocks shoot up. After they make their run over a few hours or a day or two, the operators sell their stock positions for a profit.

That takes days and sometimes a couple of weeks.

Insider trading can run in conjunction with pump-and-dump where the insiders could be given advance knowledge several days ahead of a major announcement, or even get wind that the announcement they were promised is about to happen.

And there was the stunning video of tRump in the Oval with car billionaires and said one recently made hundreds of millions in the market and the other just made billions.

Paladin

(32,354 posts)Why should they bother? It's not as if there are any consequences for their plundering, either from the other branches of government, or the docile media, or for that matter, from the American public. Their looting will continue, until such time as something is done to prevent it---if ever. It may not be the leadership we deserve, but it's damn sure the leadership we're allowing. And we ought to be ashamed.

bucolic_frolic

(54,530 posts)Somebody's making wheelbarrows full of money

moondust

(21,257 posts)He announces big tariffs on a country and then waits for a private "offer" from that country that convinces him to go easy on them.