General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsMan who created own credit card sues bank for not sticking to terms.

When Dmitry Argarkov was sent a letter offering him a credit card, he found the rates not to his liking.

But he didn't throw the contract away or shred it. Instead, the 42-year-old from Voronezh, Russia, scanned it into his computer, altered the terms and sent it back to Tinkoff Credit Systems.

Mr Argarkov's version of the contract contained a 0pc interest rate, no fees and no credit limit. Every time the bank failed to comply with the rules, he would fine them 3m rubles (£58,716). If Tinkoff tried to cancel the contract, it would have to pay him 6m rubles.

Tinkoff apparently failed to read the amendments, signed the contract and sent Mr Argakov a credit card.

-snip-

http://www.telegraph.co.uk/finance/personalfinance/borrowing/creditcards/10231556/Man-who-created-own-credit-card-sues-bank-for-not-sticking-to-terms.html

![]()

![]()

idwiyo

(5,113 posts)onethatcares

(16,980 posts)when the bank is screwing you, but turn the tables and principles get flushed down the commode.

Orrex

(66,951 posts)With interest!

onethatcares

(16,980 posts)I thought you were going to be the spelling police.![]()

thanks.![]()

Orrex

(66,951 posts)Thanks for the set up!

What the man did was delish! Don't see how he can lose here. ![]()

Logical

(22,457 posts)blkmusclmachine

(16,149 posts)tridim

(45,358 posts)groundloop

(13,743 posts)I'm pretty sure that exact same fine print is in most credit card applications.

Monk06

(7,675 posts)signed it. Law faculties all over the EU and Americas will be pouring over this little gem.

Gman

(24,780 posts)Demo_Chris

(6,234 posts)alcibiades_mystery

(36,437 posts)It's not sitting across a table, but lawyers adding changes to existing documents. You always blackline the returned contract.

If I was a judge on this, I'd award it to the cardholder on general principle.

Ms. Toad

(38,506 posts)Those contracts, or the documentation with the card itself, usually make it pretty hard to alter the terms of the offer. I haven't written credit card contracts - but I have written enough others which reimpose themselves as of the first use - that it would take someone very skilled at reading fine print to draft the right language to avoid the anti-alteration "tricks."

diabeticman

(3,121 posts)Major Nikon

(36,925 posts)I had a tree removed from my front yard because it had gotten too big. My front yard is smaller than anyone else and there wasn't room for two mature trees. They sent me a letter saying I was required to have two trees in my front yard and they would start fining me $30 per month until I planted another. Little did they know they had installed some sprinkler equipment on my property they thought was part of the common area. I said them a letter saying they needed to remove it or pay me $60 per month rent. It would have cost them thousands to relocate it. The next thing you know I get a knock on my door from the HOA president with an apology.

BainsBane

(57,724 posts)I hate one in Florida. I can't stand the conformity.

LAGC

(5,330 posts)Sure hope some first-class lawyers step up to defend him pro bono, because if not the bank's corporate lawyers will tear him to shreds just to make an example out of him. It would seem they have a pretty good case for fraudulent doctoring of legally-binding documents at the very least -- deliberate embezzlement at worst.

I admire the guy for standing up to the bank and making fools out of them, but when you mess with the bull you get the (you-know-what).

![]()

It's not a legally binding contract until both parties sign it. The initial contract was unsigned. He was free to send the bank a counter-offer, to which they agreed.

ryan_cats

(2,061 posts)No, this is fraud and he will be fined or do time or both. Even if he told the credit card company what he had done so they could check it out, he's still toast and guess what, the bank has an army of attorneys to deal with this.

This reminds mo of when someone in SF deposited one of those fake checks you get for $100,000 and after a month, he assumed it was legal to remove the money but what he did was commit fraud and paid for it.

Contract law is pretty specific. What if someone sent in their credit app with invisible ink that becomes legible after two weeks, would that be fraud? Of course.

jeff47

(26,549 posts)Because........?

Or do you believe it's not actually possible to negotiate a contract?

