General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsBernie Sanders Would Tax The Income Of The Wealthiest Americans At 90 Percent

In an interview with CNBC’s John Harwood, Sen. Bernie Sanders (I-VT), who is running for the Democratic presidential candidacy, said he could back a 90 percent top marginal tax rate.

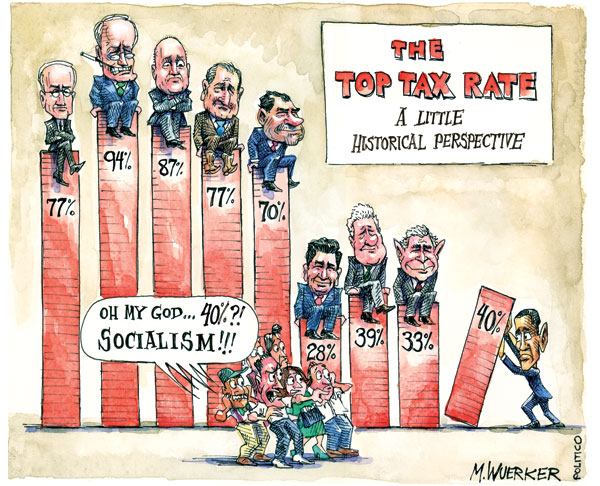

Harwood brought up that some have likened efforts to combat income inequality to Nazi Germany. Sanders noted sarcastically, “When radical, socialist Dwight D. Eisenhower was president, I think the highest marginal tax rate was something like 90 percent.”

Harwood followed up by asking, “When you think about something like 90 percent, you don’t think that’s obviously too high?” to which Sanders replied, “No.”

http://thinkprogress.org/economy/2015/05/26/3662773/sanders-90-percent-tax/

Go Vols

(5,902 posts)Coventina

(29,562 posts)hifiguy

(33,688 posts)So why not now?

backwoodsbob

(6,001 posts)the top anyone actually paid was no where near 90% and the repukes will jump all over this.

The top marginal rates may have been 90% but deductions were much higher then.

I would be shocked if the top real tax rate after deductions was more than 45%

NaturalHigh

(12,778 posts)The effective federal rate was indeed right about that. I just saw a chart on it recently - don't remember where, though.

salib

(2,116 posts)And it definitely was not "stupid".

It was actually a very strong comment, reminding people that Ike was president when the top marginal rate was >90%.

That is it. And it was strong.

He must face these issues head on, and not try to shy away from. He is doing just that.

kenfrequed

(7,865 posts)We all get that marginal tax rates are different than effective tax rates. Right?

DFW

(60,000 posts)If you had a secret offshore account, it was almost impossible to find, too.

In an incentive-driven economy, it's difficult to get someone earning a certain amount to risk investing in something if they only get to keep 10% of their earnings over that given amount. It sounds good in speeches, but it won't touch enough pockets to pay for the cheerleaders' health care or put their kids through college. Let them pay 50% and give them an incentive not to hide it. That's WAY more than the top earners pay now as it is.

davekriss

(5,379 posts)I much prefer to see a wealth tax coupled with a fairly high marginal FIT rate.

The wealth tax is an acknowledgement that the very rich are served very well by our imperial armies, our judicial system and its enforcement of power-asymmetric contracts, our infrastructure, our embrace of near monopolies and the rents that accrue to their wallets as a result.

The high marginal rates give us an opportunity, via exemptions and deductions, to steer the social ship in directions that better serve the non-wealthy.

I don't care if this is a little less "efficient" as long as it truly lifts all boats, not just the 1%

DFW

(60,000 posts)He got lucky in his job and his investments, is worth maybe $50 million by now. He has set up a charity foundation to provide supplemental education, since our Texas legislature apparently feels that educating our children is of low priority. His wife is a dancer, and he has financed her dance seminars and concerts, many of which have garnered praise in the local press. Her guiding light was Pina Bausch. He set aside a million bucks each for two sons to inherit, and the rest goes to his foundation. He donated heavily to Wendy Davis and Howard Dean's campaign and subsequent projects.

