General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsSocial Security is Wage Insurance, for wage earners, not people who earn from capital

Last edited Fri Nov 29, 2013, 07:36 PM - Edit history (1)

Many people who advocate for removal of the SS income Cap may not have thought out all the implications.

If you want progressivity, the income tax system is the place for that. Do not threaten the existence of Social Security by ending the program as it has existed for decades and substituting a welfare program ("the dole"

Read the entire article here:

http://www.dailykos.com/story/2013/03/29/1197639/-Social-Security-is-Wage-Insurance

X-posted from the SS & Medicare group.

http://www.democraticunderground.com/?com=forum&id=1261

TheKentuckian

(26,314 posts)No welfare necessary, just a reasonable formula for rate of return at certain levels, much as we do already.

No reason to make it harder than it actually is.

FogerRox

(13,211 posts)Not politically, not financially.

Raising the cap to 1983 levels- 90%- would raise the cap to about 216k. That would raise the average benefit by thousands, while improving Trust Fund revenues by 30 billion a year.

Afterall the 2014 COLA of 1.5% is accomplished by raising the income cap from 113.7k to 117k.

TheKentuckian

(26,314 posts)Nye Bevan

(25,406 posts)They pay the same SS taxes, and receive the same SS benefits, as people earning $120,000 per year. For this reason SS is generally perceived as "fair".

But if the payroll tax cap was eliminated, without a commensurate increase in benefits for those paying the higher taxes, SS would come to be perceived as welfare. And we all know what tends to happen to "welfare as we know it" (courtesy of Democrats as well as Republicans).

Eliminating the cap on taxes but not the tax on benefits would be the sneakiest way of eventually getting rid of SS altogether.

FogerRox

(13,211 posts)See my comment concerning the 2014 COLA above.

If the income cap is eliminated, benefits automatically go up, to something more than 150k per year for the uber richest Americans. ANd those people earn from capital after retirement.

The act of capping benefits would require a means test, that is the component that turns SS into welfare.

Nye Bevan

(25,406 posts)1. SS taxes are the same as they are now EXCEPT that there is no cap; and

2. SS benefits are the same as they are now, except that no extra benefits will be paid in exchange for the extra taxes paid in (1).

In other words the maximum benefit would be the same as it is today, but the maximum SS tax paid would be unlimited.

FogerRox

(13,211 posts)Many of them see eliminating the income cap as a fix for SS. But SS isn't broken, the economy is broken.

sabrina 1

(62,325 posts)people by pretending eg, that there was no inflation for two years, as happened recently.

And if everyone was paying into it, if there was no cap, the top amount could be raised, and should be.

Raise the cap, it makes no sense at all to have one. And raise benefits to a higher level. There is no need to raise them to an impractical level. But with the extra income to the fund, a raise would be fine.

Aside from all that, benefits should be raised anyhow so that there is no huge accumulation of money in the fund for the Govt to 'borrow' from. Let them get their war money somewhere else.

I'm for raising benefits now. IT would serve as a stimulus package that doesn't come from the General Fund AND help seniors who rely on it to improve their lives a little.

FogerRox

(13,211 posts)Currently at 113,700 it goes up to 117,000 - thats how the 2014 COLA is made up. 117k is at about 86%, in 1983 it was 90%, which today would be about 216k.

SO raising the income cap to 216k (90%) would raise benefits by several thousand dollars a year, and would only be fair.

But eliminating the cap altogether opens a can of worms. IT creates a 6 figure benefit annually for the richest, think of it this way, the President of CBS who earns about 20 million, would have to pay a million in more FICA, so would CBS.

Even rich Democrats would fight like hell to avoid that.

Silver Swan

(1,118 posts)As is now, for workers first eligible in 2013, a benefit is based on 90 percent of the first $791 of the average indexed monthly earnings (AIME), plus 32 percent of the amount over $791 through $4768, plus 15 percent of everything over $4768.

I propose that the cap be raised to about $250,000, and that 15 percent apply for AIME amounts over $4768 through $9500, and for everything over that, the percentage would be 1/100th of one percent.

