General Discussion

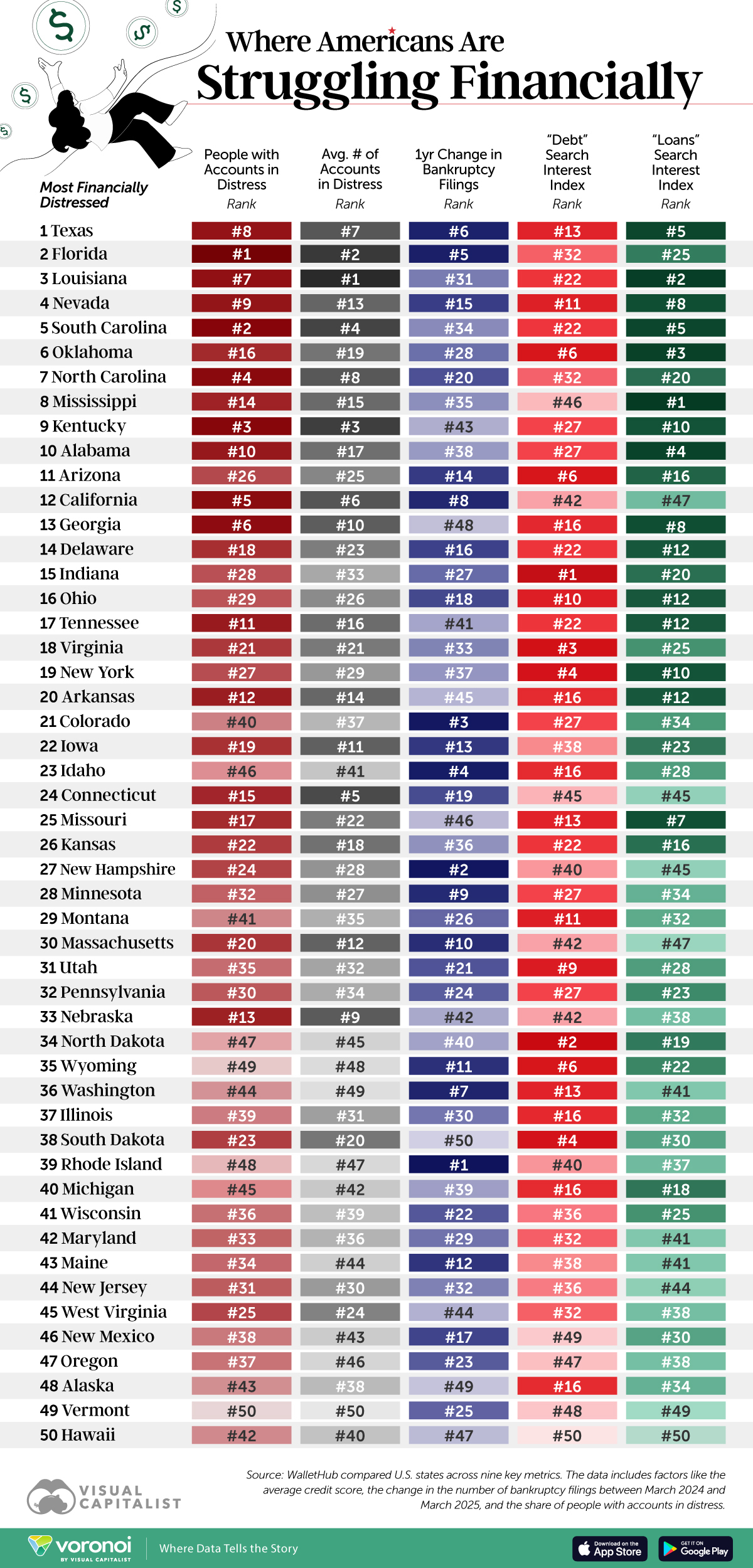

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsRepublican States Are Struggling the Most Financially

https://www.visualcapitalist.com/ranked-states-where-americans-are-struggling-the-most-financially/

These states tend to show lower bankruptcy increases, fewer accounts in distress, and less debt-related search interest. Notably, Vermont ranks last in the number of people and accounts in distress.