MAYBE a bunch of self-righteous theorists have a better idea what to do with his money, but he doubts it and so do I. He gave plenty to Wendy Davis, still keeps in touch with Howard Dean. If the bureaucrats here in Europe are any indication, a 90% marginal tax would mean limousines and huge tax-free pensions for the bureaucrats and token sums left over for whatever they purported to be needing the money for.

I will not champion blanket confiscatory policies just because of the likes of the Kochs, Adelsons, etc. They can be addressed without destroying incentive. A wealth tax was described by a politician in Germany as a "jealousy tax," as it was a second tax on money already taxed. No one found a credible answer to him. The German Supreme Court struck down the proposed law, anyway, as double taxation is forbidden under their constitution. The Germans have an allergic reaction to confiscatory policies in general, anyway, as the party in power here from 1933 to 1945 practiced it with brutal efficiency on people they perceived as unjustly wealthy. It didn't end very well for either side.

davekriss

(5,379 posts)...who plows some of his money back in to good causes, there are probably dozens in Texas who don't. They're more likely to plow it into some right winger's campaign, a candidate who will protect their wealth and augment their ability to make more. Some buy media to mollify the minds of the many into believing this is the best of all possible worlds, the only natural and therefore benevolent arrangement of affairs. It is not.

I MUCH rather we tax your friend's wealth and democratically decide to educate our young. I rather we don't leave it to the philanthropy of the few. We should not leave it to the whims of a rare, kind autocrat but instead take our futures into our own hands.

I much rather we decide for ourselves - democratically - to stop strengthening the very rich and instead strengthen ourselves.

LanternWaste

(37,748 posts)Odd that Eisenhower would be considered a communist by the standard of today's GOP, but he would.

JHB

(38,120 posts)...as their intellectual (in the very technical sense of the word) descendants do now, by implication.

JHB

(38,120 posts)Tax brackets for selected years, adjusted for inflation:

If a marginal rate of 91% is too high, cut the Ike-era/Cold War rates by a third to half, but bring back the distribution of brackets.

GummyBearz

(2,931 posts)That a candidate who isn't bought out by billionaires wont hesitate to tax billionaires? Interesting, I wonder how a billionaire bought-and-paid-for candidate would respond?

upaloopa

(11,417 posts)the government do with that money?

Any ideas?

How would your life change?

lame54

(39,464 posts)CreekDog

(46,192 posts)in order to shield it from those taxes.

upaloopa

(11,417 posts)I use to do taxes for wealthy before the rates were lowered. People with businesses did not pay themselves a salary so they would not have earned income. They formed partnerships or sole proprietorships and took money out as withdrawal of owner's equity. Withdrawls were not taxes at 90%.

on point

(2,506 posts)and others.

SomethingFishy

(4,876 posts)How about REAL broadband? High Speed Rail? How about fixing the infrastructure? Investments in medical research and clean energy? There is enough shit to do to keep us busy for 50 years, and that means getting everyone who is able, working and everyone who is not the help they need to survive.

NCTraveler

(30,481 posts)They currently bring in the necessary revenue to do all of those and still maintain a military that can take on the universe. Taxing at a higher percentage will not make any of those happen in any way. The feds have the money. Giving them more before fixing the systemic problems will be devastating.

Scootaloo

(25,699 posts)I think at this point in the game, all higher taxes would do is bloat "defense" spending even more.

We can cut the pentagon's budget by two thirds and still rule the fucking world (if that's what we're after, anyway). i think that is a more important place to look than raising taxes at this moment

Of course, once that hole in the hull is patched, by all means, let's start taxing the wealthy again

abelenkpe

(9,933 posts)Fund our public schools, repair our infrastructure...or should we continue to have the most expensive healthcare and underfunded schools that need to hold constant fundraisers to afford art and science?

Sanders tax proposal is no different than taxes were under Eisenhower. Rich people were still rich.

jwirr

(39,215 posts)Gregorian

(23,867 posts)I love Bernie. I'm voting for him. I probably won't ever make enough to be taxed like that. But what about moderate taxes for all instead of a super high tax on some?

