General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forums"We are in a depression."

Probably posted here last week, but worth repeating.

We ended the Great Depression with a great program of government spending for an unfortunate reason. It was known as World War II…but when the war broke out in Europe, and we began our buildup that Great Depression that had been going on for ten years. People thought it would go on forever. Learned people stroked their chins and said there are no quick answers. In two years, employment rose 20%. That’s the equivalent of 26 million jobs today, the depression was over. We had full employment, and it never came back, or it didn’t come back until 2008, because people managed to pay down those debts, and we had a durable recovery.

Paul Krugman on Real Time with Bill Maher 5/25/12

MannyGoldstein

(34,589 posts)I see green shoots everywhere.

For example, the Bain VP who lives a few blocks from me just put a full-size soccer field in his backyard for his kid.

Only the useless eaters are having a tough time of it - those stupid enough to be born poor or empathetic. They need to start banks of their own.

Bigmack

(8,020 posts)If I steal enough... quick enough... I can maybe catch up with my hero... Mutt Ronmey!

Everybody send money. I'll invest it well. Trust me.

hifiguy

(33,688 posts)to

Soupy Sales

WXYZ TV

Detroit

![]()

Soupy actually did that once.

DearAbby

(12,461 posts)not that I remember it of course.....dear old old aunt told me about it....yeah that's the ticket.

Odin2005

(53,521 posts)robinlynne

(15,481 posts)Tripod

(854 posts)You can't just say you disagree without explanation that's tacky!

And my world is spinning way to fast. How is that for a reply?

Quantess

(27,630 posts)just keep one foot on the floor while you go to sleep. ![]()

Tripod

(854 posts)I don't think it will help.

coalition_unwilling

(14,180 posts)not as economists use the term.

A 'depression' requires a contraction of 10-15% in GDP. Our GDP has been growing, albeit anemically. Hence, we are not in a depression nor even a recession.

I've been unemployed for 84 weeks now but my personal misfortune does not allow me to turn economics on its head.

Selatius

(20,441 posts)The popularly followed U3 unemployment index stands at roughly 8% currently.

The U6 unemployment index is hovering around 15%, which is far higher in comparison, but this measure of unemployment excludes people who have been discouraged for more than a year. Adding back in those people could easily push this index into the high teens and perhaps 20% unemployment. Those who have been discouraged for more than a year were excluded starting in the Clinton Administration, and the change has remained in place since then.

coalition_unwilling

(14,180 posts)'depressed' about many others' situations in this economy.

But the word 'depression' actually has a well-defined meaning. To wit, an economy must contract by at least 10% for it to qualify as a 'depression.' Since our GDP is growing, however anemically, it cannot be a 'depression,' at least as economists use the term.

Today's spike of 10,000 in initial unemployment claims and ADP's lackluster survey of new jobs added in the private sector combine to reaffirm my feeling that the economy, while neither in depression or even recession, is in a 'dead cat bounce.' That is, the aggregate demand curve is in the process of re-setting itself to the left as consumers demand less of everything. The good news in all this, I suppose, is that inflation will remain a non-threat for the near future (next 12 months). There will simply be no demand pressure putting pressure on prices.

DCBob

(24,689 posts)Is he suggesting the numbers are bogus and the Obama admin is cooking the books? Or is this some sort of new type of "pseudo depression" that has never happened before? I dont get it.

cthulu2016

(10,960 posts)He is suggesting that the numbers play out as a generational depression of economic activity.

We call the 1930s the depression, but that doesn't mean there wasn't job growth. There was. Just not enough to ever regain the ground lost 1929-1932.

We, in the US, have high unemployment and a flat economy, and there is no sign of the sort of robust recovery that repairs things. We are growing enough to keep from slipping down further (knock wood) and that is much better than being in freefall.

We are gaining enough jobs to break-even (with population growth). That is better than the alternative.

DCBob

(24,689 posts)jwirr

(39,215 posts)long said that the only reason it does not look like the 1930s is because we have government safety net programs that are still allowing most of us to continue buying food, rentals, etc. If those programs disappeared today - no one would be doubting we are in a depression.