It's time to make billionaires pay - BumRushDaShow's post https://www.democraticunderground.com/10143516844

Link to Make Billionaires Pay website - https://www.makebillionairespay.us/

Raven123

(7,661 posts)Just curious. How reliable are those variables in assessing distress?

Habitation

(5,717 posts)In a nutshell, the search terms amount to 33% of the total weight.

The link below is to the data and at that link they have a state-by-state breakdown indicating the correlation between bankruptcies, search terms and accounts in distress meaning accounts where the account holder was temporarily allowed to not make payments due to financial difficulty.

In order to shed light on the financial troubles experienced by people across the U.S., and to show where those difficulties are most pronounced, WalletHub compared the 50 states across nine key metrics. Our data set includes factors like the average credit score, the change in the number of bankruptcy filings between March 2024 and March 2025, and the share of people with accounts in distress.

https://wallethub.com/edu/states-with-the-most-people-in-financial-distress/130790

Raven123

(7,661 posts)Johnny2X2X

(23,839 posts)Far Right state and local governments lead to awful living and working conditions for regular people.

It's long overdue for Democrats to use the state of the Red States against the Republican Party. There are large portions of the reddest states that are darned near 3rd World living conditions.

Habitation

(5,717 posts)to drown out the actual facts in people's lives. Now that the IRS has ruled churches can campaign from the pulpit, expect fear-driven wedge politics to be amplified especially in the South.

Are low information voters going to care about what their pastor says when they can't afford the gas to get to church?

MichMan

(16,896 posts)Seems legit

![]()

Habitation

(5,717 posts)In a nutshell, no, your statement is not accurate.

The two search term indexes (16.66% each) are relative volume data derived from Google Trends and the balance, 66%, is from cited financial data (the additional research).

Search terms are a reliable indicator of regional trends, but their accuracy depends on proper methodology and awareness of their limitations. Regional search data is based on relative popularity, not absolute volume, and can be skewed by outside factors like media coverage. For the most dependable results, it is crucial to validate search term data with additional research which is exactly what the writer did. The writer, Adam McCann, has a B.A. in Writing Seminars and International Studies from Johns Hopkins University.

In my opinion one thing that could have been done is a correlation analysis between the terms and the additional research. He could have employed regression analysis to find statistically significant relationships between search data and real-world data. The discussion about individual states does however indicate that there is a significant positive correlation between the various terms and the various States, for example:

Texas is the state experiencing the most financial distress, which might seem counterintuitive, given that Texas is the eighth largest economy in the world, with a bigger GDP than most countries. However, Texans are having a number of economic struggles, which are demonstrated by the fact that residents had the ninth-lowest average credit score in the country in Q1 2025. Texas also had the third-highest number of accounts in forbearance or with deferred payments per person, and the seventh-highest share of people with these distressed accounts, at 7.1%.

To top things off, Texans had an increase of more than 22% in non-business bankruptcy filings in the past year, the sixth-highest increase in the country. Texans also search Google for “debt” and “loans” at a high rate, which shows that many people are desperate to borrow, despite already owing money.

Florida

Florida residents are the second-most financially distressed people in the country. In Q1 2025, Florida had the seventh-most accounts per person in financial distress, meaning accounts where the account holder was temporarily allowed to not make payments due to financial difficulty. Floridians also had the second-highest increase in the share of people with distressed accounts between Q1 2024 and Q1 2025, at nearly 23%.

In addition, the Sunshine State had the sixth-highest overall share of people with accounts in distress, at 7.3%.

As you can see from the data in the post Floridians searched the terms debt and loans at ranked rates of 32 and 25 which would seem to rank them relatively low on the overall ranking but despite that, the additional research has them ranked in the number two position. So, what you are implying is that search is going to weigh abnormally high on the rankings is not proven by the results and you could see that in my original post.