SickOfTheOnePct

(8,710 posts)but 90% is too, IMO.

tk2kewl

(18,133 posts)It only applies to income over some threshold - i.e. Anything more than $5,000,000/yr

SickOfTheOnePct

(8,710 posts)and I still think it's too high.

salib

(2,116 posts)Then 90%+ top marginal tax rates are a minimum step to start to equalize things a little bit. Much else is also required, but that is a necessary step.

It is simply immoral to allow someone to hoard so much of what all of us are producing.

SickOfTheOnePct

(8,710 posts)of what someone, anyone, earns above a certain level. 65%, 70%, fine, but 90% is too much, IMO.

oberliner

(58,724 posts)Immoral seems a strong word to use there.

We are talking about the One Percent here - and the rate would only apply to their income over and above a very high threshold.

salib

(2,116 posts)Are you sick of the one percent, or not?

We all know that NO ONE WORKS $1 billion worth in a year when the median is in the $10K-$100K range.

NO ONE.

Society is allowing such a person to screw a very large number of people out of a percentage of what they are worth or what they own.

THAT is immoral.

DanTex

(20,709 posts)A 90% tax rate would probably be counterproductive because once people hit that rate they would spend a lot of time and effort figuring out how to dodge the tax. On the other hand, the top capital gains tax rate right now is 20%, whereas the top income rate is 39.6%. Wealthy people earn a lot of income from capital gains, which effectively lowers their tax rate. You may have heard, for example, the story of Warren Buffet paying a lower rate than his secretary. This is because his income is basically all capital gains.

Raising capital gains taxes so that the top rate is even 30% would raise a lot of money.

Orsino

(37,428 posts)The economy is (should always be) a moving target. What if we increased that top marginal rate to 40%, and watched the results?

Even beginning to approach 90% is almost certain to reduce income inequality.

morningfog

(18,115 posts)He doesn't say he would so that or even try to do it. He says that tax rate is not unreasonable. And he is right.

Gregorian

(23,867 posts)oberliner

(58,724 posts)He certainly has talked about raising taxes on the wealthy to address the problem of income inequality.

Human101948

(3,457 posts)Every time we hear talk like this someone gets killed.

bunnies

(15,859 posts)Not that he supported doing it.

closeupready

(29,503 posts)Transparently pushing Hillary there, IMO. ![]()

bunnies

(15,859 posts)Seems to be the thing to do these days. ![]()

oberliner

(58,724 posts)Are you not familiar with that site?

MaggieD

(7,393 posts)It's not the tax rate that is the problem. It's the loopholes. You could raise the marginal tax rate to 100% and the uber wealthy wouldn't pay another penny more than they do now.

Why doesn't he just say that? He knows it is true.

Bluenorthwest

(45,319 posts)I'm sorry but you should post some form of support for your assertion. Your claim is that no matter what, you can't collect more taxes from the wealthy because....well just because you say so. Then you demand that others repeat your views.

MaggieD

(7,393 posts)You just don't know that because no one in government wants to admit it - on either side, by the way.

salib

(2,116 posts)You write:

"It is actually the truth, you just don't know that..."

Is that really your response?

That sounds like the logic of the fundamentalist.

Erich Bloodaxe BSN

(14,733 posts)Or dialogue from a really bad movie.

salib

(2,116 posts)Thanks for the laugh.

DanTex

(20,709 posts)A lot of wealthy people get a large share of their income from capital gains, which is taxed at a much lower rate than ordinary income. The top income tax rate right now is 39.6%, the top capital gains rate is 20%. That's the main reason for things like Warren Buffet paying a lower effective tax rate than his secretary.

So unless that capital gains tax rate is raised as well, it's true that a lot of rich people will still pay relatively low overall tax rates. And also, if the rate does go to 90%, the tax avoidance industry is going to get a lot more active, because once a person hits that bracket, they are going to devote a lot of effort to finding ways to avoid it.

I suspect he would obviously tighten some of the rules on that score too. He definitely wouldn't allow for tax holidays for repatriated wealth and investments that have been offshored.

Besides, the inherent argument within that is "why have laws that people can break or subvert" is kind of problematic. We both also hate the last president I recall making that argument an awful lot.

Sheepshank

(12,504 posts)tax 90% of what, exactly?