That would be on a par with the return we average folks have been getting on our savings accounts for several years.

FogerRox

(13,211 posts)that in 1984 the income cap was placed at 90% of all earners? And since then has fallen to as low as 83%, IIRC its at 87% for 2014. If we returned to 90%, the income cap would be at about 216k?

Many of the Social Security Defenders group would probably settle for moving the income cap back to 90%. It increases average benefits by thousands, and adds FICA revenue as much as 30 billion a year, which approximately equals 1/3rd of the SS projected shortfall in the intermediate cost scenario as scored by the CBO.

We have historical precedence for moving the cap back to 90% (216k), and their is considerable political support to make this happen. Considerably more support for eliminating the cap altogether.

And we even keep SS true to its original intentions as written by Edwin Whitte, who wrote the 1935 law. We avoid the political pitfalls of paying uber rich people benefits they dont need, enough to but an Italian sports car- cash, and we also avoid the pitfall of what a SS means test would do.

SO instead of 250k would you settle for what ever 90% is at, say about 216k?

Silver Swan

(1,118 posts)I was just suggesting things. I worked for SSA for 35 years, and I am aware that benefit formulas have changed over the years to protect the trust fund. I know that raising the cap would increase benefits for the wealthy, unless the computation formula was changed.

TheKentuckian

(26,314 posts)formula is used to calculate higher incomes rate of return.

FogerRox

(13,211 posts)Thats why there never has been a SS means test for benefits.

TheKentuckian

(26,314 posts)Are you under some impression that those below but near the cap get the same ROI as someone making 30ķ?

Folks that pay more get more but the rate of return isn't always the same now, the same thing applies under a higher or eliminated cap.

TheKentuckian

(26,314 posts)No welfare required.

This only gets complicated because some folk's want to protect their incomes from taxation here.

FogerRox

(13,211 posts)Their share of FICA would be 6.2%, something like 1 million.

SO there would be considerable resistance to eliminating the SS income cap

TheKentuckian

(26,314 posts)Hoyt

(54,770 posts)a lot of money for SS that is needed elsewhere - education, extended unemployment benefits, food stamps, welfare, jobs programs, etc. Tweaking the cap limits and rates makes more sense, along with increasing general tax rates and cutting defense. But, just raising the cap is essentially a 13 percentage point increase in tax rates. That's a lot when we need money for so many things.

FogerRox

(13,211 posts)As scored by the CBO, .6% of GDP. 90 billion a year.

We can add 89.2 billion in FICA if we create 20 million jobs at 36k.

Hoyt

(54,770 posts)we don't improve the economy, especially for young folks who will be paying my SS, raising the cap won't be enough for long.

Romulox

(25,960 posts)at all above $130k.

Hoyt

(54,770 posts)Romulox

(25,960 posts)Social Security taxes not paid on incomes above $130,000 are not deferred into the general fund.

There's no mechanism to make that happen, and it's just a strange argument.

Hoyt

(54,770 posts)do it as an income tax, not FICA tax.

FogerRox

(13,211 posts)Lets add 6 more brackets

40% @ 2mil

41% @ 4mil

42% @ 6mil

44% @ 12mil

46% @ 24mil

48% @ 48mil

Romulox

(25,960 posts)that making SS taxes more fair somehow stands in opposition to income tax increases.

The two issues are not logically related in any way, and certainly don't stand in opposition to one another.

Egalitarian Thug

(12,448 posts)Applying the money to the SS system will open many options, most of which end up directly helping society far more efficiently and effectively than Congress. Whatever you imagine will be done with all that extra tax money, and result it might achieve will be less than whatever can be done with SS surpluses.

FogerRox

(13,211 posts)Which would automatically create a $150,000 annual benefit for the richest Americans. thats how the AIME formula works.....

Buy them all Ferraris .....

TheKentuckian

(26,314 posts)You've just been going on about turning the system into welfare and here are complaining about payouts.

I think there are just some higher earners and people who expect to join them that feel the status quo benefits them just as the Wealthcare and Profit Protection Act that maintains fee for service benefits them more than a single payer system would as far as health care expense as percentage of income.

