General Discussion

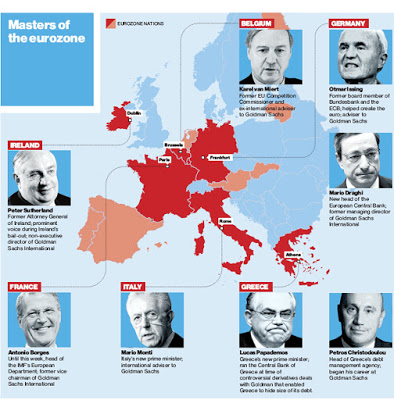

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsGoldman Sachs – Masters of the Eurozone

By Gaius Publius, a professional writer living on the West Coast of the United States and frequent contributor to DownWithTyranny, digby, Truthout, and Naked Capitalism. Follow him on Twitter @Gaius_Publius, Tumblr and Facebook. This piece first appeared at Down With Tyranny.

Interesting headline, yes? I have a two-point intro and then the piece.

First, when a “private” group’s chief individuals flow back and forth constantly between government and that group, the group can be said to be “part” of government, or to have “infiltrated” government, or to have been “folded into” government. (Your phrasing will be determined by who you think is the instigator.)

For example, a network of private “security consulting” firms does standing business with the (Pentagon’s) NSA, and by some accounts performs 70% of their work. Are those firms part of the NSA or not? Most would say yes, to a great degree. It’s certain that the NSA would collapse without them, and many of these firms would collapse without the NSA (though many have other … ahem, international … clients, which starts an entirely different discussion).

As another example, the role of mega-lobbying firms as a fourth branch of government was explored here. Same idea.

In the case of the security firms, one might say they have been “folded into” government. In the case of the lobbying firms, one might say they have “infiltrated” government. I hope you notice the difference; both modes of incorporation occur.

Second, consider how in general the “world of money” and the parallel world of “friends of money” — its enablers, adjuncts, consiglieri and retainers — flow in and out of the world of government, of NGOs, of corporate boards, of foundation boards, attends Davos and the modern Yalta (YES) conference, and so on. Now consider how someone like Hillary Clinton — not money per se, though she has a chunk, but certainly a “friend of money” — ticks off most of those boxes (foundation board, corporate board, government, Davos, Yalta, and so on). There are many people like Hillary Clinton; she’s just very front-and-center at the moment.

.....(snip).....

Now the piece from The Independent (my emphasis). Note that it was written in 2011.

What price the new democracy? Goldman Sachs conquers Europe.........................(more)

The ascension of Mario Monti to the Italian prime ministership is remarkable for more reasons than it is possible to count. By replacing the scandal-surfing Silvio Berlusconi, Italy has dislodged the undislodgeable. By imposing rule by unelected technocrats, it has suspended the normal rules of democracy, and maybe democracy itself. And by putting a senior adviser at Goldman Sachs in charge of a Western nation, it has taken to new heights the political power of an investment bank that you might have thought was prohibitively politically toxic.

http://www.nakedcapitalism.com/2015/07/gaius-publius-goldman-sachs-masters-of-the-eurozone.html

think

(11,641 posts)ranking positions in many other EU governments and banks.

What could go wrong?

Goldman already controls much of what goes on here in America. GS was at the epicenter of the 2008 meltdown with their reckless, immoral, and deceitful business dealings.

closeupready

(29,503 posts)mortgage-backed CDO's early in the 2000's (likely because they predicted such a downturn, and knew that it would have looked bad). It was most of the other investment banks which drove that sector. This has been well-known from even BEFORE the meltdown occurred, covered extensively in the WSJ and other trade publications.

think

(11,641 posts)~Snip~

Much of the blame for the 2008 market collapse belongs to banks that earned billions of dollars in profits creating and selling financial products that imploded along with the housing market,]according to the report.

The Levin-Coburn panel levied its harshest criticism at investment banks, in particular accusing Goldman Sachs and Deutsche Bank AG of peddling collateralized debt obligations backed by risky loans that the banks’ own traders believed were likely to lose value.

~Snip~

Full article:

http://www.bloomberg.com/news/articles/2011-04-14/goldman-sachs-misled-congress-after-duping-clients-over-cdos-levin-says

closeupready

(29,503 posts)I love Sen. Levin, but I don't think he understands how these complicated financial machinations work, and also, I think GS made a convenient punching bag in the worst days of the crisis.

