Video & Multimedia

Related: About this forumshakedown1970

(64 posts)1StrongBlackMan

(31,849 posts)Octafish

(55,745 posts)And this guy.

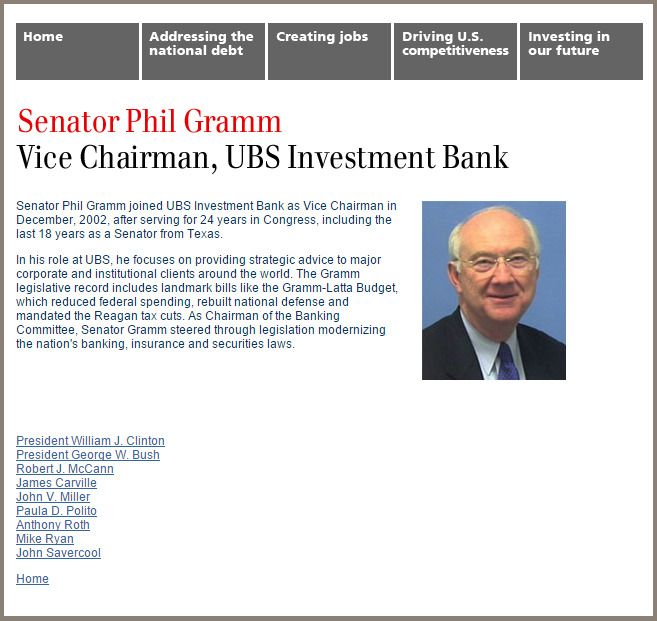

After his exit from the US Senate, Phil Gramm immediately found a job at Swiss bank UBS as its Vice Chairman. Gramm today works in the Wealth Management department, where he brought on, among others, former President Bill Clinton, former pretzeldent George W Bush and one James Carville.

See for you'self.

President William J. Clinton

President George W. Bush Heh heh heh.

Robert J. McCann

James Carville

John V. Miller

Paula D. Polito

Anthony Roth

Mike Ryan

John Savercool

SOURCE: http://financialservicesinc.ubs.com/revitalizingamerica/SenatorPhilGramm.html

Who would have thought President Clinton and Sen. Gramm -- the two key figures in repealing Glass-Steagall -- would work together in Wealth Management at a Swiss bank?

Since the New Deal, Glass-Steagall had protected the US taxpayer from the Wall Street casino by law. After its repeal, the US taxpayer got put on the hook for, among other things, the most recent $16 trillion Wall Street bailout.

In September 2008 on DU2 I described the situation: Know your BFEE: Phil Gramm, the Meyer Lansky of the War Party, Set-Up the Biggest Bank Heist Ever.

Those interested may also enjoy what Robert Scheer thinks about Phil Gramm.

https://panamapapers.icij.org/20160403-panama-papers-global-overview.html

Until the Panama Papers, this information wasn't much interest to the USA's "news media." They don't like to disturb their owners and operators any more than they have to.

1StrongBlackMan

(31,849 posts)Octafish

(55,745 posts)And, am I running for President of the United States?

1StrongBlackMan

(31,849 posts)And that makes it 'Okay", how?

MrMickeysMom

(20,453 posts)You seem to do kind of a silly thing when real questions go out. Are you disturbed by what the real answers are? There's no need to be intimidated, as these are REAL questions.

AlbertCat

(17,505 posts)..... that aren't there.... and then try to accuse you of...something...anything.

1StrongBlackMan

(31,849 posts)only I have examples to support my claim.

AlbertCat

(17,505 posts)Oh please....

you have not ![]()

1StrongBlackMan

(31,849 posts)and provide examples. I haven't because I consider it bad form to talk at someone through someone else.

arikara

(5,562 posts)what the hell you are talking about.

1StrongBlackMan

(31,849 posts)is worth remembering during this General Election season, in which HRC is the (presumptive) Democratic Nominee.

It seems to be a thinly veiled attempt to hang the repeal of G-S onto HRC. I could be wrong here; but, given history, I sorely doubt it.

arikara

(5,562 posts)Possibly she did have something to do with it, they said they were two for the price of one when Bill was elected. I highly doubt she by herself was to blame for GS though.

