General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsBy Accident or Design, Trump Will Make US Oil Dependent on Russia...

...for the benefit of Russia and U.S. Oil interests. It is a pretty straight forward three step plan.

Step One: Trump will support Russian military intervention in the Middle East - Under the guise of fighting terrorism, Trump has signaled that he is willing to support Russia's military intervention in Syria. Also, by threatening to walk-away from the Iran nuclear deal, Trump is isolating the U.S. by signaling that it is unreliable when it comes to such deals. Russia alone becomes the consistent and active power in the Middle East, particularly given Trump's reluctance to confront Russia. Indeed, U.S. oil interests may support policies that inflate oil prices as a result of turmoil in the middle east.

Put another way, remember when McCain attacked candidate Obama for failing to have a plan to combat high oil prices near the end of Dubya's term? Well, with the Iran deal, oil prices have remained at historic lows:

http://www.reuters.com/article/us-global-oil-idUSKCN12401K

A Trump administration's threats to walk away from the Iran deal would cause an increase in oil prices, which benefits U.S. oil interests, but harms U.S. consumers.

Step Two: Trump will work to roll back sanctions against Russian, particularly with respect to oil exploration. This is why Trump's appointment of Exxon CEO Rex Tillerson as Secretary of State is key. As Russian oil interests are developed, and the U.S. becomes dependent on Russian oil, Russia is in a better position to both profit, as well as manipulate oil prices and threaten energy supplies. In addition, this puts Russian in a position to threaten the U.S., China, as well as Europe's energy supplies:

http://www.independent.co.uk/news/world/europe/putins-gas-threat-what-happens-if-russia-cuts-the-gas-to-europe-10074294.html

Thus, Russia accomplishes the hat trick of marginalizing both the U.S. and China, which are heavily dependent on foreign oil.

Step Three: Trump will work to roll back U.S. renewable energy initiatives - Trump's skepticism regarding climate change and hostility to the EPA serves as a foundation for Trump to walk away from renewable energy sources, thus increasing U.S. dependence on fossil fuels, which Russia will be in a better position to control. Also, as oil prices increase, Trump will predictably call for further roll backs against environmental regulations and allow expanded drilling, which again serves U.S. oil interests, but hurts consumers and the environment. Finally, Trump will use the increased oil prices to argue for further oil deals with Russia, thus further increasing U.S. dependence on Russia.

Put another way, whether by accident or design, Trump's policies will put Russia in a position of strategic dominance over the U.S. by allowing Russia to both control oil while also increasing U.S. dependence on foreign oil.

underthematrix

(5,811 posts)Merlot

(9,696 posts)Because we can all afford a new car, and BTW, if you're a renter, finding a place to plug in may not be easy.

Personally, I'd love a Tesla.

But thanks for the advice.

underthematrix

(5,811 posts)it uses gas. However, I'm retired and we fill it up every two to three months.

Merlot

(9,696 posts)putin's design.

global1

(26,484 posts)already gas prices are creeping up and he's still president-elect.

He'll probably blame Obama.

TomCADem

(17,837 posts)...even though such regulations had no adverse impact during Obama's Presidency. All you need to do is generate a crisis in the Middle East, perhaps by threatening to bomb or invade Iran, which will cause oil prices to rise, then begin to whine about environmental regulations.

hack89

(39,181 posts)Makes such a scenario very unlikely.

The vast majority of that production is for export, not for domestic consumption! Sure some will put placed in strategic reserves, but those reserves will be for use of the US government, and not the American consumer!

hack89

(39,181 posts)The world is awash with crude. US oil imports are at a 10 year low as domestic production climbed. We are closer to oil independence than we have been in a very long time.

TomCADem

(17,837 posts)

Think about it. Flooding the market is not in the interest of oligarchs. Instead, they want to create a crisis, consolidate sources of supply, and drive up the price of oil. Indeed, as the U.S. become more energy efficient under President Obama, and as sanctions against Iran have lifted, you have U.S. producers trying to compensate by producing more oil, which further drove down the price.

hack89

(39,181 posts)Ok - not sure have anything to talk about.

Amishman

(5,917 posts)The prices on oil is based on global markets. Where a barrel is produced and consumed has little impact on prices other than transportation costs.

There is also good reasoning behind why US oil is being exported. Refineries are setup to process specific blends/types of oil. Most US refineries are setup to process heavy crude from South America or Canada. Shale oil mostly produces more easily refined light oil. It is actually more economical to sell the excess light oil and buy foreign heavy oil than retool the refineries.

