General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsRevealed: JPMorgan Paid $190,000 Annually to Spouse of Bank's Top Regulator

On May 10 of this year, Jamie Dimon, Chairman and CEO of JPMorgan, announced that billions of insured deposits at his bank had been invested in high risk derivatives and had sustained at least a $2 billion loss. The Department of Justice and FBI have commenced investigations. Dimon is expected to announce the current extent of those losses this Friday in an earnings conference call.

Following the May 10 announcement, there were numerous calls for Dimon to step down from the Board of Directors of the Federal Reserve Bank of New York. That organization is the primary regulator of the firm. There was widespread public outrage that the CEO of a bank had no business serving on the governing body of his regulator. (The New York Fed has a long history of such conflicts.)

Now it has emerged that not only was Dimon conflicted in his role on the New York Fed but the President and CEO of the New York Fed had an equally dubious conflict of interest.

William C. Dudley has been employed by the New York Fed since January 1, 2007, first heading up the powerful Markets Group. That Group manages the supply of bank reserves in the banking system according to the mandate of the Federal Open Market Committee (FOMC). On January 27, 2009, Dudley was elevated to President and CEO of the New York Fed. Financial disclosure forms for 2008 through 2010 show that Dudley’s wife, Ann Darby, was a former Vice President of JPMorgan and had holdings of more than $1,500,000 in deferred income accounts at the firm as well as between $250,000 to $500,000 in a 401(K) plan there.

In a letter dated January 22, 2009, authored by the New York Fed’s General Counsel, Thomas C. Baxter, Jr. and Deputy General Counsel, Michael Held, two financial waivers were sought for Dudley. One involved $1.45 million in Treasury Inflation Protected Securities (TIPS) and the other involved a small monthly pension of $124.38 that Dudley would receive from his previous employer, Goldman Sachs, at age 65. (Dudley’s financial disclosure forms show over $1 million in his Federal Reserve Retirement Thrift Plan, which seems an extraordinary sum for his 5-year tenure. It could be that he was permitted to roll over most of his Goldman pension into the Federal Reserve plan, explaining why his monthly Goldman benefit at age 65 is so small.)

The January 22, 2009 letter carries the following statement:

“In addition, please note Mr. Dudley’s spouse previously worked at J.P. Morgan Chase (JPMC) and as a result received certain deferred income distributions from JPMC in the aggregate amount of approximately $190,000 annually. These disbursements will wind down and cease in 2021. We are currently in discussions with Mr. Dudley, representatives from the Board of Governors and JPMC regarding these financial interests. These interests would only give rise to a conflict in the event that Mr. Dudley were to work on a matter having a direct and predictable effect on JPMC’s ability or willingness to continue paying these amounts to Mr. Dudley’s spouse. Currently, no such matter exists. We hope to come back to you with an update on this issue in the near future to let you know how it has been resolved.”

The New York Fed carries the following statement about conflicts on its web site:

“New York Fed employees are subject to the same conflict of interest statute that applies to federal government employees (18 U.S.C. Section 208). Under Section 208 and the New York Fed’s code of conduct, a Bank employee is prohibited from participating personally and substantially in an official capacity in any particular matter in which, to the employee’s knowledge, the employee has a financial interest if the particular matter will have a direct and predictable effect on that interest. Participation in a particular matter may include making a decision or recommendation, providing advice, or taking part in an investigation.”

In this case, the top official of the regulatory body overseeing JPMorgan Chase, was receiving $190,000 per year in household income from the bank he was supervising. If Dudley was the named beneficiary of his wife’s assets, he had a current interest in $1.75+ million from JPMorgan Chase.

More"..... http://wallstreetonparade.com/as-criminal-probes-of-jpmorgan-expand-documents-surface-showing-jpmorgan-paid-190000-annually-to-spouse-of-banks-top-regulator/

I see a slap on the wrist coming.