So they weren't blameless, but they DID get out of it while others stayed in.

think

(11,641 posts)Senator Levin understands damn well what they did.

Their sales people had emails that showed they knew the investments were toxic.

And Senator Levin called them out directly for screwing their clients.

GS hires great lawyers to make sure they don't violate the letter of the law while completely disregarding the spirit of the law.

Just as they did in Greece by helping the Greek government hide their debt so they would be qualified to join the EU and again in selling these toxic CDOs.

By GREG GORDON - MCCLATCHY NEWSPAPERS - NOVEMBER 1, 2009

WASHINGTON — In 2006 and 2007, Goldman Sachs Group peddled more than $40 billion in securities backed by at least 200,000 risky home mortgages, but never told the buyers it was secretly betting that a sharp drop in U.S. housing prices would send the value of those securities plummeting.

Goldman's sales and its clandestine wagers, completed at the brink of the housing market meltdown, enabled the nation's premier investment bank to pass most of its potential losses to others before a flood of mortgage defaults staggered the U.S. and global economies.

Only later did investors discover that what Goldman had promoted as triple-A rated investments were closer to junk.

Now, pension funds, insurance companies, labor unions and foreign financial institutions that bought those dicey mortgage securities are facing large losses, and a five-month McClatchy investigation has found that Goldman's failure to disclose that it made secret, exotic bets on an imminent housing crash may have violated securities laws.

~Snip~

McClatchy's inquiry found that Goldman Sachs:

Bought and converted into high-yield bonds tens of thousands of mortgages from subprime lenders that became the subjects of FBI investigations into whether they'd misled borrowers or exaggerated applicants' incomes to justify making hefty loans.

Used offshore tax havens to shuffle its mortgage-backed securities to institutions worldwide, including European and Asian banks, often in secret deals run through the Cayman Islands, a British territory in the Caribbean that companies use to bypass U.S. disclosure requirements.

Has dispatched lawyers across the country to repossess homes from bankrupt or financially struggling individuals, many of whom lacked sufficient credit or income but got subprime mortgages anyway because Wall Street made it easy for them to qualify.

Was buoyed last fall by key federal bailout decisions, at least two of which involved then-Treasury Secretary Henry Paulson, a former Goldman chief executive whose staff at Treasury included several other Goldman alumni.

Read more here: http://www.mcclatchydc.com/news/politics-government/article24561376.html#storylink=cpy

By CHRIS V. NICHOLSON APRIL 28, 2010 4:33 AM

Evidence released Tuesday by Senator Carl Levin, the Michigan Democrat in charge of the Permanent Subcommittee on Investigations, includes a series of e-mail messages sent by executives at Goldman Sachs as the bank attempted to shed mortgage-related assets in the run-up to the subprime crisis of 2007.

The e-mails appear to support one of the most important criticisms of the bank — that it served itself at the expense of its clients — and illustrate the conflicts of interest that arise when banks’ proprietary trading overlaps with customer sales.

Full article:

http://dealbook.nytimes.com/2010/04/28/the-goldman-e-mails-or-how-to-sell-junk/?_r=0

stevenleser

(32,886 posts)Bank of America, Wells Fargo and Citigroup.

http://www.accuity.com/useful-links/bank-rankings/

As I responded to the OP, its smaller than about 15 banks local to the Eurozone. Those banks would laugh at the assertion that Goldman has more to do with what is going on financially in the Eurozone than any one of them, let alone all 15.

Goldman's total assets under management amounts to around $850 Billion. The banks I've noted all have assets in the trillions.

stevenleser

(32,886 posts)hill2016

(1,772 posts)let facts get in the way of a righteous rant.

Octafish

(55,745 posts)Here is something you don't hear on Fox News, from 2011:

Draghi at the Central Bank

Is Goldman Sachs Poised to Takeover Europe?

by MIKE WHITNEY

CounterPunch, OCTOBER 31, 2011

Goldman Sachs is about to take over Europe, but you wouldn’t know it by reading the papers.

On Tuesday, G-Sax alum, Mario Draghi, will take the helm at the European Central Bank replacing retiring ECB president Jean-Claude Trichet. The appointment has slipped by the media virtually unnoticed even though the ECB is the most powerful institution in the EU and is likely to play a critical role in solving the debt crisis.