1StrongBlackMan

(31,849 posts)arikara

(5,562 posts)I highly doubt she by herself was to blame for the repeal of GS though.

I guess we both are having a problem with vagueness today.

1StrongBlackMan

(31,849 posts)That remains a possibility. No?

Why are you trying so hard to pin/link the repeal of G-S to HRC? ... besides the obvious reason, I mean.

arikara

(5,562 posts)Possibly not. Only the ones who did it may ever know for sure. Probably if they hadn't made such a big deal out of their twofer presidency I wouldn't have even considered it. So no, I'm not trying to "pin" anything on her, I am however interested in the possibilities.

1StrongBlackMan

(31,849 posts)make such a big deal out of their twofer presidency? If it wasn't back in 1999, then your "possibilities" premise fails.

whathehell

(30,395 posts)hollysmom

(5,946 posts)1StrongBlackMan

(31,849 posts)her financial system regulatory plan goes far beyond reinstating G-S.

avaistheone1

(14,626 posts)1StrongBlackMan

(31,849 posts)we will have a 2 for 1 presidency.

gwheezie

(3,580 posts)I thought for sure it must have been Hillary Clinton.

Winston.Smith

(32 posts)avaistheone1

(14,626 posts)Honestly, I really do think Bill is going to be in charge of pretty much everything. I just don't think Hillary can handle it herself. I believe Bill will be the advisor and decider. Hillary will be the mouthpiece.

http://elections.ap.org/content/hillary-clinton-and-2-1-presidency

rhett o rick

(55,981 posts)Maybe you'll be ok with the next crisis. It's becoming a business model. $12.5 trillion transferred in one fell swoop from the 99% to the 1% and you don't care. Some might argue that the $150,000,000 that the Clintons have amassed reflects the thanks from the banksters and Wall Street for their help.

pnwmom

(110,218 posts)driven by the shadow banking system. We need regulations to regulate the system as it is today, not as it was decades ago.

AgingAmerican

(12,958 posts)Shadow banks did gamble recklessly, but where did that money come from? It came from the federally insured bank deposits of big commercial banks - something that would have been banned under the Glass-Steagall Act

1StrongBlackMan

(31,849 posts)and G-S did nothing to prohibit commercial banks from purchasing debt.

seabeckind

(1,957 posts)Glass-Steagal would have deprived the gamblers from the funds they gambled with.

I admit that without a strong regulatory system behind it it's be difficult to police.

Who was in charge of the regulatory stuff prior to 2001? Who put the watchdogs in place?

Reagan dismantled much of the regulatory system. He also gutted the anti-trust.

Who had the power to reverse that and didn't?

You might look into the Progressive Policy Institute.

Watched the Big Short couple weeks ago. The movie pointed out that the situation is worse than it was in 2008.

rhett o rick

(55,981 posts)the legislation for a reason. So they could gamble with depositors money. And after they gambled and lost, they wanted the 99% to bail them out. No one bailed out those that lost their homes. I personally know friends and family that lost their homes. Do you have any concept of the damage done when you are forced to move out of your home? How do you find a place with a repossession on your record? How can you find a place that will allow you to bring your pets. How do you come up with the higher deposit? But you apparently don't care as do many others that blame the victims and reward the crooked banksters. To hell with the millions that were thrown into the streets by the Banksters. Living in their cars or on friends couches. I volunteer at a foodbank and have zero love for those that defend the crooked banksters that we bailed our with our money, the 99%'s money to the tune of $12 trillion dollars. Shame on those that side with the wealthy 1%.

1StrongBlackMan

(31,849 posts)I really am agnostic with respect to G-S ... It served it's purpose in addressing the '29 financial crash; but, it would have done little to deal with the crash of 2006, or what threatens us today, and tomorrow.

G-S would not have prevented commercial banks from investing in/purchasing the fraudulent paper that the far more damaging, Bernie supported Commodity Futures Modernization Act of 2000, that enabled.

