General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWhat does it mean to say 51% of exchange veterans don't plan to return for round two?

On the other hand, a slight majority of the exchange veterans (51 percent) say they don't plan to return for round two, which begins Nov. 15.

Do people have to sign up every year?????? And That does sound like a high number but at the link to bankrate they say it is kind of normal.

Read more: http://www.bankrate.com/finance/insurance/health-insurance-poll-0914.aspx#ixzz3I4WjWYeo

It started with this story on Yahoo finance:

http://finance.yahoo.com/news/obamacare-could-face-large-numbers-101500195.html?soc_src=mediacontentstory

"More than half the people who enrolled in Obamacare last year don’t plan to sign up again—and that’s bad news for the president’s health care law.

A new Bankrate survey reveals that 53 percent of current Obamacare enrollees who signed up through the exchanges said they would not be enrolling for 2015. Their reason--“much higher prices for health plans.”

==============================================================

So I went to bankrate and found this:

"Obamacare users wary of new enrollment season

By Jay MacDonald • Bankrate.com

Those who experienced the rocky rollout of the Obamacare health exchanges firsthand are feeling nervous about prices and wary of technical glitches on the eve of the second open enrollment period, according to the latest Bankrate Health Insurance Pulse survey. All of the survey respondents were from households that used the exchanges during the initial open enrollment last fall and winter.

Within that group of respondents, a slight majority -- 52 percent -- report they had a positive experience, and 53 percent feel confident that the online health insurance marketplace will operate smoothly this time around. In an earlier Bankrate survey, only 39 percent of the general population expressed confidence that the exchanges will work well during the new signup season.

On the other hand, a slight majority of the exchange veterans (51 percent) say they don't plan to return for round two, which begins Nov. 15.

MannyGoldstein

(34,589 posts)kelly1mm

(5,756 posts)premiums before the insurance kicks in have been quite a shock to many. If your choice is to pay $100 per month plus $6000 deductible (roughly $7200 per year) before health insurance even kicks in or a much smaller fine, many will chose the fine.

Maraya1969

(23,486 posts)So how can you hit that limit and then be responsible for the first $7,000?

I checked another one that said it had a $7,000 and at the bottom notes it says:

HII-HealtheMed

HealtheMed STM 6 Months

Plan Brochure

MONTHLY PRICE

$285.55

Copay N/A

Deductible $7,500

Family Deductible $22,500

Coinsurance 50%

Coinsurance Limit $5,000

Network

Emergency Room 50% after deductible; Extra $250 deductible applies for Sickness visits if not admitted

And then it said this:

"Out of Pocket Maximum Individual: $5000; Family: $5000"

I think I remember someone explaining how this happens. The $7,000 could be for the year and divided by 12 to get each month's deductible.

But that still does not explain why there is an out of pocket maximum of $5,000

kelly1mm

(5,756 posts)on your deductible in your plan and your monthly premium, it can easily be $10,000 out of pocket expenses for a single person before even $1 of your health care cost is picked up by the insurance company.

The OOP maximum does not include the premiums either.

Here is a link:

https://www.healthcare.gov/glossary/out-of-pocket-maximum-limit/

Out-of-pocket maximum/limit

The most you pay during a policy period (usually one year) before your health insurance or plan starts to pay 100% for covered essential health benefits. This limit must include deductibles, coinsurance, copayments, or similar charges and any other expenditure required of an individual which is a qualified medical expense for the essential health benefits. This limit does not have to count premiums, balance billing amounts for non-network providers and other out-of-network cost-sharing, or spending for non-essential health benefits.

The maximum out-of-pocket cost limit for any individual Marketplace plan for 2015 can be no more than $6,600 for an individual plan and $13,200 for a family plan.

Nuclear Unicorn

(19,497 posts)The law will survive by veto only, become so radioactive to those who touched it only the deepest of blue states will insulate them and in 2016 the Democratic party won't offer a candidate so much as it will prepare a sacrificial lamb.

The GOP now has even more incentive to kill the law and if they gain the senate today they will call it a mandate. They will want to humiliate Obama by destroying his namesake law. Obviously Obama will not let that happen. The ensuing battle will become an albatross around the neck of Dems that voted for the bill and the 2016 presidential candidate. With stories like this there is simply too much blood in the water for the RW to NOT attack. Repeal or not, the battle itself is a victory.

You can curse me for saying it's unfair but it's what I honestly think the GOP will do and unless the law suddenly becomes popular I see no reason to think I am wrong. I read last night that Andrew Cuomo has written off a 2016 presidential campaign believing it to be already lost (No, I'm not endorsing Cuomo; I'm just reciting what I read.). Perhaps things such as this are a part of his calculations.

strawberries

(498 posts)ACA should they win. I have my doubts about them winning. Perhaps they will modify it and wouldn't it be nice if they added single payer to it.

Yes I can dream

Nuclear Unicorn

(19,497 posts)And the longer it stays on the books and the Dems fight to keep it that way the longer the Des can't fight for SP.

