General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWall Street Legend William H. Gross Admits: ‘We Got Rich Off the Backs of Workers’

Wall Street Legend Admits: ‘We Got Rich Off the Backs of Workers’

~snip~

What follows is a letter from William H. Gross, who is an author, financial manager and co-founder of investment firm Pacific Investment Management Company. PIMCO is one of the largest active global investment firms in the world, with over $2 TRILLION in assets under management in 2012. Gross has been donating to charitable causes like Duke University, Doctors Without Borders and to various hospitals and medical foundations. Gross is known for his colorful memos and letters to investors, and this one may be the missive to top them all.

~snip~

Investment Outlook

November 2013

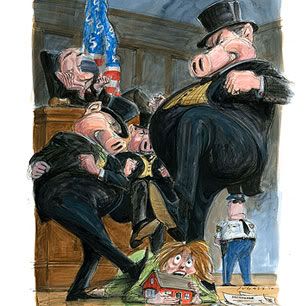

Scrooge McDucks

William H. Gross

With the budget and debt ceiling crises temporarily averted, perhaps a future economic priority will be to promote economic growth; one way to do that may be via tax reform. How to proceed depends as always on the view of the observer and whether the glasses are worn by capital, labor or government interests.

Having benefited enormously via the leveraging of capital since the beginning of my career and having shared a decreasing percentage of my income thanks to Presidents Reagan and Bush 43 via lower government taxes, I now find my intellectual leanings shifting to the plight of labor. I often tell my wife Sue it’s probably a Kennedy-esque type of phenomenon. Having gotten rich at the expense of labor, the guilt sets in and I begin to feel sorry for the less well-off, writing very public Investment Outlooks that “dis” the success that provided me the soapbox in the first place. If your immediate reaction is to nod up and down, then give yourself some points in this intellectual tête-à-tête.

Still, I would ask the Scrooge McDucks of the world who so vehemently criticize what they consider to be counterproductive, even crippling taxation of the wealthy in the midst of historically high corporate profits and personal income, to consider this: Instead of approaching the tax reform argument from the standpoint of what an enormous percentage of the overall income taxes the top 1% pay, consider how much of the national income you’ve been privileged to make. In the United States, the share of total pre-tax income accruing to the top 1% has more than doubled from 10% in the 1970s to 20% today. Admit that you, and I and others in the magnificent “1%” grew up in a gilded age of credit, where those who borrowed money or charged fees on expanding financial assets had a much better chance of making it to the big tent than those who used their hands for a living.

Yes I know many of you money people worked hard as did I, and you survived and prospered where others did not. A fair economic system should always allow for an opportunity to succeed. Congratulations. Smoke that cigar, enjoy that Chateau Lafite 1989. But (mostly you guys) acknowledge your good fortune at having been born in the ‘40s, ‘50s or ‘60s, entering the male-dominated workforce 25 years later, and having had the privilege of riding a credit wave and a credit boom for the past three decades. You did not, as President Obama averred, “build that,” you did not create that wave. You rode it.

~snip~

Scrooge McDucks Speed Read

1) Growth depends on investment and investment in part depends on an equitable rebalancing of personal income taxes, capital gains and carried interest.

2) The era of taxing “capital” at lower rates than “labor” should end.

3) Investors in the U.S. and elsewhere must look for investment in the real economy, not share buy-back maneuvers that artificially elevate stock prices.

William H. Gross

Managing Director

DeSwiss

(27,137 posts) - And they're all his friends and co-workers......

- And they're all his friends and co-workers......

K&R

[center]

[/center]

[/center]AllyCat

(18,660 posts)And a fine. And a jail term. I'm sorry, I cannot celebrate this pig's "change of heart". He only sees a game he hasn't played yet. When he gets out there and starts actually pushing this in earnest at a personal cost to himself, I might want to listen.

JDPriestly

(57,936 posts)golden eggs. Give the goose some time to get back in shape and start producing eggs again.

King_Klonopin

(1,365 posts)Any proposals on how to accomplish this ???

Any proposals on retribution (e.g. pension holders) or redistribution ???

Any proposals on how to get others -- especially the Republicans in Congress -- to admit to this ?????????

Any proposals on how to get those folks to stop their war on labor, unions, the poor, "entitlements" etc.

and to stop giving out favors (quid pro quo's) to those who don't need any favors ???

Any proposals as to who should be held to account (i.e. who should go to jail?!)

Any of your peers willing to make similar admissions of guilt ... on record ?

Or do you just "feel bad about it" ? ![]()

![]()

JHB

(38,066 posts)The policies that created the credit wave you and others rode didn't just happen all by itself. It came about thanks to substantial financial backing -- strategic donations to academic institutions favoring neoliberal economics, the establishment of conservative think tanks and media outlets to propagate those academic views to audiences both in Washington and among the general public, and undermining any entity (unions, media not promoting that viewpoint) that might push back against that agenda.

By 1980 some "course corrections" were needed in policies and other rules due to changes in the economy, technology, and global situation that had built up during the postwar period. Thanks to the intellectual and lobbying infrastructure, the political pressure was to scrap, not fix. Radical change, not tinkering. The changes in laws and regulations directly contributed to your profiteering.

Will you build an infrastructure to push back against it? Because that what it will take, not just a memo here and there.