General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThis message was self-deleted by its author

This message was self-deleted by its author (PeaceWave) on Sat Nov 15, 2025, 02:10 PM. When the original post in a discussion thread is self-deleted, the entire discussion thread is automatically locked so new replies cannot be posted.

BeerBarrelPolka

(2,173 posts)Learn to say that a Democrat, ANY Democrat, is wrong when they are wrong.

Silent Type

(12,412 posts)We do have a hypocrisy problem at times.

Was surprised to see some DUers complaining about Fannie Mae lowering credit score to 620 for consideration. They aren't approving loans just because of that, but they aren't denying them either. Sounds like a good thing in any other world.

I hope we get our bearings before midterms.

Response to Silent Type (Reply #3)

PeaceWave This message was self-deleted by its author.

Silent Type

(12,412 posts)Response to Silent Type (Reply #5)

PeaceWave This message was self-deleted by its author.

yaesu

(9,128 posts)Response to yaesu (Reply #7)

PeaceWave This message was self-deleted by its author.

uponit7771

(93,504 posts)pat_k

(12,821 posts)If the small reduction in payment makes such a difference, you cannot afford the house. Subjecting yourself to 10 or 20 years of additional payments and tens of thousands more in interest is a very, very bad deal in any book I know of.

Consider this:

A homeowner with a 30-year, 6.4% $400,000 mortgage owes $2,502 per month for a total cost of $900,729 over the life of the loan.

If that homeowner has Obamacare their health insurance will go up at least $800.

Trump's solution to affordability: Get that family a 50 year mortgage!!

With a 50-year loan at 6.4% our homeowner's payments would be $2,225 a month for a total cost of $1,334,877.

So, instead of paying $2,502 per month on a 30 year mortgage, they are paying $2,225.

Oh goody, they have a whooping $277 to put toward that $800 health insurance increase. And all this at a cost of a mere $434,148 and 20 additional years of payments.

Does he really think people will get all excited over the prospect of shoveling hundreds of thousands more dollars in the pockets of banks for the privilege of squeezing expenses down a couple hundred dollars -- dollars that won't even begin to offset the costs of health insurance, electricity (no more clean energy subsidies), groceries, and every other necessity?

On edit:

I am an old fogy, but my approach to taking on debt is that I put enough down to make the payment so manageable that I can make larger payments with regularity, and only have limit myself to regularly scheduled payments when some emergency or unexpected expense leaves me short.

If I can't put that much down, I need to downsize the purchase.

Torchlight

(6,516 posts)If it's not, I doubt any real distancing action or behavior is needed. Seems more audience perception than it is a part of the design itself.

bucolic_frolic

(54,502 posts)We should be lending to homeowners and landlords to renovate. And making modest size homes spiffy with features and the lower taxes and mortgages that go with the lower prices. Instead we feed the homebuilders - Pulte, Toll, Hovnanian (are they still around) - to build McMansions. Everything has to be Home & Garden perfect.

Response to bucolic_frolic (Reply #9)

PeaceWave This message was self-deleted by its author.

AZJonnie

(3,230 posts)and comparing them both as "Great Presidents". Esp. when FDR had nothing to do with 30 year mortgages, and longer mortgages (over 30 years) have been bandied about for decades. It's not even CLOSE to his own idea.

I really don't care if 50 year mortgages (or 40 year ones) are "allowed" as long as there are still shorter ones. Not really my business. Consumers DO need to be well-informed, however, and I would be concerned that if there's suddenly 50 year mortgages due to their actions, the Trumputin-GQP axis will somehow make sure that they are available only from their cronies and campaign contributors and as deceptively-marketed, with the shittiest terms, possible.

Response to AZJonnie (Reply #12)

PeaceWave This message was self-deleted by its author.

uponit7771

(93,504 posts)Wiz Imp

(9,318 posts)The premise of this article is total BS. It was primarily a single Obama advisor advocating for 40 year mortgages. That person did not represent the Obama administration as a whole, and certainly did not represent he opinions of the Democratic Party as a whole.

https://finance.yahoo.com/news/forget-30-mortgage-40-mortgage-164749315.html

It’s no secret that people can’t afford to buy homes in this post-pandemic era. Home prices skyrocketed during the pandemic, mortgage rates soared after, and that brings us to the present moment: The storm has sort of calmed, and yet prices are still high, and so are rates. But the founder and chief executive of a nonprofit has an interesting proposal: a 40-year mortgage.

