General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsBOO!!! - And Fucking BRAVO !!! - A Shit Of A WaPo Editorial, And One HELL Of A Response...

Social Security proposals are wrongheadedWaPo Editorial Board

11/17/13

<snip>

PRESIDENT OBAMA and the Republicans never have struck a “grand bargain” on spending and taxes. Nor does it appear likely that the current budget bargaining between Democratic and GOP negotiators in Congress, who met inconclusively again on Wednesday, will produce one. They may fail to achieve even a small bargain. Even so, Mr. Obama faces rising pressure from the left flank of his party to defend entitlement programs tooth and nail. That pressure comes although such programs represent the lion’s share of federal expenditure growth in the coming decades.

In recent days, those styling themselves “bold progressives” have been rallying support for a bill sponsored by Sen. Tom Harkin (Iowa) and Rep. Linda Sanchez (Calif.), both Democrats, that would increase Social Security benefits. Supporters tout it as courageous pushback against austerity; in fact, it’s a case study in how not to redefine liberalism for the 21st century.

The Harkin-Sanchez proposal would change Social Security benefit formulas to produce an average increase of $60 per month, plus a more generous annual inflation adjustment, than the program uses now. It also would extend the life of the notional trust fund from which benefits are drawn by 16 years. To pay for this, the bill would subject all wage and salary income to the 12.4 percent Social Security payroll tax, as opposed to only drawing from income up to $113,700 as is presently done. For someone earning $200,000 per year, this would mean a tax increase of more than $4,000 per year. For someone earning $1 million, the tax increase would be $58,700.

It’s a massive transfer of income from upper-income Americans to the retired. A tax increase is not, in itself, objectionable. Revenue is necessary to pay the costs of an aging society, and it should be raised progressively. With respect to Social Security specifically, the percentage of wage and salary earnings subject to the tax has shrunk in recent years, and there’s an argument for correcting that.

Yet even the rich have finite resources...

<snip>

More: http://www.washingtonpost.com/opinions/social-security-proposals-are-wrongheaded/2013/11/17/38ebb486-4bde-11e3-ac54-aa84301ced81_story.html

The Very 1st Response:

11/18/2013 8:04 AM PST

On December 7, 1941 the Japanese Empire attacked U.S. naval and air bases at Pearl Harbor. Thereafter sixteen million young men wore the uniform, and, after 3 years and 8 months secured the unconditional surrender of Italy, Germany, and, Japan, Then, except for 405,399, they came home, went to school of the G.I. Bill or got jobs and entered into delayed marriages. The delayed marriages created the "demographic bubble" known as the Baby Boom generation and the children of WW II vets began to turn 65 in 2011.

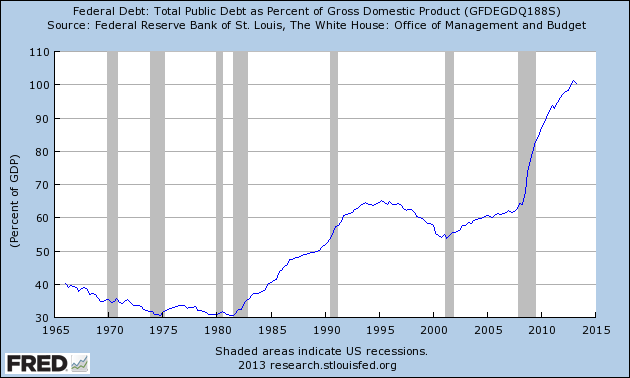

In 1946 the Gross Federal Debt amounted to 121.7% of GDP. the Truman administration reduced it to 71.4% of GDP; Eisenhower to 55.2%; Kennedy/Johnson to 38.6%; Nixon/Ford to 35.8%; and, Carter to 32.5%.

Then came Ronald Reagan with massive "supply side" tax cuts primarily for the wealthy and budget deficits in each of eight years increasing the Gross Federal Debt from 32.5% to 53.1% of GDP. Bush I had four more years of budget deficits increasing the debt to 66.1%.

Clinton raised taxes, had 4% unemployment, balanced budgets and reduced the debt to 56.4%.