Draghi was formally a Managing Director at Goldman. He also served as an advisor to the Bank of Italy in 1990, chairman of the Italian Committee for Privatisations, and was an Executive Director of The World Bank from 1984 to 1990. His bio. affirms his globalist pedigree which makes him the perfect candidate to replace the curmudgeonly Trichet who failed to comply with all of Big Finance’s demands. That’s not likely to be the case with Draghi.

The new ECB chief faces the difficult task of trying to pacify Germany while implementing policies that are opposed by the German political class as well as the German people. It won’t be easy, even for a skilled diplomat like Draghi. But Draghi will move forward with his bank-centric agenda, because it may be the last chance to keep the 17-member monetary union from disintegrating.

First, he will lower interest rates by .50 basis pts (from 1.5% to 1.%) at the ECB meeting on November 3 even though headline inflation in the eurozone is presently 3 percent and even though the move is bound to raise eyebrows in Berlin. Then he will announce that the ECB will step up its controversial bond buying program (already 170 billion euros) in order to push yields on soaring Italian debt below 6 percent. The Italian 10-year bond has zoomed to over 6.15 percent since the EU leaders announced their “breakthrough” agreement last Thursday. That means that bondholders do not believe the deal will solve the crisis. Draghi will act quickly to address the situation despite German opposition. Italy has 1.9 trillion euros in debt, 200 billion of which will come-due next year. Rising yields pose an existential threat for the faltering country.

In exchange for ECB support, Draghi will demand that Prime Minister Silvio Berlusconi (Bunga-bunga) push through unpopular reforms that target the unions and pensions. Italy will also be required to privatize more of its public assets and services. At the same time, the bank bailouts will continue mainly through easing new capital requirements and by underwriting bank debt so banks can issue bonds that are guaranteed by the ECB. Here’s the scoop from Bloomberg:

“European banks, which need to refinance more than $1 trillion of debt next year, may struggle to fund themselves until policy makers follow through on a pledge to guarantee their bond sales.

European Union leaders promised this week to “urgently” look at ways to guarantee bank debt in a bid to thaw funding markets frozen by the sovereign debt crisis. Lenders have found it hard to sell bonds for the past two years and have increasingly turned to the European Central Bank for unlimited short-term emergency financing…

In the U.S., the Temporary Liquidity Guarantee Program allowed banks to issue bonds with backing from the FDIC for as long as three years…

European governments including France, Spain, the U.K. and Germany guaranteed some bonds issued by their banks to reassure investors after the collapse of Lehman Brothers Holdings Inc. in September 2008. In May 2010, the EU ended the program when it said banks that relied on the pledges would face a review of their long-term viability.” (“European Bank Debt-Guarantee Proposals May Struggle to Thaw Funding Market”, Bloomberg)

Guarantees on bank debt is a direct subsidy to big finance, which is why we think that a former G-Sax exec. will support the policy.

Draghi is no fool, he knows that the German plan that was announced last week is more of the same “extend and pretend”. It has no chance of ending the crisis. Regardless of the stock market’s (positive) reaction, borrowing costs are still rising, the credit markets are in turmoil, and the clock is ticking. It’s now or never. Either the ECB takes the initiative and acts as lender of last resort or the eurozone is toast.

CONTINUED...

http://www.counterpunch.org/2011/10/31/is-goldman-sachs-poised-to-takeover-europe/

"Facts are stupid things. Stubborn things." -- Ronald Reagan

hill2016

(1,772 posts)has everything to do with the ECB and nothing to do with Goldman.

Octafish

(55,745 posts)Goldman Sachs.

hill2016

(1,772 posts)because Obama worked at Harvard, Harvard is taking over the US.

Octafish

(55,745 posts)Not the same as what I said or the article explained.

hill2016

(1,772 posts)the only times Goldman appears in the article is in the first paragraph and the bio.

Would have failed as a paper in a high school writing class.

Goldman Sachs is about to take over Europe, but you wouldn’t know it by reading the papers.

Draghi was formally a Managing Director at Goldman.

Octafish

(55,745 posts)Working for the same company that profited under the leadership of the former Goldman exec may seem dumb to you, hill2016, but not to me.

Tyler Durden notes:

http://www.zerohedge.com/news/2015-07-06/who-biggest-winner-greek-tragedy

stevenleser

(32,886 posts)Notice the passive-aggressive Fox News smear at me.

Octafish

(55,745 posts)Roger Aile's GOP show boat.

NuclearDem

(16,184 posts)Hell, he's a more aggressive Kremlin stooge than even Parry.