I think it's loopholes we need to fix so they are paying taxes on all of their income, not the paltry amount left after all of the tax evasion tactics they employ.

TexasMommaWithAHat

(3,212 posts)Stop subsidizing the wealthy. If the 1% actually paid taxes on all income at 45%, we'd collect way more taxes.

salib

(2,116 posts)Loopholes are important in terms of ensuring that taxes are collected and that the Govt gets enough to function. It is important to revenues.

However, as important as that is, the point of the high marginal tax rates (what is almost equivalent to a maximum wage) is to ensure that money is invested, to become part of the larger pool of available capital, rather than what has been happening with lower rates but fewer loopholes, which is that the money is simply being hoarded.

Thus, unless you make it basically pointless to keep paying a few people more and more (because as some point which is the top marginal rate you cannot really make any more money), people with the wherewithal will simply hoard, no matter the loophole elimination. It must be near 100% rates to accomplish this.

oberliner

(58,724 posts)It's the non-income wealth.

guillaumeb

(42,649 posts)would they still be able to spend billions on buying politicians, funding right wing think tanks and generally trying to impoverish the bottom 90%?

Sounds like class warfare to me, and I say bring it on.

Nice post oberliner.

smokey nj

(43,853 posts)It's also an argument that can win over a lot of underprivileged right wingers. I've tried it out on a few that I know and they get it.

guillaumeb

(42,649 posts)And get your point about underprivileged right wingers.

kenfrequed

(7,865 posts)The interviewer does not understand the difference between marginal tax rate and a regular tax rate.

Nye Bevan

(25,406 posts)I respect his frankness. And I expect that this issue will come up in the debates, as it should.

valerief

(53,235 posts)one million that were taxed at 90%, not the earning under one million.

Maybe I have the cutoff amount wrong, but no one makes this clear when they talk about taxing at 90%.

The rich will still be quite rich!

Sheepshank

(12,504 posts)shenmue

(38,595 posts)Although I think Congress, specifically the Republicans, would fight it like crazy, I dream to set the taxes for billionaires at that level again.

tblue37

(68,388 posts)valerief

(53,235 posts)the income of millionaires in the 50s was taxed at 90%.

tblue37

(68,388 posts)about tax rates in the two different time periods labor under that same misconception!

valerief

(53,235 posts)thing as journalism anymore anyway. Most readers, OTOH, probably are under that misconception about the tax rate.

tblue37

(68,388 posts)pnwmom

(110,237 posts)At half a million a year? Ten million a year? A billion?

Details matter.

beaglelover

(4,461 posts)pnwmom

(110,237 posts)were trying to punish success -- rather than to expect those who benefit most to be taxed the most.

And if the Democrats were to lose because this idea were to be twisted and used against them, then the whole country would be hurt.

So he needs to be very specific about who he thinks should be taxed at that rate -- and at other rates that are higher than the highest now.

He also needs to keep in mind that many voters don't really understand the concept of "marginal tax rate." And the media is unlikely to help by explaining it every time.

DCBob

(24,689 posts)0rganism

(25,557 posts)very unlikely that an average voter will pick up on the word "marginal" before "tax rate".

not Bernie's best moment, imho.

oberliner

(58,724 posts)Then perhaps they would be less ignorant.

FrodosPet

(5,169 posts)Like NOT murder and rape and steal.

Unfortunately, many people don't do what they SHOULD.

DCBob

(24,689 posts)Cheese Sandwich

(9,086 posts)And as others have said, remember we are talking about marginal rates.

If we create a billionaires tax bracket, your first billion would still be taxed at the lower rate. Only your income after the billion would be taxed at the higher rate.

jwirr

(39,215 posts)the ME wars and it should (like in Eisenhower's day) come from the people who made the profits from it. I do not think it is too much.

gordianot

(15,766 posts)Back in the day when the one percent could claim they were job creators though not voluntarily.

oberliner

(58,724 posts)Well said!

LWolf

(46,179 posts)he said "No" to the question about 90% being too high, which can be interpreted to mean that he could back a 90 percent top marginal tax rate. It's possible that he might.