Bush II instituted two rounds of "supply side" tax cuts in 2001 and 2003, had eight more years of deficits and increased the Gross Federal Debt from 56.4% of GDP to 85.1% with a crippled economy.

In 1983 Reagan signed a regressive FICA payroll increase so as to create a surplus in the Social Security Trust Fund which has a $2.6 trillion dollar reserve as of December 2012.

Social Security did not contribute one thin dime to the massive Federal Debt.

This massive Federal Debt was caused by borrowing all these trillions to fund "supply side" tax cuts for the wealthiest citizens most able to pay taxes.

The massive Federal Debt was not for any great national purpose such as the Revolutionary War, the Civil War, WW I, or, WW II. It was for "supply side" tax cuts for the wealthy.

Start with eliminating "supply side" economics and return to traditional Republican tax and fiscal policy.

Do this first.

gopiscrap

(24,671 posts)SomeGuyInEagan

(1,515 posts)Fantastic Anarchist

(7,309 posts)winter is coming

(11,785 posts)WillyT

(72,631 posts)lunasun

(21,646 posts)Curmudgeoness

(18,219 posts)I am bookmarking this so that I can use the information in it.....often.

Samantha

(9,314 posts)or perhaps they should chair it. Excellent response.

Sam

Mike Nelson

(10,943 posts)...those Post writers!

KoKo

(84,711 posts)zeemike

(18,998 posts)Enough of the bullshit from these trickle downers...it was a big fucking failure and it is time they fessed up to it.

WowSeriously

(343 posts)We are currently living under traditional Republican tax and fiscal policy.

Sheesh, get it right!

![]()

IrishAyes

(6,151 posts)ffr

(23,349 posts)progressoid

(52,992 posts)the party used to have by referencing Eisenhower and Nixon. ![]()

Adsos Letter

(19,459 posts)WowSeriously

(343 posts)Jackpine Radical

(45,274 posts)He's shaming today's insane Republicans by comparing them to their relatively sane (if generally wrongheaded) political ancestors.

bvar22

(39,909 posts)...our government has lurched over the last 60 years.

We are now WELL to the RIGHT of Republicans like Eisenhower and Nixon.

GeoWilliam750

(2,555 posts)to run as a liberal democrat today

bvar22

(39,909 posts)ffr

(23,349 posts)Terrific!

Oilwellian

(12,647 posts)a lot of people will read it. ![]()

grasswire

(50,130 posts)Thanks, Willy and Dryly.

WillyT

(72,631 posts)WillyT

(72,631 posts)And they actually printed that.

Like for... regular people... to read.

Enthusiast

(50,983 posts)Stimulating, you know. ![]()

jtuck004

(15,882 posts)And just for context...because we are still keeping taxes low for the wealthiest Americans:

Divernan

(15,480 posts)7962

(11,841 posts)Should they be paying more? YES. But you could take ALL the money from the 1% and it would barely make a dent in those numbers. That is something that nobody says. But its true, look at the numbers for yourself. The problem is the tax code itself and our spending. Too many people pay no income taxes. They do pay SS taxes, but not income taxes. I know its sounds "libertarian" of me; I dont care. Its the truth. And no democrat or republican has the guts to step up and change the way we do things.

Enthusiast

(50,983 posts)Every time Republican talking heads are on TV talking about the debt they say exactly what you said. It's on every dishonest lying goddamned right wing channel on my TV.

7962

(11,841 posts)Tax the bastards at 100% and you still wont get rid of the debt.

Show me where thats wrong. The debt is going on 17T and by the time obama gives the keys to hillary it'll probably be 20+T.

We cant keep whistling down the road. I'm too old to be around when the train runs off the tracks, but its damn sure gonna happen.

Enthusiast

(50,983 posts)57 cents of every tax dollar right now goes to an unnecessarily large military. That doesn't include the massive outlay for the CIA and NSA.

Most corporations pay near zero taxes after their deductions. The wealthy pay extremely low taxes(Romney 12%).

What you claim is just not true. The debt is the result of borrowing money to enact tax cuts for the rich and two wasteful counterproductive wars.

Those are my taking points buddy. You won't hear them where you are from.

I really wish you would go back to where you came from. We are liberals here. We grow weary of right wing misinformation.