But I have zero confidence that the 100th explanation will have any more effect than the first 99.

rhett o rick

(55,981 posts)and working class. They want G-S badly and rewarded the Clintons greatly for their help. Your rationalizations as to why it was cool for the banksters to ruin the lives of millions is cruel at best. How can you side with the wealthy when so many were hurt. THEY LOST THEIR HOMES. I guess you can somehow rationalize that away.

1StrongBlackMan

(31,849 posts)antibiotics are ineffective "cures" for colds and horse calvaries are ineffective against drones. G-S was effective in preventing the causes of the '29 crash; but, was (largely) irrelevant to the causes that led to the '06 crash, and will be irrelevant to what faces us in the future.

rhett o rick

(55,981 posts)were involved and want it to remain repealed. I don't want my deposits used by the investment gamblers. I won't argue that G-S may need to have some strengthening but it was repealed because the banksters wanted badly to get it repealed and Clinton was glad to oblige.

1StrongBlackMan

(31,849 posts)I don't either ... that is why I bank with credit unions, whose investment philosophy I understand.

floriduck

(2,262 posts)a conservative runned oligarchy, where big business runs our political leaders. We're just along for the ride. Very sad indeed.

Octafish

(55,745 posts)I'm no tax lawyer, but before Reagan and the capital gains tax cuts, I understand, that would mean $1 billion would go to the US Treasury.

djean111

(14,255 posts)I am sure that will be excellent for ordinary people who are not the 1%.

Yay!

Octafish

(55,745 posts)Money helps control the mob.

Milton Friedman and the Rise of Monetary Fascism

The Dark Age of Money

by JAMES C. KENNEDY

CounterPunch Oct. 24, 2012

EXCERPT...

Monetary Fascism was created and propagated through the Chicago School of Economics. Milton Friedman’s collective works constitute the foundation of Monetary Fascism. Knowing that the term ’Fascism’ was universally unpopular; Friedman and the Chicago School of Economics masquerade these works as ‘Capitalism’ and ’Free Market’ economics.

SNIP...

The fundamental difference between Adam Smith’s free market capitalism and Friedman’s ‘free market capitalism’ is that Friedman’s is a hyper extractive model, the kind that creates and maintains Third-World-Countries and Banana-Republics, without geo-political borders.

If you say that this is nothing new, you miss the point. Friedman does not differentiate between some third world country and his own. The ultimate difference is that Friedman has created a model that sanctions and promotes the exploitation of his own country, in fact every country, for the benefit of the investor, money the uber-wealthy. He dressed up this noxious ideology as ‘free market capitalism’ and then convinced most of the world to embrace it as their economic salvation.

SNIP...

[font color="green"]Monetary Fascism, as conceived by Friedman, uses the powers of the state to put the interest of money and the financial class above and beyond all other forms of industry (and other stake holders) and the state itself.[/font color]

SNIP...

Money has become the state and the traditional state is forced to serve money’s interests. Everywhere the Financial Class is openly lording over sovereign nations. Ireland, Greece and Spain are subject to ultimatums and remember Hank Paulson’s $700 billion extortion from the U.S. Congress. The $700 billion was just the wedge. Thanks to unlimited access to the Discount Window, Quantitative Easing and other taxpayer funded debt-swap bailouts the total transfers to the financial industry exceeded $16 trillion as of July 2010 according to a Federal Reserve Audit. All of this was dumped on the taxpayer and it is still growing.

CONTINUED...

http://www.counterpunch.org/2012/10/24/the-dark-age-of-money/

We need to get back to the day when people were more important than profits; when peace trumped money.

disillusioned73

(2,872 posts)Inconvenient truths....

Thanx Octafish ![]()

Octafish

(55,745 posts)What's not OK is to help Detroit or Puerto Rico when bankrupted by predatory Wall Street loans and disastrous state and national policies.

Neil Barofsky, then-IG for TARP, explained current cornucopia of corruption.

For those lacking integrity, a pot of gold awaits...

Neil Barofsky Gave Us The Best Explanation For Washington's Dysfunction We've Ever Heard

Linette Lopez

Business Insider, Aug. 1, 2012, 2:57 PM

Neil Barofsky was the Inspector General for TARP, and just wrote a book about his time in D.C. called Bailout: An Insider Account of How Washington Abandoned Main Street While Rescuing Wall Street.