You sure do know how to pick 'em.

Octafish

(55,745 posts)You ever wonder why that is, NuclearDem? Funny, Mike Whitney does, as, I'd think, most anyone alive since Trickle Down came to Reagan would.

The Rich Get Richer

by MIKE WHITNEY

CounterPunch, May 6, 2015

EXCERPT...

More borrowing, more risk taking, more financial instability. And it’s all the Fed’s doing. If rates were neutral, then prices would normalize and CEOs would not be engaged in this reckless game of Russian roulette. Instead, it’s caution to the wind; just keep piling on the debt until the whole market comes crashing down in a heap like it did six years ago. And that’s the trajectory we’re on today, in fact, according to TrimTabs Investment Research, February saw buybacks in the amount of $104 billion, ” the largest monthly figure since these flows were first tracked 20 years ago. ”

So things are getting worse not better. Bottom line: The Fed has led the country to the cliff-edge once again where the slightest uptick in interest rates is going to send the economy into freefall.

But why? Why does the Fed keep steering the country from one financial catastrophe to the next?

That’s a question that economists Atif Mian and Amir Sufi answer persuasively with one small chart. Check it out:

“Here is the distribution of financial asset holdings across the wealth distribution. This is from the 2010 Survey of Consumer Finances:

The top 20% of the wealth distribution holds over 85% of the financial assets in the economy. So it is clear that the direct income from capital goes to the wealthiest American households.” (Capital Ownership and Inequality, House of Debt)

CONTINUED...

http://www.counterpunch.org/2015/05/06/the-rich-get-richer/

Yeah. I can see why you wouldn't like Mike Whitney, NuclearDem.

NuclearDem

(16,184 posts)Mike Whitney thinks so. I can see why you like Mike Whitney, Octafish.

Octafish

(55,745 posts)NuclearDem

(16,184 posts)Octafish

(55,745 posts)I don't recall calling you names. As I don't recall ever reading anything you've posted, I can also say I haven't called any of your sources names.

So. Why don't you comment on what I post? Nothing to say?

NuclearDem

(16,184 posts)I didn't say asshole--you did--but that fits him too.

I didn't call you an asshole, nor did I intend to. Though on the subject of calling people assholes...

http://www.democraticunderground.com/?com=view_post&forum=1002&pid=6316382

Octafish

(55,745 posts)Understand?

NuclearDem

(16,184 posts)Maybe clean your own house before lecturing me, okie dokie?

Octafish

(55,745 posts)Two things:

1. Show where I called you, "asshole."

2. I'm not your buddy, dude.

NuclearDem

(16,184 posts)You even got a hide for it.

Unless "fuck you, asshole" somehow miraculously doesn't mean you called me an asshole.

Oh, and I'm not your dude, friend.

Octafish

(55,745 posts)Which is the point: I don't recall you ever posting anything worth knowing, NuclearDem.

NuclearDem

(16,184 posts)I don't tend to post anti-science drivel, Kremlin apologia, or links to white nationalists and anti-Semites.

Octafish

(55,745 posts)NuclearDem

(16,184 posts)No, you won't, because you never do.

What you'll do is disregard the proof that you're wrong, then accuse the poster of 1) being a shill for the closest industry or interest tied to the subject you're being corrected on, 2) smearing you, 3) "tag-teaming" you with other posters, and/or 4) being an agent of COINTELPRO/FBI boogeyman-of-the-day.

A tactic very useful as an escape hatch, but not one useful for an adult discussion.

Octafish

(55,745 posts)Feel free to get mad all you want.

NuclearDem

(16,184 posts)You never accuse posters of tag-teaming. You never accuse posters of being shills. You never accuse posters of conspiring to silence you.

Whatever you say, buddy. ![]()

Octafish

(55,745 posts)Never said I didn't, dude.

So, show where I "post anti-science drivel, Kremlin apologia, or links to white nationalists and anti-Semites."

GOOGLE Octafish + whatever; go through my journals on DU3 or DU2.

Like I wrote above, if I've made a mistake, I'd be happy to apologize. Otherwise, all you got is a smear.

uhnope

(6,419 posts)stevenleser

(32,886 posts)Working for actual policies. It's much easier to do that.

think

(11,641 posts)By Ben Rooney, staff reporterApril 14, 2011: 9:40 AM ET

~Snip

A Senate panel issued a scathing report Wednesday that describes Goldman Sachs as a "case study" of the recklessness and greed on Wall Street that set off the 2008 financial crisis.

