Its time for corporations to pay their fair share of taxes

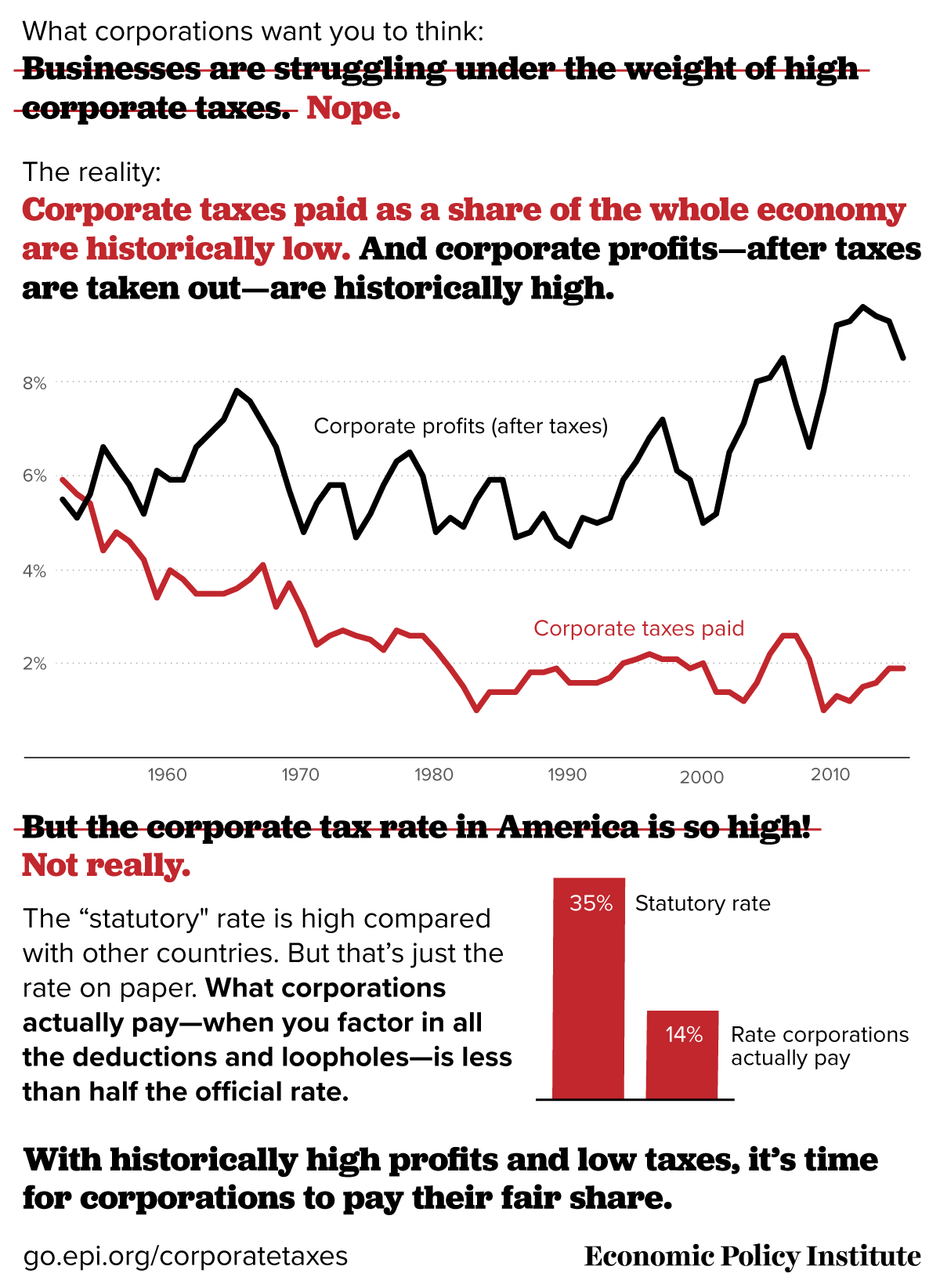

It is often claimed that American corporate tax rates are much-higher than our international peers, and that this has harmed U.S. corporations’ competitiveness. However, these claims are both factually incorrect and economically meaningless. On the facts, while the statutory corporate tax rate in the United States is 35 percent, after loopholes and deductions, the effective tax rate that corporations pay is only 14 percent. On the economics, even if U.S. corporations were paying higher taxes than their international peers, cutting these rates will do nothing to help the vast majority of American families, but will exacerbate inequality by boosting the post-tax incomes of owners and managers of corporations.

To help most American families, corporate tax proposals should focus on increasing, not decreasing, the taxes paid by corporations. The corporate tax system is so riddled with loopholes that it raises far too little revenue and doesn’t contribute enough to the need of the federal government to honor existing commitments to social insurance, income support, and public investment. If policymakers are going to push corporate “tax reform,” they should focus on requiring corporations to pay their fair share of taxes.

http://www.epi.org/publication/its-time-for-corporations-to-pay-their-fair-share-of-taxes/

NCjack

(10,297 posts)suggested Republican approach to bring that money to the USA is wrong. The tax rate on that money should not lowered, which would reward these crooks. The tax rate should go up 5% every month, beginning now, until that money is home and taxes paid. If the money is not brought home within 12 months, it should be declared to be illegal gains, subject to seizure by the IRS, and the CEOs subject to criminal prosecution. The gentle treatment of these crooks needs to stop.

stuffmatters

(2,580 posts)Not to mention pay state, county and city taxes where they're headquartered.

National, state and local budget deficits are direct result of corporate tax evasion.

Ultimately small businesses,which pay their taxes, are severely handicapped trying to compete with large corps that evade them

NCjack

(10,297 posts)the reforms that we have suggested.