SNIP...

Bottom line: Barofsky said the incentive structure in our nation's capitol is all wrong. There's a revolving door between bureaucrats in Washington and Wall Street banks, and politicians just want to keep their jobs.

For regulators it's something like this:

[font color="green"]"You can play ball and good things can happen to you get a big pot of gold at the end of the Wall Street rainbow or you can do your job be aggressive and face personal ruin...We really need to rethink how we govern and how regulate," Barofsky said.[/font color]

CONTINUED... http://www.businessinsider.com/neil-barofsky-2012-8

...For those with integrity, along with most everyone else, it's Austerity Time for Ever -- until We the Proles do something about it.

DianaForRussFeingold

(2,552 posts)Last edited Thu Jun 16, 2016, 04:58 PM - Edit history (1)

Thanks for posting this, Octafish.

(7/1/1999) Here's Bernie being brilliant and courageous,

trying to stop them from being stupid and repealing Glass-Steagall:

Bernie Sanders Predicts Crash of 2008 in 1998;

"Bernie Sanders doing what he does best, standing up for the public.

He was concerned with the way the economy was being managed like a casino":

Duval

(4,280 posts)rhett o rick

(55,981 posts)Zen Democrat

(5,901 posts)And Bill Clinton happily put his signature on it.

Octafish

(55,745 posts)per Yves Smith, Naked Capitalism, April 28, 2016:

But even allowing for the fact that some and probably most of the gains were real, you’ll see Clinton try to sell a Big Lie: that productivity gains were tied to increased worker prosperity. As numerous commentators pointed out, that story had stopped being true as of roughly 1976. Businesses once did share the benefits of productivity gains with workers, but as labor bargaining power weakened, kept it for themselves. Clinton continues with his canards, praising “open borders” as keeping inflation low. The mechanism by which inflation is contained is by restricting wage growth. A prosperous, full employment economy will feature strong growth in pay levels, and will at some point lead to pricing pressure (mind you, profit levels in the US are now so far outside historical norms that businesses could go a long way in increasing wages if they weren’t so greedy). So his low inflation story is again at odds with his effort to depict everything as rosy for average workers.

SNIP...

The large point is the Clintons have been loyal followers of the Robert Rubin school of thinking, that bankers should run the economy, not just ours but everywhere. And he and his acolytes have been extremely successful in promoting finance-friendly policies around the world. And despite the wreckage of the global financial crisis, there has been little change in either the fealty to neoliberal ideology or the power of financiers. But both are seen as less and less legitimate by broader society, which is a key first step in reducing their influence.

Funny how many "fathers and mothers" the repeal of Glass Steagall had before the crash it caused. Guess who paid the $24 trillion it cost?

Wars Without End. Millions tossed from homes. Gig Economy and McJobs Only.

It's not just American Democracy, it's a Planet Run By Banksters and Warmongers.

floppyboo

(2,461 posts)after his drooling dementia moment at the Iowa speech, we've been spared looking/listening to him too much. I really can't understand why some include him in Hillary's 'dream team'. Or why Hillary said she would have him heading up some jobs program. Yeah, great economic bubble, and disco still sucks.

Stryder

(450 posts)I recall a cartoon from...30? yrs back.

Showed "21st century T shirt, Disco still sucks."

Well here we are and it still does.

Off to the T shop tomorrow.

arikara

(5,562 posts)He will be after all, co-president like she was during his tenure. At least that's how they billed themselves.

BootinUp

(51,035 posts)Octafish

(55,745 posts)Again, I'll go with James Rickards:

Repeal of Glass-Steagall Caused the Financial Crisis

The repeal of the law separating commercial and investment banking caused the 2008 financial crisis.

By James Rickards | Contributor Aug. 27, 2012

The oldest propaganda technique is to repeat a lie emphatically and often until it is taken for the truth. Something like this is going on now with regard to banks and the financial crisis. The big bank boosters and analysts who should know better are repeating the falsehood that repeal of Glass-Steagall had nothing to do with the Panic of 2008.