7962

(11,841 posts)Maybe not as many yrs as you, but so what, I'm no newbie. And I read here for years before I ever joined up. Its amazing how this bastion of tolerant liberals has so many who are eager to jump you and call you names at the slightest difference of opinion. "Go back to where you came from". Really? Channeling a tea partier there?

And actually Romney paid a bit over 14%. Obama paid a bit over 18%. So theyre pretty much riding in the same boat. But I'm sure you were just as critical of the President when his returns were released.

And hey, I agree with you that we spend too much on the military. I think Iraq was useless. I DO think we shouldve gone to Afghanistan, but I also think we should have been gone years ago. I also think we should stop spending billions on weapons that the military doesnt even WANT. I also think that we should close a lot of bases overseas. We have over a thousand bases overseas and its time for some of those countries to start taking better care of themselves. Thats billions more right there. And without reducing our readiness. And I also believe we should do away with the Bush tax cuts too!

Since I'm such a right winger, I better be careful or I might get thrown out of the club making statements like that.

jeff47

(26,549 posts)How 'bout showing your basic math that a 100% tax at say $1M income would not reduce the deficit?

Or is this a situation where you don't understand what our debt actually is, that we are constantly paying it off, and that it will not "come due" at some point?

7962

(11,841 posts)If we are "constantly paying it off" (the debt), then why does it keep going UP? We simply pay interest most of the time. We're sitting at 17 trillion. How much is high enough?

The top 1% earn somewhere between 1-2 trillion annually (if i multiply correctly). If you take ALL of that, it would still take years to pay off the debt. And of course it could never happen because if you were going to take ALL of their income, they wouldnt work. Whats the point.

If I'm so wrong, show me the proof that my facts are wrong.

Hell yes, the rich should pay more in taxes. But there just isnt enough of them.

edit: With regard to SS, I also think the cap should be done away with and tax all income.

jeff47

(26,549 posts)Well then it would be very easy for you to show that with some math. Yet you didn't quite do so. Almost as if using actual numbers would not support your argument.

Looks like we'll have to go back to "Government Debt 1". We can get to "Government Debt 101" in a while.

Government debt is financed by bonds. Those bonds have a maturity date when the government pays back the money, with interest. That maturity date is not "forever". It's fixed.

As a result, we are constantly paying off the bonds we already issued.

As for why it keeps going up, that's because the debit and the deficit are two different things. The deficit is the difference between the money the government takes in from all sources and the money the government spends. Our debt is the cumulative effect of those deficits.

So how does this come together? By reducing the deficit, we are adding less to the debt. Which shrinks the next deficit. And so on. Since we're constantly paying off the debt, we do not need to suddenly pay trillions of dollars.

In addition, there's two things that 'deflate' our debt. Inflation reduces the real value of our debt. Under "normal" conditions, our real debt goes down all on it's own by 2% per year, because the borrowed money is worth 2% less. But a much larger deflator is GDP growth - the larger our GDP, the less our debt really is. Since you're stuck in a personal economics model, think of it like you getting a raise. Suddenly that car that was too expensive is affordable.

This effect is why actual economists measure government debt as a debt-to-GDP ratio instead of absolute numbers. $1T would be a huge problem for a country with a $1B GDP. It's nothing for a country with a $20T GDP.

Our debt-to-GDP ratio is less than other times in our past. For example, after WWII our debt-to-GDP ratio was much higher. In addition, we have examples like Japan who have a much worse debt-to-GDP ratio than we do. They'll run into problems before we do - we don't have to worry about debt suddenly becoming a huge problem.

False. When the bonds mature, both interest and principle must be paid. And as mentioned above, we are constantly paying off bonds.

The fact that the number is large is utterly irrelevant. The only thing that matters is the interest rate we have to charge to get people to buy our debt.

So how's that interest rate going? Well, people are willing to buy US debt at a negative real interest rate. As in, you give the government $100, and they will pay you back $98. And people are signing up to do this.

So we can run that $17T up a lot higher before we even begin to have a problem.

Government debt is not like your credit card. You can not pay it off in just a few years, because you can not pay it until the bonds mature.