TomCADem

(17,837 posts)...did not work under Dubya, and it will not work under Trump.

hack89

(39,181 posts)Last edited Tue Dec 20, 2016, 10:59 AM - Edit history (2)

and we are actually exporting oil, I would say it is working pretty well. We just saw Saudi Arabia nearly bankrupt themselves trying to knee cap US oil production with little success - they certainly take the threat of US production seriously.

TomCADem

(17,837 posts)Once again, you are attributing oil lower oil imports strictly to greater oil production. However, this ignores the significant decline in total oil consumption in the U.S. If you were to look at it from a per capita perspective, the decline is even more clear.

Is it a coincidence that the decline coincides with Barrack Obama's Presidency given his emphasis on policies promoting energy efficiency and renewable energy? Likewise, is it coincidence that Trump's administration will be filled with folks who question climate science, renewable energy and are supportive of the oil industry?

https://www.weforum.org/agenda/2015/07/the-surprising-decline-in-us-petroleum-consumption/

US oil production has transformed itself fundamentally in the past decade. Between 1970 and 2008, US crude oil production fell by nearly half as conventional wells were depleted. Since 2008, however, production has rebounded from 5 million barrels per day to an average of 8.7 million barrels per day in 2014. The almost entirely unexpected increase – largely attributable to technological innovations such as advances in horizontal drilling, hydraulic fracturing, and seismic imaging – has helped the US become the world leader in oil production.

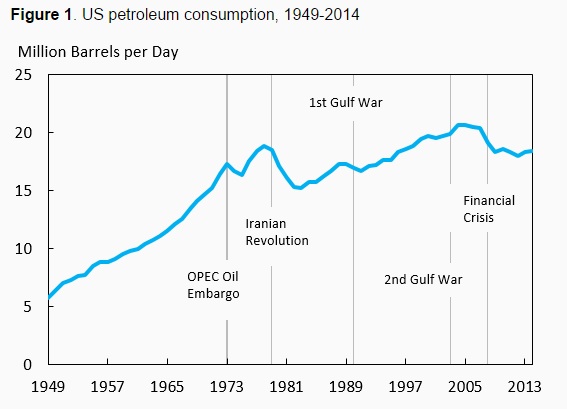

Whereas the developments in oil production have been widely reported and appreciated, far less attention has been paid to US petroleum consumption’s remarkable decline relative to both recent levels and past projections — one of the biggest surprises to have occurred in global oil markets in recent years. Petroleum consumption in the US was lower in 2014 than it was in 1997, despite the fact that the economy grew almost 50% over this period. As illustrated in Figure 1, consumption rose steadily from 1984 through the early 2000s, peaking in 2004 before decreasing in conjunction with rising oil prices.

hack89

(39,181 posts)part of the drop in oil use is the increased use of natural gas for industrial purposes - the best example is the rapid conversion of many electrical generating plants to NG.

My only point is that the US has significantly increased its energy independence. That's all.

Strelnikov_

(8,131 posts)Putin is now well on the way to his goal of replacing the Petro-dollar with the Petro-rouble.

With an incompetent and compliant (at a minimum) administration in the White House, it is more than likely only a matter of time until the Petro-Dollar arraingement with KSA collapses.

Further, considering the probable level of corruption, along with potential for alienation of strategic economic partners (re: OECD), as a result of this administration, the Dollars status as the world's reserve currency could be threatened.

Trump, by design or accident, the Leningrad Oblast candidate.

Putin has long been nursing ambitions of using Russia's vast oil and gas supplies as an instrument of power. In the mid '90s, after 15 years in the KGB, Putin went back to school, attending the St. Petersburg Mining Institute. He wrote a dissertation titled "Toward a Russian Transnational Energy Company." The topic: how to use energy resources for grand strategic planning.

“In the early stages of pro-market reforms in Russia the state temporarily lost strategic control over the mineral resources industry. This led to the stagnation and disintegration of the geological sector built over many decades…. However, today the market euphoria of the early years of economic reform is gradually giving room to a more balanced approach that... recognises the need for a regulatory role of the state.”

- Vladimir Putin, “Toward a Russian Transnational Energy Company.”, PhD dissertation, St. Petersburg Mining Institute

”The Rouble must become a more widespread means of international transactions. To this end, we need to open a stock exchange in Russia to trade in oil, gas, and other goods to be paid for in Roubles. Our goods are traded on global markets. Why are not they traded in Russia?”