Certain folks will soon be gently pushing for more tolls, VATS, fee for service fire protection, reliance on charities for the safety nets, and anything else that moves the lion's share of financing down the income hill some, just like the right wingers.

FogerRox

(13,211 posts)You make the choice what you want to advocate for.

But in this conversation we must agree to use proper definitions. Are we on the same page here?

TheKentuckian

(26,314 posts)Further, as is benefits are capped, so is Social Security currently welfare?

There are people who want to remove the cap and limit the payout, that is not my position though I do favor an open ended but diminishing with wealth return. A person with a income of 20 million would get more back than one with 19 million but their rate of return would be lower than the guy who made 20K.

FogerRox

(13,211 posts)And bend points are used in the calculation see AIME formula, based on ones income.

Yeah I know, it sounds like a bunch of legal mumbo jumbo, but there is an important difference.

bend points

http://www.ssa.gov/oact/cola/bendpoints.html

AIME

http://www.ssa.gov/oact/progdata/retirebenefit2.html

At the end of the day it means a top benefit of just under 31k, and this is accomplished without an actual cap on benefits.

TheKentuckian

(26,314 posts)Maximum benefits that cannot be increased mean they are for all practical purposes, capped.

But you know what we can end the cap on contributions, end maximum benefits, have hypothetically uncapped payouts, and grow the pool of resources all by just setting up the right formula.

Egalitarian Thug

(12,448 posts)Secondly, formulas are just that, they can be changed to suit the need. Of the unnumbered benefits making all of us kick in, one is that we might well find that 13% is too high.

What I'd like to know is, how much more would you end up paying?

FogerRox

(13,211 posts)Romulox

(25,960 posts)Or popular, for that matter!

![]()

FogerRox

(13,211 posts)Like you read VCLib's article in the first place.

Romulox

(25,960 posts)FogerRox

(13,211 posts)ISnt that what income tax is for?

And youre right, if we have 20 more years of recession, SS wont be solvent. In the last 400 plus years of recorded human history there hasnt been a 25 year long recession.

Romulox

(25,960 posts)to divert income taxes into the Social Security system.

FogerRox

(13,211 posts)Romulox

(25,960 posts)duffyduff

(3,251 posts)gulliver

(13,902 posts)The "optics" argument is silly. We are letting optics get in our way, and Republicans just plain won't.

Social Security is a program that protects old and sick people from going poor. If you notice, right now Republicans are of a mind to put it all on the block, and that is with the income cap where it is now. They don't care about the "I earned it" argument. Republicans want to destroy Social Security using arguments like "you would have earned more" and "people earning it now won't get it." Whatever argument you muster, they will find a way to twist and undermine it.

Raising the income cap isn't going to do anything to the rhetorical balance.

lumberjack_jeff

(33,224 posts)Benefits are tied to average earnings. I don't think it's inappropriate to raise the cap while simultaneously raising the cap on maximum benefits. The formula is progressive, so it wouldn't be a wash, it would still guarantee solvency while maintaining the systems "not-welfare" fairness.

geek tragedy

(68,868 posts)without them receiving additional benefits, that does make it a welfare program. It's taking tax revenue paid by one group and paying it directly to another.

It's still good, indeed essential policy, but it is what it is.

lumberjack_jeff

(33,224 posts)... higher income folks get less ROI. Benefits are capped because income subject to taxation is capped. Just project out the ROI curve to those high income levels.

Under current law If your average income was 10,000 a month, your benefit will be $2533.

If they raise the cap and tax people with monthly income of $50,000, I don't have a problem with a $5000 SS benefit.

FogerRox

(13,211 posts)The 2014 COLA, a 1.5% benefits increase is accomplished by raising the income cap from 113,700 to 117,000.

geek tragedy

(68,868 posts)Current recipients will get a better return on what they paid in than what future recipients will.

Ditto Medicare.

Taxes on our generation will have to go up to sustain current benefit levels. That needs to happen, but it doesn't do a lot of good to pretend SS isn't a welfare program at this point.

lumberjack_jeff

(33,224 posts)geek tragedy

(68,868 posts)vs projected liabilities/obligations . . .