Scuba

(53,475 posts)Ichingcarpenter

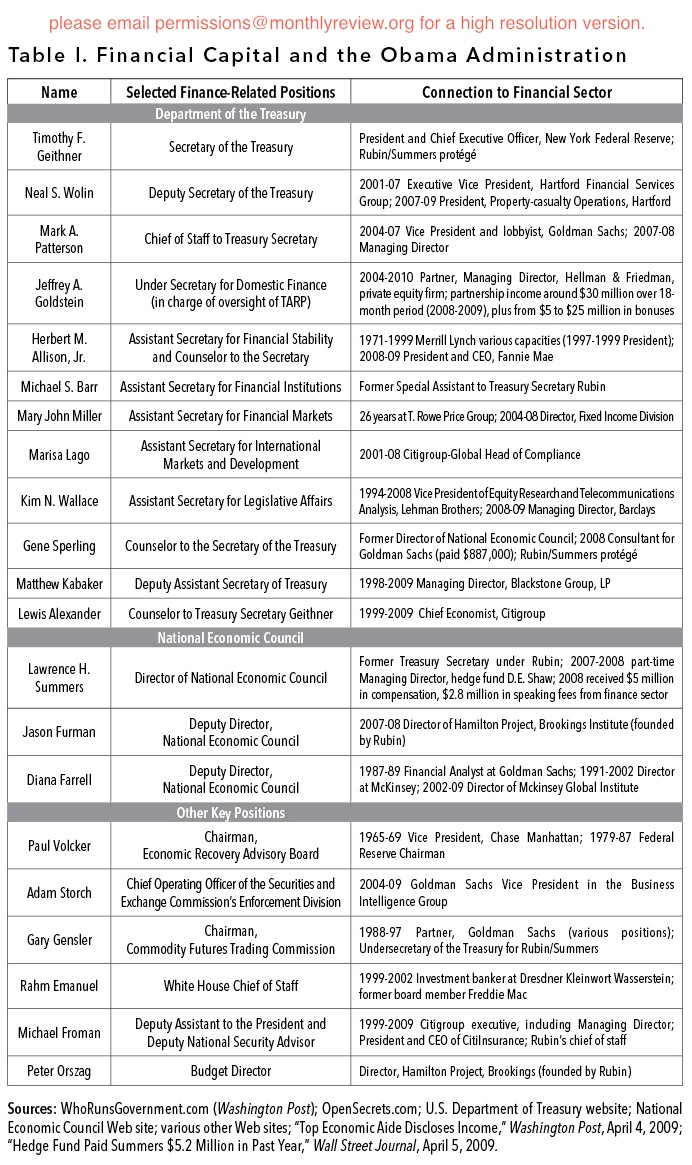

(36,988 posts)Financialization of the State

The dominance of the capitalist class over the U.S. state is exercised through representatives, or various power elites, drawn directly from the capitalist class itself and from its hangers-on, who come to occupy strategic positions in corporate and government circles. The concept of “the power elite” was introduced in the 1950s by sociologist C. Wright Mills, and was subsequently developed by others, notably G. William Domhoff, author of Who Rules America? For Domhoff, the power elite is “the leadership group or operating arm of the ruling class. It is made up of active, working members of the ruling class and high-level employees in institutions controlled by members of the ruling class.”27 In practice, the notion of a general power elite has often given rise to the consideration of specific elites, reflecting the various segments of the capitalist class (for example, industrial and financial capital) and the different dimensions of the exercise of power (economic, political, military, communications, etc.).

As Paul Mason, economics editor of BBC Newsnight, wrote in his 2009 book Meltdown:

Fortunately, even if it is hard to theorise, the power elite of free-market global capitalism is remarkably easy to describe. Although it looks like a hierarchy, it is in fact a network. At the network’s centre are the people who run banks, insurance companies, investment banks and hedge funds, including those who sit on the boards and those who have passed through them at the highest level. The men who met in the New York Federal Reserve on the 12 September 2008 meltdown would deserve a whole circle of their own in any Venn diagram of modern power….Closely overlapping with this network is the military-diplomatic establishment….Another tight circle comprises those companies in the energy and civil engineering business that have benefitted from marketisation at home and US foreign policy abroad.28

The first element in Mason’s composite description of the power elite under “free-market global capitalism” relates to the financial power elite.29 A critical issue today is the extent to which such financial elements have come to dominate strategic sectors within the U.S. state, reflecting the financialization of the capitalist class—and how this affects the capacity of the state to act in accord with the needs of the public. The influence of financial interests is invariably greatest in the Treasury Department. Andrew Mellon, banker and third richest man in the United States during the early twentieth century, served as Secretary of the Treasury from 1921 to 1932. More recently, Bill Clinton selected as his first Treasury Secretary Goldman Sachs co-chairman Robert Rubin. George W. Bush chose as his third Treasury Secretary Goldman Sachs chairman Henry Paulson.30

In looking at the penetration of the financial elite into the corridors of state power (particularly in those areas where their own special interests are concerned), the Obama administration deserves special scrutiny, since the presidential election occurred in the midst of the Great Financial Crisis, which ushered in what has come to be known as the Great Recession. A bailout of the financial sector was already well under way in the Bush administration, and was to be expanded under the new administration. The choice of officials to address the financial crisis was, therefore, by far the biggest, most pressing issue facing the Obama transition team following the election. It was these officials who would be responsible for running TARP (the Troubled Asset Relief Program). Not since the election of Franklin Roosevelt in 1932 had a similar situation presented itself.

http://monthlyreview.org/2010/05/01/the-financial-power-elite

Ganja Ninja

(15,953 posts)How the fuck do these people not get arrested?

riderinthestorm

(23,272 posts)myrna minx

(22,772 posts)Brickbat

(19,339 posts)AnotherMcIntosh

(11,064 posts)As just one example, isn't Justice Clarence Thomas's wife a long-term paid lobbyist for the Heritage Foundation?

How many hundreds or thousands of more examples are there?

Are the DC politicians or a great many of them in on the take? Indirectly through their spouses, children, and grandchildren?

Is this an open secret within the beltway?