In fact, the financial crisis might not have happened at all but for the 1999 repeal of the Glass-Steagall law that separated commercial and investment banking for seven decades. If there is any hope of avoiding another meltdown, it's critical to understand why Glass-Steagall repeal helped to cause the crisis. Without a return to something like Glass-Steagall, another greater catastrophe is just a matter of time.

History is a good place to begin. After the Depression of 1920-21, the United States embarked on a period of economic prosperity known as the Roaring Twenties. It was a time of innovation, especially in consumer goods such as automobiles, radio, and refrigeration. Along with these goods came new forms of consumer credit and bank expansion. National City Bank (forerunner of today's Citibank) and Chase Bank opened offices to sell securities side-by-side with traditional banking products like deposits and loans.

As the decade progressed, the stock market boomed and eventually reached bubble territory. Along with the bubble came market manipulation in the form of organized pools that would ramp up the price of stocks and dump them on unsuspecting suckers just before the stock collapsed. Banks joined in by offering stocks of holding companies that were leveraged pyramid schemes and other securities backed by dubious assets.

In 1929, the music stopped, the stock market crashed and the Great Depression began. It took eight years from the start of the boom to the bust. Subsequent investigations revealed the extent of the fraud that preceded the crash. In 1933, Congress passed Glass-Steagall in response to the abuses. Banks would be allowed to take deposits and make loans. Brokers would be allowed to underwrite and sell securities. But no firm could do both due to conflicts of interest and risks to insured deposits. From 1933 to 1999, there were very few large bank failures and no financial panics comparable to the Panic of 2008. The law worked exactly as intended.

[font color="green"]In 1999, Democrats led by President Bill Clinton and Republicans led by Sen. Phil Gramm joined forces to repeal Glass-Steagall at the behest of the big banks. What happened over the next eight years was an almost exact replay of the Roaring Twenties. Once again, banks originated fraudulent loans and once again they sold them to their customers in the form of securities. The bubble peaked in 2007 and collapsed in 2008. The hard-earned knowledge of 1933 had been lost in the arrogance of 1999.[/font color]

CONTINUED...

http://www.usnews.com/opinion/blogs/economic-intelligence/2012/08/27/repeal-of-glass-steagall-caused-the-financial-crisis

Seeing how the repeal of Glass Steagall put the US taxpayer on the hook for the Wall Street casino, I can understand why a Hillary supporter would side with Bill.

FTR: Here's what I wrote in February 28, 2008 regarding the S&L crisis, a dress-rehearsal for what was to come with the banks:

Know your BFEE: They Looted Your Nation’s S&Ls for Power and Profit

Then, after the Bankstershitstorm in September 21, 2008, I asked them who stole it to put it back:

Know your BFEE: Phil Gramm, the Meyer Lansky of the War Party, Set-Up the Biggest Bank Heist Ever.

ancianita

(43,162 posts)Uncle Joe

(64,564 posts)Thanks for the thread, Octafish. ![]()

felix_numinous

(5,198 posts)JEB

(4,748 posts)Octafish

(55,745 posts)I believe two different DUers brought up a year-old article on a Wall Street Journal article that looked at Clinton-UBS story. The article devoted many words to show what the WSJ article itself said in "paragraph 6":

The Journal's disclaimer comes in the sixth paragraph:

“There is no evidence of any link between Mrs. Clinton’s involvement in the case and the bank’s donations to the Bill, Hillary and Chelsea Clinton Foundation, or its hiring of Mr. Clinton.”

They know how much shit they’re shoveling.

http://m.dailykos.com/story/2015/8/2/1408141/-Setting-the-Record-Straight-on-the-Wall-Street-Journal-Hatchet-Job-of-Hillary-Clinton-Regarding-UBS

The author seems an oppo guy working the Bernie beat. He generates a lot of bulk to state the obvious, while ignoring the real point:

Former Sen. Gramm became UBS Vice Chairman immediately upon leaving the Senate.

Former President Clinton made $1.5 million on speaking fees for UBS, plus whatever he took home from his gig in "Wealth Management."

It doesn't matter whether Sec. Clinton did a major for UBS. They did nice things for her.

Most importantly: You are most welcome, JEB!

The_Casual_Observer

(27,742 posts)This is one of those Thom Hartman rant topics that is badically a poorly understood

Buzzword.

