General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsNot just the Teabaggerati, but any other 501( c ) (4) that does it too…

Yo_Mama

(8,303 posts)Here:

http://en.wikipedia.org/wiki/Category:501%28c%29%284%29_nonprofit_organizations

Democratic Leadership Council:

http://en.wikipedia.org/wiki/Democratic_Leadership_Council

Democrats for Life of America:

http://en.wikipedia.org/wiki/Democrats_for_Life_of_America

PFAW:

http://en.wikipedia.org/wiki/People_For_the_American_Way

Friends Committee on National Legislation:

http://en.wikipedia.org/wiki/Friends_Committee_on_National_Legislation

(Quakers)

Brady Campaign:

http://en.wikipedia.org/wiki/Brady_Campaign

Gender Rights Maryland:

http://en.wikipedia.org/wiki/Gender_Rights_Maryland

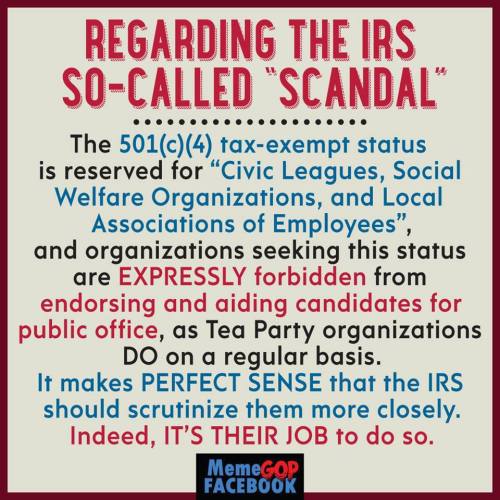

I'm trying to gently hint that you appear not to know what you are talking about. (c)4s are expressly permitted to engage in political advocacy.

MrScorpio

(73,765 posts)The law needs to be changed back to the way that it used to be

Yo_Mama

(8,303 posts)501(c)4 tax exempts really date back to the 1900s, but the category was codified in the 1950s.

http://blogs.wsj.com/law/2013/05/16/the-surprisingly-muddled-history-of-the-501c4-exemption/

Political advocacy was well established as being legitimate for this category in the 1950s. After that, many of them did campaign one way or another, and they had been campaigning before that.

More stuff here:

http://www.irs.gov/pub/irs-tege/eotopicm95.pdf

Political parties are exempt from taxation, but a political party has to be affiliated with a party and focused on that party's candidates, so a group that is pushing a particular issue or set of issues generally would wind up in the 501(c)4 bucket.

IADEMO2004

(6,380 posts)Cut:

(4)

(A) Civic leagues or organizations not organized for profit but operated exclusively for the promotion of social welfare, or local associations of employees, the membership of which is limited to the employees of a designated person or persons in a particular municipality, and the net earnings of which are devoted exclusively to charitable, educational, or recreational purposes.

(B) Subparagraph (A) shall not apply to an entity unless no part of the net earnings of such entity inures to the benefit of any private shareholder or individual.

End:

The ads I watched in 2012 were soooo f'en far from educational.