76% of Americans Are Living Paycheck-To-Paycheck

Source: CNN

NEW YORK (CNNMoney)

Roughly three-quarters of Americans are living paycheck-to-paycheck, with little to no emergency savings, according to a survey released by Bankrate.com Monday.

Fewer than one in four Americans have enough money in their savings account to cover at least six months of expenses, enough to help cushion the blow of a job loss, medical emergency or some other unexpected event, according to the survey of 1,000 adults. Meanwhile, 50% of those surveyed have less than a three-month cushion and 27% had no savings at all.

"It's disappointing," said Greg McBride, Bankrate.com's senior financial analyst. "Nothing helps you sleep better at night than knowing you have money tucked away for unplanned expenses."

Even more disappointing; The savings rates have barely changed over the past three years, even though a larger percentage of consumers report an increase in job security, a higher net worth and an overall better financial situation.

Read more: http://money.cnn.com/2013/06/24/pf/emergency-savings/index.html

MindMover

(5,016 posts)CNN Money is also not a reliable source for this information.

Orrex

(66,931 posts)tblue

(16,350 posts)Things are tough all over.

Ishoutandscream2

(6,781 posts)closeupready

(29,503 posts)Warpy

(114,547 posts)the real problem is that wages were never indexed to inflation and purchasing power goes down year after year.

Until people report higher disposable income, the economy is just not going to improve.

BeyondGeography

(41,002 posts)tech3149

(4,452 posts)Not to discount the pain of trying to get by on the meager wages most employers are willing to pay. I was able to get by through most of those years because I lived as frugally as anyone could. The next few years I was living with and caring for my parents.

Now their both gone and I have to cover the expenses for this big old house that I don't need but it's been part of the family for three generations. My bank account doesn't like dealing with the costs but it's something I can't walk away from.

silvershadow

(10,336 posts)The energy sector continues to be a drag. Unless you are a Bush, et al. Never mind that minimum wage is hardly that. The race to the bottom continues, unabated.

intheflow

(30,133 posts)We're getting screwed all around.

silvershadow

(10,336 posts)intheflow

(30,133 posts)However, you can buy almost anything else used, usually sold locally and at reduced cost since there are no manufacturing or transportation costs associated with it. Food, not so much. Hence the rise in dumpster diving. And, thankfully, urban farming. But still, as you say, it ain't looking good for the future.

xtraxritical

(3,576 posts)intheflow

(30,133 posts)Seems completely out of context, not to mention you could probably guess if you took two seconds to look at my profile. ![]()

xtraxritical

(3,576 posts)intheflow

(30,133 posts)I was talking about Goodwills, flea markets and thrift stores. So I'm still confused. But whatever.

I'll bet there are farmer's markets by you. I've lived all over the country, in urban, suburban and rural settings, and I've always had access to a farmer's market during summer months. Not to mention, you can always grow your own food, even if it's only a small amount.

xtraxritical

(3,576 posts)jtuck004

(15,882 posts)things would get really bad otherwise.

I was told so right here on DU.

silvershadow

(10,336 posts)secure, and as they spend it, the bankers, et al can have the opportunity to earn it back. Simple, right?

jtuck004

(15,882 posts)better when the bankers weren't doing so well, that it would be a foregone conclusion.

HockeyMom

(14,337 posts)in 2013, with this time period cost of living. This is why.

love_katz

(3,241 posts)Thank you Ronnie Raygun, so much, for trickle down economics. ![]()

I have cut just about all expenses that I can: don't go out to eat and seldom buy takeout; no t.v. and cable is only for internet and landline phone; don't rent movies nor use NetFlix; only buy clothes when something wears out; only drive to work, grocery store, library and to visit family because I can't afford the gas; had to give up hiking and camping years ago due to gas prices and having to buy parking permits for the trail head ![]() ; can't give gifts because I am at the subsistence level of income; try to buy used stuff when I need something; intend to create some raised beds to grow food, using scrounged materials and homemade compost; look for ideas on Pinterest and check books out of the library when I want to learn how to make or do something; also read DU's Frugal and Energy Efficient living for ideas; check Craig's list for free stuff near home. I haven't had much luck with Freecycle...seem to have trouble getting in to their web site. Haven't had a vacation in years. Etc., ad nauseum.

; can't give gifts because I am at the subsistence level of income; try to buy used stuff when I need something; intend to create some raised beds to grow food, using scrounged materials and homemade compost; look for ideas on Pinterest and check books out of the library when I want to learn how to make or do something; also read DU's Frugal and Energy Efficient living for ideas; check Craig's list for free stuff near home. I haven't had much luck with Freecycle...seem to have trouble getting in to their web site. Haven't had a vacation in years. Etc., ad nauseum.

But, of course, in the eyes of the 1% we are all over-paid, over benefitted, lazy and entitled. ![]()

![]()

![]()

I know people really snark at conspiracy theories, but it sure seems like a conspiracy to me. ![]()

Awknid

(381 posts)A while back (don't remember when or where I read it), I read that this was a conscious decision by the economic ruling class such as IMF, etc. They decided the US living standard was too high and the "playing field" must be more level. We are seeing the result.

love_katz

(3,241 posts)Someone must've figured out that we wouldn't have any time to become informed, let alone take action to fight back, if we had to work 2 or 3 jobs just to keep our heads above water.

I know $ doesn't fix everything, but poverty is really a drag and interferes with being able to do anything more than just survive. ![]()

Marthe48

(23,000 posts)The poor are too hungry, too tired, too preoccupied with survival. So destroy the middle class, and there is no one to revolt. That race to the bottom and you know the ones who are manipulating this have bets to see who can screw the most the fastest.

