General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWarren Buffett: Buy stocks, beware bonds

Warren Buffett: Buy stocks, beware bonds

Staff and wire reports10:56 a.m. EDT May 6, 2013

OMAHA, Neb. (AP) — Billionaire investor Warren Buffett says he doesn't like owning bonds right now, and he doesn't think average investors should either.

The CEO and chairman of investment conglomerate Berkshire Hathaway says individual investors should keep enough cash on hand to be comfortable if the unexpected happens.

The rest should be invested in stocks, he added, even though stock prices are well above the rock-bottom levels they hit several years ago during the Great Recession.

Buffett said on CNBC financial news network Monday that bonds are a terrible investment at the moment and that owners of long-term bonds may see big losses when interest rates eventually rise.

http://www.usatoday.com/story/money/business/2013/05/06/warren-buffett-federal-reserve-stocks-bonds-heinz/2138403/

dixiegrrrrl

(60,154 posts)Bonds ( debt) more and more unlikely to be paid off as more levels of gov't go broke.

and who are the biggest buyers of bonds?

Pension/retirement funds.

Common Sense Party

(14,139 posts)Interest rates have nowhere to go but up.

When inflation and interest rates go up, bonds get hammered.

byeya

(2,842 posts)and many said "coupon only" for 2012. Sure it's got to end, probably soon.

I try to remember that no one ever went broke taking profits.

Common Sense Party

(14,139 posts)All Buffett (and many money managers) are saying is now is probably not the right time to get into bonds. Take profits from what you already have and diversify it, but don't buy into a basket of long duration corporate bonds now, or you may be sorry over the next decade.

byeya

(2,842 posts)A HERETIC I AM

(24,872 posts)Yo_Mama

(8,303 posts)Even supposing there is no default risk on any bond you buy, if the bond is paying 2.5% for 15 years and interest rates go up within three years 1.5%, you are going to take a very large loss.

Yupster

(14,308 posts)and how do you pay interest on $ 17 trillion?

Three percent interest is $ 510 billion a year.

byeya

(2,842 posts)States and localities are laying off workers instead of defaulting. The default rate is at the low end of its historic range.

The question is: When are interest rates going up. The bond markets are not sensing any imminent rise in spite of economic commentators saying(for the past 3 years) inflation is just around the corner.

dixiegrrrrl

(60,154 posts)(Reuters) – Slovenia abandoned an attempt to issue bonds and Moody’s cut its debt rating to “junk” on Tuesday, dealing a blow to the country’s goal of healing its ailing state-owned banks and avoid following Cyprus into the euro zone’s emergency room.

http://www.euronews.com/business-newswires/1941664-moodys-cuts-slovenia-to-junk-torpedoing-bond-issue/

roh oh...

byeya

(2,842 posts)for $1.06. That means you pay your dollar and get 94 cents of value with a lot of risk. They are overpriced but people are starved for yield.

Those retired people who were used to living on their bank CDs can't live on a less than 1% return so they are turning elsewhere and it will not end prettily.

As for countries without their own currency: don't.

A HERETIC I AM

(24,872 posts)Really? "Junk" bonds selling for 106% of Par?

And what do you mean by this statement?;

"That means you pay your dollar and get 94 cents of value with a lot of risk."

The reason I ask is because on its face, it isn't true, not to mention it makes no sense.

reformist2

(9,841 posts)You still get all the interest payments along the way, so you'll actually still get more than your purchase price, if all goes well.

A HERETIC I AM

(24,872 posts)No bond, and I mean NO BOND AT ALL has a "Par Value" of one hundred dollars.

So now I know what YOU think it meant.

I'm curious what the author of the post I responded to thinks it means.

Sure, you get the coupon payments, that's the primary point of buying bonds. That's why they are known as "Fixed income" investments.

reformist2

(9,841 posts)A HERETIC I AM

(24,872 posts)Secondly, I should probably tell you that I held a Series 7 Securities license and was a broker, and though I don't know all there is to know about bonds, it is clear by what you and byeya wrote, that I am much better versed on the subject than either of you.

What I want to know is where he got the information that told him junk bonds are selling for "$1.06" (which is the WRONG way of stating the price, BTW) and what he thinks he means by the statement "That means you pay your dollar and get 94 cents of value with a lot of risk."