“The 30-year mortgage has been the American standard for decades, balancing affordable monthly payments with a reasonable repayment period,” Operation Hope’s John Hope Bryant wrote in an op-ed for CNBC. “However, as home prices soar and interest rates rise, particularly in urban areas, even 30-year mortgages can leave many families struggling with unaffordable payments.”

He continued: “A 40-year mortgage would lower monthly payments by extending the repayment period and possibly locking in an affordable market rate, making homeownership accessible to a broader segment of the population.”

Hope Bryant, a former advisor in the Obama administration, goes on to say the 30-year mortgage was a product of the Great Depression when people lived much shorter lives. “Today, with life expectancy nearing 80 years, a 40-year term aligns better with modern realities,” he wrote.

Random comments Found online:

40-year loans are a niche product used mainly for loan modifications and are not widely "embraced" by the mainstream mortgage market due to regulatory constraints and the long-term financial disadvantages for the borrower.

While 40 year mortgages do exist they are rarely used.

40 year mortgages have existed for many years. But they are non-QM, because one of the QM criteria is "term no greater than 30 years." That means that, as far as what the consumer sees, while the 40 year term makes the payment lower, the rates/fees/etc are all higher.

The Fed does not have unilateral authority to redefine QM. Congress would have to do it, via amending/repealing Dodd Frank and/or the Truth in Lending Act.

Response to Wiz Imp (Reply #17)

PeaceWave This message was self-deleted by its author.

DBoon

(24,825 posts)which were carefully thought out to provide affordable housing

Trump's 50 year mortgage is something a housing developer whispered in his ear. It has no context and no other supporting policies to ensure affordability as is typical for Trump.

Wiz Imp

(9,318 posts)The statement that the Obama administration did not embrace 40-year mortgages for general use is accurate. Forty-year mortgages were primarily an optional component within the administration's specific loan modification programs designed to help struggling homeowners avoid foreclosure, not a new, broadly encouraged standard for new home purchases.

Loan Modification (HAMP): The primary initiative, the Home Affordable Modification Program (HAMP), aimed to reduce monthly payments for at-risk homeowners. As part of a series of steps to achieve this, mortgage servicers had the option to extend the loan term up to 40 years. This was a tool for loss mitigation in cases of financial hardship, not a standard offering for all borrowers

General Mortgage Market: For the general market, the Obama administration did not promote 40-year mortgages. In fact, after the financial crisis, the Federal Housing Finance Agency (FHFA) prohibited Fannie Mae and Freddie Mac from purchasing loans with a term longer than 30 years.

Volaris

(11,507 posts)To qualified buyers. If we're gonna counter this fake rascist grifter populism from the right, we should think about playing on the same field.

Oh, MAGA and trump want obamacare gone, cause look at how expensive it really is?

Ok. We will abolish it in exchange for anyone in the country being able to use VA Healthcare, so long as they pay a hundred bucks a month out of their check (voluntary, of course)

The ACA would be voted out of existence in one cycle, because that's how dumb they really are.

WarGamer

(18,338 posts)If you're buying a home as an investment... but can only afford 5000/mo... the longer mortgage will get you into a more expensive home with greater potential for growth.

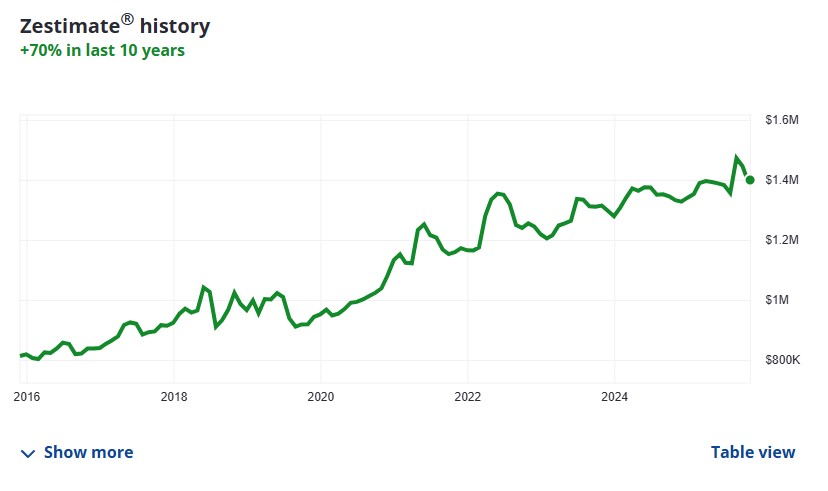

Here's where I live.