SheilaT

(23,156 posts)right around the time things were beginning to get just a little better, because then the down-trodden had a clear image of what they'd lost, what they could get, what was really at stake.

love_katz

(3,241 posts)When I was in high school (centuries ago :rofl![]() we learned something about the heirarchy of needs (can't remember if this was from Malthus or not

we learned something about the heirarchy of needs (can't remember if this was from Malthus or not ![]() ). Anyway, it was about how people need to take care of their basic survival needs before they can move on to higher needs like spirituality or social needs (as in social change).

). Anyway, it was about how people need to take care of their basic survival needs before they can move on to higher needs like spirituality or social needs (as in social change).

I think it is a conspiracy...the uber wealthy know that the only thing which could derail their plans for a dictatorship is to crush the people who could successfully oppose them...and that is the middle class.

Another DUer replied to my comment about that in the thread. They said they actually read something somewhere, about how the IMF decided that the standard of living in the US was to high, so they decided to level off the playing field. If that is true, it seems they forgot something: they are not separate from us, and the economic engine can't run on the wealthy alone, because the wealthy don't spend that much of their money. They have dammed the flow, and can't figure out why the engine of the economy is coughing along on just a few cylinders. ![]()

love_katz

(3,241 posts)see post #11 in this thread by bvar22. Their remark about how this kind of situation does not happen by accident, but is the result of Economic Policy is right on the money (pun intended ![]() , and they provide supporting links which help explain what is going on.

, and they provide supporting links which help explain what is going on.

raccoon

(32,337 posts)Did the other DU'er provide a link?

seltzerwater

(53 posts)by parking near the external trails that lead from the road into the parks.

I hike 5-6 times a week and never ever pay for parking at a "Park".

Marthe48

(23,000 posts)you can get a lifetime park pass for $10 to all US national parks. Details at this link:

http://www.nps.gov/findapark/passes.htm

love_katz

(3,241 posts)not quite old enough yet. Thanks for the info though...it will come in handy a few years from now. ![]()

totodeinhere

(13,688 posts)Agschmid

(28,749 posts)Newest Reality

(12,712 posts)There are actual Serf positions now, so you might survive at the edge of your teeth, but you are working without any pay and a place to stay.

jwirr

(39,215 posts)cstanleytech

(28,383 posts)onestepforward

(3,691 posts)I had savings for a 2 year economic downturn, but that was 6 years ago.

Sadly, I don't see anything changing for the better.

progressoid

(53,015 posts)Autumn Colors

(2,379 posts)Safetykitten

(5,162 posts)bvar22

(39,909 posts)and the economy is adding low paying no benefits McJobs!

New Rule (Passed by Congress and signed by President Obama) signals Kiss of Death for Pensions

http://www.cnbc.com/id/100694955

Wealthy win lion's share of major tax breaks

http://www.boston.com/business/news/2013/05/29/wealthy-win-lion-share-major-tax-breaks/Ua0UyYle21EUXub7g1suCI/story.html

Half of America is in poverty, and its creeping toward 75%

http://www.alternet.org/economy/real-numbers-half-america-poverty-and-its-creeping-toward-75-0

Wealth gap widens as labor's share of income falls

http://www.nbcnews.com/business/wealth-gap-widens-labors-share-income-falls-1B6097385

As the Economy Recovers, the Wealth Gap Widens

http://www.usnews.com/news/blogs/rick-newman/2013/03/11/as-the-economy-recovers-the-wealth-gap-widens

Top One Percent Captured 121 Percent Of All Income Gains

http://www.huffingtonpost.com/2013/02/12/top-one-percent-income-gains_n_2670455.html

Corporate Profits Hit Record High While Worker Wages Hit Record Low

http://thinkprogress.org/economy/2012/12/03/1270541/corporate-profits-wages-record/?mobile=nc

These things ^ do NOT happen by accident.

They are the result of Economic Policy.

They take careful planning, preparation, marketing, buying the right politicians, message control, and the marginalization of any opposition.

Half-Century Man

(5,279 posts)NSA gonna get ya.

love_katz

(3,241 posts)Great post!

The links are great, but your ending sentences are right on target. ![]()

![]()

![]()

![]()

Your words need to be bolded, the whole paragraph. I would do it, but I'm not sure how to post that on DU.

Sentath

(2,243 posts)Scuba

(53,475 posts)So it all averages out.

well said, totally right on. ![]()

newblewtoo

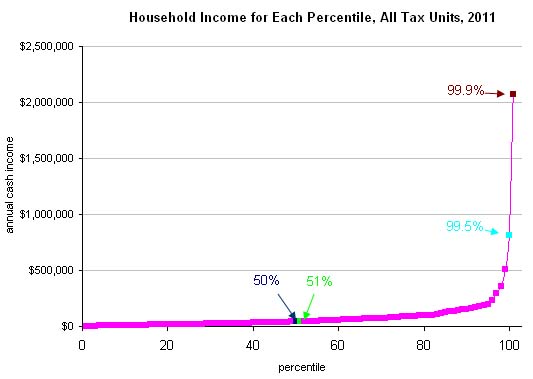

(667 posts)The disparity shows up in numbers Wolff calculated. He found that the average U.S. household's net worth rose this year to $522,000. But the average is skewed higher by the vast net worth of America's wealthiest — Bill Gates' $67 billion, for instance, according to Forbes magazine.

So Wolff looked at the net worth of the median U.S. household — those smack in the middle, where half of households earn more and half less. The median family's net worth is far more modest than the average: $61,000, Wolff estimates. That is $50,800, or 47 percent, short of where it was in 2007

http://bigstory.ap.org/article/rising-us-wealth-doesnt-generate-spending-surge-0

Amazing? Not to those living paycheck to paycheck trying to raise a couple kids.

upaloopa

(11,417 posts)I think I saw a statistic that incomes for 99% went up $59 over 10 years. The cost of living went up well over that.