Google Trends is a generally reliable tool for comparing search interest between states because it provides real-time, anonymized, and aggregated data that is normalized to show relative popularity on a 0-100 scale.

Regional differences in internet usage and data variability over time can influence reliability, so it's best used for comparative analysis of trends rather than precise volume or as a standalone data source and that is exactly what the writer did by using 1. The Change in Number of Bankruptcy Filings - March 2025 vs. March 2024 (~8.33 Points) 2. The Change in the Share of People with Accounts in Distress - Q1 2025 vs. Q1 2024: Full Weight (~8.33 Points) 3. The Change in Credit Score - March 2025 vs. March 2024: Full Weight (~5.55 Points) 4. The Change in the Average Number of Accounts in Distress - Q1 2025 vs. Q1 2024: Full Weight (~8.33 Points).

The entire methodology is presented below:

In order to determine the states where people are in the most financial distress, WalletHub compared the 50 states across nine key metrics in six overall categories: 1) Credit Score, 2) People with Accounts in Distress, 3) Average Number of Accounts in Distress, 4) Change in Number of Bankruptcy Filings - March 2025 vs. March 2024, 5) “Debt” Search Interest Index and 6) “Loans” Search Interest Index. WalletHub defines an account in distress as one which either is in forbearance or has its payments deferred.

We then determined the weighted average across all metrics to calculate an overall score for each state and used the resulting scores to rank-order the states.

Credit Score – Total Points: 16.66

Average Credit Score March: Double Weight (~11.11 Points)

Change in Credit Score - March 2025 vs. March 2024: Full Weight (~5.55 Points)

People with Accounts in Distress – Total Points: 16.66

Share of People with Accounts in Distress in Q1 2025: Full Weight (~8.33 Points)

Change in the Share of People with Accounts in Distress - Q1 2025 vs. Q1 2024: Full Weight (~8.33 Points)

Average Number of Accounts in Distress – Total Points: 16.66

Average Number of Accounts in Distress in Q1 2025: Full Weight (~8.33 Points)

Change in the Average Number of Accounts in Distress - Q1 2025 vs. Q1 2024: Full Weight (~8.33 Points)

Change in Bankruptcy Filings March 2025 vs. March 2024 – Total Points: 16.66

“Debt” Search Interest Index – Total Points: 16.66

“Loans” Search Interest Index – Total Points: 16.66

Sources: Data used to create this ranking were collected as of June 17, 2025 from the Administrative Office of the U.S. Courts, TransUnion, Google Trends and WalletHub database.

MichMan

(16,896 posts)Average Credit Score March: Double Weight (~11.11 Points)

Change in Credit Score - March 2025 vs. March 2024: Full Weight (~5.55 Points)

People with Accounts in Distress – Total Points: 16.66

Share of People with Accounts in Distress in Q1 2025: Full Weight (~8.33 Points)

Change in the Share of People with Accounts in Distress - Q1 2025 vs. Q1 2024: Full Weight (~8.33 Points)

Average Number of Accounts in Distress – Total Points: 16.66

Average Number of Accounts in Distress in Q1 2025: Full Weight (~8.33 Points)

Change in the Average Number of Accounts in Distress - Q1 2025 vs. Q1 2024: Full Weight (~8.33 Points)

Change in Bankruptcy Filings March 2025 vs. March 2024 – Total Points: 16.66

“Debt” Search Interest Index – Total Points: 16.66

“Loans” Search Interest Index – Total Points: 16.66

I said "So, doing an internet search with words "Debt or Bankruptcy" has the same effect as actually being delinquent"

Appears that the weighting agrees with what I said.

Habitation

(5,717 posts)Last edited Fri Aug 22, 2025, 07:23 PM - Edit history (1)

As you can see from the data in the original post Floridians searched the terms debt and loans at ranked rates of 32 and 25 which would seem to rank them relatively low on the overall ranking but despite that, with the additional research has FL ranked in the number two position. So, what you are implying is that search is going to weigh abnormally high on the rankings is not proven by the results and you could see that in my original post.