~Snip~

Goldman paid a record $550 million fine to the Securities and Exchange Commission in July to settle charges it misled investors in the 2007 sale of a collateralized debt obligation, or CDO, known as Abacus.

Full article:

http://money.cnn.com/2011/04/13/news/economy/goldman_sachs_senate_report/

hill2016

(1,772 posts)just because a bank bets against you means nothing by itself.

If you buy a variance swap from a bank, it could be short the same trade to hedge out its risk or because it has the opposing view.

What Goldman is accused of doing is mis-representing its role in structuring the trade in this case.

Octafish

(55,745 posts)...one might jump to the conclusion that Greece and its finance officials were knowing participants in the deal. That would be a reasonable assumption were it not for counties and cities and school districts across America that were similarly fleeced and hoodwinked by investment banks on Wall Street."

-- Pam Martens and Russ Martens, Goldman Sachs Doesn’t Have Clean Hands in Greece Crisis

think

(11,641 posts)hedge fund king John Paulson:

By Kevin Connor

Co-founder, LittleSis.org; Co-founder, Public Accountability Initiative - Posted: 04/17/2010 5:12 am EDT

~Snip~

Considering this, hedge fund king John Paulson's role in Greece deserves far more scrutiny. I wrote about this last week, pointing out that they shared the same vulture flight pattern in Greece, but at the time did not realize that Paulson and Goldman actually partnered in executing massive and profitable bets against the subprime market. Are they doing the same with Greece?

News of Paulson's fund taking large positions against Greek debt has barely risen above rumor in the English-language press, despite this article in a Greek daily, which says that Paulson is "orchestrating the pressure on Greek government bonds and the Euro," and reports that Paulson has a team of 20-30 traders focused on Greece.

~Snip~

Since Paulson was in the room with Goldman (and several other banks) when these CDOs were first conceived, it would seem that the fund had an unfair edge over the investors that would lose their shirt buying the securities. Zuckerman notes that Deutsche Bank suffered losses because it couldn't find takers; that famous taker, AIG, may have been Goldman's convenient solution.

These parallels raise obvious questions: was Paulson also in the room with Goldman before it tried to sell Greece on a new way to hide its debt this past November? As a hedge fund client of Goldman's, did Paulson have special information about Greece's true debt situation? Are Goldman and Paulson partnering, once again, to profit from the downfall of an entire country/continent?

Full article:

http://www.huffingtonpost.com/kevin-connor/what-is-john-paulson-doin_b_463084.html

Octafish

(55,745 posts)Zip from the fair and balanced set. This from Forbes casuses one to ask: Could the hedge fund guy be playing both sides, er, hedging his bets?

This hedge fund manager just lost millions on Greece and Puerto Rico

by Stephen Gandel

Forbes, JUNE 29, 2015

One of the biggest losers in the Greek and Puerto Rican debt crises is hedge fund billionaire John Paulson.

Talk about a horrible way to start the week.

A number of hedge funds that were already bracing for losses on Greek debt also found out late Sunday night that they would likely have to swallow big losses on investments in Puerto Rico as well.

One of the biggest losers appears to be John Paulson. After the Greek government, his Paulson Special Situation Fund is the second-biggest shareholder of Piraeus Bank, which is one of the largest financial firms in Greece. Piraeus holds nearly a third of all Greek deposits. Over the weekend, the Greek government closed banks in Greece in order to prevent their collapse. Panicked depositors had already pulled roughly a billion euros out of them.

Paulson’s fund said it owned 6.6% of Piraeus at the end of the first quarter, which was the last time the fund filed its holdings. Greece also closed its stock market Monday, so shares aren’t trading. But as of Friday, the bank’s stock price, which had fallen 56% this year, was $0.40. It would certainly be lower today. Paulson could lose as much as $161 million on the investment.

There there’s Athens Water. Paulson put $137 million into the utility just a year ago, hoping to cash in on the fact that the monopoly was going private. That didn’t happen. And now Athens Water is having trouble collecting its bills from the government, which is out of cash. Paulson has already lost about $75 million on the investment, and he could lose much of the rest. Two years ago, Greece’s finance minister Yanis Varoufakis wrote a blog post criticizing Paulson’s investment in Greek banks.