Those not saving have no control over this yet it seems to me this is reported as if the lack of savings was a choice people make.

Orrex

(66,931 posts)They waste their vast sums of discretionary income on such luxuries as food, shelter, clothing and occasionally medicine.

durablend

(9,175 posts)Well, that and the house full of plasma teevees and microwaves that these people are OBVIOUSLY frittering their money away on.

former9thward

(33,424 posts)They go on and on about how many X hundred thousand dollars you need to save up to have the same quality of life in retirement. As if people have a choice to be able to save that much and are just being irresponsible if they don't do it.

Art_from_Ark

(27,247 posts)Bank interest is diddly-squat, Treasuries are paying next to nothing, and everything else is a big gamble.

Marthe48

(23,000 posts)now, I don't care. I figure we might have enough to last a few years, then our kids will step up to the plate, because we will be old. Not the story I planned, but glad we have such great kids ![]() The quality of American life is slipping away--all the DUers listing what they've given up, and even if you give it up, it is never quite enough sacrifice. And if you do manage to break even, the utilities, the groceries, the taxes, something, somewhere, goes up, and then you make more cuts. I don't see anyone trying to make it stop. It is sad to see so many family businesses failing because there isn't enough in the paycheck to take the family out for dinner, or bowling, or (fill in the blank), so our communities are dying and there isn't any place to go, because it is the same all over.

The quality of American life is slipping away--all the DUers listing what they've given up, and even if you give it up, it is never quite enough sacrifice. And if you do manage to break even, the utilities, the groceries, the taxes, something, somewhere, goes up, and then you make more cuts. I don't see anyone trying to make it stop. It is sad to see so many family businesses failing because there isn't enough in the paycheck to take the family out for dinner, or bowling, or (fill in the blank), so our communities are dying and there isn't any place to go, because it is the same all over.

magellan

(13,257 posts)Usually hours before I should be up, and I don't get back to sleep. To say we're living paycheck to paycheck is a masterful understatement. Self-employed, really hurting...coz no one has money to spend.

Extra money to put away? HA!!

Nye Bevan

(25,406 posts)Would anyone who is living paycheck-to-paycheck and has no savings ever pay $5 for a cup of coffee? I hope not.

Orrex

(66,931 posts)Give them a call!

Well played. ![]()

Agschmid

(28,749 posts)Starry Messenger

(32,380 posts)Be that guy.

Nye Bevan

(25,406 posts)After 10 years, your Starbucks habit costs you a car. After 30 years, the $239,891 that you drank away (including investment returns), could have bought a house. Over 40 years, the Starbucks habit could reduce your retirement nest-egg by an astounding $634,428 -- enough to generate an income of more than $2,600 a month.

No one is suggesting that you give up your daily jolt of joe. (This would be a particularly unlikely suggestion from me -- the person whose caffeine addiction built that impressive tower of latte cups.) But you might want to consider a cheaper way to go at it.

Costco, for example, sells a 2.5 pound bag of Starbucks French roast for $22; A couple gallons of milk will run another $7. For that $29 -- roughly the cost of a week of barista-made lattes -- you can have a pot of lattes every day for at least a month. Net savings: $91.

http://finance.yahoo.com/news/what-your-starbucks-habit-really-costs-you.html

Starry Messenger

(32,380 posts)Or perhaps one is indulging in confirmation bias whilst forgetting that the people in line at Starbucks are pre-selected and not a random slice of all sectors of working people.

Orrex

(66,931 posts)Last edited Mon Jun 24, 2013, 03:11 PM - Edit history (1)

$4 coffee x 365 days x 40 years = $58,400.

I'd like to see the investment strategy that's strongly likely to turn that into $634,428, especially considering that $14,600 of that will be invested for less than 10 years.

Does that article provide precise annual earnings required to secure that generous return, or is it one of those hocus-pocus declarations that crank out a huge payoff if only you don't look at the reality of the numbers? And is the $2600 per month actual income, or is it a bleeding of principal?

Or is the article, instead, another in a long line of scolding admonitions for the great unwashed plebes who would be as rich as creosote if only they weren't so stupid and short-sighted?

In short, the article can go fuck itself.

love_katz

(3,241 posts)Logic wins, propaganda loses. ![]()

![]()

Orrex

(66,931 posts)Nye Bevan

(25,406 posts)But the point remains valid, that nobody who is living paycheck to paycheck should be buying Starbucks coffees except possibly very occasionally.

Orrex

(66,931 posts)If we start nickel-diming people's spending at the microscopic level, of course we'll find places to tighten the budget. However, I'm reluctant to scold people who just scraping by, because if a cup of coffee helps to lift their spirits after a 10-hour shift of minimum wage drudgery, then I say they're welcome to it.

We also have no idea of that hypothetical person's circumstances outside of the Starbucks. Maybe they bought rice instead of chicken this week specifically so that they could reward themselves with that cup of coffee after a long week. In short, we don't know what budget concessions they've made prior to stepping into our line of sight, and without having access to that information, we should really just mind our own business.

Someone downthread suggested that employers could simply raise wages by $0.50 per hour, which would give the person the same $20 per week. Why do we forgive the employer for paying shit wages while criticizing the employee, in short, for not having more money?

Agschmid

(28,749 posts)Marthe48

(23,000 posts)!

Spitfire of ATJ

(32,723 posts)Orrex

(66,931 posts)Much easier to blame the person who's working for less than the cost of living than to demand that employers actual pay a living wage to their employees.

Spitfire of ATJ

(32,723 posts)Nye Bevan

(25,406 posts)Spitfire of ATJ

(32,723 posts)And that's coming from regulars at Starbucks.

My secret?

http://slimages.macys.com/is/image/MCY/products/1/optimized/38661_fpx.tif

Oh,...and whipped cream.