He did not say anything to lead to the "would" in the article's title.

That said, I agree with him. 90% is not too high, as the article points out a little later on:

But that’s not likely the case. Last year, economists found that the point at which the top tax rate is high enough to maximize government revenues but not so high that it discourages the rich from trying to earn more is quite high: about 95 percent for the 1 percent. History bears that out. Economists have pointed out that post-war American growth has been higher during periods with much higher top marginal tax rates and lower when tax rates were substantially lower. When the top rate was more than 90 percent in the 50s, economic growth averaged more than 4 percent a year. But recently when the top rate has been closer to 35 percent, growth has been less than 2 percent a year on average.

WillyT

(72,631 posts)

oberliner

(58,724 posts)Is there no turning back?

WillyT

(72,631 posts)We have to get rid of Citizens United.

![]()

oberliner

(58,724 posts)The median net worth of the nine current Supreme Court justices was between $1 million and $2.6 million in 2009, according to the Center's research. The median of the average net worths of the nine justices is $1.8 million.

http://www.opensecrets.org/news/2011/09/ruth-bader-ginsburg-steven-breyer/

Octafish

(55,745 posts)

They're still ahead and they'd get to keep theirs, too.

99Forever

(14,524 posts)I'm not seeing a downside to this.

madokie

(51,076 posts)this is a crock of shit. The heading implies that if Sanders were President he would impose a 90 percent tax on some of the rich. If reading the short three paragraphs you come to that conclusion I truly don't know what to say.

Actually makes me more confident than ever in Sanders if the knifes come out so early around here

oberliner

(58,724 posts)This is from Think Progress. They are very supportive of Sanders. The article explains why a 90 percent top marginal tax rate would be a good idea that would help grow the economy.

ChisolmTrailDem

(9,463 posts)tax set at, just that he doesn't think it's too high.

oberliner

(58,724 posts)Here is the full context:

HARWOOD: Have you seen some of the quotations from people on Wall Street, people in business? Some have even likened the progressive Democratic crusade to Hitler's Germany hunting down the Jews.

SANDERS: It's sick. And I think these people are so greedy, they're so out of touch with reality, that they can come up and say that. They think they own the world.

What a disgusting remark. I'm sorry to have to tell them, they live in the United States, they benefit from the United States, we have kids who are hungry in this country. We have people who are working two, three, four jobs, who can't send their kids to college. You know what? Sorry, you're all going to have to pay your fair share of taxes. If my memory is correct, when radical socialist Dwight D. Eisenhower was president, the highest marginal tax rate was something like 90 percent.

HARWOOD: When you think about 90 percent, you don't think that's obviously too high?

SANDERS: No. That's not 90 percent of your income, you know? That's the marginal. I'm sure you have some really right-wing nut types, but I'm not sure that every very wealthy person feels that it's the worst thing in the world for them to pay more in taxes, to be honest with you. I think you've got a lot of millionaires saying, "You know what? I've made a whole lot of money. I don't want to see kids go hungry in America. Yeah, I'll pay my fair share."

http://www.cnbc.com/id/102694365

I would also mention that the Think Progress article is very supportive of the idea.

madokie

(51,076 posts)Nothing more or nothing less.

The more I read shit like this the more I LIKE Bernie Sanders

oberliner

(58,724 posts)This piece is from Think Progress - a progressive site that is supportive of Sanders

The article describes exactly why such a tax rate would be a good idea that would grow the economy.

madokie

(51,076 posts)its a bullshit story and a bullshit post

Bernie Sanders did NOT say he would raise anyone taxes to 90 percent. Based on the heading of the linked article and that fact it is a Bullshit story by a bullshit artist.

oberliner

(58,724 posts)Here is the full context:

HARWOOD: Have you seen some of the quotations from people on Wall Street, people in business? Some have even likened the progressive Democratic crusade to Hitler's Germany hunting down the Jews.

SANDERS: It's sick. And I think these people are so greedy, they're so out of touch with reality, that they can come up and say that. They think they own the world.

