Consumer prices spiked in April, growing at fastest pace in more than 12 years

Source: NBC News

The Consumer Price Index, a measurement of price changes for items ranging from food to clothing to pet products, jumped by 0.8 percent in April, beating expectations of 0.2 percent, or 2.3 percent year over year.

Car sales led the surge, with used cars and trucks rising by 10 percent in April, the largest month-to-month increase in the index's history. Housing, airlines, recreation, motor vehicle insurance, and household furnishings also contributed to the overall increase, the agency said.

The food index rose sharply as well, rising by 0.4 percent for both home-cooked meals and dining.

Read more: https://www.nbcnews.com/business/consumer/consumer-prices-spiked-april-n1267058

radical noodle

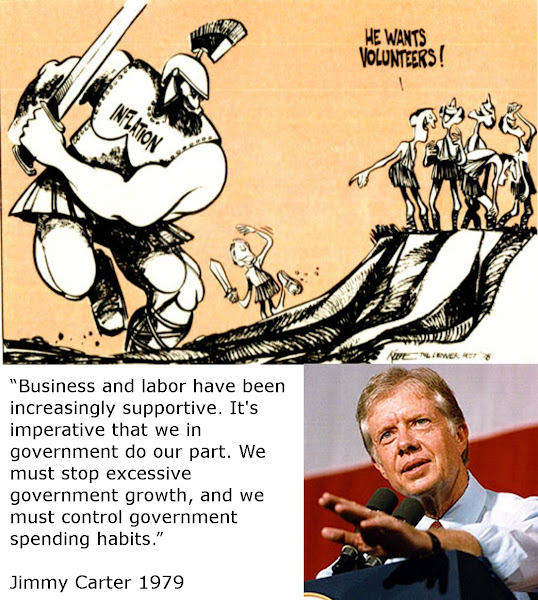

(10,563 posts)for those on a fixed income. I hope once supply catches up with demand, things will settle down. If not, I hope we don't resort to WIN buttons again. ![]()

Phoenix61

(18,804 posts)will return to baseline. The used car issue is due to car rental companies dumping all their cars during the pandemic. They are now trying to restock which is driving up car prices.

DENVERPOPS

(13,003 posts)(actually HW-Cheney-Rummy in 1980 deceivingly changed THE WAY the Consumer Price Index was calculated to what has been ever since......And people still believe it to be an accurate depiction.

Which resulted in an EXTREME distortion of reality to deceivingly lower the numbers........

At the same time, they changed many ways the un-employed figures were calculated, to artificially lower the unemployment numbers being reported......One of several things they did was to include the ENTIRE military in the Overall number of "employees"....LOL.....who ever heard of an "un-employed" frikking soldier......

former9thward

(33,424 posts)The last major change was made in 1998 (Clinton) and there have been changes since then.

https://www.bls.gov/cpi/additional-resources/historical-changes.htm#:~:text=Since%20its%20inception%2C%20the%20CPI,expanded%20coverage%2C%20and%20enhanced%20methodologies.

DENVERPOPS

(13,003 posts)none the less, Reagan was the first that I witnessed. And his alterations were pretty major as I remember.

And there is NO WAY it accurately depicts the true cost of living/consumer price increases for the average American.

peppertree

(23,252 posts)Besides the wars, financial heists, and all the doublespeak - what I remember most about Bush's second term is that, no matter how gas prices went up by leaps and bounds, and rent, medical, and everything in general, official CPI (annually) would always be "3-point-something %."

By '08, it was clearly in double digits.

DENVERPOPS

(13,003 posts)for pointing that out.........

peppertree

(23,252 posts)Fond memories, right?

George II

(67,782 posts)....took over, after campaigning on "high inflation" he changed the way inflation was calculated. He took out interest rates and price of gasoline, the two biggest contributors to inflation. That instantly cut inflation, making him look like a hero.

Back then the "unemployment rate" was based in part, if not entirely, on the number of people receiving unemployment compensation. He reduced the number of weeks people could get unemployment compensation (forget the weeks, from 26-13 maybe?), which instantly cut "unemployment" by a huge amount.