Well, you've yet to show any facts. Instead you think government debt is exactly like you charging stuff on your Visa. It isn't, but the Republicans thank you for buying into their framing.

Springslips

(533 posts)What he was saying was a kin to freaking out because 100-percent of a year salary wouldn't pay off your house and car loans. Come on people!

7962

(11,841 posts)And without insulting me. Believe me, any time I post something that seems even slightly different than what the majority on DU thinks I get called every name in the book. Its like I missed the "Terms you MUST agree with" page when I signed up.

We continue to spend way more than we take in, and simply raising the taxes on the rich isnt enough.

So, I really do understand what youre saying. And yes, the bonds are due at different times. And also, the US public owns a lot of that debt. More than the Chinese. And contrary to what a few folks here think of me, I also think the Bush tax cuts shouldve ended when they were supposed to. But at the same time, there is a point where the rich, just like corporations, will do whatever it takes to avoid higher taxes. Its already happening in Europe. Back when we used to have 90% rates in the 50s, nobody paid that rate because we also had a million deductions. IMO, we need to do a couple things. I believe (and so does the president for the most part) that we should do away with all deductions and reduce the corp tax rate. It is one the highest, if not THE highest, in the world. If we did that, then the corps wouldnt have any reason to pay a thousand lawyers to get out of taxes. I believe that would actually raise the avg rate that corps pay from what it is now. We have a 25% rate, but nobody pays that.

Second, and here's where so many here hate me, we need a consumption tax. Not the "fair tax", more of a plain old sales tax like most of our counties use. With some sort of a check paid to cover the costs to the poorer folks. Because here's the problem with the current system: There are SO MANY people who pay little or no income taxes. And I'm not talking about the working poor. I'm talking about the cash-workers such as heat/AC folks, contractors, plumbers, mechanics, landscapers, electricians, etc etc. Sure they pay, but they also put a lot under the table. I know because I deal with a lot of them and a lot of them are friends. And a LOT of them make damn good money and brag about how much they get in cash that they dont claim. And thats not even including the illegal money from the criminal element that would now be taxed

We need more people paying something into the system. Just like the ACA was designed. EVERYBODY pays in so that lowers the cost for health care. Thats what the president always talked about when trying to get it passed. We should look at taxes the same way.

jeff47

(26,549 posts)You continue to say this, yet don't actually back up your position with any actual math. Heck, do you even know that our annual deficit has been MASSIVELY reduced since 2008?

In addition, there is no deadline for paying off our debt. If you run the numbers, 2% inflation means we are best served by always running a small deficit - inflation eats away the debt so that we end up with more real spending.

What appears to be going on is you've bought into the media and right-wing framing of the debt issue.

If this was an actual problem, you would find the most wealthy people living in the lowest-tax states. Moving within the US is trivial, especially for the wealthy, so if larger tax burden were such a problem they would move to low-tax states.

The majority of the wealthy in the US live in California and New York. Our two highest-tax states.

Wow is that delusional. Corporations would still retain a bunch of accountants and lawyers to avoid paying taxes, because they want to avoid paying taxes. Corporations based in very low-corporate-tax countries like Switzerland still have armies of accountants and lawyers working to reduce their taxes.

But even better, you destroy this argument with your own next sentence:

So you are arguing both that corporations would just pay their taxes because they are lower, and that they would pay higher taxes.

I realize this is the media and right-wing framing of the issue, but you have to take a moment to realize this is utterly contradictory: You are simultaneously claiming they would pay more and pay less.

So you're very, very, very worried about rich people not having enough money, but you're happily going to slap a massive tax increase on the poor?

No, the rich do not pay more in sales taxes. What happens is "regular" people buy goods. "Rich" people buy services. For example: Lawn care. If you are not wealthy, you go buy a lawnmower. If you are wealthy, you hire a gardener. Let's slap some fake numbers on that to illustrate the point:

Not wealthy - $200 lawnmower, 10% sales tax, means $20 in taxes. That $20 is paid by one household.

Wealthy - Gardener buys $2000 lawnmower, 10% sales tax means $200 in taxes. Gardener has 30 clients. Each household pays $6.67 in sales tax.

So we need to raise taxes on the poor, and lower taxes on the wealthy, because you witness people breaking federal law and refuse to report it.