FWIW, if he had simply said "Right now the average junk corporate bond is selling for 106." (leaving out the dollar sign and the decimal point) it would have given him a LOT more credibility. If he had said they were selling for 106% of par, that would have done the same thing. But to state specifically that average junk corporate bonds are selling for one dollar and six cents shows me he is either unfamiliar with proper nomenclature, ignorant of how bonds are priced or both.

And a moderate amount of searching shows ZERO BBB or worse rated, American Corporate bonds selling for 106. It doesn't happen. Crap bonds rarely if ever get bid into above par territory.

If he is quoting an index or a CEF or an ETF, then he is misleading his readers.

reformist2

(9,841 posts)A HERETIC I AM

(24,872 posts)I can't explain it if I don't know the source or context.

Here....allow me to show you but ONE source that supports my contention that junk bonds don't get bid into premium territory;

http://investment-income.net/rates/high-yield-bonds-rate-page

Scroll down toward the bottom for the short list of junk status bonds they provide. If you read that list carefully, you'll note that almost all of them are selling between 61.00 and 95.00. That is percent of par or $1000.00. Note that there are several that are selling for more than par and one is even priced at 107, but it is callable at 105.750 on the 28th of this month AND it has an 11.5% coupon.

If a bond is continuously callable by the issuer AND will call for a premium to par, then it makes perfect sense for it to be priced at or near that call price. But the vast majority of the bonds listed on that page, and I admit, it is but a tiny fraction of all similar securities, are ALL priced at a steep discount to par.

I am quite confident that I would find similar pricing were I to look for a more extensive list.

lumberjack_jeff

(33,224 posts)Interest rates are not at imminent risk of leaping.

Granted, with rates as low at they are, even a small uptick will devalue bonds a bunch.

http://finance.yahoo.com/q/pm?s=VWEHX

byeya

(2,842 posts)unless you own the bond outright and don't intend to sell it. Then you'll have to be satisfied with the coupon.

Rates have to go up some time but the world's bankers are more worried about deflation than inflation. They will err by keeping the easy money policy for too long then those in mutual funds and ETFs will get hurt. Closed end funds, not as much.

You can buy reputable socially-not-to-bad companies with yields higher than most investment grade bonds. I think that's Buffet's message.

Johonny

(25,960 posts)you are probably pretty happy right now.

Blue_Tires

(57,596 posts)unless you had reliably solid inside info...

byeya

(2,842 posts)retail investor can't pick a stock that pays a nice dividend at a fair price with a strong balance sheet and a product line that is meant for the long term. But yes, I think the system - all these instantaneous trades looking for a very quick few cents appreciation, then sell - is stacked against the average person who, unfortunately, has to try and manage a 401(k) or similar.

cbdo2007

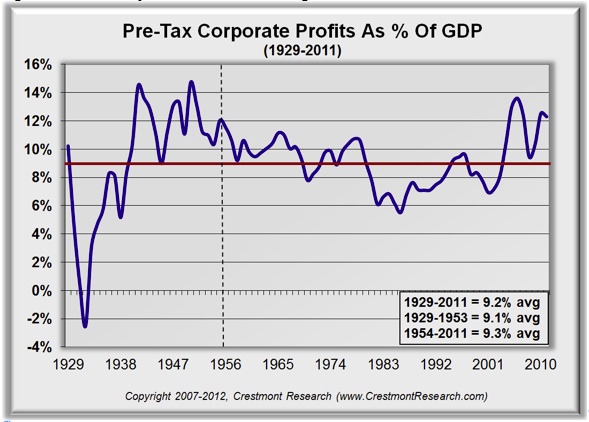

(9,213 posts)but I see tons and tons of evidence that that they will go up over time. Think I'll trust the data in this case. And the billionaire.

byeya

(2,842 posts)for the stock market to regain its value.

Stocks had greater dividend yield than US bonds through most of this period.

Blue_Tires

(57,596 posts)through buying/selling patterns, derivatives, false/leaked info, etc.??

Isn't one of the reasons he stays a billionaire is because he is privy to information long before it becomes public knowledge?

byeya

(2,842 posts)as the basis for short selling and other speculation. I believe ex-Governor Corzine could tell us about that during visiting hours.

reformist2

(9,841 posts)The reversion-to-the-mean theory would say Warren is wrong.

byeya

(2,842 posts)ng interest rates so that a company can easily refinance its debt and issue new debt, sometimes at less then 2% interest.

reformist2

(9,841 posts)cbdo2007

(9,213 posts)hahaha