What a disgusting remark. I'm sorry to have to tell them, they live in the United States, they benefit from the United States, we have kids who are hungry in this country. We have people who are working two, three, four jobs, who can't send their kids to college. You know what? Sorry, you're all going to have to pay your fair share of taxes. If my memory is correct, when radical socialist Dwight D. Eisenhower was president, the highest marginal tax rate was something like 90 percent.

HARWOOD: When you think about 90 percent, you don't think that's obviously too high?

SANDERS: No. That's not 90 percent of your income, you know? That's the marginal. I'm sure you have some really right-wing nut types, but I'm not sure that every very wealthy person feels that it's the worst thing in the world for them to pay more in taxes, to be honest with you. I think you've got a lot of millionaires saying, "You know what? I've made a whole lot of money. I don't want to see kids go hungry in America. Yeah, I'll pay my fair share."

http://www.cnbc.com/id/102694365

Sanders brought up the 90 percent marginal tax rate. The Think Progress article expounds on why this would be a good idea.

Sanders consistently talks about wanting to raise taxes on the very wealthy in order to address income inequality.

madokie

(51,076 posts)no amount of your pushing this is going to change that. Bernie has made it pretty clear that he thinks the top need to be paying more in taxes, no where has he said by how much and I'm sure he won't suggest an Eisenhower type tax rate, if he does point me in that direction. Otherwise this article linked to by you is a bullshit article. Simple as that and you keep making it worse by your continued support of it.

oberliner

(58,724 posts)ThinkProgress is progressive.

Sanders suggests that the Eisenhower type tax rate is perfectly reasonable, and the article expounds on why that is the case.

I'm trying to figure out where your hostile reaction is coming from.

madokie

(51,076 posts)is hostile. I'm done with you. Good day

oberliner

(58,724 posts)That's all I am trying to get clarity on.

Are you saying the content is made up?

Again, the article is very supportive of Sanders and of raising the marginal tax rate on the wealthiest Americans.

kenfrequed

(7,865 posts)The marginal tax rate is not the effective tax rate. I recommend reading a book on taxation and then going back to look at this article again to see what is wrong with how it is coached and the headline of the goddamned thing.

oberliner

(58,724 posts)That is made very clear in the article.

In fact, it is in the first paragraph:

In an interview with CNBC’s John Harwood, Sen. Bernie Sanders (I-VT), who is running for the Democratic presidential candidacy, said he could back a 90 percent top marginal tax rate.

And then the author expresses support for the idea (again reiterating that it is marginal tax rates we are talking about)

American growth has been higher during periods with much higher top marginal tax rates and lower when tax rates were substantially lower. When the top rate was more than 90 percent in the 50s, economic growth averaged more than 4 percent a year. But recently when the top rate has been closer to 35 percent, growth has been less than 2 percent a year on average.

kenfrequed

(7,865 posts)Sorry, I guess I was responding more to the responses to this post than I was the post itself. There are like half a dozen of the usual suspects on here slamming on Sanders as usual and just running with a rather contorted argument. (I had to rewrite that last sentence a dozen times)

oberliner

(58,724 posts)Especially on the right - people see 90 percent tax rate and they think it means if you make a million dollars that the government takes 900,000. So I do agree that it is in fact important to make it clear that the rate would not kick in until a certain income level is reached.

kenfrequed

(7,865 posts)And that was the absolute top marginal rate, it was progressively rated all the way up. It did make taxes kind of complicated at times but it isn't as if the wealthy aren't constantly screwing with things to pay less. We need to make them pay their share!

The big payback!

Erich Bloodaxe BSN

(14,733 posts)95% would be better, but baby steps.

(And remember that's a top MARGINAL rate. That means they'd be taxed the same as anyone else on their earlier income. If the 90% bracket started at, say, 100 million, that means they're not getting taxed 90% on that first hundred million.)

oberliner

(58,724 posts)It seems quite reasonable to me as well.

yuiyoshida

(45,289 posts)and tweeted ![]()

PowerToThePeople

(9,610 posts)DanTex

(20,709 posts)I think that when the top income rate was 90%, the top capital gains tax rate was still only about 25%. Which, if the idea is to raise money from the wealthy, doesn't make much sense, because on average the wealthier a person is, the larger the share of their income that comes from capital gains.