In my case I am not buying anything special because I have no credit left and very little to live on. For me it is a depression.

Bake

(21,977 posts)If your neighbor loses his job, it's a recession. If you lose YOUR job, it's a depression.

And I'm depressed.

Bake

coalition_unwilling

(14,180 posts)cthulu2016

(10,960 posts)Krugman is, after all, an economist and we know how he uses the term.

There isn't any universally accepted economic definition. There have been definitions suggested that require a contraction in GDP of 10%+ and a recession lasting more than two years, but that is not universally accepted.

Unlike recession, depression is more a category than a statistical thing. It is, to my way of thinking (and Krugman's apparently) defined by it behavior, not only in terms of intensity.

A business-cycle recession holds the seeds of its own recovery in inventory depletion and inventory rebuild. But if demand is consistently depressed there is no intrinsic path to recovery.

I would say a big drop-off that does not "bounce" off a bottom and that changes psychology long-term, changing the populaces economic expectations fundamentally, is not merely a recession.

A prolonged economic downturn that is not a typica; business-cycle recession is, to my way of thinking, a sort of depression. A depression has to be bad to be worth the name, but can be more or less severe.

Was Japan's "lost decade" a depression? It had the crash of a stock bubble and a housing bubble followed by a decade of near-deflation (and sometimes deflation itself) and was immune to conventional notions of monetary and fiscal stimulus. That sounds like a version of what the Great Depression was about... but less than "Great."

The 1930s was "The Great Depression," which strongly suggests that most depressions are less severe than the 1930s. There were a lot of depressions between the Civil War and WWII, and people saw the 1930s as a big version of an already identified sort of event. Hence "The Great." (I would guess the term came from the practice at the time of calling WWI "The Great War"![]()

Since there is not a universal statistical definition, and since this global event shows no signs of recovering the ground lost and since the UK is currently in recession several years after the event in 2008, and the eurozone very nearly so, and since the event may well lead to the break-up of the eurozone, and since the economy ad jobs are the top issue in US politics coming-up on four years after the Lehman brothers failure...

We have to call this thing something, and it isn't just a recession, of the sort any of us have seen.

The Fed-induced recession of 1981-1982 was a comparable short-term shock in the US, but then bounced back hard with GDP quarters of almost 10% annualized. We haven't seen a single quarter like that and nobody predicts we will.

Whatever we call this thing, it is a type of prologued event that changes all the rules.

coalition_unwilling

(14,180 posts)saw GDP (called Gross National Product, or GNP, back then) contract by some 20% (hence 'Great'). National unemployment rate was 25% in January, 1933, when FDR took office. When Obama took office, we faced the very real threat of depression, no matter whose definition we use.

I just resist using the word 'depression' when GDP is actually growing.

But I understand where you are coming from and think I somehow acquired my definition of 'depression' from Macro Economics 101 (or maybe Industrial Organization and Public Policy, another macro econ course I took many years ago).

cthulu2016

(10,960 posts)GDP was growing throughout a lot of of what we call the Great Depression. That's what makes it so tricky, terminology wise. Using a statistical standard the Great Depression probably ended around 1933-1934 but then what do we call 1935-1941? The great non-recovery?

Krugman has been calling this "the lesser depression" for a while, which I think is about right. It is lesser than the 1930s, but the Iraq War was lesser than WWII. If we use the biggest example as the definition then the term loses usefulness.

The best reason to call this a depression is that it is that category of disease, though a less dramatic case of the disease. The likeliest cure is big fiscal stimulus. But since this is a smaller sort of depression that fiscal stimulus need not be as massive as WWII.

FogerRox

(13,211 posts)GNP grew 112% in 1933, 9% in 1935 and 13.9% in 1936.

The Depression business cycle ended Macrh 1933, the month FDR was sworn in.

So if GDP this year is less than 2.5% why doesnt 2012 qualiy as a Depression? Unemplyment of what 20%?