In fact, nothing much changed at all in either regard, at least not as drastically.

I don't even want to get into the smoke and mirrors of his "tax cut". All I'll say is that the first year of his tax cut I was unemployed and I paid MORE in taxes than when I was working. AND, he made unemployment compensation taxable.

His economic and tax policies were a complete sham. I'm surprised someone as smart as Bill Bradley fell for it.

DENVERPOPS

(13,003 posts)And he did away with deductions for medical and medical insurance.

He did away with all interest expense deductions for everything but a Mortgage and then immediately raised he usury rate for interest charged from a cap of 12% to 24%.

Again, I must say, it wasn't actually Reagan, it was HWBush/cheney/et al......

Most people didn't realize all this was taking place, or were not adults at the time, so the just figure this is the way things are.....................And there is a new resurgence of it, these past 4-5 years.

The one thing that amazes me the most is that the Trumphumpers don't even begin to understand that the Repubs are screwing them over also.........unfathomable.....Of course, I'm sure it is tied to the destruction of education being one of the Republicans main goals.........

Lonestarblue

(13,434 posts)Thanks to the Republican deregulation of the energy grid that led to extensive power outages, thousands of property owners have significant damage to repair. Contractors and repair people are taking advantage and hiking prices. A lumber shortage isn’t helping since costs for lumber have also increased. It may take a year for prices to come down here. Friends had significant damage from burst pipes, and they haven’t even been able to get the work started on repairs—three months after the storm! Some is insurance delay, but contractors also have more work than they can handle.

DENVERPOPS

(13,003 posts)there is so much going on that inspectors are also overworked, inspections are cursory at best, and the people doing the work know that better than anyone and take full advantage of the situation. People rarely understand that an inspector is only concerned with the code/safety of the work, and could care less about the overall quality.....

For the past decade or two, cities have learned that the inspection fees are a cash cow. Many fees have doubled or quadrupled, and even with the increases in building permits and inspections, the cities refuse to hire more inspectors....

WHITT

(2,868 posts)1) A lot of this is transitory.

2) Both Powell, the Chairman of the Fed, and Yellen, the Treasury Secretary and former Chairman of the Fed, are on the record saying they're willing to allow inflation to run somewhat above 'normal' for an extended period of time to allow the national economy to fully recover. They can always ramp-up rates if necessary.

progree

(12,890 posts)Official report: https://www.bls.gov/news.release/cpi.nr0.htm

CPI: March: +0.6%, April: +0.8%, 12 months: +4.2%

This is the largest 12-month increase since a 4.9-percent increase for the period ending September 2008. (I don't know where NBC got its "2.3 percent year over year" unless that was the expectation -Progree)

Core CPI (CPI less food and energy): April: +0.9%, 12 months: +3.0%,

Over the past 12 months:

The energy index rose 25.1 percent , and the food index increased 2.4 percent. Gasoline prices up 49.6% ((and this is long long before the Colonial Pipeline shutdown. Just wait for the May report -Progree))

Tables at the link showing for several items and composites the month by month changes over the last 7 months, and then the 12 months numbers ending April 2021.

JohnnyRingo

(20,783 posts)The argument is that if we raise the minimum wage, prices will increase.

Well, prices have nearly doubled since the Bush years while wages have remained historically low.

Lettuce Be

(2,355 posts)The supply chain has been broken for over a year. Many many things are impossible to get because parts are in short supply. This was not unexpected and blaming Biden's efforts to get the country back on track for "inflation" is ridiculous, yet that is what's coming. Wailing and whining, it's all Biden's fault! Stop helping people! I just want cheap stuff back! Take away benefits and poor people with no food or housing will flock to those $7.25 an hour jobs!

peppertree

(23,252 posts)Carter can tell him all about that.

mahatmakanejeeves

(69,206 posts)Some time ago, I had a post that went into the various types of CPI. Here it is. It might be outdated by now, but I've never let a thing like that stop me in the past, so why start now?