You know, there's a much better solution to this problem...

.......I don't think I've seen a dumber argument. You are claiming criminal enterprises would collect sales taxes? And submit them to the government? Thereby proving that they are a criminal enterprise?

Wow that's a dumb argument.

Because the ACA didn't include Medicaid expansion and massive subsidies.

7962

(11,841 posts)First, I did say there should be some sort of payment to offset taxes paid by the poor. And of course the rich may buy services, they also buy Ferraris and BMWs and paintings, etc etc, that cost a crapload of money ANd you're not understandting taxing the criminals. The tax is a sales tax. So when the drug dealer goes and buys HIS car or jewelry or whatever, he pays when he buys. Of course the criminals wouldnt collect taxes!! That WOULD be a dumb argument! Maybe theres a store just for criminals....

And I'm NOT saying to cut the taxes on the wealthy, I'm saying we need more than what we'd get from them.

If there are NO deductions for corporations, there is no need to have lawyers with regard to taxes. For what? How would you get out of paying 8% if there are NO DEDUCTIONS? Thats about what they're paying now, and if you raise it they'll just work harder to avoid it. The US corp rate, according to KPMG, is 40%. NOBODY pays it, so whats the point of having it? Here's an analogy that makes perfect sense: If you get caught speeding and it only costs you 5.00, are you really going to think about slowing down? But if you pay 200.00, you'll darn sure use that cruise control. It works the same with taxes. Tax planning is a big deal to those with a lot of money. A friend of mine is in commercial real estate. He's told me about how people will come to him looking for an investment property to roll over a profit. Its called a 1031 exchange. You pay no taxes if you do one of these. So he says you'd be surprised at the not-so-great deals that people will do just to NOT pay the tax. But when that rate was lowered, half of that business went away. Because it wasnt worth the hassle to avoid paying a lower amount. A tax is looked at as a penalty. If the penalty is high, people will avoid it. When the rate was 90%, NOBODY paid that because of deductions. Look where Google and others have their heads.

Here's how Google gets out of paying here:

http://www.theguardian.com/business/ireland-business-blog-with-lisa-ocarroll/2011/mar/24/google-ireland-tax-reasons-bermuda They base themselves in Ireland and Bermuda. Apple and Microsoft do the same thing. And what does the US get? Nothing from those profits. Sure they'll spend money to get out of a 40% bill. The rich, whether corps or individuals, WILL find a way out of a higher rate.

I simply want what I believe is the best way to get more revenue for the govt. without hurting the poor. Obviously we disagree on the best way to do that, but thats life!

JDPriestly

(57,936 posts)paid additional taxes.

The disparity in incomes between rich and poor mean that the poor cannot survive and pay taxes.

The average Social Security benefit for a retiree is $1,269. There is very little difference between the mean and the average benefits because the top benefit is somewhere around $3,300.

You can Google the top benefit.

Here is the link for the average benefit.

http://www.ssa.gov/pressoffice/basicfact.htm

Don't be too embarrassed about your ignorance on this issue. Most Americans do not realize that the average Social Security benefit barely keeps a person above the poverty level.

The poverty level for a household with one person was $11,490 in 2013.

http://aspe.hhs.gov/poverty/13poverty.cfm

The average Social Security benefit is $15,228 per year. If you work 40 hours every week at the federal minimum wage of $7.50. You make $16,500 per year.

Increase the minimum wage and not only do incomes rise but so do tax revenues at the state and federal levels.

California's new $10 minimum wage per hour will mean that a person earning a minimum wage and working 40 hours per week will earn about $22,000 per year.

Low income workers put everything back into the economy. The rich hoard, save, "invest" overseas, buy luxury items, travel outside the US, live outside the US, and spend a much smaller percentage here in the US than do low-income people.

Every penny given to a person on Social Security or a person earning minimum wage goes back into our economy to increase our GDP.

Lowering taxes on rich Americans may help the Chinese economy and other foreign economies but nowadays, on the average, I don't think you would find that lowering taxes on rich Americans helps the American economy nearly as much as raising the incomes of low income people including people on Social Security does.