FloridaJudy

(9,465 posts)That's enough to buy, like, a quarter of a car! In twenty years, I could have reliable wheels! Oh, wait. I'm 66: I'd most likely be too old to drive it safely. Or dead.

Why assume that everyone you see at Starbucks is drinking a latte a day? I've been known to go there occasionally, but it's an every other week treat. I also economize in other ways, as I'm sure many customers do.

But then I expect you think every one who isn't among the 1% should just sit here at home and never go anywhere or buy anything. Way to grow the economy, dude!

NeoConsSuck

(2,547 posts)we have an office coffee club, 25 cents/cup. And I'm sure the taste is comparable to Starbucks. It's only coffee for chrissakes.

Yet, there are others in my office who are in our coffee club who still stop at Starbucks on their way to the office. To each his own.

siligut

(12,272 posts)They do it so they won't look poor. ![]()

NickB79

(20,299 posts)Cable TV when you don't really need it: over-the-air local channels, Netflix and a library card to check out movies, music and books can sub in nicely for entertainment.

Eating out far too often: learn how to make a good pot of rice and beans and have some with every meal: https://www.google.com/search?q=puerto+rican+beans+and+rice&client=firefox-a&hs=ZQt&rls=org.mozilla:en-US![]() fficial&source=lnms&tbm=isch&sa=X&ei=iqDIUdvqMOSQyAGm7IDACQ&ved=0CAkQ_AUoAQ&biw=1366&bih=636#imgdii=_

fficial&source=lnms&tbm=isch&sa=X&ei=iqDIUdvqMOSQyAGm7IDACQ&ved=0CAkQ_AUoAQ&biw=1366&bih=636#imgdii=_

Ignoring garage sales, thrift stores, and Craigslist for clothes, kids toys, building supplies, craft supplies, etc. I picked up an entire summer wardrobe for my 3-yr old daughter in the past week for $30. This included 10 T-shirts, 2 nice airy dresses, 5 pairs of jeans, a few pairs of shorts, a skirt, a nice pair of khakis, and a pair of Croc sandels. A friend of mine, who does live paycheck to paycheck to maintain the upper middle class image, can spend $30 on ONE SHIRT for her kid. I've also picked up enough free wood pallets, nails, hinges, etc, that I was able to build a boatload of garden projects, including a chicken coop big enough for 4 hens!

Investing money on aesthetic home improvements, not energy-efficient ones: when we started upgrading our house, we put top priority on energy efficiency. New insulation and a very efficient furnace came before granite countertops and hardwood floors. Ceiling fans run before we resort to the A/C. Yardspace was converted from grass into edible landscaping and vegetable gardens.

I really don't feel like I'm missing out on anything in life despite having cut back my spending substantially in the past 5 years. I can now devote 10% of my take-home pay to savings, and my wife devotes 5% of hers. I spend a lot of time taking my daughter to the park instead of the mall or Target (where I would invariably buy something), and I cook her healthy meals instead of buying her Happy Meals. She's only 3, but she LOVES going to the library and snuggling up with Daddy on a beanbag with a good book ![]()

NickB79

(20,299 posts)My friends and I have started pooling our resources, helping each other out with DIY projects. Everyone has a few skills, so why not put them to use? One friend is an electrical engineer, so he helped us put up some new light fixtures, fans and outlets. I in turn helped him tear up his yard for garden space. My wife helped his wife out with caring for their newborn baby. Another friend and I traded vegetable seedlings and cuttings this spring. Home repair, auto repair, etc.

I've since found out there's a name for such a group: http://localcircles.org/

love_katz

(3,241 posts)building stuff yourself works best if you have $ to buy or rent tools. And the skills and know-how to use them. I have neither.

I did pick up some pallets recently. Now I just have to figure out how to saw them apart so I can make something with them. The only saws I have are a pruning saw, and a cheap folding saw that seems to have teeth that are too fine for sawing wood...did not work when I was trying to cut down some giant bamboo which are growing too close to my house. And, I do know that the bamboo can be used for projects...I bought a book (used) from our local wonderful used book store.

I am glad that I don't have kids...even without them, I seem to have no extra $ after I get my paycheck. I am not wasteful nor a spendthrift. I don't drink coffee at all, nor alcohol, don't smoke and never have. For the rest of what I do, please so my post upthread. ![]()

Some of us are really scraping bottom. My monthly income has fallen by over $1,000.00 since 2002. I tried to get a better paying job back in 2012. It didn't work out, and although I was extremely lucky to get rehired by my employer, I lost my seniority and took a big drop in pay. My AGI was $5,000.00 less in 2012 than it was in 2011. ![]()

My extended family members all seem to be in the same or similar boats...and because they have back injuries, I can't ask them to help me with any project which involves heavy lifting.

I know what you mean...but it doesn't always work out so tidy for everyone, jes' sayin'.

NickB79

(20,299 posts)So, we learned to make due with what we had, grow vegetables, raise livestock and hunt wild food, and how to use all manner of tools even if they're 20-yr old hand-me-downs from Grandpa Leo's toolshop.

What I thought was hell as a kid, I now actually appreciate every day.

love_katz

(3,241 posts)actually, my parents worked their way there during their life times. They were depression era people, and taught me very well about getting by, making do, etc.

Unfortunately, due to sexism, girls were not allowed to take shop when I was growing up, and my dad's attitude to teaching me to use tools was, "you'll have a man to do that for you someday". ![]()

![]()

![]()

![]()

I am aware that places like Home Depot (dare I say that, here? ![]() ), have classes on DIY and how to use tools. I just don't have enough extra $ to buy or rent tools, nor the small fittings and extras which are often needed to make a project complete.