Wed Jun 12, 2019: BLS Report: CPI for all items rises 0.1% in May as shelter, food indexes increase

More on the CPI:

Set the WABAC Machine for a year ago:

BLS Report: CPI-U for all items rises 0.1% in June as shelter, gasoline, food indexes increase

From CPI for all items falls 0.1% in December as energy and food indexes decline:

Not all CPI's are alike. For an earlier discussion at DU about that, see:

CPI for all items rises 0.2% as gasoline and shelter prices rise; food prices decline

From the zeroeth post:

Cryptoad points out the significance of the CPI-W. It is used to calculate Social Security's Cost-of-Living Adjustment (COLA):

Consumer Price Index Frequently Asked Questions (FAQs)

What goods and services does the CPI cover?

FOOD AND BEVERAGES (breakfast cereal, milk, coffee, chicken, wine, full service meals, snacks)

HOUSING (rent of primary residence, owners' equivalent rent, fuel oil, bedroom furniture)

APPAREL (men's shirts and sweaters, women's dresses, jewelry)

TRANSPORTATION (new vehicles, airline fares, gasoline, motor vehicle insurance)

MEDICAL CARE (prescription drugs and medical supplies, physicians' services, eyeglasses and eye care, hospital services)

RECREATION (televisions, toys, pets and pet products, sports equipment, admissions);

EDUCATION AND COMMUNICATION (college tuition, postage, telephone services, computer software and accessories);

OTHER GOODS AND SERVICES (tobacco and smoking products, haircuts and other personal services, funeral expenses).

The CPI-U is used by the Treasury Department to set the interest rates on I Bonds.

I Savings Bonds

Interest on an I Bond rates is a combination of two rates:

1.A fixed rate of return which remains the same throughout the life of the I Bond

and

2.A variable inflation rate which we calculate twice a year, based on changes in the nonseasonally adjusted Consumer Price Index for all Urban Consumers (CPI-U) for all items, including food and energy (CPI-U for March compared with the CPI-U for September of the same year, and then CPI-U for September compared with the CPI-U for March of the following year).

In specific, there is a discussion of the Cost of Living Index here:

Let's look at that.

The CPI-W is discussed here:

CPI-W methodology

- - - - -

Note that there is a:

Consumer Price Index for All Urban Consumers (CPI-U)

Chained Consumer Price Index for All Urban Consumers (C-CPI-U)

Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W)

The fine print goes into the distinction.

Here's the thread from three months ago about the March CPI:

CPI for all items rises 0.2% as gasoline and shelter prices rise; food prices decline

Cryptoad points out the significance of the CPI-W. It is used to calculate Social Security's Cost-of-Living Adjustment (COLA):

Consumer Price Index Frequently Asked Questions (FAQs)

What goods and services does the CPI cover?

FOOD AND BEVERAGES (breakfast cereal, milk, coffee, chicken, wine, full service meals, snacks)

HOUSING (rent of primary residence, owners' equivalent rent, fuel oil, bedroom furniture)

APPAREL (men's shirts and sweaters, women's dresses, jewelry)

TRANSPORTATION (new vehicles, airline fares, gasoline, motor vehicle insurance)

MEDICAL CARE (prescription drugs and medical supplies, physicians' services, eyeglasses and eye care, hospital services)

RECREATION (televisions, toys, pets and pet products, sports equipment, admissions);

EDUCATION AND COMMUNICATION (college tuition, postage, telephone services, computer software and accessories);

OTHER GOODS AND SERVICES (tobacco and smoking products, haircuts and other personal services, funeral expenses).

The CPI-U is used by the Treasury Department to set the interest rates on I Bonds.