— President Vladimir Putin, Speaking before the full Russian parliament, Cabinet and international reporters, May 2006

”Russia has found the Achilles’ heel of the US colossus. In concert with its oil-producing partners and the rising powerhouse economies of the East, Russia is altering the foundations of the current US-led liberal global oil-market order, insidiously working to undermine its US-centric nature and slanting it toward serving first and foremost the energy-security needs and the geopolitical aspirations of the rising East”

- W. Joseph Stroupe, author, Russian Rubicon: Impending Checkmate of the West, as quoted in the Asia Times, November 22, 2006

From the Russian perspective, the Saudi role and OPEC model have benefited the United States, which can pressure Saudi Arabia into opening the spigot to deal with supply emergencies; the US also pressures other oil producers, such as Libya, Iraq, Iran, Venezuela, and Indonesia, by military methods, diplomacy, and economic sanctions. In the Russian alternative, the US will be far less influential, and have fewer levers, commercial or military, to effect pressure on the energy suppliers. Russian arms and defense-industry partnerships are on offer to relatively weak, intervention-prone energy producers in Africa and Latin America to offset US pressure.

In the OPEC model, the benchmark is Brent crude, priced in US dollars. In the Russian model, the discount and disadvantage between the Brent and Urals benchmarks will be reduced, and pricing will evolve toward a currency basket, including the ruble. In the OPEC model, suppliers hold much of their cash and government securities in US controlled institutions. In the Russian model, cash is held in the form of a currency basket; conversion from cash is sought into non-US assets, particularly in the European market.

In the OPEC model, investment in new energy reserves should be open to, and may be controlled by, US corporations. In the Russian model, strategic reserves should be controlled by national companies, state-controlled champions, or joint ventures in which Russian interests are in the majority. The Russian model also extends to energy-convertible coal, uranium, and other mineral resources. Through negotiations for Russian accession to the World Trade Organization (WTO), the US, Australia, Canada and other resource-exporting states have sought to gain unlimited access to search and development of Russian minable resources.

The Russian model rejects this, and instead assigns priority and equity control of domestic resources to national resource companies. The model proposes tradeoffs and partnerships in resource exploitation in third countries, especially the developing states. The US-backed OPEC model assigns international priority to the Arab states. The Russian model assigns priority to the Central Asian alliance, including China, India, and Iran; secondarily to Latin America and ultimately Africa.”

- John Helmer, “Russian energy model challenges OPEC,” Asia Times, July 18, 2006,

hunter

(40,478 posts)As the arctic ice melts the pie is going to be divided in half.

Russia and the U.S.A. will control one half of the oil and gas reserves, Canada and Northern Europe the other half.

wikipedia

wikipedia

Russian and U.S. plutocrats will keep the profits to themselves and screw anyone who's not useful to them.

Canada and Northern Europe will use a large portion of the profits for social programs and climate change mitigation.

Either way, the natural world as we knew it is going away. We humans can't seem to quit our fossil fuel addiction.

Initech

(107,992 posts)HoneyBadger

(2,297 posts)We have plenty of oil in the US, right up there with OPEC. It just happens to be quite expensive to drill vs what it costs OPEC (as low as $5/bbl).

Climate change is the number one issue in the world. Cheap oil is terrible for climate change. I.e. Expensive oil is good for climate change.

TomCADem

(17,837 posts)Remember how SUVs were created to take advantage of the loophole allowing automakers to build lower fuel economy "light trucks"? Under the Obama administration, CAFE standards were made more stringent in an effort to make the U.S. more energy independent. As a result, as noted above, gross and per capital oil consumption in the U.S. has declined under President Obama from the highs under Bush. However, Trump plans to reverse this progress:

http://www.latimes.com/business/autos/la-fi-hy-trump-electric-vehicles-20161121-story.html

The day after the election, on Nov. 9, Trump senior policy advisor John Mashburn was quoted saying CAFE standards would be reviewed “to make sure they are not harming consumers or American workers.”

The next day, the big auto lobby group, the Alliance of Automobile Manufacturers, sent a letter to Trump’s transition team, a copy of which was leaked to Automotive News.

Alliance Chief Executive Mitch Bainwol called for creation of a presidential advisory committee to guide the review process, and hinted at a “new paradigm” for vehicle regulation. But the letter made no call for scrapping CAFE.

Government analysts at the time calculated CAFE-related prices would add $926 to the cost of an average vehicle sold in 2016 and $2000 in 2025. Although several outside analysts have made their own calculations that in some cases add thousands more to those figures, no one except perhaps the automakers themselves knows for sure.