The bank sent him an offer. He sent them a counter-offer. The bank agreed to it. This has nothing to do with invisible ink or other attempts at deception you are trying to drag in - the contract explicitly spelled out the terms of the agreement. The fact that the agreement greatly favored the guy over the bank doesn't make it fraud. It makes it the reason the bank should have turned him down.

"Read before you sign" also applies to banks.

ryan_cats

(2,061 posts)Well we'll just see. This will not end well for your hero.

ChisolmTrailDem

(9,463 posts)subject line and then repeat it in the body of your post. Why do you think anyone wants their time wasted reading your opinions twice?

No one else on DU is doing what you are doing. It is kind of annoying clicking though to see the rest of your post only to find repeated commentary.

Could you please begin your comment in the subject line and continue it in the message body - like everyone else does? Also, if your comment fits entirely into your subject line, if you add a "n/t" at the end it will let readers know there's no reason to click through to read further because there is "no text" in the body of the post.

Thanks! ![]()

ryan_cats

(2,061 posts)Last edited Sun Dec 1, 2013, 07:04 PM - Edit history (1)

I've been doing it for eight years and no one has complained and since you obviously have zero idea how people's minds work, if you whine about somethings, I not to mention most sentient beings ratchet up whatever it is that is giving you sniffles.

Grow up, is my post rude or hurtful? Better run to your Jr. High nurse to make you feel valuable again, even though you aren't.

ryan_cats

(2,061 posts)I'm sorry to have given you the vapors. Maaybe a little time in the sanitarium in the country will help.

jeff47

(26,549 posts)ryan_cats

(2,061 posts)How can you have 9,621 post since 2008 and I have 960 something since 2005?

Must be nice to have so much free time between periods in High School.

jeff47

(26,549 posts)ryan_cats

(2,061 posts)SO, you're admitting your wrong? That's the first step towards enlightenment. You would do well to send me $12.95 for my pamphlet on English comprehension and basic argument.

I await your check.

jeff47

(26,549 posts)Perhaps you could answer the question you keep desperately avoiding:

Why is it illegal to send the bank a counter-offer?

ryan_cats

(2,061 posts)Because I'm Batman!

You're the first to whine about it.

ryan_cats

(2,061 posts)How many business contracts have you had to negotiate?

Zero is probably the number.

Slipping in some verbiage like this soon to be living in a cell person, contracts are gone over and over. If on the last day we come to an agreement only to find out the other party changed the terms, at the very least, the contracts would be declared null and void and, I would bet that the offending contract has a clause that any changes have to be agreed by both parties.

So, I'm basically calling B.S and clearly we don't know all the details.

He can write up any contract he wants in his comfi cell in Russia.

This is clearly the Freeman on the Land in Russia Kookier. Just like pretty much all of them either end up in jail, theyre property is either seized or the kook is faced the taxes he things he should be able to avoid.

jeff47

(26,549 posts)Many.

Considering you think it's impossible for an individual to negotiate with a business, I'm guessing you have peripheral contact, but don't really get involved in negotiation.

Again, why is it impossible for the bank to read the contract before they sign it?

And both parties did agree to those changes - the bank signed AFTER THE CHANGES WERE MADE.

The bank did not sign, send it off, and this guy changed it. The bank sent an offer. He sent a counter-offer. The bank signed the counter-offer.

ryan_cats

(2,061 posts)I've been involved in many contracts, corp to corp, corp to individual although these are usually employment contracts.

We'll see when the weight of the corp crushes Mr. Scammer. This sounds like the work of a teenager. If you modified a Publisher's Clearing mailing house I doubt they're show up with a check, but a Marshall.

We'll see and of course, this thread and your post will go down the memory hole...

jeff47

(26,549 posts)Which is nothing like this situation. Again.

Publisher's Clearing House in your scenario did not agree to the changes. The bank agreed to the changes. Period. Full stop. There was no agreement. The bank made an offer. The individual made a counter-offer. The bank signed the counter-offer.

If the bank did not read the contract, that is the bank's fault.