), have classes on DIY and how to use tools. I just don't have enough extra $ to buy or rent tools, nor the small fittings and extras which are often needed to make a project complete.

I keep hoping that my situation will improve. There is some truth to the idea that you can often live better with more time and less $ than you can with more $ and less time...but there is a limit to how well that works.

Thanks for the link about local people helping each other. I will check that out. ![]()

We live in a culture that essentially tells us that if you don't spend money you're a failure. If you don't buy things for spouses/partners/children you're a loser. Shopping is the highest form of recreation.

Really? I actually do enjoy shopping for things I need. Sometimes I need new clothes. Sometimes I need new shoes. Sometimes I need a new car. Just not very often. I really enjoy spending time with friends, talking about ideas or books or movies. I used to buy lots of books, but in recent years my life has changed and I go to the library instead. I had honestly forgotten the joys of the public library, and I am genuinely delighted to re-discover them.

Since I embroider and crochet and make jewelry, a lot of the presents I give are hand made. People do seem to appreciate them, and if they don't, too bad. I've given up on the notion that I have to compete in the amount of money I spend on presents.

Lex

(34,108 posts)how anyone can afford to buy a $500,000 house.

(Using your logic.)

CreekDog

(46,192 posts)RobinA

(10,478 posts)people who are living paycheck to paycheck AND have no savings and they aren't hurting for money, they just spend it all every month. Paycheck to paycheck needs to be defined in order for this kind of statement to mean anything.

Agschmid

(28,749 posts)I have no savings check to check, however it seems like I will be able to start to really save now (so exciting!).

That being said I have. 401k with over 15k, and no debt other than a car loan of 17k. I also have access to a good amount of revolving credit if I need it in an emergency.

Feels okay, wish I could save a bit more. Credit score is pretty high... Funny they seem to not take savings ability into that huh?

I am mid twenties male, college educated.

freshwest

(53,661 posts)Spitfire of ATJ

(32,723 posts)Ever seen the sneering way they talk about the "happiness index"?

Half-Century Man

(5,279 posts)Is that the Rolodex where you can look up the few who are happy?

Spitfire of ATJ

(32,723 posts)....to the Addams Family:

freshwest

(53,661 posts)Last edited Mon Jun 24, 2013, 06:09 PM - Edit history (1)

You have percieved the problem.Anyone who thinks the media darlings care in the slightest proportion to the adulation the masses daily shower them with, needs to remember that who they sneer and smear shows a lot about who they really support. And is the first sign of who pays them to do it.

Their words are not about informing or finding the truth. They generate hatred toward those their masters hate. As you noted, they really love their masters for their paychecks, and let it show.

When we discuss the right of freedom of speech, we naively think the words are from the mind of the speaker. For those of us here, the majority, I am sure, are not paid and I hold that speech much more valuable, unless I recognize it is parroting the shills and repetition.

They are not expressing their own logic or reasoning, as the repeat what they heard by those who are paid. Then they try to convince others that they have the truth, when they are merely the reflection of not real political movements, but the big bucks the media was paid.

The big money coordinates coverage in the media they own, no doubt about that, to create an atmosphere of outrage or sympathy for who the 1% want taken down or lifted up. When it's heard from every corner of paid punditry, left and right, the media echo box, some think they have actually found something that is the truth, due to paid momentum. Meh.

I do not believe commercial speech is what the first amendment was designed to protect, because it is not their words that they speak. They are creating and selling a product, for those behind them.

They will never speak for me, as I cannot afford to pay them. This blindness of those who fall for every fire in the mind that the media lights, is hurting me in the real world, not the one created by media, who know how to get paid.

They could give a rat's ass about my life or rights anymore than those spewing it for free.

Thanks for noticing what the media are.

love_katz

(3,241 posts)+ a gazillion.

Love you, freshwest. ![]()

![]()

![]()

freshwest

(53,661 posts)

love_katz

(3,241 posts)and it seems like another one is trying to move in on me, even though my current kitteh is very territorial and will NOT stand for it. ![]()

I keep forgetting to ask the neighbors if that other cat has been abandoned. Poor critter is always outdoors, and is always hanging around. I fear that his people moved away and left him behind.

I need another pet like I need a hole in the head ![]() , but I could rig up some shelter for him in my garage. Not sure if I can feed him, though, just don't have any extra $.

, but I could rig up some shelter for him in my garage. Not sure if I can feed him, though, just don't have any extra $. ![]()

spooky3

(38,510 posts)They will do whatever they can to help.

Spitfire of ATJ

(32,723 posts)The price going down at the pump is a DISASTER and disasters are an opportunity to cash in. CEOs are the most trustworthy people in the world and the ONLY reason bad things happen is because Washington gets in the way.

And that's from the REPORTERS who have their booth front and center right under the opening bell.

freshwest

(53,661 posts)Spitfire of ATJ

(32,723 posts)freshwest

(53,661 posts)Is that clown Kramer still pushing bad investment advice?

I ask because I don't watch anymore.

My barf-o-meter stays pegged as it is.

Spitfire of ATJ

(32,723 posts)no name no slogan

(25,184 posts)Crap

Nobody

Cares

About

CNBC is TV by the 1% for the 1%. It has as much in common with regular people as Marcus Bachmann has with heterosexuality.

SheilaT

(23,156 posts)Of that three-quarters who are living paycheck to pay check, a quarter or so of them must be earning above the median. Why haven't they saved anything?

At least part of the problem is movies and TV, because in those places you almost never see ordinary middle class or working class life portrayed accurately. They show people living extremely well even though the jobs they supposedly have would not support that lifestyle. Then there's the credit card ads, which neglect to point out that you actually have to pay back the "borrowed" money you use for that impulse trip to the Greek Islands.