Paulson has also been one of the biggest financial backers of Puerto Rico. Last year, he called the U.S. territory the Singapore of the Caribbean. In March 2014, Paulson’s fund was one of a number of hedge funds that bought into a $3.5 billion bond offering by the Puerto Rican government. Paulson reportedly bought $120 million of the bonds, according to the Wall Street Journal.

CONTINUED...

http://fortune.com/2015/06/29/john-paulson-greece-puerto-rico-hedge-funds/

Reading the two articles together and now it makes sense, how the smartest guy in the room could act so dumb.

Ichingcarpenter

(36,988 posts)Sen. Bernie Sanders was reacting to Loyd Blankfein's comments about how we must cut our safety nets because we can't afford them in his words. This is coming from another wealthy CEO-type that has racked in hundreds of millions of dollars of his own while accepting big bailouts from the federal government.

Here's what he said to CBS:

An interview with Lloyd Blankfein is as rare as a look inside the Goldman Sachs money machine. He showed us one of seven trading floors at his Manhattan headquarters. Goldman is one of America's most successful investment banks. It had net earnings of $4.4 billion dollars last year. When we asked Blankfein how to reduce the federal budget deficit, he went straight for the subject politicians don't want to talk about.

BLANKFEIN: You're going to have to undoubtedly do something to lower people's expectations -- the entitlements and what people think that they're going to get, because it's not going to -- they're not going to get it.

PELLEY: Social Security, Medicare, Medicaid?

BLANKFEIN: You can look at history of these things, and Social Security wasn't devised to be a system that supported you for a 30-year retirement after a 25-year career. ... So there will be things that, you know, the retirement age has to be changed, maybe some of the benefits have to be affected, maybe some of the inflation adjustments have to be revised. But in general, entitlements have to be slowed down and contained.

Here's how Bernie reacted:

Sanders: Goldman Sachs CEO Lloyd Blankfein came to Capitol Hill this week to call for cuts in Social Security, Medicare and Medicaid. As Congress and the White House are negotiating a year-end deficit deal, Blankfein sought to “lower people’s expectations” about their retirement and health care. He spoke with all the sympathy for someone struggling to get by on $14,000-a-year retirement that you’d expect from a Wall Street banker paid $16 million last year.

“Think about the arrogance of these guys on Wall Street who were bailed out by the middle class of this country when their greed and recklessness nearly destroyed the financial system and now they come to Capitol Hill to lecture Congress and the American people about the need to cut programs for working families,” Sen. Bernie Sanders said in a Senate floor speech.

http://crooksandliars.com/john-amato/bernie-sanders-lloyd-blankfein-arroganc

also see this piece on Blankfein

Lloyd Blankfein's the Wrong............ Rolling Stone

http://www.rollingstone.com/politics/news/blankfein-the-wrong-spokesman-for-gay-rights-20120214

The People vs. Goldman Sachs

A Senate committee has laid out the evidence. Now the Justice Department should bring criminal charges

Read more: http://www.rollingstone.com/politics/news/the-people-vs-goldman-sachs-20110511#ixzz3g9rRDpsx

Follow us: @rollingstone on Twitter | RollingStone on Facebook

The latest evil from Goldman Sachs

http://www.dailykos.com/story/2014/11/21/1346544/-The-latest-evil-from-Goldman-Sachs

pampango

(24,692 posts)Goldman Sachs faces the prospect of potential legal action from Greece over the complex financial deals in 2001 that many blame for its subsequent debt crisis. A leading adviser to debt-riven countries has offered to help Athens recover some of the vast profits made by the investment bank.

The Independent has learnt that a former Goldman banker, who has advised indebted governments on recovering losses made from complex transactions with banks, has written to the Greek government to advise that it has a chance of clawing back some of the hundreds of millions of dollars it paid Goldman to secure its position in the single currency.

Greece managed to keep within the strict Maastricht rules for eurozone membership largely because of complex financial deals created by the investment bank which critics say disguised the extent of the country’s outstanding debts.

Greece’s membership of the euro gave it access to billions of easy credit which it was then incapable of paying back, leading to its current crisis. Lenders took its euro membership as a stamp of creditworthiness, but the true state of its economy was far less healthy.

http://www.independent.co.uk/news/world/europe/greek-debt-crisis-goldman-sachs-could-be-sued-for-helping-country-hide-debts-when-it-joined-euro-10381926.html

Rex

(65,616 posts)

How DARE you discuss facts on a progressive website!