The Republican mantra about the "job creators" is not based on reason. The math shows you improve your economy when you have a BETTER BALANCE between the incomes of those who earn less and spend a larger percentage of what they earn and those who earn a lot and "invest" or save or spend outside the US most of their money.

Social engineering? Anything you do about incomes and taxes and investments, etc. will change the distribution of wealth to favor the rich or the poor. Doing nothing about it will also change3 the distribution of wealth. You end up with a feudal state if you just let people have whatever they can take, whatever they can grab, whatever they can outsmart others for. There is no way to avoid it.

Actions cause effects. That is true of economics just as it is of engineering or physics or even music. (Rub a string the right way and you get something beautiful. Press the string too hard with your bow and you get the sound of a dying cat.) The libertarian dream is so much hooey.

So we should tax the rich more and raise the minimum wage. We should increase not decrease Social Security benefits.

The GDP measures the flow of money from buyer to seller, from producer to buyer. We need to encourage the flow of money within the US to truly improve our GDP and end our deficits.

Every time you have an exchange of money for goods or services you improve the economy. The rich can only buy so much. The poor and middle classes keep the GDP going.

riqster

(13,986 posts)Because we need more fact-based discussions about fiscal policy. Great response!

Warpy

(114,547 posts)It seems like a lot of people out there are waking up to the colossal screw job the wealthy with their paid for Congress have given us over the past 40 years.

Bravo! whoever you are.

kristopher

(29,798 posts)This is the same post in the comments section of an Ezra Klein article:

http://www.washingtonpost.com/blogs/wonkblog/wp/2013/10/28/would-the-white-house-accept-a-budget-deal-without-taxes-maybe/?commentID=washingtonpost.com/ECHO/item/1382982383-635-301

dgauss

(1,505 posts)"change Social Security benefit formulas to produce an average increase of $60 per month" according to the editorial. 15 extra bucks a week for the elderly.

The editorial then goes on to complain that that would be a "massive transfer of income from upper-income Americans to the retired."

Nice perspective on the injustice of a massive transfer of money, given the last 30 years.

![]()

WillyT

(72,631 posts)Exactly !!!

![]()

grasswire

(50,130 posts)WillyT

(72,631 posts)

Thanks.

A Simple Game

(9,214 posts)I would have said: In 1983 Reagan signed a regressive FICA payroll increase so as to steal a surplus in the Social Security Trust Fund which has a $2.6 trillion dollar reserve as of December 2012.

Reagan didn't plan on it nor do todays Republicans ever plan to pay that money back.

mimi85

(1,805 posts)Very well put! ![]()

![]()

stillwaiting

(3,795 posts)I'm sure the financial elite believe it is a done deal. I hope they are wrong.

Completely opposite from what the author stated in their propaganda piece.

maddiemom

(5,169 posts)hollysmom

(5,946 posts)silvershadow

(10,336 posts)Uncle Joe

(64,788 posts)Thanks for the thread, WillyT. ![]()

WillyT

(72,631 posts)dchill

(42,660 posts)mckara

(1,708 posts)countmyvote4real

(4,023 posts)ReRe

(12,183 posts)... Budgetary Realism? How's about "Stacked Deck" Washington Post? Did some mogul buy WaPo recently? This sounds more like something the Washington Times would espouse. I don't subscribe to the WaPo as I'm out here in the hinterland, but if I did, I would cancel it. "The rich have finite resources..." my ass. Poor babies. Cry me a river, poor rich folks. Remember how they used to holler "Class Warfare" and the Democrats would sulk off to the corner and cry?

I don't know who "Dryly41" is, but that was a most excellent comeback. Frankly, I am shocked that WaPo printed it. But, as we all know, the WaPo knows who he/she is. "Dryly41" must have some mythical power? Told WaPo to "print it or else"? Where's that damn tinfoil hat when I need it? ![]()

Oh yeah, K&R

UtahLib

(3,181 posts)Flagrante

(138 posts)FTA: "the bill would subject all wage and salary income to the 12.4 percent Social Security payroll tax, as opposed to only drawing from income up to $113,700 as is presently done. For someone earning $200,000 per year, this would mean a tax increase of more than $4,000 per year. For someone earning $1 million, the tax increase would be $58,700."