I Savings Bonds

Interest on an I Bond rates is a combination of two rates:

1.A fixed rate of return which remains the same throughout the life of the I Bond

and

2.A variable inflation rate which we calculate twice a year, based on changes in the nonseasonally adjusted Consumer Price Index for all Urban Consumers (CPI-U) for all items, including food and energy (CPI-U for March compared with the CPI-U for September of the same year, and then CPI-U for September compared with the CPI-U for March of the following year).

mahatmakanejeeves

(69,206 posts)Consumer Price Index Summary

Transmission of material in this release is embargoed until 8:30 a.m. (ET) May 12, 2021

Technical information: (202) 691-7000 • cpi_info@bls.gov • www.bls.gov/cpi

Media Contact: (202) 691-5902 • PressOffice@bls.gov

CONSUMER PRICE INDEX – APRIL 2021

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.8 percent in April on a seasonally adjusted basis after rising 0.6 percent in March, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 4.2 percent before seasonal adjustment. This is the largest 12-month increase since a 4.9-percent increase for the period ending September 2008.

The index for used cars and trucks rose 10.0 percent in April. This was the largest 1-month increase since the series began in 1953, and it accounted for over a third of the seasonally adjusted all items increase. The food index increased in April, rising 0.4 percent as the indexes for food at home and food away from home both increased. The energy index decreased slightly, as a decline in the index for gasoline in April more than offset increases in the indexes for electricity and natural gas.

The index for all items less food and energy rose 0.9 percent in April, its largest monthly increase since April 1982. Nearly all major component indexes increased in April. Along with the index for used cars and trucks, the indexes for shelter, airline fares, recreation, motor vehicle insurance, and household furnishings and operations were among the indexes with a large impact on the overall increase.

The all items index rose 4.2 percent for the 12 months ending April, a larger increase than the 2.6- percent increase for the period ending March. Similarly, the index for all items less food and energy rose 3.0 percent over the last 12 months, a larger increase than the 1.6-percent rise over the 12 month period ending in March. The energy index rose 25.1 percent over the last 12-months, and the food index increased 2.4 percent.

{snip Table A. and a lot more}

Not seasonally adjusted CPI measures

The Consumer Price Index for All Urban Consumers (CPI-U) increased 4.2 percent over the last 12 months to an index level of 267.054 (1982-84=100). For the month, the index increased 0.8 percent prior to seasonal adjustment.

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 4.7 percent over the last 12 months to an index level of 261.237 (1982-84=100). For the month, the index rose 0.9 percent prior to seasonal adjustment.

The Chained Consumer Price Index for All Urban Consumers (C-CPI-U) increased 4.1 percent over the last 12 months. For the month, the index increased 0.8 percent on a not seasonally adjusted basis. Please note that the indexes for the past 10 to 12 months are subject to revision.

_______________

The Consumer Price Index for May 2021 is scheduled to be released on Thursday, June 10, 2021 at 8:30 a.m. (ET).

* * * * *

[center]Facilities for Sensory Impaired[/center]

Information from these releases will be made available to sensory impaired individuals upon request. Voice phone: 202-691-5200, Federal Relay Services: 1-800-877-8339.

DallasNE

(7,994 posts)This was predicted based on underlying problems in the economy, namely supply chain issues. Opening up too fast assures inflation will occur. And the tariff issue plays a role as well as it represents another disruption in the supply chain. But this is exactly what the Republicans are clambering for. Throw in a pipeline hijacking for more inflation - brought to you by Putin. Plus, is this unique to America or is Europe also experiencing this?

TomDaisy

(2,120 posts)bucolic_frolic

(54,812 posts)So this will continue for about a year I think. My reasoning is ... have you been shopping? Grocers and Walmart are keeping up pretty well, as are home stores - Home Depot, Lowes, Home Goods. But my local Macy's, JC Penney, Nordstrom Rack and shoe retailers are stretched. It's a strange mix. While there are still clearance items, many departments have areas where merchandise is spread thin, especially shoes, as well as outerwear. I went to 6 retailers in the last week for spring outerwear. I saw 3 jackets, all in Macy's, all closeout. None in any other store, including Burlington Coat. BC had exactly no mens jackets or coats. It could be merchandise is being sold onine, and the unpopular stuff is in the physical stores.

To resupply, merchants want to know new inventory will sell, and they need the float to advance it. Once they see price hikes will stick, inflation will bump a little more.