FogerRox

(13,211 posts)And if you read the report, you would know that the Intermediate scenario is a very conservative estimate, it relies on weak job creation, unrealistic workforce projections, and next to no wage growth for 20 years.

geek tragedy

(68,868 posts)seems to be the logical assumption given the past 40 years have provided just that.

The program is already ahead of schedule in seeing negative cash flows.

FogerRox

(13,211 posts)We've averaged 4.4% GDP growth over 40 years, wage growth for a few years under Reagan and later under Clinton grew higher than inflation & U3 unemployment down to 5%. U6 at 7%.

Currently GDP growth is 1.6% over the last 4 FQ, and U6 is at 13.8%, roughly 21 million people. Household wage growth over 5 years is negative $5,000. Down 10% from 50k to 45k.

According to the SS Trustees report 2.8% GDP growth or better does the trick.

The program is already ahead of schedule in seeing negative cash flows.

Please provide a citation for that claim, some might mistakenly think youre making stuff up.

geek tragedy

(68,868 posts)as witnessed by the failure of real incomes to even tread water.

Here's an intelligent look at the negative cash flow issue:

http://www.brookings.edu/research/opinions/2011/11/16-social-security-burtless

FogerRox

(13,211 posts)Which the article you link to explains, fairly well. IT appears that author has read more than a few SST reports, as have I.

On bubble, we didnt have bubbles for 40 years, if want change the subject, fine. GDP 25-40 years was based more on the last of plentiful resources like Iron, and oil. Thats the period when Hematite iron ore in the US started to run out, and we started mining deeper for the not as good taconite.

Todays economy relies more on services (20%?) than back in the day (services 8%-10%) when iron and oil had a larger impact on GDP thanh they do today.

Energy, resources, productivity, workforce growth are the 4 large long term impactors on GDP. Not Bubbles.

Not to say youre totally wrong about the impact of these bubbles (.com & Housing), these bubble drove GDP up, and then down, so the average long term look at GDP tends to average out the effect of the bubbles in GDP numbers. Just not in families who lost homes.

FogerRox

(13,211 posts)Thats simply wrong, and the CBO scoring makes it clear. The SS Trustees reports make it clear that job creation has the biggest impact on SSTF revenues, next is wage growth, next is workforce growth.

In fact the most recent SST report tell us in the low cost scenario, SS is good thru 2090, in the stochastic model SS is good thru 2042 IIRC.

geek tragedy

(68,868 posts)Labor force participation is the lowest since FDR's term in office, and it is not getting better.

We will never--I repeat never-- get back to the growth/employment situation that existed pre-2006. Negative wage pressure from global competition, lack of future bubbles, climate change dynamics, etc.

1.6 to 2.5% is as good as it's going to get.

Fewer people working, wages stagnating. Increased tax rates are the only way to make up for the shortfall.

Romulox

(25,960 posts)CBO projects that under current law, the DI trust fund will be exhausted in fiscal year 2016 and

the OASI trust fund will be exhausted in 2038.

http://www.cbo.gov/sites/default/files/cbofiles/attachments/43648-SocialSecurity.pdf

FogerRox

(13,211 posts)The SST generates 3 other scenarios, high cost, low cost & Stochastic.

In all of the simulations, Social Security outlays are based on CBO’s most recent 10-year

baseline. Thereafter, in the simulations based on the Trustees’ assumptions, Social Security

outlays are based on the intermediate estimates from the most recent Trustees’ report.

CBO's projections - US Government Accountability Office

http://www.gao.gov/special.pubs/longterm/pdfs/fall2012_model_description.pdf

From the CBO/GAO long term budget outlook.

Seems Brookings and Urban use the intermediate cost scenario too

http://www.brookings.edu/~/media/events/2012/12/07%20working%20longer/steuerle_working_longer_slides

My google search shows the multiple sources, all pointing to the CBO is using the SST int cost scenario.

https://www.google.com/search?q=CBO+uses+intermediate+cost+scenario&ie=utf-8&oe=utf-8&aq=t&rls=org.mozilla:en-US

99Forever

(14,524 posts)... are concerned with "fairness" is when it might affect THEIR wallet?