How many people have you sent to prison for making a counter-offer?

ryan_cats

(2,061 posts)Again, English coursework would help with the comprehension level.

Then maybe you could understand the meaning of the word, "Example". And once you've learned it you could apply that to here. These are examples of the same type as the original post meant to emphasize the ridiculousness of this, soon to be imprisoned' scammer.

It's obvious you hate banks. Keep that in mind when you go to get a mortgage. What, you have a mortgage, did you modifiy the mountain of paperwork to go with it in order to screw the man?

Do you support that nutcase Seattle board member who said the machinists should occupy Boeing's plant and produce buses.

Yeah, we don't need engineers, sales folks and QC folks, the machinists will just re-purpose the line to create buses.

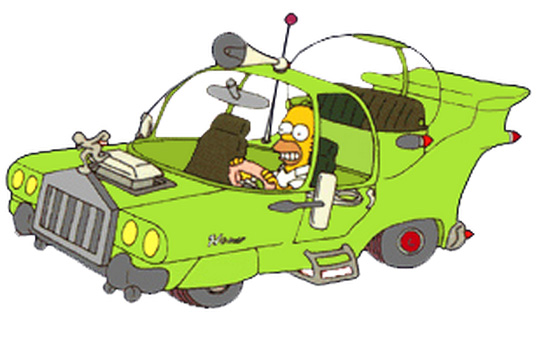

Why am I reminded of the Homer.

<img src=" ">

">

And before you say I'm off topic, this is the end result of people who have zero experience in design yet they think they do.

jeff47

(26,549 posts)Again, your claim is that it's fraud to make a counter-offer. You also claim to have negotiated many contracts.

How many people have you sent to prison for making counter-offers?

And if you were not so desperately defending your erroneous position, you might realize that not all examples are appropriate.

Miley Cyrus's antics are an example. Doesn't mean it's an example of negotiating a contract.

You keep bringing up situations where the corporation is making an offer, and then does not sign the resulting contract. In those situations, the person signing is saying they agree to the offer as presented by the corporation, but they alter the offer in the text. That's fraud because the person altered the contract while agreeing to not alter the contract.

This is not that situation. The bank signed the resulting contract after the changes. That's because this is Russia, not the US, and the bank must explicitly sign the contract.

Your claim that this is fraud requires that the bank to not agree to the changes. They agreed to the changes by signing the counter-offer. The fact that they did not read the counter-offer does not make it fraud on the customer's part. It makes it negligence on the bank's part. But it's still a valid contract.

No, I hate people who desperately cling to an insanely stupid argument in an attempt to out-last everyone else, and thus not have to admit they made an insanely stupid argument.

But once again, you are trying to run away from the relevant questions in an attempt to deflect from your original error: You are claiming it is fraud to make a counter-offer to a contract.

And you are going to keep throwing anything you can find at this situation in a desperate attempt to hide from that insane argument. Let me help:

In case you can't tell, that's a kitchen sink for you to try and throw at your problem.

ryan_cats

(2,061 posts)Would copying a legitimate document and then altering and passing it off as the original be fraud?

We'll see who's insane argument as this goes through appeal or whatever they have in Russia.

Oh, and have a nice day.

jeff47

(26,549 posts)You can alter a proposed contract all you want up until one party signs it. Neither party had signed the contract when the bank mailed out the offer.

What you think happened:

-Bank sent SIGNED offer to customer - In the US, a credit card offer is considered "signed" by the bank.

-Customer changed offer, signed and returned it.

-Bank issued credit card.

What actually happened:

-Bank sent UNSIGNED offer to customer.

-Customer changed offer, signed and returned it.

-Bank signed changed offer.

-Bank issued credit card.

The bank should have confirmed the terms of the contract before signing it. But that isn't fraud, it's negligence by the bank's employees.

closeupready

(29,503 posts)Sure seems that way, judging by every single post you've put in this thread. ![]()

ryan_cats

(2,061 posts)Perhaps a course in reading comprehension might help understanding your hero.

jeff47

(26,549 posts)Heck, you still can't find the "edit" link to add additional snark as an attempt to cover up being wrong.