I'm not talking to those who really do earn less than the median, or who are struggling to survive on the miserable amount disability pays. I'm talking to those who think they need to buy a new car every few years, and have no trouble with a financing scheme that means they'll owe more than it's worth for three-quarters of the loan. Or the ones who eat out several times a week, even though it's not that hard to cook at home. Or the ones who must wear the latest fashions. Or who think living in a mcmansion is required. And then wonder why they can't save a penny.

For me, childhood poverty turned me into a reluctant consumer. Recent downturns in my personal finances made me stop eating out entirely for a couple of years, and I no longer purchase books but to the library regularly. This way there is room in my budget for small luxuries, and I do eat out a couple of times a month with friends now. But the last time I got a car, six years ago, I paid cash for a used one, and the house I bought four years ago is less house than I could have, because the affordability factor was huge for me. My monthly payment is a little less than the rent I'd been paying. It's small, but it's enough for me.

It's not fun to do without, I know that. But it's going to be a lot less fun to continue to struggle long after you should have been able to retire, because it never dawned on you that you'd live to retire.

Spitfire of ATJ

(32,723 posts)Don't forget that if minimum wage kept pace it would be $25 an hour.

Half-Century Man

(5,279 posts)...as "not currently on fire"?

Spitfire of ATJ

(32,723 posts)....it's like the media had made it a mission to give Wall Street their spokes model.

They started out really liking him too. He was presented as the simple country boy who was going to wash the Nixon smell out of DC.

snot

(11,674 posts)--really?? As in, like, the bottom ten percent of the 1%?

Initech

(108,414 posts)No sick days, no paid vacation, if I want to take time off I'm screwed and have to save in advance.

Half-Century Man

(5,279 posts)...when I worked at Al*oa for fourteen years. Went to Ottumwa Iowa, lots of corn.

kirby

(4,532 posts)I hate that statistic because I know several people who live paycheck to paycheck because of their lifestyle. They have to purchase every latest consumer item possible, even when the last generation/model still works. A good portion of this country does not know how to manage their finances AND what really is the incentive to save? There is the security of having a rainy day fund, but other than that, the interest paid in this near-zero interest economy discourages savings.

I know so many people who complain about how they have no money left, yet they wont get rid of the $200/mo Ultimate Cable package or the extra data plan on the cell phone, or cut out the $8 coffees, etc.

Spitfire of ATJ

(32,723 posts)Walk away

(9,494 posts)no kids and no one else to support. No major illness or calamities. She has been living in her condo without making a mortgage payment for over 3 years and before that she had a negative amortized mortgage that she took about $120,000 out of before she went bankrupt on over $60,000 worth of credit card debt. She was smart enough to pay for a good lawyer and is walking away from about $400,000 dollars in unpaid debt and bills. And yet she doesn't have a penny. Seriously! She is a fifty year old woman who just spent $400,000 of our money, makes $100,000 a year and she has nothing. When her Jag broke down last year, her father had to buy her a Honda Accord.

No savings, no equity, no investments and not even much jewelry to hock in a pinch.

Believe me, I know that most of us are struggling but this woman drives me crazy. Her lawyer tells her she still has another 8 or nine months in her condo for free and then she will have to rent for 2 years. After that she'll be eligible for another mortgage!

Nye Bevan

(25,406 posts)LanternWaste

(37,748 posts)Maybe she had a gift-card... I've got a $25 gift card for Starbucks. I certainly hope no one sees me in a line and presupposes in a fit of self-validating petulance that I'm squandering my savings based on mere bias. That would be rather idiotic of them to do.

NickB79

(20,299 posts)And since we're Teamster's Union, we have been getting annual raises per our contract to the tune of 40-75 cents/hr, as well as EXCEPTIONAL health insurance.

Yet, I know so many of my coworkers who have ZERO savings. I know married couples that both work at the factory making 100K a year combined, yet still have nothing. They blow it on new cars, the latest cellphones, vacations to Jamaica twice a year, etc.

Hell, one of my coworkers WON THE LOTTERY two years ago! He walked away with $500K after taxes. Today, he's bitching about having no money! He blew it on new cars, a house way out of his budget on lots of acreage, gifts to family, etc.

leftyladyfrommo

(19,969 posts)We noticed that a lot when we were making residential mortgage loans. Those guys spend a ton of money on expensive toys. Often had a lot of credit card debt and auto loans, too.

NickB79

(20,299 posts)How strange.

MindPilot

(12,693 posts)He was a heavy truck tech; he made really good money, 60-70k in the early eighties. He lived a very frugal lifestyle, and he would have to be reminded to cash his paychecks. He just simply didn't need the money, so he saved it all.

Dude probably retired to St Maarten before he hit 30.

SheilaT

(23,156 posts)when I was married and my husband (I was a stay-at-home mom) got a bonus, or when his parents gave us money, we saved that money, didn't spend it. Some ten years into the marriage when I really, really thought it was about time we bought a dining room set, he went along very reluctantly. You'd have thought I was suggesting blowing huge sums in Vegas, not buying something we'd actually use all the time.

Our overall attitude was that the extra money wasn't really ours to spend, but needed to be saved and invested. It paid off. Our sons were able to go to college without borrowing the money. We could afford reasonable vacations. In the divorce, while I did not get as much as I thought I should have (and he probably thinks I got more than I deserved, such are the differences of opinion) I walked away with a nest egg that means while I still need to work, I have a reasonable cushion. Every single time I see what the median income is, or what school teachers make (who never cease complaining about how badly paid they are) all I can see is that we NEVER earned that amount of money, but because we saved every single penny that was extra, we came out ahead.

AnnieK401

(541 posts)It only relates to the lives of most Americans.

The NSA / GCHQ tap into the Internet and this statistic was taken from monitoring of everyones financial transactions.

So not only is the spying good for us, but it also has research value like these statistics.