12.4% of ($200,000 - 113,700) = $10,700, not "more than $4,000."

and

12.4% of (1,000,000 - 113,700) = $109,901, not "$58,700."

Anyone know what's up with this?

moxybug

(35 posts)I think they calculate only the 6.2% paid directly by the employee which would make the numbers 5350 and 54950. Still not the best math but considering the republican war on education that has been raging for 40+ years its not necessarily a surprise.

gopiscrap

(24,671 posts)rhett o rick

(55,981 posts)BlancheSplanchnik

(20,219 posts)She deserves a medal!!!

That was a thing of beauty.

Facts. Imagine that.

stopbush

(24,796 posts)while a person making $1-million pays FICA tax on only the first 10% of their income?

Talk about finite resources.

Divine Discontent

(21,057 posts)malaise

(295,002 posts)Great post

Laelth

(32,017 posts)-Laelth

Fumesucker

(45,851 posts)myrna minx

(22,772 posts)reformist2

(9,841 posts)THIS is the reason they keep coming back to Social Security "reform" over and over again - after of decades of borrowing

from the Social Security trust fund, and giving the rich huge tax breaks, our leaders now know the next few

decades everything will work in reverse - the government paying back Social Security, and the ultrarich having

to pay (gasp!) higher income taxes. Much higher income taxes. And the ultrarich are starting to freak out.

unhappycamper

(60,364 posts)'Emergency' supplemental = National Credit card = debt. Period.

DirkGently

(12,151 posts)annabanana

(52,802 posts)Enthusiast

(50,983 posts)Love that response.

Hey, the wealthy are just going to have to cough it up or just migrate to somewhere else. Love it or leave it.

ProSense

(116,464 posts)"Yet even the rich have finite resources... "

...they wrote that.

Billionaires Collect Millions In Taxpayer Dollars Through Farm Subsidies

http://thinkprogress.org/economy/2013/11/07/2912031/billionaires-farm-subsidies-snap-cuts/

freshwest

(53,661 posts)Larkspur

(12,804 posts)You can tell Progressive Dems are hitting a nerve among the entitled rich with expanding Social Security instead of supporting transferring it to the entitled rich.

66 dmhlt

(1,941 posts)They're from Table B-79 on page 418 of "Economic Report of the President 2012"

http://www.nber.org/erp/ERP_2012_Complete.pdf

And the source for THAT reference was found in an entry (also posted by "Dryly 41" as was the WaPo one) with much the same text found here:

http://delong.typepad.com/sdj/2013/10/whiskey-tango-foxtrot-wall-street-journal-bang-query-bang-query-is-this-some-strange-berkeley-acid-trip-i-am-on-weblogging.html

L0oniX

(31,493 posts)Aerows

(39,961 posts)Hmm. That would affect people that make over $121,000 per year. Which 535 Americans make well above that and would have to pay more taxes? Why, the people that would vote to remove that cap, that's who.

Too many legislators are only concerned about themselves.

bvar22

(39,909 posts)Pretzel_Warrior

(8,361 posts)This should go viral. Also, Jeff Bezoa is a libertarian asshole.

whathehell

(30,420 posts)NastyRiffraff

(12,448 posts)More like this please. The response was devastating and complete.

Burf-_-

(205 posts)

Wounded Bear

(64,110 posts)as this flies over the heads of the neocons running things these days, and their misinformed minions.

![]()

klook

(13,566 posts)Thanks.

RobertEarl

(13,685 posts)If the rich want to horde that money, they have to pay a tax.

If they spend it by paying fair wages to the workers they won't pay much tax. What happens in that case is the workers pay most taxes.

A $15 min wage, and 15% tax on horded, unspent money, and things will be more fair and balanced.

countryjake

(8,554 posts)I love that it was the very first response, too!

![]()

stage left

(3,260 posts)For a great catch and a great response from Dryly 41. ![]()

JEFF9K

(1,935 posts)GeoWilliam750

(2,555 posts)why our democratically elected Democrat leaders do not shout this from the rooftops?

cliffordu

(30,994 posts)mother earth

(6,002 posts)Springslips

(533 posts)Whoever made that response is a great, great person!