Again, why is it illegal to negotiate with a bank?

ryan_cats

(2,061 posts)Ohhh, such bad manners.

It's is not illegal to negotiate with a bank. It is illegal to negotiate in bad faith such as your hero did. Luckily for him, in round one, the Russian judge agreed with the ner'dowell. I'm sure the bank will appeal. We'll see, does Russia still have Gulags?

Lookie, I used small words so you could understand.

jeff47

(26,549 posts)Again, you keep pretending that he altered the only offer. That is not the case. He sent a counter-offer, which the bank signed after he altered it.

ryan_cats

(2,061 posts)I'll type slowly. He forged the application, do you understand what that means?

Let's see what happens in six months.

jeff47

(26,549 posts)Russian banks, shockingly enough, comply with Russian law when issuing credit cards.

In the US, the bank sends you an application, includes the contract in that application. If you sign it, you are agreeing to those terms. The bank doesn't sign anything after you. As a result, altering the contract and then signing it would be fraud - by signing their application you agreed to their terms so you can't change the terms.

In Russia, the credit card offer is a run-of-the-mill contract, not something jammed into an application. Both parties sign the contract, and the bank signs after the consumer. As a result, the terms of the contract can be altered up until both parties sign.

The fact that the bank signed without reading the contract is not fraud on the consumer's part. It's negligence on the bank's part. But it still produces a binding contract.

Major Nikon

(36,925 posts)Credit card companies put themselves in a precarious position by radically changing the terms of their original agreements and then send out mass mailings in the hope that most people won't notice. I have no idea of Russian jurisprudence, but I would think it would be hard to get a jury to be sympathetic to their fraud allegation. Seems to be a weak attempt at bluffing him out of his lawsuit.

Hosnon

(7,800 posts)Offer -> counteroffer. It's first year contract law stuff.

And the invisible ink thing would clearly be fraud. Failing to read something you sign is your fault, not the other party's.

former9thward

(33,424 posts)A court will not enforce a contract where the terms are shockingly unfair to one party. For example if the bank sent him a fine print document, which most people don't read, and said the interest was 1000% and cancellation fee $10,000 then no court would enforce those terms even if the other party had started using it. A court will determine his terms were unreasonable and dismiss it. If he wasn't so greedy it might have worked.

cstanleytech

(28,393 posts)the court may decide that this is one case where the failure to read the contract is fully upon the banks rather than the other way around which is the usual way such cases go when it comes to a person wanting to back out of a contract with them and they have that person over a barrel.

former9thward

(33,424 posts)There may be a phrase in the bank's offer which says "any alteration of these terms makes our offer null and void" and "use of this card constitutes acceptance of all terms in this agreement." I doubt the banks have anyone reading things like this being sent back to them.

Vincardog

(20,234 posts)former9thward

(33,424 posts)Vincardog

(20,234 posts)Institution on the following terms:

Interest rate - (-25%)

Credit Limit - none

Payment due date - 90 days after last purchase

Any aspect of this agreement can be changed (ONLY by ME at my discretion)

Any dispute will be arbitrated by an arbitrator of my choosing

(The arbitration costs and expenses shall be born by the company exclusively).

The company shall incur a $10,000/day charge for each violation of these terms.

Major Nikon

(36,925 posts)I've gotten threatening letters from businesses before that I wrote "sue me" in big letters and sent back to them.

former9thward

(33,424 posts)unblock

(56,145 posts)it doesn't matter what's in a draft that was rejected.

the version the bank signed is what's binding.

obviously the bank didn't read it but what is unusual (at least in the u.s.) and in the cardholder's favor is that the bank *signed* the altered version.

former9thward

(33,424 posts)Here in the U.S. I have never signed anything for any card I use (other than the application which is not the contract) and no bank has ever signed anything either that I have been sent.

jeff47

(26,549 posts)and I have no idea what the relevant differences are.

grahamhgreen

(15,741 posts)former9thward

(33,424 posts)The fact that "banks get that all day long" proves to a court that it is a common rate that people willingly and knowingly pay. That is how a U.S. court looks at those things.

grahamhgreen

(15,741 posts)don't sign it!