Iliyah

(25,111 posts)everything will relate to NSA.

But the article tells truth but the % is a bit low, I believe its higher regarding people who live by paycheck to paycheck, and the use of credit cards as well inorder to make ends sorta meet, and again that trickle down BS is that - BS.

love_katz

(3,241 posts)the wealthy and the politicians who are in their pocket have been pi$$ing on the rest of us, from a great height. This has been going on since the oil embargo in the 1970's. And thanks to Ronnie Raygun and friends, it has been accelerating enormously, ever since the 1980's

You state the case exactly. ![]()

![]()

Spitfire of ATJ

(32,723 posts)MindPilot

(12,693 posts)not true anymore

Spitfire of ATJ

(32,723 posts)Art_from_Ark

(27,247 posts)were paying 5.25% to 5.5% interest in the late '60s.

wordpix

(18,652 posts)No more. Put your savings into something else besides the bank, but what is the question. Real estate? Art? Gold? Jewelry? Antique furniture? Stocks and bonds?

Everything is a risk but doing nothing is REALLY risky if you have savings. Between rising prices for food and fuel and no interest on savings, it sucks if you're trying to put money away for a down payment on a home, college, retirement, caring for elderly parents or any other big ticket item.

Ash_F

(5,861 posts)pakilolo

(5 posts)Low paying service jobs (Mac Donalds, Starbucks, WallMart) means no savings. And with Banks paying no determinable interest on savings accounts, why give them your money to spend free of charge. It is better to spend your money on food for the future. Bags of rice and beans and coffee and other foods that keep over time. Food will only get more expensive to buy and getting it now makes more sense than putting money in the bank.

closeupready

(29,503 posts)And relatively cheap.

Puzzledtraveller

(5,937 posts)kentauros

(29,414 posts)Yes, I know what it is, but it's been so low for so long that I don't understand why my credit union bothers to post it to my account. I think I garnered all of $3 for all of last year from that pitiful rate.

aquart

(69,014 posts)adric mutelovic

(208 posts)Why do pollsters say "Americans" referring to a sample of people that includes foreigners?

leftyladyfrommo

(19,969 posts)when the stock market crashed twice and then lost my job in the recession. I had quite a bit in savings.

Purveyor

(29,876 posts)as I anticipated them to be at this age.

RebelOne

(30,947 posts)And it is just as bad as living week to week. My neighbor just got a job after being out of work for 2 years. She is only earning about $900 a month. I do not know how she is doing it. My Social Security after the Medicare deduction is $1368 a month and is not easy to live on. Fortunately, since I am not working, I do not have to pay for gas to drive back and forth to work. My car is free and clear, and I do not have any credit cards. I live in a mobile home and the lot rent is $385 per month including water and garbage pickup. I am learning to live frugally, especially when I shop for groceries. Luckily, I only have to feed me and my little dog.

DCBob

(24,689 posts)I burned all my savings, including 401k, when I lost my job and had some costly personal issues. Its hard to recover after that.

roamer65

(37,894 posts)The present monetary policy is designed to discourage savings and promote consumption.

The vast majority are living paycheck to paycheck, but I am sure a sizable percentage fall into the 76% because they don't want to let the banks use most of their money for free. Their savings have moved to higher yielding investments or a 401K.

trekbiker

(768 posts)It's sad that more people did not have parents that could teach the basics of money management. I was fortunate to have frugal parents that set me up with a small savings account from a very young age and taught my brother, sister and I the value of saving money. Also, the concepts of delayed gratification, long term planning, living within your means, etc. We were not poor, basically middle to lower middle class. Thrift store clothes, gardens and home cooked meals, no luxuries at all, maybe go to the movie theater twice a year. No TV either for many years. Growing up I thought everyone lived this way.

I tried to teach my last girlfriend some basic money skills. I customized a simple spreadsheet for her so she could at least see the cash flow, and where the cash was dissappearing to. But she was 52 and could not be less interested. If she saw something she liked she bought it. Every closet in her house was jam packed with probably $50,000 total in clothes and shoes most of which she only wore once or twice or not at all, lots with the price tags still attached. She had $100,000 in new vehicles in the garage. All sorts of expensive toys. Her sizeable divorce settlement was dwindling fast and it was as if she simply blotted the spending out of her mind. Cognitive dissonance. She did not want to see the actual facts and would quickly change the subject when I would bring it up.

It finally drove me crazy when my $400 per month contribution to the grocery budget was "not enough" and she asked me to up it to $600. I asked her how was it possible that two people needed $1200 per month for groceries? The amount of top dollar food that spoiled and she threw out each month made me sick to think about.

I moved out. My spending and saving habits were ingrained so deep at so young an age that to live with someone like her that burns cash with no thought was very disturbing for me. At age 54 I still buy $20 jeans and $15 shirts, I have three pairs of shoes, one 15 year old suit and a 10 year old truck with 240,000 miles on it.

closeupready

(29,503 posts)as times have gotten hard, I've tightened up - I'm not from a wealthy background and am not ashamed to live frugally and modestly. Yes, I also like the sweet life, but you need the money for that, lol.

Now, I brownbag lunch, cook dinner, rarely go out for dinner or to a movie - that doesn't mean I have no social life - I exercise, I hit happy hour every now and then, see my friends for that occasional dinner out, read books, etc. Not an extravagant life at all.

SheilaT

(23,156 posts)is to teach the children how to live within their means. Whatever those means are.

I've also read that having even a modest savings account as a child has a very positive impact on things like attending college, graduating, getting a decent job.