FogerRox

(13,211 posts)OR would you entertain that FDR and his people knew what they were doing when they wrote the SS law.

99Forever

(14,524 posts)... ALL INCOME, put a cap on the maximum BENEFIT that can be paid.

Problem solved.

Next bullshit excuse for the 1%?

FogerRox

(13,211 posts)Of course we could create 20 million jobs at 36k each and the additional FICA would ensure SS is good thru 2090, and indicated in the SS Trustees low cost scenario in the last report.

99Forever

(14,524 posts)A cap on payout, period. No calculations, a top dollar amount, no more for anyone. Period. NO checking of "means." Period.

Next bullshit excuse why the 1% shouldn't pay their FAIR share?

FogerRox

(13,211 posts)

99Forever

(14,524 posts)And precisely where will these "20 million new jobs" come from? Why not 50 million? Why not 100 million?

And when does this raise in the Minimum Wage take effect?

The 1%ers have the money right now to pay their fair share.

alarimer

(17,146 posts)It is too low, obviously. And a simple fix.

FogerRox

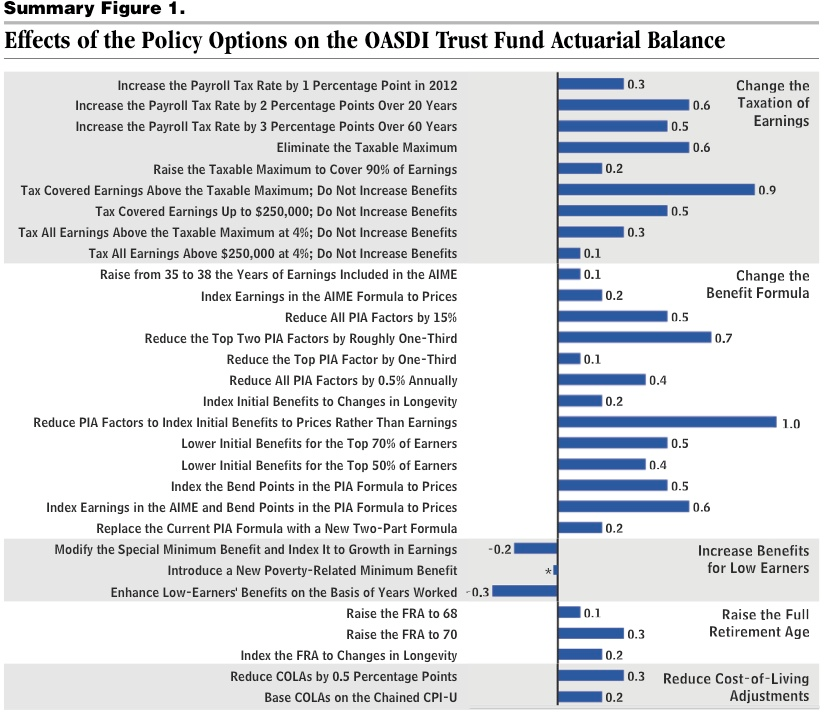

(13,211 posts)Though raising the income cap to about 216k (90% of income eraners, from the current 86%) would increase benefits by thousands and add more revenue to the SS Trust Fund, and about 30 billion according to the CBO scoring of the shortfall in the intermediate cost scenario. See chart:

We need to find .6% of GDP to secure SS thru 2090:

None of these estimates consider job creation or raising the min wage.

duffyduff

(3,251 posts)do you understand?

What we have are looters like Peter J. Peterson who want to destroy it to enrich themselves. They do this by buying off politicians and peddling lies about "shortfall" projections which are based on pessimistic projections that have no basis in reality.

Shit, people, it's like I have to remind people of this solvency bullshit for thirty fucking years, ever since the Cato Institute and Concord Coalition started peddling lies about SS back in the early 1980s, AFTER Congress made adjustments to cover the baby boom generation.

slipslidingaway

(21,210 posts)Rex

(65,616 posts)Until they put the 2 trillion plus back into the program, I don't want to HEAR anything about SS.