So yeah using only 1 metric to judge if a country is in a Depression is "tricky".

coalition_unwilling

(14,180 posts)a question will better illustrate the linguistic and ontological conundrum:

What is the difference between a 'recession' and a 'depression'? The way I was trained, a 'recession' occurs when there are two or more successive fiscal quarters of negative GDP, no matter how small the shrinkage. A 'depression,' by contrast, occurs when there is an aggregate contraction in GDP of 10% or more (even if that contraction occurs over a time-span of years).

The half-decade of 1935-41 is probably best thought of as years of modest recovery. IOW, 'The Great Depression' is a label historians have affixed to the 30s, not a technical indicator used by economists.

Further proof of my "dead-cat-bounce" trope is today's weekly initial unemployment claims which rose from 373,000 to 383,000. Eminently predictable and a pathetic indictment of the technocrats and demagogues who have charge of the economy right now.

cthulu2016

(10,960 posts)Last edited Thu May 31, 2012, 06:22 PM - Edit history (2)

It sounds like the 10% depression rule was widely taught at some point, and perhaps it still is. I don't know. My impression (which may be wrong) is that most economists do not use any numerical defintion today. If it has faded I support the change because such a statistical rule encourages us to think of recession and depression as points on a continuum, like tropical storm and hurricane.

But they are different animals. I would say that recessions are weather, whereas a depression is climate. All depressions will begin with a recession but few recession lead to depression.

When this thing started people were looking to 1981-1982 for the most comparable recession, because that was the sharpest since the Great Depression. And that comparison had unfortunate effects.

For instance, we can deduce from policy that the Obama administration assumed that the crash of 2008 was a comparable event to 1981 and that Obama would be running in 2012 on "Morning in America' just like Reagan in 1984. And Europe thought the same way, but moreso.

But the initial conditions were radically different.

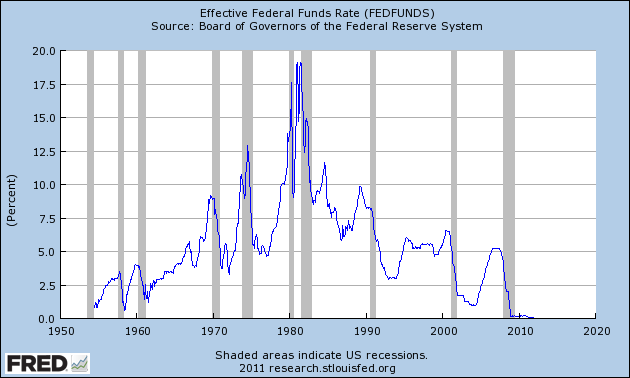

The 1981 recession was induced by Paul Volker to wring inflation out of the economy. Jack the fed funds rate up to 19% until the economy stops and then you have an amazing 19 points of monetary stimulus available to restart it. You can see that the Fed Funds rate was decreased ten points during that recession.

Our recent recession, on the other hand, happened in an already low-inflation environment. The Fed was only able to reduce that rate 4-5 points before hitting zero.

The very same initial GDP drop or unemployment increase in those two environments will play out very differently.

The GHW Bush recession that put Clinton in office was created by Iraq invading Kuwait. By the time that shock worked through the system we had already beat Iraq and come back home... and then the recession came. Ironic for Bush.

That was the product of uncertainty and a commodity shock in oil. The 1981 recession was a product of monetary policy. The Great Depression was the product of a bubble collapse. (The stock market, in 1929). With different origins we shouldn't expect similar results. Bubble collapses tend to take down whole economies.

For some reason, bubble collapses are harder on employment. The market crash of '29 lead to a decade of low employment. The burst of the internet bubble led to Bush's jobless presidency. (Despite incredible levels of fiscal stimulus) And the collapse of the housing market lead to our current job-weak world, without ever recovering from the internet bubble in between.

I would say a depression is the condition you can get from a type of big recession that is not self-repairing (unlike a business inventory cycle or monetary policy or temporary commodity shock recession) and that simple GDP will not identify the difference.

Depressions feature basic psychological changes in the economy. People do not assume a recovery and that becomes a partially self-fulfilling prophecy. In a usual recession half the players are positioning themselves to profit on the recovery. But sometimes the players go hide in a cave.