The duration of a mortgage isn't about paying it off... for most people, it's about securing the property to be in line for appreciation.

Response to WarGamer (Reply #20)

PeaceWave This message was self-deleted by its author.

Happy Hoosier

(9,446 posts)50 year mortgages mean hundreds of thousands in interest costs over the life of the loan. That welath being transferred from the buyer to the banks. It’s a disaster.

flvegan

(65,983 posts)No suggestion I give here is realistic. Not with this congress, not with any congress I've ever witnessed. Too beholden to people/industries/money that frankly ain't We the People.

Response to flvegan (Reply #22)

PeaceWave This message was self-deleted by its author.

PBC_Democrat

(450 posts)I would love to see our leaders go one step further and lock rates at 2.5%.

Home ownership is the basis for family and neighborhood stability, it starts the process of building generational wealth, and is generally good for society.

Sailingdiver

(350 posts)I loathe the idea of a 50 years mortgage even more.

It's pretty simple, for me.

CentralMass

(16,909 posts)spooky3

(38,393 posts)1) HAMP was instituted to help homeOWNERs who already had mortgages they were having trouble affording, not prospective home BUYERS. It was to enable people to avoid foreclosure and being kicked out of homes. People who didn't own homes were not eligible. See your own Brookings link - there is no mention of this in the Wiki link. The Pulte/Trump plan appeared to be available to prospective buyers, to encourage more home sales. BIG DIFFERENCE.

2) I don't see any evidence that Obama or Democrats in general "endorsed" a 40 year mortgage. Some may have supported HAMP.

3) We learned something since the financial crisis in 2008. Several controls have been instituted. Even if 1) and 2) were untrue, someone could reasonably have supported the 40 year mortgage ~ 2009 but now believe 50 year mortgages would be a mistake.

Renew Deal

(84,770 posts)Thanks for letting me know

newdeal2

(5,051 posts)This is not a policy tied to the Democratic Party at all in voters’ minds.

So whether this is good or bad policy, it doesn’t really matter. We can say we are against Trump’s 50 year mortgage and win on it.

JT45242

(3,929 posts)My son lives in Richmond Indiana and housing costs are not exploding. I live in Iowa City where they are.

Maybe regulation of venture capitalist to stay out of residential neighborhoods and turning what should be home into air bnb and similar would help to reset the market.

Regulate that new development must include xx% affordable housing.

Not convinced that 50 year mortgage is the answer when we could regulate greed and vulture capital groups out of housing markets.

Response to JT45242 (Reply #32)

PeaceWave This message was self-deleted by its author.

Totally Tunsie

(11,679 posts)Last edited Wed Nov 12, 2025, 01:43 AM - Edit history (1)

See the year 2007? That's when sub-prime mortgages were running rampant and many of those mortgages should not/would not have been granted under responsible lending practices. Note the price at $325,000, and there was a big rush to get into the homebuyer elite. Now look at the average price a mere two years later...down $75,000 to $250,000. If anyone who squeaked by in 2007 to buy a home they could barely make payments on, by 2009 they were $75,000 in the hole if they needed to sell out to resist eviction. The slide continued in and past 2011. How can you call these buyers advantaged? Not only did they lose a large percentage (about 23%) of their investment, they may quite possibly have an eviction or bankruptcy on their record making it near impossible to ever afford even the barest of homes in their future. Doesn't sound like a desirable outcome to me.

ETA: NOTE that the OP has removed and replaced the graph in the original post two hours after my post here. Actually, going through OP's edits, this is the third graph they have used. The information presented by this graph is quite different than the original, posing the question as to which of the three has the accurate information. To eliminate confusion, my comments were based on the information in the first graph posted so that now my reply does not align with OP's new presentation.