NO ONE willingly pays 29%.

ryan_cats

(2,061 posts)How dare you make sense!

Do people actually think they can modify a contract with ridiculous terms that are way out of normal terms. Otherwise, we'd hear about this everyday until the law was changed.

I haven't read a CC contract in years but I seem to recall that the terms in the contract are non-negotiable even if some nutwad changes the terms.

I hope prison in Russia isn't to bad but maybe he can re-write his sentence.

Jenoch

(7,720 posts)but somewhere on all of the credit card applications in the U.S. there is a clause that says "applicants cannot change the terms of this offer" or something to that extent. This is a 4 month old bullshit story.

whopis01

(3,915 posts)You can't be held liable to the details of a contract to which you have not agreed.

jeff47

(26,549 posts)He didn't. He wrote up a counter-offer and signed that.

Jenoch

(7,720 posts)by changing the terms of the offer. It does not matter whether or not the bank accepts it or not. There is no way this bullshit would work in the U.S.

Chan790

(20,176 posts)There is no law regarding banks (US banks or US laws in specificity) which renders the proffered terms of an unsigned contract valid or enforceable, nor its terms unalterable. He made a counter-proposal that they accepted because they failed to perform due diligence and assumed his returned document was the original proposal with the same terms. As he did not act to conceal his alteration of their terms, he's in the clear.

The inalterability of the original terms is not legally-enforceable by statute but enforceable by negating the pre-approval of the offer by the bank...that went out the window when they issued a card under his terms. He rejected their pre-approved offer. They approved his counter offer by issuing the card. Unlike the offer they sent him, they had no legal obligation to accept the proposal he sent them. They chose to accept his offer.

A US bank would lose this case as clearly as a Russian bank will. What is probably unenforceable is the termination clause however, as onerous (generally considered to be "any"![]() termination penalties on non-term-limited multi-party contracts for ongoing provision of services are generally not enforceable in US courts. (So said the lawyers of evil mega-corporate bank I worked for.)

termination penalties on non-term-limited multi-party contracts for ongoing provision of services are generally not enforceable in US courts. (So said the lawyers of evil mega-corporate bank I worked for.)

Banker. I used to deal with this crap for a living. There's a reason I read fast and accurately. I got used to reading everything before I signed it so that I was not responsible for avoidable losses. You'd be amazed how often these sorts of things happen (when lawyers are involved, such as mortgage signings...constantly) and how often it works. Usually not in such a grand fashion though. Sometimes the counter proposal is even acceptable when caught...we'd rather lose the quarter-point your lawyer shaved in rewriting the terms than lose the sale of a mortgage product.

Jenoch

(7,720 posts)Vincardog

(20,234 posts)Propose be enforced? It seems to me that the contract he sent to the bank is the original offer letter. The fact that the banks representative accepted it and issued the CC would appear to validate my view.

Hosnon

(7,800 posts)of U.S. contract law I've ever heard.

Kudos.

Sen. Walter Sobchak

(8,692 posts)The salesman was fired for signing off on it.

Edit: Just to clarify it wasn't anything ridiculous. Only that the lease was a fixed term and could not be ever-greened, they were responsible for repatriating their equipment at the end of the lease and we weren't going to pay $50 a month to rent a surge protector or for "software maintenance".

nyquil_man

(1,443 posts)treestar

(82,383 posts)for once they assumed and did not read the fine print. ![]()

![]()

![]()

![]()

Mrdrboi

(110 posts)About time someone one ups on the bank.

ChisolmTrailDem

(9,463 posts)Is it a legally binding contract under Russian law?

closeupready

(29,503 posts)stuff that happens BEFORE the fact is actually stuff that happens AFTER the fact, and even constitutes FRAUD. Simples, see.

Who said Russia's laws were complicated to understand. ![]()

On edit, I guess the Romanovs have also been unexecuted, and the gulags never happened.

Laelth

(32,017 posts)-Laelth