General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWealthy seen snaring a $21 billion gift with Trump tax overhaul

NEW YORK — Some of the wealthiest families in the U.S. are hoping for a $21 billion benefit from President-elect Donald Trump next year.

They and their businesses are re-evaluating, or putting on hold, strategies for transferring money to heirs as the new administration could work with a cooperative Congress to reform or repeal federal estate and gift taxes among its early moves. That would be an about-face from President Barack Obama, who sought to place tighter restrictions on the way wealth could be passed from generation to generation.

“Eliminating the death tax will equate to an enormous gift,” said Peter Rup, who manages about $900 million for rich families at Artemis Wealth Advisors in New York. The IRS collected $21 billion from taxes on estates and gifts in its fiscal year 2016, according to data from the U.S. Treasury Department.

Trump is gearing up to embark on the biggest U.S. tax overhaul in three decades. His proposals include cutting income and corporate taxes and eliminating the so-called death tax, which is paid primarily by the richest 10 percent of earners, according to the Tax Policy Center. Advisers to wealthy families and their offices also anticipate that the new administration’s approach to estate and gift taxes could negate rules they were bracing for, which sought to limit tax breaks on transferring wealth.

Wealthy families sometimes use a discount strategy to pass on shares in their privately owned businesses and family offices — that is, firms that handle the financial affairs of a single family and are often structured as partnerships or limited liability companies. Families often took a discount of 20 percent to 45 percent on the value of the stakes to save on taxes, according to a report by law firm White & Case LLP. The Obama administration tried for years to curtail the benefit through legislation without success and instead in August proposed rules through the Internal Revenue Service set to do just that.

https://www.msn.com/en-us/news/politics/wealthy-seen-snaring-a-dollar21-billion-gift-with-trump-tax-overhaul/ar-AAkXGiC?li=BBnbcA1

tenderfoot

(8,982 posts)eom

Initech

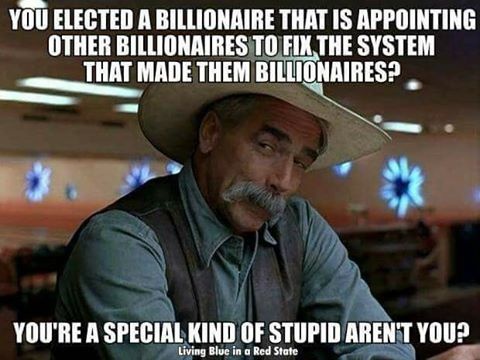

(108,466 posts)They chase after money like Gollum chases the precious. These are the real welfare queens mooching off our paycheck and taking our jobs. ![]()

JHan

(10,173 posts)Yo_Mama_Been_Loggin

(134,823 posts)

JHan

(10,173 posts)Solly Mack

(96,799 posts)& multi-millionaire cabinet and Congress would forget the plight of the uber-wealthy.

I've read that some of them have had to cut their maids down to 5 days a week.

But this is such a relief that I can now stop worrying about how the mega-bucks crowd will survive a Trump presidency.

Because, you know, that's really been burning a hole in my heart.

subterranean

(3,753 posts)As it stands now, you have to inherit an estate worth more than $5.43 million ($10.9 million in the case of a married couple) to owe any estate tax at all.

It's a problem I would like to have.