Texas

Related: About this forumLone Star Rail seeks cut of Austin property tax growth

[div style="width:35%;"]

City of Austin property tax dollars would start flowing to the Lone Star Rail District as soon as next year, even with the proposed commuter rail line’s fate still uncertain, under a proposed agreement that has city and rail district officials far apart on the deal’s broad outlines.

City officials, in a briefing Tuesday to the Austin City Council, said that all taxes collected near the seven planned Austin stations should remain in city hands until the rail line opens. Officials also said that the 50 percent of property tax growth near stations that the district wants is too high a percentage to give the rail district, and that the deal’s proposed 40-year length (with a possible 40-year extension) is too long. Getting a deal worked out by a target date of early November, allowing council approval of a final agreement before the end of the year, might be a tall order, city Chief Financial Officer Elaine Hart told the council.

“We can provide a draft by then,” Hart said, “but it may not be one we can recommend.”

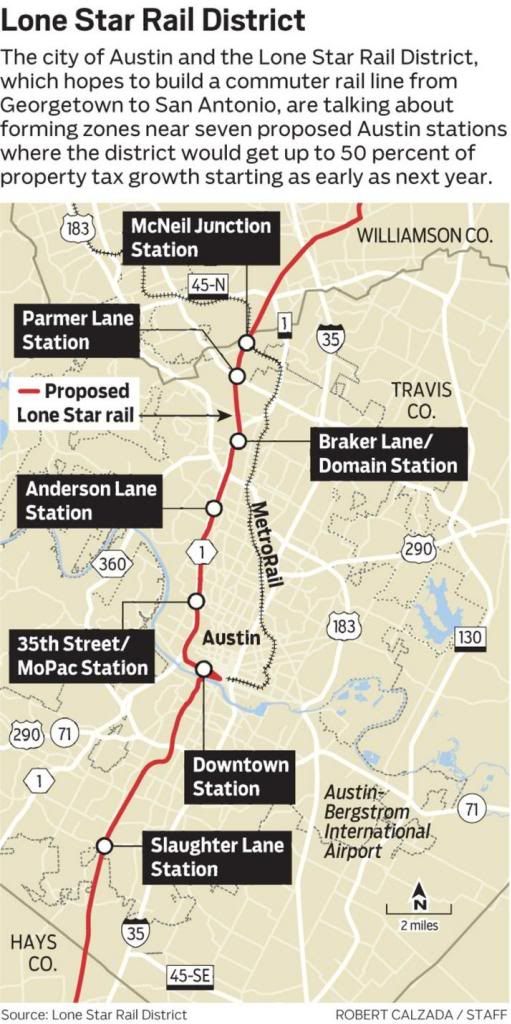

The rail district — which, despite daunting financial challenges, hopes to have the line between San Antonio and the Austin area operating by 2018 — is in similar discussions with Travis County, Austin Community College, Hays County and San Marcos. It eventually also will approach the San Antonio, Bexar County and Williamson County governments.

The district, formed in 2003, hopes to harvest property tax growth, and in some cases sales taxes as well, within a half-mile of most of the 18 planned stations on the proposed 115-mile line, starting with the 2014 tax year. One exception would be the proposed station near the Seaholm development in downtown Austin, where the “transportation infrastructure zone” instead would have a quarter-mile radius. That zone, even with the diminished reach, would extend north of West Sixth Street along North Lamar Boulevard into a densely developed section of the city with several large projects planned or under construction.

“The city didn’t want us to reach halfway into downtown,” said Joe Black, Lone Star’s rail director.

The district wouldn’t get taxes from single-family homes or duplexes within the zones, Black said, or from tax-exempt, government-owned land, or from tracts where more than half the land is outside the zone. But the district, at least in Austin, hopes to get parking revenue from lots and garages within the tax zones. The city of Austin opposes that parking provision, Hart said.

The money from the zones would be put in an escrow fund under the district’s control, according to the rail agency’s proposal, and be used primarily, but not exclusively, for operating and maintenance costs.

Hart said the district’s proposal would allow the money to be used for “project costs,” which she said would include not only operations and maintenance of the train line but also debt financing costs, real estate, professional services and “reasonable reserves.”

Council Member Sheryl Cole told the American-Statesman she is uncomfortable paying for that array of possible district costs. A council resolution passed earlier this year instructed city staff to negotiate an agreement with Lone Star using city taxes only for the rail line’s operations and maintenance.

“I also don’t think we should agree to hand over management of those funds to Lone Star without a detailed agreement about how those funds will be handled in the interim” before rail service starts, Cole said.

The district is seeking both property and sales tax growth from San Marcos and, potentially, Kyle and Buda, but only property taxes from the city of Austin, Black said, because 1 percent of sales taxes in Austin already go to Capital Metro for transit costs. Counties don’t have the authority to collect sales taxes.

Black said that securing the tax revenue for future operating costs is critical as the district in coming years attempts to secure huge grants from the federal government and the Texas Department of Transportation. Construction of the line, including the necessity of building an alternative freight track east of the Austin metro area to free up the Union Pacific track for passenger trains, could cost well above $2 billion.

“We need to lock these down first so we can walk in with a straight face to regulators” and ask for grants, Black said.

Reaching agreements by the end of the year would be important to Lone Star, particularly in certain station locations, because it would set a base property valuation level before more development occurs. Near the proposed Seaholm station, for instance, construction already has begun on a large mixed-use development in and around the defunct city power plant. And the Domain in North Austin continues to expand within a proposed rail taxation zone.

The district’s maps generally have shown five Austin stations — at Slaughter Lane, Seaholm, West 35th Street, the Domain and McNeil Junction. But Black said interim stations could be built at Anderson Lane and Parmer Lane as well. The property tax districts could be set up around all seven stations.

By 2028, according to figures in Hart’s presentation, as much as $6.7 million in city taxes and another $6.7 million in Travis County taxes would be going to the district. Hart said that much of the growth near the stations would be unrelated to the rail line and that giving the district half of the increased property taxes is likely excessive.

Hart’s presentation indicated that, even if the money begins flowing now under the terms envisioned by the rail district, it could be inadequate to pay for Lone Star’s service. Operating the line would cost as much as $31.7 million in 2018, $58.7 million a year by 2023 and $101.3 million by 2028. A third of that (about $10.6 million in 2018 and $33.8 million by 2028), the presentation said, would be expected to come from the city of Austin, Travis County and Austin Community College property tax growth.

However, the district is estimating that Austin, Travis County and ACC together would produce only $1.9 million of property taxes for the district in 2018 and only $14.7 million in 2028. The district also would collect passenger fares (which typically cover a small percentage of rail operating costs) and potentially other revenue.

That initial $31.7 million cost estimate for operations, Black said, is based on a “robust” level of train offerings — the district on its website envisions 32 trains a day and seven-day-a-week service.

Even if all the local governments chip in as hoped, Black said, “we’re going to have to adjust the service level.”

http://www.mystatesman.com/news/news/transportation/lone-star-rail-seeks-cut-of-austin-property-tax-gr/nbWRL/?icmp=statesman_internallink_invitationbox_apr2013_statesmanstubtomystatesmanpremium#