I have two sons, now 26 and 30. Back when the younger was 6 or 7, he talked me into giving them a raise in their weekly allowance. Crafty adult that I was, I said, "Sure. But you need to save half of your allowance." Son agreed, because he couldn't do the math in his head that quickly. After a while he realized that the new plan meant that he actually had less money to spend than before. But I wouldn't budge. We also had a rule that half of any birthday or Christmas money had to be put in savings. The upshot was that when each son needed a car, he had enough money to buy a decent second-hand car for cash.

Older son didn't care. I joke that he will die a rich man because his wants and needs are so modest. Younger son, while more apt to spend, has actually learned from all of this. He has graduated college (cum laude from the University of Tulsa) but earns his living delivering pizza. I wish he had a better job, but he's happy which is what matters. More importantly, he's supporting himself. He knows that if he were to ask for money I'd tell him to get a better job.

I think I may have done something right.

madville

(7,847 posts)The average income where I work is about $4,000-6,000 a month and I would say 3/4 of the people here are always broke. It's mainly because of their lifestyles and toys though.

I remember making $600 a month in the military and learning how to live on little cash and it has stuck with me, I tuck away a good chunk every month and these guys here act like there is no way that is possible.

madville

(7,847 posts)Internet, Cable TV, Cell Phones, Electronic Devices, Fancier Vehicles, etc, etc.

A sizable percentage of those people could save some money by ditching stuff like smart phone plans, Internet, TV service, driving an older car, etc, etc.

I know people that dismiss such suggestions as ridiculous in this day while they don't have money for gas halfway to the next paycheck but they have all the above mentioned stuff.

Auntie Bush

(17,528 posts)CBHagman

(17,480 posts)...is why the media and politics haven't been shaken up more. Yes, there are people who buy into the Fox News version of things, there are people who vote against their own interests, there are even those who have let themselves be trained to identify with the rich and to despise the poor, but still, where's the good old-fashioned outcry on behalf of the working stiff?

Pterodactyl

(1,687 posts)...the media are sympathetic to the current admin and play down economic bad news.

raccoon

(32,337 posts)Pterodactyl

(1,687 posts)Arugula Latte

(50,566 posts)wordpix

(18,652 posts)This in response to Moral Monday protests in NC, but still holds here, I'm sure.

http://www.democraticunderground.com/1014517343#post5

skepticscott

(13,029 posts)The people who not only have little or no savings, but who also have big credit card debt. Those people in reality are even worse off than just getting from paycheck to paycheck. They're actually deep in the hole.

carolinayellowdog

(3,247 posts)It's great that my health insurance will go down from almost $700/mo to about $300 in January, but I'd never have retired in 2008 had I realized that health insurance costs under Obama would go drastically UP throughout his first term before any rescue from the ACA was in sight a year into his second. At least I could keep my health insurance from my employer at my own expense post-retirement. How many others like me but without that option are bankrupt rather than merely broke?

antigop

(12,778 posts)marshall

(6,706 posts)Cancel that cable tv, keep that old car til it drops, don't get the latest iPhone, make do with an old tv, check DVDs out of the library, etc. we need to learn from our grandparents and great grandparents who went through the depression. They reused everything, from the cut off lids of tin cans to egg cartons. They made quilts out of worn out clothes and dresses out of flour sacks. They opened windows on both sides of the house for a cross breeze, and when it got really hot they moved the bed onto the porch to catch whatever wind there was.

They got through worse, and so can we.

upaloopa

(11,417 posts)Instead of accepting your place in the race to the bottom why not work for union representation so people can negotiate for better salaries and benefits. We could afford those things and have a savings too if we were paid a fair wage.

I don't think we want to settle for third world status.

marshall

(6,706 posts)We don't have to suffer, but I don't think spending our way out of this mess is the most provident thing to do.

CreekDog

(46,192 posts)nor will it help when the cost of housing has skyrocketed over the years.

marshall

(6,706 posts)Now we just have to get through the consequences as best we can.

CreekDog

(46,192 posts)No No No.

you are trying to make it sound like their cell phones and big screen TV prevented them from paying for a major health crisis which created hundreds of thousands in medical costs.

![]()

just stop.

marshall

(6,706 posts)It is that family that is feeling the awful pinch, but that entire 76% is not, fortunately, going through a health crisis. But some collective belt tightening would help lead the way to a light at the end of the tunnel. It may not be a solution we will see in our lifetimes, but in a longer perspective it will pave the way for those coming in the future.

CreekDog

(46,192 posts)oh please.

Dyedinthewoolliberal

(16,200 posts)is that it's conducted in a vacuum, meaning they seem to assume everyone has enough money to be able to save. If it's all I can do to cover rent, food, car insurance, gas and utilties, I sure am not saving for a rainy day, hell it's already leaking in the house! ![]()

This is not my situation personally but I know it exists for many...........

underpants

(195,933 posts)Kennah

(14,578 posts)I'm in the 27%, laid off for 7 months in 2011, took about a 38% pay cut to go work for the state, yet even with union protection and "luxurious and bloated benefits of fat lazy state workers" we have to buy our meds from Canada because it's still cheaper, by a huge amount, than buying meds in the U.S. with insurance.

Renting a place in town so I can bike to work as we have one vehicle that's paid for, but who knows how long it will hang on. We could move further out and I could bike in 10 miles rather than 3 miles. Rent in Littlerock is about the same though. I suppose we could move to Yelm. Probably an hour and a half by bike each way, but the rent is more affordable.

harmonicon

(12,008 posts)Brigid

(17,621 posts)Just wait till enough people don't even have a paycheck.

Arugula Latte

(50,566 posts)Oh, well, I'm sure all those people making $9 bucks an hour would have put away oodles of money if they'd known that by frittering it all away on luxuries and exotic vacations and expensive restaurant meals they were going to disappoint Greg McBride! If only they'd known that saving is important, I'm sure they would have done so, because surely there's no other factor impacting their decision to save or not save!

![]()