And I suspect that bubble collapses have a uniquely negative effect on that psychology. Things that were the pillar of the economy a year ago are now trash. We lose trust in the economy itself.

The Japanese lost decade began with a dual collapse of the stock market and housing market.

Are depressions always products of bubble collapse? I don't know, but if so that would be a useful part of a definition.

coalition_unwilling

(14,180 posts)occasion! ![]()

I guess I see recession and depression as different contiguous regions (not points) on a continuum, that continuum being annual growth (or contraction) of GDP.

That said, your point about how they are different beasts is one I had not fully considered before now and I think I'm going to have to modify my thinking to take that idea into account.

On a personal level, it sure feels like a depression (unemployed for > 75 weeks and no prospects in sight) and California is still suffering badly, with an official state unemployment rate around 11%, meaning the reality is probably closer to 20%.

Thank you very much for the detailed and thoughtful discussion. Such is more often the exception in these parts than the norm these days ![]()

Xolodno

(7,338 posts)...was missing one major factor. The industrial revolution. Prior to that, a significant portion of the population lived in an agrarian economy. And they were either immune or better equiped to weather economic cycles. With the advent of the industrial revolution, population moved to the cities and then were more subject to economic cycles.

In regaurds to Krugmans statements, he's not telling the whole story. Yeah sure no one wants to spend and prefers to pay down debt. But some simply are not in position to pay debt so they don't, but buy what they need to live on.

Banks and institutions are unwilling to extend credit in the current economic climate. And lets face facts, growing income inequality has been the problem since the late 1970's. And the problem has never really been addressed or acknowledged. Politicians just pretend its not there and Monetarist Economist continue to delude themselves into thinking that the market will right the problems, while never facing the question "Is the market broken?" as in there view it never can be. Easy credit has been the band aid over a much bigger problem for a long time. It makes me wonder, how many people out there are going back to school and using student loans to cover thier expenses once the unemployment runs out.

And the funny thing is, at some point the education loan issue will rear its head, everyone knows it and no one is addressing it. But once it does, then they will "revamp" the system, blame government involvement for gauranteeing loans...and take away yet another band aid thats covering for income inequality. The monetarists and those they influence really are setting themselves up for failure....problem is, we have to reap the consequences to their blind devotion to ideaology.

They cling to the notion that if left alone, markets will self regulate as they believe there is an incentive in doing so. But they still haven't proven that there is an incentive to self regulate. If I'm a CEO and can make 100 million being reckless instead of 10 million being sound at the end of my tenure/contract. Shoot, I'm going to take the 100 million. Where is the incentive for sound management? There is none. Stockholders have limited cards to play in these situations and often do not see the long term ramifications (if they even are long term holders) of bad decisions or for that matter good ones. And those that do see, know when to hold and fold on a stock but aren't willing to share this information.

But yeah...."Economic Depression" is as well defined as Astromoners define "what is a planet".

FogerRox

(13,211 posts)At the peak of the Republican Depression in the 1930's Unemployment peaked at about 25%, today 20% is not an unrealistic number.

When we look at economic dowturns from 1800 to 1930, we see 3 major factors, length, jobs shedding and peak to trough economic activity.

Since the current downturn has lasted nearly 4 years, and unemployment certainly qualifies, IMHO we have 2 out of 3 factors saying its a Depression.

woo me with science

(32,139 posts)magical thyme

(14,881 posts)And there is a simple solution. The government must switch sides. That is all it will take. They've got the guns, so they can do that.

They simply switch sides. They become the buyer of last resort, and they tax the 1% for the down payment on it. The 1% have stolen so much that nobody else has anything to spend, and 1% cannot and will not spend enough or fast enough to piss down some cash to the rest of us.

So the government needs to switch sides, become the big spender on rebuilding a more sustainable economy, and pay for as much of it as possible by first taking back what has been stolen, and then putting us back to work rebuilding, so we have something to spend and a future to work toward again.

Initech

(108,466 posts)azmom

(5,208 posts)ugh