Octafish

(55,745 posts)Other nice men did same in House.

Congress passed the legislation.

President Clinton signed it into law.

More than a few Democrats voted against the law, voicing how it put the taxpayer on the hook for the punters at the Wall Street casino.

Look at John Edwards, in the back of the group in the photo in the OP. Another was Bernie Sanders.

As for this being a buzzword on Thom Hartmann: the banksters cost the taxpayers uncounted trillions.

One too big to fail SWISS bank got billions of US dollars to keep afloat, UBS.

Clinton and Gramm found lucrative work there post government.

The_Casual_Observer

(27,742 posts)Hartman & co. provide a grossly oversimplified narrative of who and what was to blame. Encapsulating the whole thing in terms

Glass - Steagall is simply ignorant ranting that only discredits the argument.

Octafish

(55,745 posts)By William K. Black

New Economic Perspectives, June 9, 2015

EXCERPT...

The bailout of Goldman via AIG had two parts. The largely fraudulently-originated mortgages backing Goldman's CDOs suffered crushing defaults as the housing bubble burst and the bad loans could no longer be refinanced to delay the loss recognition. The credit rating agencies, whose managers became wealthy by selling enormously inflated ratings to toxic CDOs and mortgage-backed securities (MBS) finally began to recognize reality and engaged in, by far, the greatest and quickest rating downgrades in history. This should have triggered AIG's obligation to pay the CDS protection for vast amounts of toxic CDOs and MBS - but that would have rendered AIG insolvent and the CDO and MBS holders would have had to recognize vast losses. Other entities that sold CDS protection were in a similar position to AIG and they began negotiating deals to pay roughly 15 cents on the dollar of their obligation. It is better to get 15 cents on the dollar now than risk getting close to zero 18 months from now after the firm that sold you illusory CDS protection is liquidated in a bankruptcy proceeding. This kind of commercial workout is the norm in big finance.

Goldman had already received the twin direct bailouts provided by the Fed and Treasury (through the TARP program). Absent similar bailouts every one of the largest banks in the U.S. and the EU would have failed as the financial markets froze and the economy went into freefall.

But Goldman was the primary indirect beneficiary of two federal bailouts through AIG. The first bailout of AIG was the U.S. purchase of most of most of AIG's equity at a price far above market value. Absent this bailout AIG would have had to declare bankruptcy in Fall 2008. This bailout was strongly pushed by what became the U.S. bailout troika - Ben Bernanke (the Fed Chairman), Timothy Geithner (President of N.Y. Fed), and Hank Paulson (Treasury Secretary). Yes, the same Hank Paulson who was made even wealthier by leading Goldman's purchase of huge amounts of toxic CDOs and MBS and illusory CDS "protection" from AIG.

Goldman is known as "Government Sachs" because of its incestuous relationship with government. Bob Rubin had run Goldman before becoming President Clinton's Treasury Secretary. The Bush and Obama administration were infested with Goldman alums in key positions. The Obama administration also had Rubin protégés like Geithner controlling most of the top financial positions. Indeed, for extensive periods every top Obama economics official has been a Rubin protégé.

While Geithner is famous for his faux indignation that people believed from his slavish devotion to furthering the interests of the wealthiest and most criminal banksters that he had worked at a Wall Street firm, everyone knows that the NY Fed is Wall Street. It functions for Wall Street's CEOs, not the American people, regardless of what administration is in power. Geithner, who has now, formally, joined Wall Street and been made even wealthier, is one of the three most infamous financial regulators in U.S. history. He shares that dishonor with Bernanke and the worst-of-the-worst, Alan Greenspan. The Financial Crisis Inquiry Commission (and even the Fed's own external report) confirm what we all knew - even among the embarrassment that was "Fed Lite" regulation globally, the NY Fed stood out as uniquely terrible because of its servile approach to the elite banksters.

CONTINUED...

http://www.econmatters.com/2015/06/goldman-aig-to-become-obamas-new-scandal.html

Even if AIG repaid every cent on the dollar, they were made whole courtesy of the US taxpayer, millions of whom were tossed from their homes in the process.