So the GOP gets a weapon to hand its troops and the Dems get stuck defending something that only demoralizes their own troops. The GOP would be stupid to kill it at this point.

Vinca

(53,723 posts)I was thankful I'm finally lucky enough to get Medicare. (It used to be called "aging." It's now called "lucky."![]() It sounds incredibly complicated and we know a good half of the population is not good with "complicated." The program reinforced my belief in single-payer.

It sounds incredibly complicated and we know a good half of the population is not good with "complicated." The program reinforced my belief in single-payer.

99Forever

(14,524 posts)I can keep the shit "insurance" that I can't afford to use, for a mere 40% raise in premiums.

Sure am fucking glad we didn't get suckered into a single payer system or a public option.

Nuclear Unicorn

(19,497 posts)Well, have no fear! A new senate means new opportunities!

Right?

Maraya1969

(23,486 posts)paid?

99Forever

(14,524 posts)Deductible? Now $6200 next year $5750

Premium. Now $245 next year $423. I get no subsidy.

At work don't have copay schedule with me.

HereSince1628

(36,063 posts)of the person, or spouse, that move the persons away from the provision of medicaid support under ACA?

ACA itself includes the mandate. How does an average American escape the requirement to be insured?

Youdontwantthetruth

(135 posts)If people choose to not carry medical insurance, so be it.

There is nothing we can do.

I would just like to see a law stating if one does not have insurance ALL medical facilities can demand cash up front or refuse to see you. That would solve the problem.

That way people have a choice, they can pay cash, get insurance or die. We don't want to have single payer that is the only choice left.

Right now there is NO incentive for people to have insurance, if you get sick you can still go to the ER and get treatment, the penalty is to low for people to care about, it is cheaper then not having insurance.

If folks want compliance from the people to buy private insurance the alternative needs to be so horrific that people will obtain it.

Insurance, Cash or Die. You choose your life path.

zipplewrath

(16,698 posts)That would solve the problem.

People who can't afford to use insurance are just as broke as people who can't pay. How does this "solve" anything?

Universal health CARE would solve the problem.

Youdontwantthetruth

(135 posts)mandatory purchase of private medical insurance with no price controls that is the frame work we have to work with.

We do not currently have single payer; yet for the ACA to work, if one actually thinks it can work beyond enriching insurance companies, is for every one to purchase private insurance or pay a fine. Right now it is cheaper to not have any insurance hence no incentive for compliance.

The poor are covered, well at least some are, and those that are not covered will that is just an acceptable loss and well known acceptable compromise to those in power. IF they actually cared about the poor and working poor they would have never proposed it to begin with.

NCTraveler

(30,481 posts)BuelahWitch

(9,083 posts)stevenleser

(32,886 posts) ?t=1409842992942

?t=1409842992942

Premiums Set to Decline Slightly for Benchmark ACA Marketplace Insurance Plans in 2015

Analysis of 15 States and D.C. Also Finds Changes Vary Across States and Insurers

Results Suggest Consumers Should Shop Carefully When Open Enrollment Begins November 15

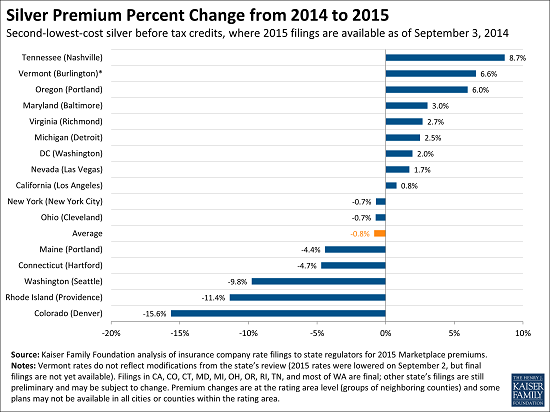

MENLO PARK, Calif. – An early look at the cost of health insurance in 16 major cities finds that average premiums for the benchmark silver plan – the one upon which federal financial help under the Affordable Care Act to consumers is based – will decrease slightly in 2015. The new study from the Kaiser Family Foundation analyzes premiums in the largest cities in 15 states and the District of Columbia where information from rate filings is available.

Premiums for the second-lowest cost silver plan for individuals will fall by an average of 0.8 percent from current levels in these cities when open enrollment begins on Nov. 15, according to the study. The analysis finds that the premium for the second-lowest-cost silver plan is decreasing in 7 of the 16 areas studied – but also that changes in average premiums will vary considerably across areas. They range from a decline of 15.6 percent in Denver, Colorado (to $211 per month), to an increase of 8.7 percent in Nashville, Tennessee (to $205 per month). In both cases premiums are for a 40-year-old nonsmoker, before taking into account any tax credit. It is important to note that rate changes may be different in different rating areas in these states.

“There is variation, but so far, premium increases in year two of the Affordable Care Act are generally modest,” said Drew Altman, Kaiser’s President and CEO. “Double digit premium increases in this market were not uncommon in the past,” Altman added.